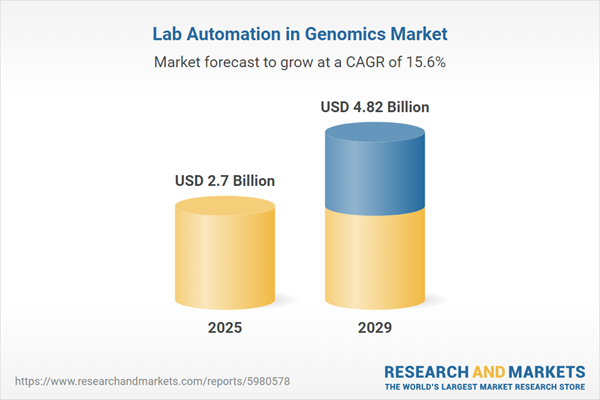

The lab automation in genomics market size has grown rapidly in recent years. It will grow from $2.33 billion in 2024 to $2.7 billion in 2025 at a compound annual growth rate (CAGR) of 16%. The growth in the historic period can be attributed to the increased demand for precision medicine, rise in the complexity of genomic data, increased focus on genomic research, increased adoption in clinical diagnostics, demand for scalability and flexibility.

The lab automation in genomics market size is expected to see rapid growth in the next few years. It will grow to $4.82 billion in 2029 at a compound annual growth rate (CAGR) of 15.6%. The growth in the forecast period can be attributed to the expansion of point-of-care testing, shift towards cloud-based solutions, focus on real-time and continuous monitoring, expansion of precision agriculture, rise of multi-omics integration. Major trends in the forecast period include the adoption of automated instruments, adoption of lab automation systems, automated technologies, cloud-based platforms.

The increasing adoption of precision medicine is poised to drive the expansion of lab automation within the genomics market in the foreseeable future. Precision medicine, characterized by its personalized approach to healthcare, takes into account individual variations in genes, environment, and lifestyle to deliver tailored medical therapies. The growing demand for precision medicine is attributed to various factors, including advancements in genomics, targeted therapies, patient-centric care, and drug development. As precision medicine relies heavily on genetic testing to identify disease-related genes, laboratories are faced with the challenge of processing a large number of samples quickly and accurately, prompting the adoption of automated systems. For instance, data from February 2024, provided by the Personalized Medicine Coalition, a US-based non-profit organization, revealed that the FDA approved 16 novel personalized therapies for rare diseases in 2023, compared to six in 2022. This indicates a significant uptick in the adoption of precision medicine, thereby driving the demand for lab automation in the genomics market.

Leading companies in lab automation within the genomics market are focusing on developing advanced solutions such as automated whole genome sequencing (WGS) to advance genomics research, clinical diagnostics, and personalized medicine significantly. Automated whole genome sequencing involves sequencing an individual's genome using high-throughput, automated sequencing technologies. For example, in May 2023, Clear Labs, Inc., a US-based genomics testing company, introduced Clear Dx, a new solution offering fully automated sample processing. Clear Dx ensures precise and consistent library preparation and management for genomics applications. The automation provided by Clear Dx reduces human variability, ensures consistency throughout sequencing, and streamlines genome sequencing processes. It reduces hands-on time to just 30 minutes with a single touchpoint, making whole genome sequencing accessible even without specialized training.

In October 2022, Ginkgo Bioworks, a US-based biotechnology company, completed the acquisition of Zymergen for an undisclosed sum. This strategic acquisition is geared towards accelerating the development of Ginkgo's horizontal synthetic biology platform by integrating critical automation and software technologies, including machine learning and data science tools. These technologies enhance exploration in both known and unexplored genetic design areas. Zymergen, a US-based biotechnology company specializing in automation technology, brings expertise in improving the efficiency and reliability of lab operations within genomics services.

Major companies operating in the lab automation in genomics market report are Pfizer Inc.; Robert Bosch GmbH; Johnson & Johnson; F. Hoffmann-La Roche Ltd.; Thermo Fisher Scientific Inc.; Novartis International AG; GlaxoSmithKline plc; Danaher Corporation; Becton, Dickinson and Company; Agilent Technologies Inc.; PerkinElmer Inc.; Bio-Rad Laboratories Inc.; Qiagen N.V.; Tecan Group Ltd.; Illumina Inc.; Hamilton Company; Promega Corporation; Oxford Nanopore Technologies Ltd.; Fluidigm Corporation; Gilson Incorporated.

North America was the largest region in the lab automation in genomics market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the lab automation in genomics market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the lab automation in genomics market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The lab automation in genomics market consists of revenues earned by entities by providing services such as sample preparation, sequencing library preparation, data analysis, sample tracking and management, quality control, customization, and integration. The market value includes the value of related goods sold by the service provider or included within the service offering. The lab automation in genomics market also includes sales of centrifuges, thermal cyclers, sequencing platforms, PCR automation systems, and robotic workstations. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

Lab automation in genomics refers to the utilization of advanced technologies and systems to streamline and automate diverse laboratory processes integral to genomic research and analysis. By leveraging lab automation, the objective is to enhance the efficiency, accuracy, and reproducibility of genomic studies while minimizing manual errors, increasing throughput, and expediting data analysis.

The primary types of lab automation in genomics encompass automated liquid handlers, automated plate handlers, robotic arms, and automated storage and retrieval systems, among others. Automated liquid handlers are specialized laboratory instruments engineered to accurately dispense precise volumes of liquids automatically, thereby optimizing processes such as sample preparation and assay setup. These devices significantly enhance efficiency and accuracy across various genomic workflows. Lab automation in genomics operates through a variety of processes, including continuous automation systems and modular automation systems. These automation solutions find application across diverse sectors, including hospitals and private labs, biotech and pharmaceutical companies, academic and research institutes, and other relevant industries.

The lab automation in genomics market research report is one of a series of new reports that provides lab automation in genomics market statistics, including the lab automation in genomics industry global market size, regional shares, competitors with a lab automation in genomics market share, detailed lab automation in genomics market segments, market trends and opportunities, and any further data you may need to thrive in the lab automation in genomics industry. This lab automation in genomics market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Lab Automation In Genomics Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on lab automation in genomics market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for lab automation in genomics? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The lab automation in genomics market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Automated Liquid Handlers; Automated Plate Handlers; Robotic Arms; Automated Storage And Retrieval Systems; Other Types2) By Process: Continuous Automation System; Modular Automation System

3) By Application: Hospitals And Private Labs; Biotech And Pharma; Academics And Research Institutes; Other Applications

Subsegments:

1) By Automated Liquid Handlers: Liquid Transfer Systems; Pipetting Robots2) By Automated Plate Handlers: Plate Stacker Systems; Microplate Transport Systems

3) By Robotic Arms: Single-Axis Robotic Arms; Multi-Axis Robotic Arms

4) By Automated Storage And Retrieval Systems: Sample Storage Systems; Automated Retrieval Systems

5) By Other Types: Nucleic Acid Extraction Systems; Other Custom Automation Solutions

Key Companies Mentioned: Pfizer Inc.; Robert Bosch GmbH; Johnson & Johnson; F. Hoffmann-La Roche Ltd.; Thermo Fisher Scientific Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Lab Automation in Genomics market report include:- Pfizer Inc.

- Robert Bosch GmbH

- Johnson & Johnson

- F. Hoffmann-La Roche Ltd.

- Thermo Fisher Scientific Inc.

- Novartis International AG

- GlaxoSmithKline plc

- Danaher Corporation

- Becton, Dickinson and Company

- Agilent Technologies Inc.

- PerkinElmer Inc.

- Bio-Rad Laboratories Inc.

- Qiagen N.V.

- Tecan Group Ltd.

- Illumina Inc.

- Hamilton Company

- Promega Corporation

- Oxford Nanopore Technologies Ltd.

- Fluidigm Corporation

- Gilson Incorporated

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 2.7 Billion |

| Forecasted Market Value ( USD | $ 4.82 Billion |

| Compound Annual Growth Rate | 15.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |