Global Flow Imaging Microscopy/Dynamic Image Analysis Market - Key Trends & Drivers Summarized

Why Is Flow Imaging Microscopy Critical in Particle Characterization?

Flow imaging microscopy, also known as dynamic image analysis, is a powerful technique used for characterizing particles in a variety of industries, including pharmaceuticals, food & beverage, chemicals, and biotechnology. This technology allows for the real-time capture of high-resolution images of particles suspended in liquid, enabling detailed analysis of their size, shape, and morphology. Unlike traditional methods like static microscopy or laser diffraction, flow imaging microscopy provides more comprehensive data by visually identifying individual particles and analyzing their features in real-time. This makes it especially valuable in applications where understanding particle behavior and quality is critical, such as in drug formulation, quality control, and contamination analysis.In the pharmaceutical industry, flow imaging microscopy is used to analyze active pharmaceutical ingredients (APIs) and excipients, ensuring that particle size and morphology meet the necessary specifications for drug efficacy and safety. It is also vital for detecting and characterizing contaminants or aggregates in injectable drugs, where even small particles can pose significant risks to patients. In the food industry, flow imaging microscopy is used to evaluate the texture and quality of ingredients, while in biotechnology, it plays a key role in monitoring cells and microorganisms in fermentation and cell culture processes. The growing need for precise and reliable particle characterization across multiple sectors is driving the adoption of flow imaging microscopy.

What Technological Advancements Are Shaping the Future of Flow Imaging Microscopy?

Technological advancements are significantly enhancing the capabilities of flow imaging microscopy, allowing for more accurate, efficient, and automated particle analysis. One of the most significant developments is the integration of artificial intelligence (AI) and machine learning (ML) algorithms into imaging systems. These technologies enable automated classification and analysis of particles based on shape, size, and morphology, reducing the time and effort required for manual analysis. AI-driven flow imaging microscopy can quickly identify and categorize particles, leading to more efficient quality control processes and faster decision-making in industrial applications.Moreover, improvements in imaging resolution and optics are providing even more detailed visualization of particles. High-resolution cameras and advanced optical systems are allowing for the capture of sub-micron particles, expanding the range of applications for flow imaging microscopy in fields such as nanotechnology and materials science. Another important advancement is the development of multi-spectral imaging techniques, which enable the differentiation of particles based on their chemical composition. This is particularly useful in industries like pharmaceuticals and chemicals, where it is essential to distinguish between different types of particles or contaminants within a sample.

Why Is Flow Imaging Microscopy Gaining Importance in Pharmaceuticals and Biotechnology?

Flow imaging microscopy is gaining increasing importance in the pharmaceutical and biotechnology industries due to its ability to provide detailed, real-time analysis of particles that can impact drug development, manufacturing, and quality control. In pharmaceutical formulation, the size and shape of drug particles can influence the solubility, bioavailability, and stability of the final product. Flow imaging microscopy allows for precise characterization of these particles, ensuring that drugs meet the necessary specifications for safety and efficacy. It is also widely used to detect and characterize unwanted particles or aggregates in injectable drugs and biopharmaceuticals, where contamination can lead to serious health risks.In biotechnology, flow imaging microscopy is critical for monitoring cell cultures and bioprocesses. It allows researchers to track the growth and morphology of cells, identify contaminants, and ensure that bioreactor conditions are optimized for maximum yield. In addition, the technology is used to analyze protein aggregates in biologics, where even small aggregates can affect the stability and performance of therapeutic proteins. As the pharmaceutical and biotechnology industries continue to advance, the need for high-precision particle analysis tools like flow imaging microscopy is becoming increasingly critical in ensuring product quality, safety, and regulatory compliance.

What Are the Key Drivers of Growth in the Flow Imaging Microscopy Market?

The growth in the flow imaging microscopy/dynamic image analysis market is driven by several factors, including the increasing demand for precise particle characterization in industries such as pharmaceuticals, biotechnology, food & beverage, and chemicals. In the pharmaceutical industry, the rising complexity of drug formulations, particularly in biopharmaceuticals and injectable therapies, is driving the need for advanced imaging technologies that can detect and characterize particles with high accuracy. Regulatory agencies like the U.S. Food and Drug Administration (FDA) have stringent guidelines regarding particle contamination in injectable drugs, further boosting demand for flow imaging microscopy in quality control and compliance.In the biotechnology sector, the rapid growth of cell-based therapies and biologics is fueling the need for technologies that can monitor cell cultures and detect aggregates or contaminants during production. Additionally, advancements in nanotechnology and materials science are expanding the use of flow imaging microscopy in research and development, as scientists seek to understand the properties of nanoparticles and other small particles. Technological advancements in imaging resolution, automation, and AI-driven analysis are further accelerating the adoption of flow imaging microscopy by making it more efficient, user-friendly, and capable of handling complex particle analysis tasks. As industries increasingly rely on accurate and detailed particle characterization, the market for flow imaging microscopy is expected to grow steadily.

Report Scope

The report analyzes the Flow Imaging Microscopy/Dynamic Image Analysis market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Sample Type (Biologics, Small Molecules, Other Sample Types); End-Use (Biotechnology, Pharmaceutical, Other End-Uses).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Biologics Sample segment, which is expected to reach US$34.7 Million by 2030 with a CAGR of a 8.3%. The Small Molecules Sample segment is also set to grow at 7.1% CAGR over the analysis period.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Flow Imaging Microscopy/Dynamic Image Analysis Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Flow Imaging Microscopy/Dynamic Image Analysis Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Flow Imaging Microscopy/Dynamic Image Analysis Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

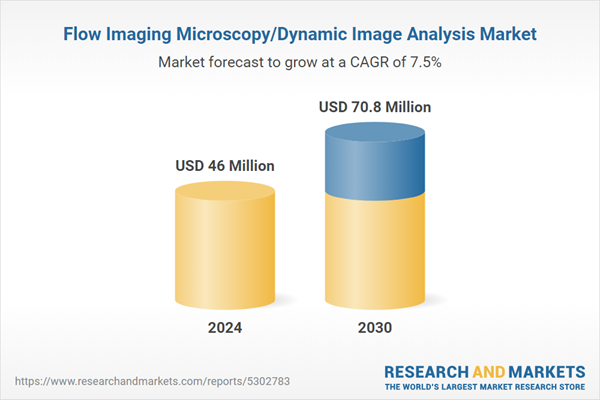

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Bettersize Instruments, Bio-Techne, Fluid Imaging Technologies, Fritsch, Micromeritics and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Flow Imaging Microscopy/Dynamic Image Analysis market report include:

- Bettersize Instruments

- Bio-Techne

- Fluid Imaging Technologies

- Fritsch

- Micromeritics

- Microtrac

- Occhio

- ProteinSimple

- Retsch

- Sympatec

- Sysmex Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Bettersize Instruments

- Bio-Techne

- Fluid Imaging Technologies

- Fritsch

- Micromeritics

- Microtrac

- Occhio

- ProteinSimple

- Retsch

- Sympatec

- Sysmex Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 279 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 46 Million |

| Forecasted Market Value ( USD | $ 70.8 Million |

| Compound Annual Growth Rate | 7.5% |

| Regions Covered | Global |