Speak directly to the analyst to clarify any post sales queries you may have.

Concise orientation to the forces reshaping natural fragrance ingredients and the operational implications for sourcing, formulation, and brand positioning

Natural fragrance ingredients are at an inflection point where consumer preferences, scientific advances, and regulatory dynamics intersect to reshape sourcing and formulation strategies. This introduction delineates the contemporary drivers that define the category, emphasizing the practical implications for brands, ingredient suppliers, and downstream channels. It highlights how evolving perceptions of naturalness, improved extraction and fermentation capabilities, and heightened scrutiny of ethical sourcing are collectively elevating the importance of transparency and traceability in ingredient selection.In the current landscape, companies must balance heritage practices with technological innovation to deliver products that satisfy regulatory expectations and consumer aspirations. This requires clear articulation of provenance, rigorous quality assurance, and the ability to pivot to alternative raw materials without compromising olfactory profiles. Moreover, the emergence of fermentation-derived ingredients and novel botanical extracts is broadening the palette of scent builders, reducing reliance on constrained animal-sourced materials, and offering more sustainable pathways to complexity in fragrance design. As a result, stakeholders across R&D, procurement, and marketing must coordinate more closely to convert these shifts into competitive differentiation and resilient supply chains.

How consumer demand for traceability and technological breakthroughs in extraction and fermentation are fundamentally reshaping supply chains and product innovation

Over the past five years, several transformative shifts have altered the competitive dynamics and commercial expectations for natural fragrance ingredients, accelerating a move from commodity supply toward differentiated, story-driven inputs. Consumers increasingly demand verifiable sustainability credentials and transparent supply chains, which in turn has driven investment from suppliers in traceability systems, regenerative agriculture initiatives, and supplier audits. Concurrently, advances in extraction technology such as supercritical CO2 and precision fermentation have expanded the toolkit available to perfumers, enabling more consistent and complex naturals while reducing dependence on fragile or controversial sourcing streams.These technological and consumer-driven shifts have also triggered consolidation and strategic partnership formation within the supply base. Companies with integrated sourcing and processing capabilities are better positioned to meet exacting quality standards and to provide integrated documentation for regulatory compliance. At the same time, formulators are recalibrating ingredient mixes, blending traditional botanical absolutes and essential oils with fermentation-derived aroma precursors to achieve both olfactory authenticity and sustainability claims. Consequently, competitive advantage increasingly depends on the ability to combine provenance storytelling with scientific rigor and reliable supply continuity.

Assessment of how the United States tariff adjustments in 2025 reshaped sourcing economics, supply chain resilience, and commercial responses across the fragrance ingredient value chain

The introduction of new tariff measures in the United States during 2025 has had a material bearing on the economics and strategy of ingredient sourcing for natural fragrances, prompting firms to reassess supplier footprints and inventory strategies. Higher import costs for selected botanical and animal-derived inputs increased landed costs for some formulations, which led to immediate commercial responses such as renegotiated supplier terms, localized sourcing initiatives, and selective reformulation to mitigate margin erosion. In parallel, tariff-driven cost pressures have accelerated nearshoring conversations, with some manufacturers exploring partnerships with domestic processors for extraction and blending to reduce exposure to cross-border duties and volatility.Importantly, the tariffs have also catalyzed shifts in supplier relationships. Buyers prioritized multi-sourcing and deeper collaboration on yield optimization and waste reduction to offset increased costs. At the same time, brands have leaned into transparent pricing communications with trade partners and consumers to explain product adjustments. Regulatory compliance efforts intensified as supply chains adapted, increasing demand for documentation and certification to validate the origin and processing methods of raw materials. These developments underscore a broader strategic lesson: tariff shocks reinforce the value of supply chain agility, diversified sourcing strategies, and investment in localized processing capabilities to protect product integrity and commercial performance.

Deep segmentation analysis revealing how source type, extraction technique, distribution channel, and end-use application collectively determine commercial and technical trade-offs

Segmentation analysis illuminates where value, risk, and innovation converge within the natural fragrance ingredient landscape. When viewed through the lens of source type, the market divides among animal-derived materials, botanical extracts, and fermentation-derived ingredients. Animal-derived materials such as ambergris, civet, and musk remain highly specialized inputs with complex regulatory and ethical considerations, prompting many brands to seek alternatives or certified supply chains. Botanical extracts encompass absolutes, CO2 extracts, essential oils, and resinoids, representing a breadth of extraction profiles and sensory characteristics that support diverse applications from fine fragrance to household products. Fermentation-derived ingredients, produced via bacterial and yeast fermentation, are increasingly used as scalable and sustainable substitutes that replicate complex scent notes without the provenance risks associated with wild-harvested sources.Extraction method further refines strategic choices: CO2 extraction, enfleurage, expression, solvent extraction, and steam distillation each deliver distinct olfactory and compositional outcomes that influence application suitability and cost structures. Distribution channels shape commercial access and margin dynamics, ranging from direct sales and distributor networks to online platforms where company websites and third-party e-commerce channels mediate discovery and fulfillment. Application segmentation captures end-use diversity across aromatherapy, fine fragrance, food and beverage, household products, and personal care. Within aromatherapy, candles, diffusers, and massage oils demand specific purity and safety profiles, while fine fragrance categories such as cologne, eau de parfum, eau de toilette, and perfume prioritize long-lasting top and base notes. Food and beverage uses span beverages, confectionery, and savory snacks and require stringent food-grade compliance. Household products like air fresheners, detergents, and dishwashing formulations emphasize stability and cost efficiency, and personal care categories including bath and shower, deodorants, hair care, oral care, and skin care impose both regulatory and sensorial constraints that guide ingredient selection. Taken together, these layered segmentations clarify the technical, commercial, and regulatory trade-offs that manufacturers and brands must manage when developing or sourcing natural fragrance ingredients.

Comparative regional view explaining how Americas, Europe Middle East & Africa, and Asia-Pacific each contribute distinct sourcing advantages, regulatory pressures, and innovation opportunities

Regional dynamics significantly influence sourcing strategies, regulatory compliance, and innovation ecosystems, and a granular view of the Americas, Europe Middle East & Africa, and Asia-Pacific reveals distinct strengths and constraints. In the Americas, proximity to major consumer markets and a strong supplier base for certain botanical crops enable responsive supply chains and closer collaboration between fragrance houses and ingredient producers. North American regulatory emphasis on labeling and safety documentation has encouraged suppliers to develop comprehensive traceability systems, while regional investment in fermentation capabilities is accelerating alternative ingredient adoption.Across Europe, the Middle East & Africa, stringent regulatory frameworks and consumer expectations around sustainability and ethical sourcing have driven suppliers to robust traceability and certification practices. The region also hosts significant botanical diversity and traditional processing expertise, which supports specialty absolutes and resinoids that command premium positioning. In the Asia-Pacific region, vast agricultural resources and evolving industrial fermentation capacity underpin both traditional botanical supply and rapidly scaling fermentation-derived production. However, supply chain variability across the region requires careful supplier qualification and quality oversight. These regional profiles highlight the importance of aligning sourcing, processing, and commercial strategies to local regulatory regimes, consumer preferences, and infrastructure realities to maintain supply continuity and brand credibility.

Insight into how company capabilities in traceability, integrated processing, and collaborative R&D are redefining competitive advantage across ingredient suppliers and technology entrants

Competitive positioning among ingredient producers and service providers is increasingly defined by capabilities in traceability, sustainability verification, and integrated processing rather than by simple scale alone. Leading companies have invested in end-to-end visibility tools, supplier development programs, and collaborative R&D to co-create novel fragrance building blocks that meet both olfactory and sustainability criteria. These organizations often combine agricultural partnerships with in-house extraction or fermentation facilities to control quality and reduce lead times, enabling closer alignment with brand development cycles.At the same time, specialized firms that focus on single-source botanicals or unique animal-derived materials retain strategic importance for niche perfumers and heritage brands, provided they can meet evolving compliance and ethical standards. Technology-focused entrants, particularly those advancing fermentation platforms, are disrupting traditional suppliers by offering consistent, scalable aroma compounds that replicate complex natural profiles while minimizing dependency on vulnerable wild-harvested resources. Strategic alliances between traditional suppliers and technology firms are emerging as a pragmatic path to balance authenticity with supply resilience. In sum, competitive advantage now requires a hybrid model that combines provenance storytelling with technical capacity to ensure consistent supply and regulatory readiness.

Actionable, prioritized strategies for senior executives to enhance supply chain resilience, broaden sourcing portfolios, and accelerate sustainable product innovation

Industry leaders should prioritize a set of actionable moves that drive resilience, protect margins, and accelerate innovation. First, invest in multi-tier traceability and supplier development to minimize exposure to single-source risk and to support credible sustainability claims that resonate with consumers and regulators. Secondly, diversify sourcing strategies across botanical, fermentation, and ethical animal-derived streams to preserve olfactory palette options while reducing vulnerability to geopolitical and environmental shocks. Simultaneously, accelerate adoption of advanced extraction technologies where appropriate to improve yields, reduce solvent dependency, and enhance reproducibility of fragrance profiles.Operationally, leaders must align procurement, R&D, and regulatory teams to enable rapid reformulation and to ensure that product claims are supported by verifiable documentation. Establishing strategic partnerships with fermentation specialists and regional processors can create near-term capacity buffers and longer-term innovation pipelines. Finally, engage proactively with regulatory bodies and industry consortia to shape practical guidance on labeling and safety evaluation, thereby reducing compliance friction and supporting a level playing field. Together, these measures strengthen supply continuity, reduce cost volatility, and unlock new product propositions grounded in both science and provenance.

Transparent mixed-methods research approach combining primary industry interviews, technical literature review, and expert validation to ensure practical relevance and rigor

The research underpinning this summary employed a mixed-methods approach to ensure robustness and relevance for commercial decision-making. Primary interviews were conducted with senior procurement, formulation, and regulatory professionals across ingredient suppliers, fragrance houses, and brand manufacturers to capture firsthand perspectives on supply chain disruptions, quality requirements, and innovation priorities. Secondary analysis incorporated peer-reviewed scientific literature on extraction and fermentation technologies, trade policy documentation, and public regulatory guidance to triangulate industry narratives and validate technical assertions. Wherever possible, cross-validation between primary interviews and technical literature was used to establish confidence in observed trends and emergent best practices.Quality assurance measures included purposive sampling to ensure representation across source types and geographies, thematic analysis of interview data to identify consistent patterns, and expert review by senior industry practitioners to confirm the practical relevance of conclusions. Limitations are acknowledged: the rapidly evolving nature of policy and technology means that some operational dynamics may change more quickly than documented here. To mitigate this, the full report includes an updatable annex of technical references and a prioritized set of indicators to monitor ongoing developments.

Synthesis of the strategic implications for stakeholders and the imperative for integrated sourcing, formulation, and regulatory alignment to secure long-term advantage

In closing, natural fragrance ingredients are undergoing systemic change driven by converging forces of consumer expectations, technological innovation, and policy shifts. These forces collectively elevate the importance of traceability, diversified sourcing, and investment in novel production methods to balance authenticity with supply resilience. Firms that proactively integrate procurement strategy with formulation science and regulatory planning will be better positioned to navigate cost pressures, tariff-induced disruptions, and evolving sustainability requirements while sustaining the sensory quality that defines their brands.Looking ahead, the capacity to blend traditional botanical expertise with fermentation-derived innovation and advanced extraction processes will determine which organizations can maintain both olfactory leadership and commercial resilience. The imperative for cross-functional alignment and strategic partnerships is clear: companies that act decisively to shore up supply chains, document provenance, and invest in scalable alternatives will convert current disruptions into long-term competitive advantage.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

16. China Natural Fragrance Ingredient Market

Companies Mentioned

The key companies profiled in this Natural Fragrance Ingredient market report include:- BASF SE

- Bell Flavors & Fragrances

- Biolandes

- CPL Aromas

- Firmenich SA

- Givaudan SA

- International Flavors & Fragrances

- Mane SA

- Privi Speciality Chemicals Limited

- Robertet SA

- S H Kelkar and Company Limited

- Sensient Technologies Corporation

- Symrise AG

- T. Hasegawa Co., Ltd.

- Takasago International Corporation

Table Information

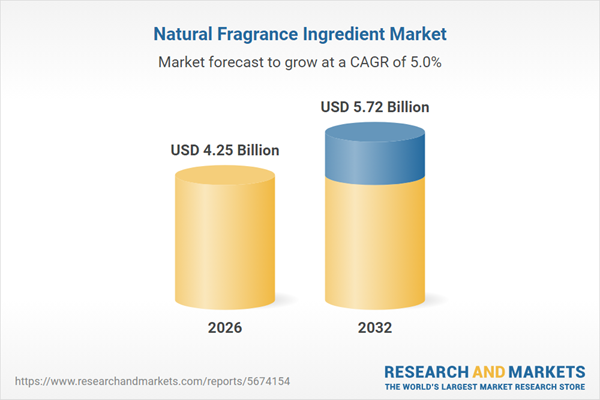

| Report Attribute | Details |

|---|---|

| No. of Pages | 194 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 4.25 Billion |

| Forecasted Market Value ( USD | $ 5.72 Billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |