Liquid-Cooled Engine is the fastest growing segment, Asia-Pacific is the largest market globally

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The ongoing demand for high-performance and fuel-efficient engines significantly influences the global automotive engine cooling system market. Modern engine designs, including turbocharged and downsized architectures, operate at elevated temperatures and pressures to maximize power output while adhering to stringent fuel economy targets. This operational intensity necessitates advanced thermal management solutions capable of dissipating increased heat loads effectively and reliably. For example, according to the European Automobile Manufacturers' Association (ACEA), European vehicle production reached 12.8 million units in 2023, with 42% featuring turbocharged engines requiring enhanced cooling capacity. Such engines demand precision cooling to prevent overheating, ensure component longevity, and maintain optimal combustion efficiency, thereby driving the development and adoption of more robust cooling systems.Key Market Challenges

The accelerating shift towards vehicle electrification represents a significant challenge to the growth of the Global Automotive Engine Cooling System Market. This transition fundamentally alters the cooling requirements within vehicles, leading to a reduced demand for traditional cooling systems designed for internal combustion engines. Electric vehicles, including both battery electric and plug-in hybrid models, do not require the same extensive engine-centric cooling mechanisms.Instead, their thermal management needs are redirected towards specialized systems for batteries, electric motors, and power electronics, which differ significantly in design and function from conventional engine cooling components. This pivot results in a contraction of the market for radiators, water pumps, and thermostats historically integral to gasoline and diesel powertrains. The continued rise in electric vehicle adoption directly impacts the manufacturing volumes and revenue streams for suppliers focused on conventional cooling solutions.

Key Market Trends

The escalating adoption of electric vehicles necessitates a fundamental reorientation of automotive cooling systems towards electrification-specific thermal management solutions. These advanced systems precisely manage temperature requirements for high-voltage batteries, electric motors, power electronics, and cabin climate control, often integrating heat pump technology. This specialized approach optimizes battery performance, extends range, and ensures component longevity. According to the International Energy Agency (IEA), in May 2025, global electric vehicle sales were projected to surpass 20 million units, representing a quarter of overall car sales. This growth drives significant investment and innovation in cooling technologies uniquely tailored to electric vehicle operational characteristics, shifting focus to comprehensive thermal orchestration.Key Market Players Profiled:

- Denso

- Valeo

- Mahle

- BorgWarner

- Hanon Systems

- Calsonic Kansei

- Modine

- Visteon

- NRF

- T.RAD

Report Scope:

In this report, the Global Automotive Engine Cooling System Market has been segmented into the following categories:By Vehicle Type:

- Two Wheelers

- Passenger Vehicles

- Commercial Vehicles

By Engine Type:

- Air-Cooled Engine

- Liquid-Cooled Engine

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Automotive Engine Cooling System Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Denso

- Valeo

- Mahle

- BorgWarner

- Hanon Systems

- Calsonic Kansei

- Modine

- Visteon

- NRF

- T.RAD

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | November 2025 |

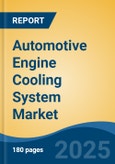

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 38.9 Billion |

| Forecasted Market Value ( USD | $ 55.85 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |