Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

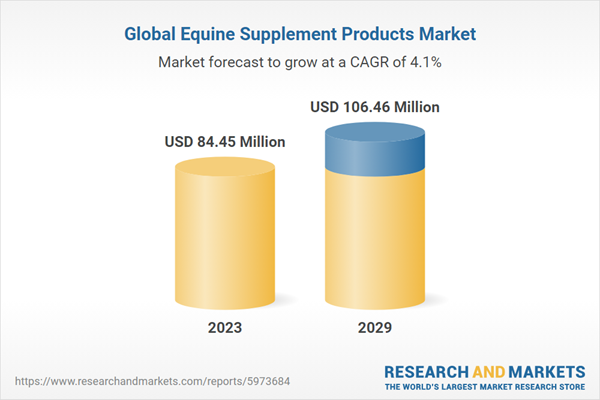

The globalization of equine sporting events and competitions contributes to the expansion of the market. Horses participating in various disciplines, such as racing, show jumping, and dressage, require specialized veterinary care to optimize their performance and ensure their welfare. This has led to the development of innovative therapeutic solutions tailored to the unique physiology and healthcare needs of horses. The market is characterized by a diverse range of products and services, including anti-infectives, anti-inflammatory drugs, vaccines, and supplements. Also, technological advancements in diagnostics and treatment modalities play a crucial role in shaping the equine veterinary therapeutics landscape. Challenges in the market include regulatory complexities associated with international movement of horses, economic constraints affecting spending on non-essential healthcare, and the need for specialized research funding. However, collaborative efforts between industry stakeholders, advancements in biotechnology, and a focus on ethical considerations in equine healthcare contribute to overcoming these challenges. As the equine industry continues to grow and globalize, the Global Equine Supplement Products Market is positioned for sustained expansion, addressing the dynamic healthcare requirements of the diverse equine population worldwide.

Key Market Drivers

Growing Equine Industry

The Global Equine Supplement Products Market is significantly influenced by the burgeoning growth of the equine industry worldwide. The rising popularity of equestrian sports, recreational riding, and other equine-related activities has resulted in an increased population of horses globally. As the equine industry expands, so does the demand for effective and specialized veterinary therapeutics to address the health and well-being of these animals. Horse owners and professionals within the equine sector are increasingly recognizing the importance of investing in veterinary care to maintain the health, performance, and longevity of their equine companions. The growing equine industry encompasses a spectrum of activities, including horse racing, show jumping, dressage, and leisure riding. Each of these disciplines requires unique veterinary interventions, ranging from preventive healthcare measures to therapeutic treatments for specific conditions. With a heightened awareness of the economic and emotional value associated with horses, owners are more inclined to seek advanced veterinary solutions to optimize the health and performance of their equine partners. This escalating demand for equine veterinary therapeutics is driving innovation within the market, prompting pharmaceutical companies and research institutions to develop specialized medications, diagnostics, and treatment protocols. As the equine industry continues to flourish, the Global Equine Supplement Products Market is positioned for sustained growth, fueled by the evolving healthcare needs of the diverse equine population around the world.Emphasis on Preventive Healthcare

The Global Equine Supplement Products Market is experiencing a notable surge driven by a growing emphasis on preventive healthcare within the equine industry. Horse owners and professionals are increasingly recognizing the value of proactive measures to maintain the health and well-being of their equine companions. This shift towards preventive healthcare in the equine sector includes a focus on vaccinations, deworming, nutritional supplements, and routine veterinary check-ups. The aim is to prevent diseases, detect potential health issues early, and optimize the overall health of horses. The emphasis on preventive healthcare is propelled by a desire to enhance the longevity and performance of horses, particularly those involved in various equestrian disciplines. As the understanding of equine physiology advances, there is a growing awareness of the importance of nutrition, vaccinations, and regular health monitoring in preventing common ailments. This trend aligns with the broader movement towards responsible horse ownership and the recognition of horses as valuable and cherished companions. In response to this emphasis on prevention, the equine veterinary therapeutics market is witnessing an increased demand for vaccines, anthelmintics, and nutritional supplements tailored to the unique needs of horses. Pharmaceutical companies are developing innovative and effective preventive solutions to address the evolving healthcare preferences within the equine industry. As the awareness of preventive healthcare practices continues to grow, the Global Equine Supplement Products Market is poised for sustained expansion, meeting the rising demand for therapeutics that contribute to the overall well-being of horses.Rise in Equine Sporting Events

The Global Equine Supplement Products Market is experiencing a significant upswing propelled by the burgeoning rise in equine sporting events globally. The expansion of horse racing, show jumping, dressage, and other equestrian competitions has created a heightened demand for specialized veterinary care and therapeutics. Horses participating in these events undergo rigorous training and face unique health challenges, necessitating advanced healthcare interventions to enhance their performance and ensure their overall well-being. As the equine sporting industry continues to grow, the market for veterinary therapeutics is witnessing a surge in demand for medications, performance-enhancing supplements, and rehabilitation services tailored to the specific needs of these high-performance animals. The nature of equine sports places exceptional demands on the health and fitness of participating horses, leading to an increased focus on injury prevention, recovery, and optimal performance. Veterinary therapeutics, ranging from anti-inflammatory drugs to regenerative medicine, play a crucial role in addressing the unique healthcare requirements of sport horses. This trend aligns with the broader recognition of horses as valuable athletes, prompting owners, trainers, and event organizers to prioritize top-tier veterinary care to ensure the welfare of the competing animals. As the popularity and economic significance of equine sporting events continue to grow, the Global Equine Supplement Products Market is poised for sustained expansion. This trend not only reflects the evolving healthcare needs of performance horses but also underscores the market's responsiveness to the dynamic landscape of the global equine industry.Key Market Challenges

Regulatory Compliance

Regulatory compliance is a critical aspect that significantly influences the dynamics of the Global Equine Supplement Products Market. The complex and varied regulatory landscape governing veterinary pharmaceuticals poses challenges for companies operating in this market. As equine veterinary therapeutics are subject to different regulations in various regions, navigating this intricate web of compliance requirements becomes essential for market participants. The regulatory environment encompasses product registration, marketing authorization, and adherence to specific standards and guidelines set forth by regulatory bodies. In the United States, the Food and Drug Administration (FDA) oversees the approval and regulation of veterinary drugs, ensuring their safety, efficacy, and proper labeling. The European Medicines Agency (EMA) plays a similar role in the European Union, establishing regulations for veterinary medicines. However, within the EU, each member state also maintains its own regulatory framework, adding another layer of complexity for companies seeking market approval. The diverse regulatory landscape extends beyond North America and Europe, with countries in Asia-Pacific, Latin America, and other regions having their own sets of rules and requirements. Harmonization efforts, such as the International Cooperation on Harmonisation of Technical Requirements for Registration of Veterinary Medicinal Products (VICH), aim to align regulatory standards globally.Despite these efforts, challenges persist due to variations in regulatory interpretations and local nuances. Meeting regulatory compliance demands rigorous documentation of the safety and efficacy of equine veterinary therapeutics. This involves extensive preclinical and clinical studies, data submission, and adherence to good manufacturing practices (GMP). Ensuring product safety is particularly crucial, given the unique physiology of horses and the potential impact of therapeutic interventions on their well-being. The regulatory approval process often involves rigorous scrutiny of study designs, data integrity, and the ethical treatment of animals involved in trials. Ethical considerations related to equine health and welfare are paramount, and regulatory bodies emphasize the humane treatment of animals throughout the development and testing phases. The timeframe and cost associated with obtaining regulatory approvals can be substantial. Delays in approval processes can impede the timely entry of new equine veterinary therapeutics into the market, affecting companies' revenue projections and hindering their ability to address emerging health challenges in the equine population promptly. Moreover, the complexity of regulatory requirements poses a particular challenge for small and medium-sized enterprises (SMEs) in the equine veterinary therapeutics market. SMEs may lack the resources and expertise to navigate the intricate regulatory pathways, potentially limiting their ability to bring innovative products to market.

Limited Research Funding

Limited research funding poses a significant challenge to the Global Equine Supplement Products Market, impeding the progress of innovative solutions and hindering the industry's ability to address emerging health issues in the equine population. In the realm of veterinary medicine, where research and development are crucial for advancing therapeutic interventions, the availability of funding plays a pivotal role in shaping the trajectory of scientific breakthroughs. The equine veterinary therapeutics market is characterized by its unique set of challenges and opportunities, necessitating targeted research to develop effective medications, vaccines, and treatment modalities tailored to the distinct physiology of horses. However, compared to more mainstream fields, such as human medicine or even companion animal therapeutics, funding dedicated to equine health research is often limited, creating a gap in knowledge and innovation. One of the primary factors contributing to the limited research funding in equine veterinary therapeutics is the comparatively smaller market size. With horses constituting a niche segment of the overall veterinary market, attracting investment and research funding can be challenging. Pharmaceutical companies and research institutions may prioritize areas with larger market potential, leaving equine health research with constrained financial support. The lack of a robust commercial market for certain equine health issues further exacerbates the funding challenge. Conditions specific to horses, such as certain infectious diseases or less common ailments, may not attract sufficient attention from funding bodies due to their limited economic impact or the perception that they affect only a small population of animals.Moreover, the cost-intensive nature of equine research poses a hurdle. Conducting clinical trials, maintaining research facilities, and ensuring the ethical treatment of research animals, all integral components of equine health studies, require substantial financial resources. The high cost associated with equine veterinary research may discourage potential funders, limiting the scope and scale of research initiatives. Another contributing factor to the funding constraint is the lack of centralized funding bodies dedicated exclusively to equine health. Unlike some other areas of veterinary research, such as companion animal health or food animal production, equine health may not benefit from dedicated funding agencies or foundations that prioritize and allocate resources specifically for equine research. The limited collaboration between academia and industry in the equine veterinary therapeutics sector also contributes to constrained research funding. Collaborations between universities, research institutions, and pharmaceutical companies can facilitate the translation of research findings into practical applications. However, the scarcity of such collaborative initiatives in the equine sector hampers the flow of funds into critical research endeavors.

To address the challenge of limited research funding, concerted efforts are required from various stakeholders. Pharmaceutical companies operating in the equine veterinary therapeutics market can play a pivotal role by allocating resources to support research initiatives, recognizing the long-term benefits of a robust evidence base for their products. Collaborations between industry and academia can foster a synergistic approach, leveraging the strengths of both sectors to advance equine health research. Government agencies and private foundations dedicated to animal health research can contribute by prioritizing equine health within their funding initiatives. Establishing targeted grant programs and fostering a supportive environment for equine research can encourage scientists and veterinarians to explore innovative solutions for equine health challenges. Also, advocacy for equine health research within the broader veterinary and animal welfare community is crucial. Raising awareness about the importance of equine health, both in terms of the animals' welfare and the economic contributions of the equine industry, can garner support from diverse funding sources. Educational institutions can also play a role in addressing the funding gap by incorporating equine health into their research priorities. By encouraging faculty and students to pursue research projects in equine veterinary therapeutics, universities contribute to expanding the knowledge base and addressing the specific healthcare needs of horses.

Key Market Trends

Increasing Adoption of Biologics

The Global Equine Supplement Products Market is experiencing a noteworthy trend with the increasing adoption of biologics. Biologic products, which include monoclonal antibodies, cytokine therapies, and other advanced biological agents, have gained prominence as innovative treatment modalities for various equine health conditions. These biologics offer targeted and specific interventions, often addressing complex diseases and disorders with a higher degree of precision. The trend reflects a shift towards personalized and advanced therapeutic approaches in equine healthcare. One notable area of adoption is in the field of regenerative medicine, where biologics like stem cell therapy and platelet-rich plasma (PRP) have demonstrated efficacy in promoting tissue repair and accelerating the healing process in horses. These regenerative therapies hold promise for addressing musculoskeletal injuries, a common concern in equine sports and activities. The use of monoclonal antibodies and cytokine therapies is also gaining traction, particularly in the management of inflammatory conditions and immune-related disorders in horses. These biologics, designed to modulate specific pathways in the immune system, offer novel and targeted solutions for conditions that may have been challenging to address with traditional pharmaceuticals. The increasing adoption of biologics in the equine veterinary therapeutics market signifies a growing understanding of the unique physiology of horses and the potential benefits of tailored, biologically derived treatments. As research and development in this domain continue to advance, biologics are likely to play an increasingly pivotal role in shaping the future of equine healthcare, offering new possibilities for improving the overall well-being and performance of horses.Globalization of Equine Therapeutics Market

The Global Equine Supplement Products Market is undergoing a transformative phase marked by the globalization of its landscape. The equine industry's increasing internationalization and the global movement of horses have significantly influenced the dynamics of the therapeutics market. This trend is propelled by the growing participation of horses in various global events, such as equestrian sports competitions, breeding programs, and international trade. As horses traverse borders for racing, breeding, and leisure, there is a heightened demand for standardized and internationally recognized equine veterinary therapeutics. The globalization of the equine therapeutics market has implications for regulatory harmonization and the development of consistent treatment protocols. Regulatory frameworks are evolving to accommodate the cross-border movement of horses, necessitating alignment and collaboration between regulatory bodies worldwide. This shift facilitates a more seamless introduction of equine veterinary therapeutics in different regions, ensuring that products meet standardized safety and efficacy requirements. Moreover, the sharing of knowledge, research findings, and best practices on a global scale is fostering collaboration between veterinarians, researchers, and pharmaceutical companies. This exchange of information contributes to the development of innovative solutions that cater to the diverse healthcare needs of horses across different geographical locations. The globalization trend not only expands market opportunities for equine veterinary therapeutics but also underscores the need for a comprehensive and interconnected approach to equine healthcare on a global scale. As the equine industry continues to transcend borders, the Global Equine Supplement Products Market is poised to benefit from increased collaboration, regulatory alignment, and the development of universally applicable therapeutic solutions for horses worldwide.Segmental Insights

Supplements Insights

Based on Supplements, Protein have emerged as the fastest growing segment in the Global Equine Supplement Products Market in 2023. This is ascribed due to its crucial role in supporting the overall health and performance of horses. Proteins are essential for muscle development, tissue repair, and overall body maintenance in equines. Equine enthusiasts, trainers, and veterinarians prioritize protein-rich supplements to enhance muscle strength, promote recovery, and support the horse's energy levels. As protein plays a fundamental role in equine nutrition, supplements catering to this specific need are in high demand, driving the dominance of the protein segment in the market for equine supplement products worldwide.Distribution Channel Insights

Based on Distribution Channel, Veterinary Hospital have emerged as the dominating segment in the Global Equine Supplement Products Market in 2023. This is because of its role as a trusted source for comprehensive equine healthcare. Veterinary hospitals, with their specialized expertise, recommend and administer supplements tailored to individual horse needs. They provide a professional environment for assessing nutritional requirements and addressing specific health concerns, ensuring accurate supplement recommendations. Moreover, veterinary hospitals maintain quality standards, influencing the preference for supplements prescribed within a clinical setting. Horse owners often rely on the expertise of veterinary professionals in these institutions, contributing to the dominance of the veterinary hospitals segment in the global market for equine supplement products.Regional Insights

Based on Region, North America have emerged as the dominating region in the Global Equine Supplement Products Market in 2023. The region is home to a large population of horses, with a thriving equestrian industry comprising various disciplines such as racing, showing, and recreational riding. This substantial equine population drives demand for supplements to maintain horse health and performance. North America boasts a well-established network of equine veterinarians and professionals who recommend and prescribe supplements as part of routine care. The region's robust economy and high disposable income levels among horse owners facilitate increased spending on premium supplement products. These factors position North America as a key player in the Global Equine Supplement Products Market.Key Market Players

- Bayer AG

- Boehringer Ingelheim International GmbH

- Equine Products UK Ltd

- Zoetis Services LLC

- Purina Animal Nutrition LLC

- Vetoquinol S.A.

- Kentucky Equine Research, Inc.

- Plusvital Limited

- Lallemand Inc.

- Virbac S.A.

Report Scope:

In this report, the Global Equine Supplement Products Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Equine Supplement Products Market, By Supplements:

- Protein

- Vitamin

- Enzyme

- Electrolyte & Minerals

- Others

Equine Supplement Products Market, By Application:

- Performance Enhancement/Recovery

- Joint Disorder Prevention

- Other

Equine Supplement Products Market, By Distribution Channel:

- Veterinary Hospital

- Veterinary Clinics

- Pharmacies and drug stores

- E-commerce

- Other

Equine Supplement Products Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Egypt

Competitive Landscape

Company Profiles: Detailed analysis of the major companies presents in the Global Equine Supplement Products Market.Available Customizations:

Global Equine Supplement Products Market report with the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

1. Product Overview1.1. Market Definition

1.2. Scope of the Market

1.2.1. Markets Covered

1.2.2. Years Considered for Study

1.2.3. Key Market Segmentations

2. Research Methodology

2.1. Objective of the Study

2.2. Baseline Methodology

2.3. Key Industry Partners

2.4. Major Association and Secondary Sources

2.5. Forecasting Methodology

2.6. Data Triangulation & Validation

2.7. Assumptions and Limitations

3. Executive Summary

3.1. Overview of the Market

3.2. Overview of Key Market Segmentations

3.3. Overview of Key Market Players

3.4. Overview of Key Regions/Countries

3.5. Overview of Market Drivers, Challenges, Trends

4. Voice of Customer

5. Global Equine Supplement Products Market Outlook

5.1. Market Size & Forecast

5.1.1. By Value

5.2. Market Share & Forecast

5.2.1. By Supplements (Protein, Vitamin, Enzyme, Electrolyte & Minerals, Others)

5.2.2. By Application (Performance Enhancement/Recovery, Joint Disorder Prevention, Other)

5.2.3. By Distribution Channel (Veterinary Hospital, Veterinary Clinics, Pharmacies and drug stores, E-commerce, Other)

5.2.4. By Region

5.2.5. By Company (2023)

5.3. Market Map

5.3.1. By Supplements

5.3.2. By Application

5.3.3. By Distribution Channel

5.3.4. By Region

6. Asia Pacific Equine Supplement Products Market Outlook

6.1. Market Size & Forecast

6.1.1. By Value

6.2. Market Share & Forecast

6.2.1. By Supplements

6.2.2. By Application

6.2.3. By Distribution Channel

6.2.4. By Country

6.3. Asia Pacific: Country Analysis

6.3.1. China Equine Supplement Products Market Outlook

6.3.1.1. Market Size & Forecast

6.3.1.1.1. By Value

6.3.1.2. Market Share & Forecast

6.3.1.2.1. By Supplements

6.3.1.2.2. By Application

6.3.1.2.3. By Distribution Channel

6.3.2. India Equine Supplement Products Market Outlook

6.3.2.1. Market Size & Forecast

6.3.2.1.1. By Value

6.3.2.2. Market Share & Forecast

6.3.2.2.1. By Supplements

6.3.2.2.2. By Application

6.3.2.2.3. By Distribution Channel

6.3.3. Australia Equine Supplement Products Market Outlook

6.3.3.1. Market Size & Forecast

6.3.3.1.1. By Value

6.3.3.2. Market Share & Forecast

6.3.3.2.1. By Supplements

6.3.3.2.2. By Application

6.3.3.2.3. By Distribution Channel

6.3.4. Japan Equine Supplement Products Market Outlook

6.3.4.1. Market Size & Forecast

6.3.4.1.1. By Value

6.3.4.2. Market Share & Forecast

6.3.4.2.1. By Supplements

6.3.4.2.2. By Application

6.3.4.2.3. By Distribution Channel

6.3.5. South Korea Equine Supplement Products Market Outlook

6.3.5.1. Market Size & Forecast

6.3.5.1.1. By Value

6.3.5.2. Market Share & Forecast

6.3.5.2.1. By Supplements

6.3.5.2.2. By Application

6.3.5.2.3. By Distribution Channel

7. Europe Equine Supplement Products Market Outlook

7.1. Market Size & Forecast

7.1.1. By Value

7.2. Market Share & Forecast

7.2.1. By Supplements

7.2.2. By Application

7.2.3. By Distribution Channel

7.2.4. By Country

7.3. Europe: Country Analysis

7.3.1. France Equine Supplement Products Market Outlook

7.3.1.1. Market Size & Forecast

7.3.1.1.1. By Value

7.3.1.2. Market Share & Forecast

7.3.1.2.1. By Supplements

7.3.1.2.2. By Application

7.3.1.2.3. By Distribution Channel

7.3.2. Germany Equine Supplement Products Market Outlook

7.3.2.1. Market Size & Forecast

7.3.2.1.1. By Value

7.3.2.2. Market Share & Forecast

7.3.2.2.1. By Supplements

7.3.2.2.2. By Application

7.3.2.2.3. By Distribution Channel

7.3.3. Spain Equine Supplement Products Market Outlook

7.3.3.1. Market Size & Forecast

7.3.3.1.1. By Value

7.3.3.2. Market Share & Forecast

7.3.3.2.1. By Supplements

7.3.3.2.2. By Application

7.3.3.2.3. By Distribution Channel

7.3.4. Italy Equine Supplement Products Market Outlook

7.3.4.1. Market Size & Forecast

7.3.4.1.1. By Value

7.3.4.2. Market Share & Forecast

7.3.4.2.1. By Supplements

7.3.4.2.2. By Application

7.3.4.2.3. By Distribution Channel

7.3.5. United Kingdom Equine Supplement Products Market Outlook

7.3.5.1. Market Size & Forecast

7.3.5.1.1. By Value

7.3.5.2. Market Share & Forecast

7.3.5.2.1. By Supplements

7.3.5.2.2. By Application

7.3.5.2.3. By Distribution Channel

8. North America Equine Supplement Products Market Outlook

8.1. Market Size & Forecast

8.1.1. By Value

8.2. Market Share & Forecast

8.2.1. By Supplements

8.2.2. By Application

8.2.3. By Distribution Channel

8.2.4. By Country

8.3. North America: Country Analysis

8.3.1. United States Equine Supplement Products Market Outlook

8.3.1.1. Market Size & Forecast

8.3.1.1.1. By Value

8.3.1.2. Market Share & Forecast

8.3.1.2.1. By Supplements

8.3.1.2.2. By Application

8.3.1.2.3. By Distribution Channel

8.3.2. Mexico Equine Supplement Products Market Outlook

8.3.2.1. Market Size & Forecast

8.3.2.1.1. By Value

8.3.2.2. Market Share & Forecast

8.3.2.2.1. By Supplements

8.3.2.2.2. By Application

8.3.2.2.3. By Distribution Channel

8.3.3. Canada Equine Supplement Products Market Outlook

8.3.3.1. Market Size & Forecast

8.3.3.1.1. By Value

8.3.3.2. Market Share & Forecast

8.3.3.2.1. By Supplements

8.3.3.2.2. By Application

8.3.3.2.3. By Distribution Channel

9. South America Equine Supplement Products Market Outlook

9.1. Market Size & Forecast

9.1.1. By Value

9.2. Market Share & Forecast

9.2.1. By Supplements

9.2.2. By Application

9.2.3. By Distribution Channel

9.2.4. By Country

9.3. South America: Country Analysis

9.3.1. Brazil Equine Supplement Products Market Outlook

9.3.1.1. Market Size & Forecast

9.3.1.1.1. By Value

9.3.1.2. Market Share & Forecast

9.3.1.2.1. By Supplements

9.3.1.2.2. By Application

9.3.1.2.3. By Distribution Channel

9.3.2. Argentina Equine Supplement Products Market Outlook

9.3.2.1. Market Size & Forecast

9.3.2.1.1. By Value

9.3.2.2. Market Share & Forecast

9.3.2.2.1. By Supplements

9.3.2.2.2. By Application

9.3.2.2.3. By Distribution Channel

9.3.3. Colombia Equine Supplement Products Market Outlook

9.3.3.1. Market Size & Forecast

9.3.3.1.1. By Value

9.3.3.2. Market Share & Forecast

9.3.3.2.1. By Supplements

9.3.3.2.2. By Application

9.3.3.2.3. By Distribution Channel

10. Middle East and Africa Equine Supplement Products Market Outlook

10.1. Market Size & Forecast

10.1.1. By Value

10.2. Market Share & Forecast

10.2.1. By Supplements

10.2.2. By Application

10.2.3. By Distribution Channel

10.2.4. By Country

10.3. MEA: Country Analysis

10.3.1. South Africa Equine Supplement Products Market Outlook

10.3.1.1. Market Size & Forecast

10.3.1.1.1. By Value

10.3.1.2. Market Share & Forecast

10.3.1.2.1. By Supplements

10.3.1.2.2. By Application

10.3.1.2.3. By Distribution Channel

10.3.2. Saudi Arabia Equine Supplement Products Market Outlook

10.3.2.1. Market Size & Forecast

10.3.2.1.1. By Value

10.3.2.2. Market Share & Forecast

10.3.2.2.1. By Supplements

10.3.2.2.2. By Application

10.3.2.2.3. By Distribution Channel

10.3.3. UAE Equine Supplement Products Market Outlook

10.3.3.1. Market Size & Forecast

10.3.3.1.1. By Value

10.3.3.2. Market Share & Forecast

10.3.3.2.1. By Supplements

10.3.3.2.2. By Application

10.3.3.2.3. By Distribution Channel

10.3.4. Egypt Equine Supplement Products Market Outlook

10.3.4.1. Market Size & Forecast

10.3.4.1.1. By Value

10.3.4.2. Market Share & Forecast

10.3.4.2.1. By Supplements

10.3.4.2.2. By Application

10.3.4.2.3. By Distribution Channel

11. Market Dynamics

11.1. Drivers

11.2. Challenges

12. Market Trends & Developments

12.1. Recent Developments

12.2. Product Launches

12.3. Mergers & Acquisitions

13. Global Equine Supplement Products Market: SWOT Analysis

14. Porter’s Five Forces Analysis

14.1. Competition in the Industry

14.2. Potential of New Entrants

14.3. Power of Suppliers

14.4. Power of Customers

14.5. Threat of Substitute Product

15. Competitive Landscape

15.1. Bayer AG

15.1.1. Business Overview

15.1.2. Company Snapshot

15.1.3. Products & Services

15.1.4. Financials (In case of listed)

15.1.5. Recent Developments

15.1.6. SWOT Analysis

15.2. Boehringer Ingelheim International GmbH

15.3. Equine Products UK Ltd

15.4. Zoetis Services LLC

15.5. Purina Animal Nutrition LLC

15.6. Vetoquinol S.A.

15.7. Kentucky Equine Research, Inc.

15.8. Plusvital Limited

15.9. Lallemand Inc.

15.10. Virbac S.A.

16. Strategic Recommendations

17. About the Publisher & Disclaimer

Companies Mentioned

- Bayer AG

- Boehringer Ingelheim International GmbH

- Equine Products UK Ltd

- Zoetis Services LLC

- Purina Animal Nutrition LLC

- Vetoquinol S.A.

- Kentucky Equine Research, Inc.

- Plusvital Limited

- Lallemand Inc.

- Virbac S.A.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 184 |

| Published | June 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 84.45 Million |

| Forecasted Market Value ( USD | $ 106.46 Million |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |