Global Bioinks Market - Key Trends & Drivers Summarized

Why Are Bioinks Revolutionizing Bioprinting and Tissue Engineering?

Bioinks have emerged as a groundbreaking material in bioprinting, offering immense potential for the fabrication of complex tissue structures, organ models, and regenerative medicine applications. These specialized inks, composed of living cells and biocompatible materials, enable the precise layering of biological structures through 3D printing technology. The demand for bioinks is surging as researchers and healthcare professionals explore their applications in personalized medicine, drug testing, and organ transplantation. With the increasing burden of organ shortages and the limitations of traditional tissue grafting techniques, bioinks present a promising alternative for generating functional tissues and scaffolds. Advances in stem cell research and biomaterial engineering are further expanding the scope of bioink-based bioprinting, allowing for the creation of vascularized tissues and complex cellular architectures. As the bioprinting industry evolves, bioinks are expected to play a pivotal role in transforming regenerative medicine and accelerating the development of fully functional lab-grown organs.How Are Technological Innovations Enhancing Bioink Performance?

The continuous advancement in biomaterial engineering and 3D bioprinting technologies is significantly improving the performance and versatility of bioinks. Researchers are developing next-generation bioinks that offer enhanced mechanical strength, cell viability, and bioactivity, ensuring better integration with native tissues. Hydrogels, decellularized extracellular matrices (dECM), and nanomaterial-infused bioinks are among the innovative formulations that are pushing the boundaries of tissue engineering. Another critical development is the incorporation of smart bioinks with stimuli-responsive properties. These bioinks can adapt to environmental changes such as temperature, pH, and mechanical stress, improving their application in dynamic biological environments. Additionally, the rise of AI-driven bioprinting platforms is enabling precise control over printing parameters, optimizing cell distribution, and enhancing tissue functionality. As bioprinting techniques evolve, bioinks are expected to become more specialized, catering to specific tissue types and patient-specific therapeutic needs.What Market Trends Are Driving the Growth of Bioinks?

One of the most significant trends fueling the bioinks market is the rising demand for personalized and regenerative medicine solutions. The ability to fabricate patient-specific tissue models is revolutionizing preclinical drug testing, reducing reliance on animal models and improving predictive accuracy for human clinical trials. Pharmaceutical and biotech companies are increasingly leveraging bioinks for high-throughput drug screening and toxicology assessments, accelerating the development of novel therapeutics. Another major trend is the growing collaboration between research institutions, healthcare organizations, and bioprinting companies. Governments and private investors are providing substantial funding to support the advancement of bioprinting technology, recognizing its potential to address the global organ transplant crisis. Additionally, the expansion of biofabrication into cosmetic and dermatological applications, such as 3D-printed skin grafts for burn victims and reconstructive surgery, is broadening the market scope for bioinks. As regulatory approvals for bioprinted tissues become more streamlined, commercial adoption of bioinks is expected to rise significantly.What Are the Key Growth Drivers for the Bioinks Market?

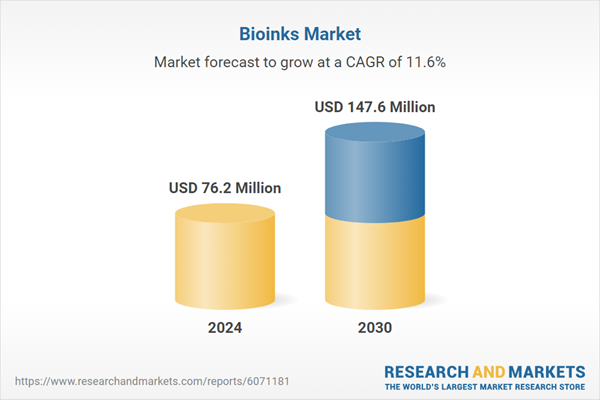

The growth in the Bioinks market is driven by several factors, including rapid advancements in 3D bioprinting technology, increasing investment in regenerative medicine, and rising demand for organ and tissue engineering solutions. The expanding applications of bioinks in pharmaceutical research, cosmetic testing, and personalized healthcare are further fueling market expansion. The growing prevalence of chronic diseases and tissue-related injuries is also a key driver, as bioinks offer a viable solution for producing customized implants and therapeutic tissues. Additionally, the development of bioinks with enhanced biocompatibility and printability is making 3D bioprinting more efficient and scalable. The continued collaboration between academia, biotech firms, and regulatory bodies is fostering innovation and accelerating the commercialization of bioprinted tissues. As technology continues to advance, the bioinks market is poised for substantial growth, shaping the future of regenerative medicine and bioprinting applications.Report Scope

The report analyzes the Bioinks market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Natural Bioink, Synthetic Bioink); Material (Collagen Material, Alginate Material, Gelatin Material, Agarose Material, Chitosan Material, Pluronic Material, Other Materials); Printing Modality (Extrusion-based Bioprinting, Inkjet-based Bioprinting, Laser-based Bioprinting); End-Use (Pharmaceutical and Biotechnology Companies End-Use, Academic and Research Institutes End-Use, Hospitals and Clinics End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Natural Bioink segment, which is expected to reach US$91.7 Million by 2030 with a CAGR of a 13.8%. The Synthetic Bioink segment is also set to grow at 8.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $20.8 Million in 2024, and China, forecasted to grow at an impressive 16.1% CAGR to reach $31.3 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Bioinks Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Bioinks Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Bioinks Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Akern Srl, Biodynamics Corporation, Bioparhom, BioTekna - Biomedical Technologies, Bodystat Limited and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Bioinks market report include:

- Allevi, Inc.

- AM Technologies by Brinter

- Axolotl biosciences

- Bico Group

- BIO INX®

- CELLINK

- CollPlant Biotechnologies

- Foldink

- Inventia Life Science Pty Ltd

- Organovo Holdings, Inc.

- Poietis Biosystems

- REGEMAT 3D

- ROKIT Healthcare, Inc.

- UPM Biomedicals

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Allevi, Inc.

- AM Technologies by Brinter

- Axolotl biosciences

- Bico Group

- BIO INX®

- CELLINK

- CollPlant Biotechnologies

- Foldink

- Inventia Life Science Pty Ltd

- Organovo Holdings, Inc.

- Poietis Biosystems

- REGEMAT 3D

- ROKIT Healthcare, Inc.

- UPM Biomedicals

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 348 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 76.2 Million |

| Forecasted Market Value ( USD | $ 147.6 Million |

| Compound Annual Growth Rate | 11.6% |

| Regions Covered | Global |