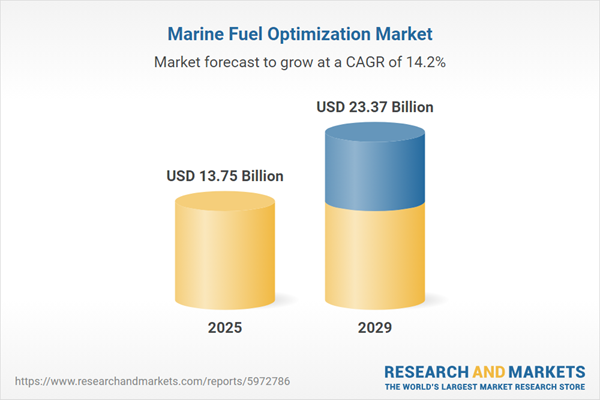

The marine fuel optimization market size has grown rapidly in recent years. It will grow from $12.01 billion in 2024 to $13.75 billion in 2025 at a compound annual growth rate (CAGR) of 14.5%. The growth in the historic period can be attributed to increasing use of wind power, rising importance of sail design, growing significance of navigation techniques, rising demand for coal fuel, and expanding role of hull design.

The marine fuel optimization market size is expected to see rapid growth in the next few years. It will grow to $23.37 billion in 2029 at a compound annual growth rate (CAGR) of 14.2%. The growth in the forecast period can be attributed to expansion of shore power infrastructure, rising fuel prices, expansion of electric propulsion, increasing public awareness of environmental issues, shift towards just-in-time shipping. Major trends in the forecast period include advancements in technology, shift towards alternative fuels, integration of AI, adoption of IoT sensors, innovations in fuel injection systems.

The marine fuel optimization market is poised for growth, driven by the escalating fuel costs affecting marine operations. Fuel costs represent the expenditure incurred by individuals, businesses, or organizations when procuring fuel to power various vehicles, machinery, equipment, or facilities. Political instability or conflicts in major oil-producing regions often disrupt the supply of crude oil, leading to increased prices for marine fuel. In response, marine fuel optimization solutions emerge as critical tools to mitigate the impact of rising fuel costs by enhancing fuel economy, optimizing routes, adjusting trim, monitoring real-time fuel usage, and ensuring compliance with environmental regulations. For instance, as reported by the National Institute of Statistics and Economic Studies in January 2024, the cost of heavy fuel oil surged from $362.7 per ton in December 2022 to $428 per ton in December 2023, marking an 18% increase. Consequently, the escalating fuel costs are propelling the growth of the marine fuel optimization market.

Key players in the marine fuel optimization market are directing their efforts towards introducing AI-powered ship operation support systems, such as Route Pilot AI, to bolster vessel efficiency and curtail fuel consumption. Route Pilot AI leverages artificial intelligence to optimize fuel consumption by analyzing a plethora of data sources, including weather conditions, sea routes, engine performance, and vessel characteristics. For instance, in September 2022, Yara Marine introduced Route Pilot AI, an AI-powered ship operations support system that leverages high-frequency data to determine the optimal propulsion settings for prospective voyages, thereby achieving fuel savings and promoting energy-efficient journeys.

In January 2022, ZeroNorth, a software development company based in Denmark, acquired ClearLynx for an undisclosed amount. This acquisition is aimed at creating a comprehensive end-to-end solution for bunker fuel optimization, allowing ship owners and operators to efficiently manage the entire bunkering process. ClearLynx, a US-based cloud platform, specializes in assisting companies within the marine fuel industry to buy, sell, trade, and broker marine fuel.

Major companies operating in the marine fuel optimization market are Siemens AG, General Electric Company, Caterpillar Inc., Honeywell International Inc., ABB Ltd., Rolls-Royce Holdings plc, Emerson Electric Co., Wärtsilä Corporation, Alfa Laval AB, MAN Energy Solutions SE, Trimble Inc., Kongsberg Maritime AS, DNV GL AS, Lloyds Register Group Limited, NAVTOR, MarineTraffic, Royston Limited, Banlaw Pty Ltd., ZeroNorth A/S, METIS Cyberspace Technology, MESPAS AG, FuelTrax, Krill Systems Inc., Bergan Marine Systems, Marine Digital GmbH.

North America was the largest region in the marine fuel optimization market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the marine fuel optimization market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the marine fuel optimization market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The marine fuel optimization market consists of revenues earned by entities providing services such as route optimization, real-time monitoring, and fuel management. The market value includes the value of related goods sold by the service provider or included within the service offering. The marine fuel optimization market also includes sales of bunker management systems, fuel monitoring systems, and propulsion efficiency systems. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

Marine fuel optimization refers to maximizing fuel efficiency and effectiveness within the maritime industry. It involves employing strategies and technologies to minimize fuel consumption while maintaining or enhancing operational performance. This optimization includes factors such as vessel design, propulsion systems, route planning, speed optimization, fuel quality management, and operational practices. The primary goals are reducing fuel costs, lowering emissions, and ensuring compliance with environmental regulations.

Key vessel types for marine fuel optimization include container ships, tankers, bulk carriers, and fishing vessels. Container ships are designed for efficient global trade by transporting containers across oceans. Technologies such as throttle optimization, fuel theft detection, and tank level monitoring are utilized across various applications such as fuel consumption tracking, fleet management, and cross-fleet standardization. Industries benefiting from these optimizations include transportation and shipping, offshore operations, fishing, naval, and defense.

The marine fuel optimization market research report is one of a series of new reports that provides marine fuel optimization market statistics, including marine fuel optimization industry global market size, regional shares, competitors with a marine fuel optimization market share, detailed marine fuel optimization market segments, market trends and opportunities, and any further data you may need to thrive in the marine fuel optimization industry. This marine fuel optimization market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Marine Fuel Optimization Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on marine fuel optimization market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for marine fuel optimization? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The marine fuel optimization market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type Of Vessel: Container Ships; Tankers; Bulk Carriers; Fishing Vessels2) By Technology: Throttle Optimization; Fuel Theft Detection; Tanks Level Monitoring; Other Technologies

3) By Application: Fuel Consumption; Fleet Management; Cross Fleet Standardization; Other Applications

4) By Industry Of End User: Transportation And Shipping; Offshore Industry; Fishing Industry; Naval And Defense

Subsegments:

1) By Container Ships: Large Container Ships; Medium-Sized Container Ships; Small Container Ships2) By Tankers: Crude Oil Tankers; Product Tankers; LNG (Liquefied Natural Gas) Tankers; Chemical Tankers

3) By Bulk Carriers: Dry Bulk Carriers; Wet Bulk Carriers

4) By Fishing Vessels: Commercial Fishing Vessels; Industrial Fishing Vessels; Small-Scale Fishing Vessels

Key Companies Mentioned: Siemens AG; General Electric Company; Caterpillar Inc.; Honeywell International Inc.; ABB Ltd.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Marine Fuel Optimization market report include:- Siemens AG

- General Electric Company

- Caterpillar Inc.

- Honeywell International Inc.

- ABB Ltd.

- Rolls-Royce Holdings plc

- Emerson Electric Co.

- Wärtsilä Corporation

- Alfa Laval AB

- MAN Energy Solutions SE

- Trimble Inc.

- Kongsberg Maritime AS

- DNV GL AS

- Lloyds Register Group Limited

- NAVTOR

- MarineTraffic

- Royston Limited

- Banlaw Pty Ltd

- ZeroNorth A/S

- METIS Cyberspace Technology

- MESPAS AG

- FuelTrax

- Krill Systems Inc.

- Bergan Marine Systems

- Marine Digital GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 13.75 Billion |

| Forecasted Market Value ( USD | $ 23.37 Billion |

| Compound Annual Growth Rate | 14.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |