The market in the North America region is expanding due to the rising need for precise and effective instruments, including reusable and disposable cartridge syringes. Consequently, the North America region captured $51,299.3 thousand revenue in the market in 2023. Additionally, the high incidence of periodontal disease, gum disease, and oral cavities fuels the demand for the treatment of dental cartridge syringes. Also, Russia market utilized 303.6 thousand units of Cartridge Syringe in 2023.

The rising incidence of periodontal and gum disease is one of the primary factors propelling the demand for dental cartridge syringes. Excessive alcohol consumption further exacerbates these problems. This, along with the issue of limited access to dental care, particularly in underserved communities, results in untreated dental conditions and disparities in oral health outcomes. Therefore, the increasing prevalence of oral diseases will aid in the market's growth.

Additionally, World Health Organization (WHO) states that by 2030, one in every six individuals will be sixty years of age or older. By 2020, the proportion of the population aged 60 and older will have increased from one billion to 1.4 billion. The global population of individuals aged 60 and above is projected to increase by twofold to 2.1 billion by 2050. Between 2020 and 2050, the population of individuals aged 80 or older is projected to triple, amounting to 426 million. Thus, the rising proportion of the aging population will result in increased demand for dental services, which will propel the market's expansion.

However, Dental practices face challenges in recruiting and staffing various positions, including administrative staff, dental hygienists, and dentists. Indeed, according to a report by the Health Policy Institute (HPI) of the American Dental Association (ADA), over one-third of dental practices are experiencing staffing difficulties, with the majority attributing these difficulties to the arduous recruitment process. The efficiency of practices and the quality of care provided to patients are both impacted by this shortage. Hence, all these factors may hamper the growth of the market.

The market was adversely affected by the COVID-19 pandemic due to the stagnant hospitalization rate and reduced demand for these products. As a result of the pandemic, numerous operations were altered or postponed. Dental personnel were classified as having an extremely high exposure risk by the Occupational Safety and Health Administration (OSHA), according to a study published in the International Journal of Dentistry in 2020. However, with an increase in the number of dental procedures, an increase in the prevalence of dental diseases, and heightened awareness regarding oral health, the market is stabilizing and recovering from the effects of the pandemic.

By Type Analysis

Based on type, the market is characterized into aspirating, non-aspirating, and self-aspirating. The non-aspirating segment recorded a 12.26% revenue share in the market in 2023. In terms of volume, non-aspirating segment registered 1,095.8 thousand unit in 2023. Non-aspirating dental syringes are often preferred for certain dental procedures where aspiration is unnecessary or desired, such as when administering local anesthesia for routine restorative procedures or when working in areas where blood return is difficult to detect.By End User Analysis

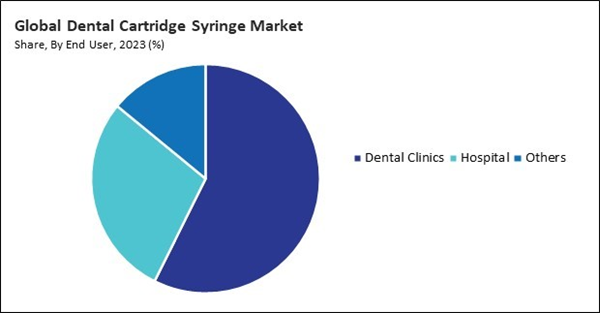

By end user, the market is characterized into hospital, dental clinics, and others. In 2023, the dental clinics segment procured the 57.35% revenue share in the market. In terms of volume, dental clinics segment consumed 3,886.2 thousand unit in 2023. Dental clinics are key end-users of dental cartridge syringes, as they are essential for delivering local anesthesia during dental procedures.By Product Type Analysis

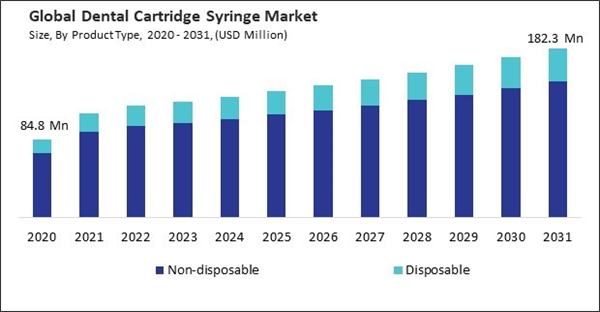

On the basis of product type, the market is classified into non-disposable and disposable. The non-disposable segment acquired the 81.76% revenue share in the market in 2023. In terms of volume, non-disposable segment utilized 4,002.6 thousand unit in 2023. Non-disposable dental syringes are typically made of durable materials like stainless steel or autoclavable plastic, allowing them to be sterilized and reused multiple times.By Regional Analysis

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment held a 25.35% revenue share in the market in 2023. In terms of volume, Asia Pacific segment registered 1,992.9 thousand unit in 2023. Increasing awareness of the significance of routine dental examinations and dental hygiene in the Asia-Pacific region contributed to expanding the market for dental cartridge syringes.List of Key Companies Profiled

- STERIS PLC

- Jalal Surgical

- B.Braun SE

- Integra LifeSciences Holdings Corporation

- Henke Sass Wolf GmbH

- Lifco AB (Carl Bennet AB)

- Vista Apex

- AR Instrumed Pty Ltd

- Septodont Holding SAS

- Snaa Industries

Market Report Segmentation

By Product Type (Volume, Thousand Units, USD Million, 2020-2031)- Non-disposable

- Disposable

- Aspirating

- Non-Aspirating

- Self-Aspirating

- Dental Clinics

- Hospital

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- STERIS PLC

- Jalal Surgical

- B. Braun SE

- Integra LifeSciences Holdings Corporation

- Henke Sass Wolf GmbH

- Lifco AB (Carl Bennet AB)

- Vista Apex

- AR Instrumed Pty Ltd

- Septodont Holding SAS

- Snaa Industries