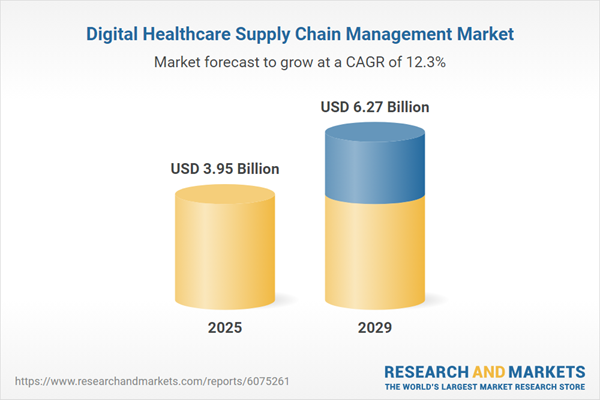

The digital healthcare supply chain management market size has grown rapidly in recent years. It will grow from $3.51 billion in 2024 to $3.95 billion in 2025 at a compound annual growth rate (CAGR) of 12.5%. The growth observed during the historic period can be attributed to several factors, including the rising demand for transparency, growing awareness of environmental impact, a heightened focus on inventory optimization, increasing concerns about data security, and a stronger emphasis on incorporating patient feedback.

The digital healthcare supply chain management market size is expected to see rapid growth in the next few years. It will grow to $6.27 billion in 2029 at a compound annual growth rate (CAGR) of 12.3%. The growth expected during the forecast period can be attributed to factors such as the expansion of healthcare markets, the growth of telehealth services, the shift towards value-based care, collaborations with tech startups, and the rise of e-commerce. Key trends anticipated during this period include the adoption of advanced forecasting tools, the implementation of automated inventory management systems, the use of remote monitoring solutions, the integration of artificial intelligence in demand sensing, and the development of smart warehousing solutions.

The growing adoption of cloud computing is expected to drive the expansion of the digital healthcare supply chain management market. Cloud computing involves the on-demand provision of computing services over the internet, such as servers, storage, databases, networking, software, and analytics. The rise in cloud computing adoption is driven by its scalability, cost-effectiveness, flexibility, improved collaboration, and the ability to access resources and applications remotely. Digital healthcare supply chain management benefits from cloud computing by enhancing data sharing, improving inventory tracking, and enabling real-time analytics, leading to more efficient operations and improved patient outcomes. For example, in December 2023, Eurostat, a Luxembourg-based intergovernmental organization, reported that 42.5% of EU enterprises used cloud computing in 2023, mainly for hosting email systems and storing files electronically, marking a 4.2% increase from 2021. As a result, the growing adoption of cloud computing is fueling the growth of the digital healthcare supply chain management market.

Leading companies in the digital healthcare supply chain management market are focusing on making advanced digitalization tools more accessible by using low-technical configuration environments, such as no-code network digitalization platforms, to improve the efficiency and flexibility of supply chain operations. A no-code network digitalization platform is a software solution that enables users to design, modify, and manage digital processes and workflows without the need for coding skills. For example, in September 2024, TraceLink, a US-based software company, introduced the Opus platform, a major innovation in supply chain management aimed at digitalizing end-to-end supply networks. It features a no-code design environment that allows users to configure complex workflows without extensive technical knowledge, offers real-time visibility into supply chain performance through integrated reports and dashboards, and provides collective intelligence capabilities that promote collaborative decision-making across multiple organizations to anticipate and mitigate supply disruptions.

In March 2022, Symplr, a US-based software developer, acquired GreenLight Medical, Inc. for an undisclosed sum. This acquisition allows Symplr to expand its healthcare operations portfolio by incorporating GreenLight’s software, which offers healthcare organizations essential data for assessing, purchasing, and deploying new medical technology. The integration is designed to streamline purchasing decisions while ensuring collaboration and compliance. GreenLight Medical, Inc. is a US-based provider of healthcare supply chain management software, specializing in digital healthcare supply chain management.

Major players in the digital healthcare supply chain management market are McKesson Corporation, Cardinal Health Inc., International Business Machines (IBM) Corporation, Oracle Corporation, SAP SE, Siemens Healthineers AG, Medline Industries Inc., Infosys Limited, Henry Schein Inc., Avery Dennison Corporation, Vizient Inc., Infor LLC, Veeva Systems Inc., Palantir Technologies Inc., Epicor Software Corporation, InterSystems Corporation, West Monroe Partners LLC, Global Healthcare Exchange LLC, Tecsys Inc., Rishabh Software Pvt Ltd., SYMPLR Inc., Terso Solutions Inc., KareXpert Technologies Pvt Ltd., Mika-Health Inc., and Jump Technologies Inc.

North America was the largest region in the digital healthcare supply chain management market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in digital healthcare supply chain management report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa. The countries covered in the digital healthcare supply chain management market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Digital healthcare supply chain management involves the integration of digital technologies and data analytics into the processes that oversee the flow of medical products, information, and services within the healthcare system. It leverages advanced technologies such as data analytics and IoT to optimize inventory management, increase visibility, and foster better collaboration among stakeholders, ensuring that medical supplies are accessible when and where they are needed.

The primary product categories in digital healthcare supply chain management include software, hardware, and services. Software refers to applications and programs designed to help healthcare organizations manage their supply chain activities, such as tracking inventory, ordering supplies, and managing product and service data. These solutions are available in various deployment types, including on-premise, cloud-based, and web-based, and are used by end users across industries such as pharmaceuticals, medical devices, biotechnology and vaccines, as well as clinical and point-of-care diagnostics.

The digital healthcare supply chain management market research report is one of a series of new reports that provides digital healthcare supply chain management market statistics, including digital healthcare supply chain management industry global market size, regional shares, competitors with a digital healthcare supply chain management market share, detailed digital healthcare supply chain management market segments, market trends and opportunities, and any further data you may need to thrive in the digital healthcare supply chain management industry. This digital healthcare supply chain management market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The digital healthcare supply chain management market consists of revenues earned by entities by providing services such as inventory management, order management, data analytics, supplier management, and logistics coordination. The market value includes the value of related goods sold by the service provider or included within the service offering. The digital healthcare supply chain management market also includes sales of analytics and reporting tools, supply chain visibility platforms, cloud-based collaboration tools, supply chain simulation software, and network optimization tools. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Digital Healthcare Supply Chain Management Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on digital healthcare supply chain management market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for digital healthcare supply chain management? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The digital healthcare supply chain management market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Product: Software; Hardware; Services2) by Deployment: on-Premise; Cloud-Based; Web-Based

3) by End-User: Pharmaceuticals; Medical Devices; Biotechnology and Vaccines; Clinical and Point of Care Diagnostics

Subsegments:

1) by Software: Supply Chain Planning Software; Inventory Management Systems; Transportation Management Systems; Order Management Systems; Analytics and Reporting Software; Others2) by Hardware: RFID Systems; Barcode Scanners; IoT-Enabled Devices; Storage and Networking Devices; Others

3) by Services: Implementation and Integration Services; Training and Support Services; Consulting Services; Managed Services; Others

Key Companies Profiled: McKesson Corporation; Cardinal Health Inc.; International Business Machines (IBM) Corporation; Oracle Corporation; SAP SE

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Digital Healthcare Supply Chain Management market report include:- McKesson Corporation

- Cardinal Health Inc.

- International Business Machines (IBM) Corporation

- Oracle Corporation

- SAP SE

- Siemens Healthineers AG

- Medline Industries Inc.

- Infosys Limited

- Henry Schein Inc.

- Avery Dennison Corporation

- Vizient Inc.

- Infor LLC

- Veeva Systems Inc.

- Palantir Technologies Inc.

- Epicor Software Corporation

- InterSystems Corporation

- West Monroe Partners LLC

- Global Healthcare Exchange LLC

- Tecsys Inc.

- Rishabh Software Pvt Ltd.

- SYMPLR Inc.

- Terso Solutions Inc.

- KareXpert Technologies Pvt Ltd.

- Mika-Health Inc.

- Jump Technologies Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 3.95 Billion |

| Forecasted Market Value ( USD | $ 6.27 Billion |

| Compound Annual Growth Rate | 12.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |