Global Diving Equipment Market - Key Trends and Drivers Summarized

What Constitutes Diving Equipment and How Has It Evolved?

Diving equipment encompasses a wide range of gear that enables divers to explore underwater environments safely and efficiently. This gear includes essential items like masks, snorkels, fins, wetsuits, buoyancy control devices (BCDs), regulators, and tanks. Each piece of equipment plays a crucial role in ensuring the diver's safety and comfort while submerged. For instance, the mask allows for clear vision underwater, the snorkel aids in breathing at the surface, and fins enhance mobility. The wetsuit provides thermal protection, while the BCD helps in maintaining buoyancy. The regulator, connected to the tank, facilitates the safe delivery of breathable air from the tank to the diver. Over the years, diving equipment has undergone significant evolution, with advancements in materials, design, and technology enhancing the safety, functionality, and user experience for both recreational and professional divers.Technological Advancements in Diving Equipment: Enhancing Safety and Experience

The diving equipment industry has seen remarkable technological innovations, particularly in the areas of safety, communication, and environmental adaptability. Modern wetsuits, for example, are crafted from advanced neoprene materials that offer superior thermal insulation and flexibility, allowing divers to explore colder waters with ease. Additionally, the development of dive computers has revolutionized underwater navigation and safety, providing real-time data on depth, time, and decompression limits to help divers avoid the risks of decompression sickness. Moreover, advances in regulator technology have improved air delivery systems, ensuring consistent and comfortable breathing even at greater depths. Innovations in underwater communication devices now enable divers to communicate more effectively with their dive buddies and surface teams, enhancing coordination during dives. These technological improvements not only make diving safer but also expand the possibilities for exploration, allowing divers to venture into more challenging environments.The Growing Popularity and Applications of Diving Equipment

Diving equipment is not only essential for recreational divers but also plays a critical role in various professional and industrial applications. Scuba diving has gained popularity as a recreational activity, with growing interest in underwater photography, marine conservation, and adventure tourism. This surge in interest has driven demand for high-quality, durable, and user-friendly diving gear. In professional contexts, diving equipment is indispensable in industries such as offshore oil and gas, underwater construction, and marine research. Commercial divers rely on specialized equipment, including underwater welding gear, rebreathers, and drysuits, to perform complex tasks in challenging underwater environments. The military also uses advanced diving equipment for specialized missions, such as underwater demolition, mine clearance, and reconnaissance. As diving continues to attract a diverse range of enthusiasts and professionals, the demand for innovative and reliable equipment is expected to grow.What Drives the Growth in the Diving Equipment Market?

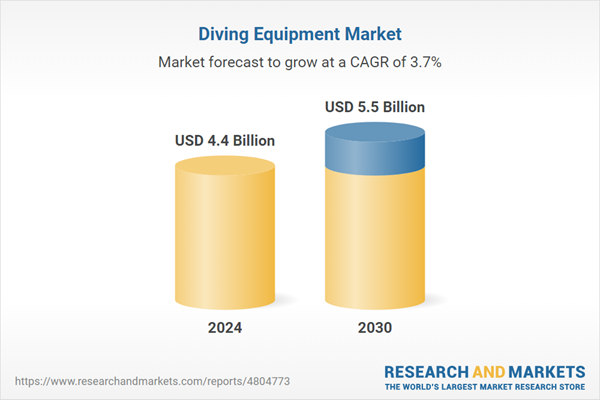

The growth in the diving equipment market is driven by several factors, including the increasing popularity of recreational diving, the expansion of underwater tourism, and the rising demand for specialized equipment in commercial and military applications. Technological advancements that enhance safety and improve user experience are also significant contributors to market growth, as divers seek more advanced and reliable gear for their underwater adventures. Furthermore, the growing emphasis on marine conservation and environmental awareness is encouraging more people to take up diving as a way to connect with and protect the underwater world. In professional sectors, the need for efficient and durable equipment to support industrial and military operations under challenging conditions is driving investments in new technologies and products. Additionally, the expansion of diving schools and training programs worldwide is introducing more people to the sport, further fueling the demand for high-quality diving equipment. These trends, coupled with the continued innovation in gear design and functionality, ensure a robust and dynamic market for diving equipment in the coming years.Report Scope

The report analyzes the Diving Equipment market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Rebreather, Cylinders & Propulsion Vehicle, Decompression Chamber, Exposure Suits, Accessories); Application (Commercial, Defense, Civil); End-Use (Oil & Gas, Naval, Aquaculture, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Rebreather segment, which is expected to reach US$2 Billion by 2030 with a CAGR of 4.3%. The Cylinders & Propulsion Vehicle segment is also set to grow at 3.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.2 Billion in 2024, and China, forecasted to grow at an impressive 6.2% CAGR to reach $1.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Diving Equipment Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Diving Equipment Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Diving Equipment Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Apollo Australia P/L, Aqua Lung International, Atlantis Dive, Cobham PLC, Dragerwerk AG & Co. KGaA and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 253 companies featured in this Diving Equipment market report include:

- Apollo Australia P/L

- Aqua Lung International

- Atlantis Dive

- Cobham PLC

- Dragerwerk AG & Co. KGaA

- Henderson Aquatics

- Honeywell International, Inc.

- Submarine Manufacturing & Products Ltd.

- Underwater Kinetics

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Apollo Australia P/L

- Aqua Lung International

- Atlantis Dive

- Cobham PLC

- Dragerwerk AG & Co. KGaA

- Henderson Aquatics

- Honeywell International, Inc.

- Submarine Manufacturing & Products Ltd.

- Underwater Kinetics

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 402 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.4 Billion |

| Forecasted Market Value ( USD | $ 5.5 Billion |

| Compound Annual Growth Rate | 3.7% |

| Regions Covered | Global |