Global Mobile Banking Market - Key Trends & Drivers Summarized

Why Is Mobile Banking Reshaping Financial Inclusion, Consumer Behavior, and Banking Models Globally?

Mobile banking has evolved into a critical pillar of modern financial services, enabling consumers to access and manage their accounts, perform transactions, and receive banking services directly from their smartphones or tablets. It represents the convergence of digital transformation, mobile-first consumer behavior, and the pursuit of operational efficiency within the financial sector. Mobile banking's rapid adoption has shifted banking from a place-centric model to a 24/7, user-controlled digital ecosystem - eliminating many of the frictions associated with branch-based service delivery.Its relevance extends beyond convenience. In emerging economies, mobile banking plays a foundational role in enhancing financial inclusion by reaching unbanked and underbanked populations. Through mobile wallets, agent banking, and USSD services, millions gain access to savings accounts, credit, insurance, and government transfers. In mature markets, mobile banking is redefining customer experience through personalized dashboards, biometric authentication, AI-powered chatbots, and embedded financial services. The sector's strategic importance was further elevated during the COVID-19 pandemic, which accelerated digital channel migration and highlighted the resilience of mobile-first banking infrastructures.

How Are Technologies Such as AI, Cloud, and Biometrics Elevating Mobile Banking Capabilities?

The functionality of mobile banking apps has expanded far beyond simple balance checks or fund transfers. Artificial intelligence (AI) and machine learning (ML) are being integrated to deliver personalized insights, spending analysis, and predictive budgeting tools. AI-driven chatbots are automating customer service, fraud detection, and transactional assistance, while natural language processing (NLP) is enhancing user interactions. Cloud computing enables agile development, real-time data synchronization, and seamless integration with third-party APIs, supporting open banking and digital banking-as-a-service (BaaS) models.Biometric authentication - using fingerprints, facial recognition, or iris scans - is enhancing security while improving user convenience. Multifactor authentication, behavioral analytics, and device binding further reduce the risk of cyber fraud. Advanced encryption, tokenization, and secure digital identity solutions are ensuring compliance with global data protection regulations. Embedded services such as investments, loans, insurance, and cross-border payments are being integrated within mobile platforms to create comprehensive financial ecosystems, reducing the need for multiple fintech apps.

Which Consumer Segments and Regional Markets Are Driving Mobile Banking Adoption and Innovation?

Millennials, Gen Z, gig workers, and digitally savvy consumers are the primary drivers of mobile banking adoption, favoring seamless, on-the-go access over traditional banking experiences. Micro-entrepreneurs and small businesses are increasingly leveraging mobile platforms to manage payments, track expenses, and access working capital. Retirees and underserved populations are adopting simplified mobile interfaces for receiving pensions and subsidies, especially in regions where physical bank access is limited.Asia-Pacific leads globally in mobile banking penetration, driven by mobile-first economies like China, India, and Southeast Asia, where fintech innovation and digital wallets dominate financial behavior. Africa is witnessing exponential growth in mobile money ecosystems, such as M-Pesa and MTN Mobile Money, supported by regulatory reforms and telco-bank partnerships. In North America and Europe, neobanks and digital challenger banks are disrupting the market through sleek, feature-rich apps and fee-transparent models, while incumbent banks are investing heavily to digitize legacy infrastructure and retain customer loyalty.

What Is Fueling Long-Term Growth and Structural Transformation in the Mobile Banking Market?

The growth in the mobile banking market is propelled by digital infrastructure proliferation, evolving consumer expectations, and fintech innovation. Increasing smartphone penetration, cheaper data plans, and enhanced digital literacy are enabling broader access to mobile financial services. Governments and central banks are encouraging digital banking adoption through regulatory sandboxes, real-time payment frameworks, and national financial inclusion strategies.The rise of platform-based ecosystems - where banking is embedded within e-commerce, ride-sharing, and social platforms - is expanding the boundaries of mobile banking. Strategic collaborations between banks, fintechs, and non-banking entities are accelerating the rollout of new services and monetization models. ESG-driven finance, green deposits, and ethical banking themes are also being incorporated into mobile interfaces to align with consumer values.

As the mobile channel becomes the primary gateway for financial engagement, banks are transitioning from transactional utilities to lifestyle enablers. The long-term outlook for mobile banking is one of continued expansion, innovation, and disruption - redefining how financial institutions interact with consumers in a hyper-connected, digital-first world.

Report Scope

The report analyzes the Mobile Banking market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Transaction (Consumer-to-Business, Consumer-to-Consumer); Platform (Android, iOS, Other Platforms).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Consumer-to-Business Transaction segment, which is expected to reach US$2.9 Billion by 2030 with a CAGR of a 14.3%. The Consumer-to-Consumer Transaction segment is also set to grow at 17.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $534.2 Million in 2024, and China, forecasted to grow at an impressive 20.4% CAGR to reach $1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Mobile Banking Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Mobile Banking Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Mobile Banking Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 4C Medical Technologies, Abbott Laboratories, Affluent Medical, Anteris Technologies, Artivion, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Mobile Banking market report include:

- American Express Company

- Bank of America Corporation

- BNP Paribas S.A.

- Capital One Financial Corporation

- Citigroup Inc.

- DBS Bank Ltd.

- HSBC Holdings plc

- ICICI Bank Limited

- JPMorgan Chase & Co.

- Monzo Bank Ltd.

- N26 GmbH

- Nubank

- Revolut Ltd.

- SoFi Technologies, Inc.

- Starling Bank Limited

- Temenos AG

- UBS Group AG

- Varo Bank, N.A.

- Wells Fargo & Company

- Wise plc

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- American Express Company

- Bank of America Corporation

- BNP Paribas S.A.

- Capital One Financial Corporation

- Citigroup Inc.

- DBS Bank Ltd.

- HSBC Holdings plc

- ICICI Bank Limited

- JPMorgan Chase & Co.

- Monzo Bank Ltd.

- N26 GmbH

- Nubank

- Revolut Ltd.

- SoFi Technologies, Inc.

- Starling Bank Limited

- Temenos AG

- UBS Group AG

- Varo Bank, N.A.

- Wells Fargo & Company

- Wise plc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 276 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

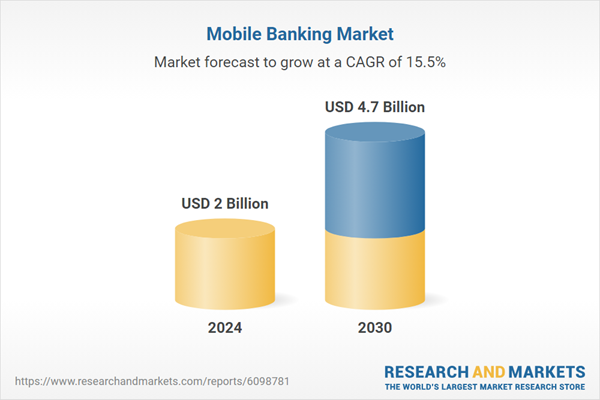

| Estimated Market Value ( USD | $ 2 Billion |

| Forecasted Market Value ( USD | $ 4.7 Billion |

| Compound Annual Growth Rate | 15.5% |

| Regions Covered | Global |