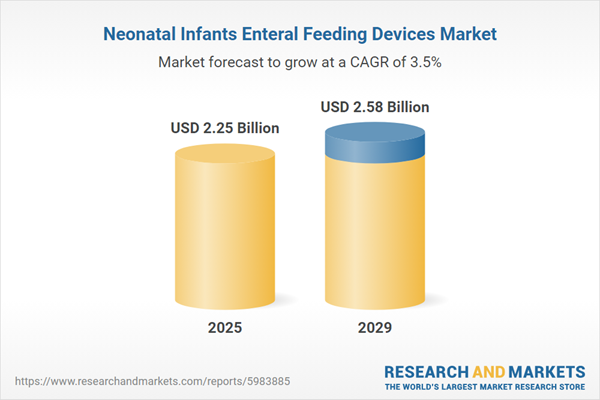

The neonatal infants enteral feeding devices market size has grown steadily in recent years. It will grow from $2.16 billion in 2024 to $2.25 billion in 2025 at a compound annual growth rate (CAGR) of 3.9%. The growth in the historic period can be attributed to increasing premature birth rates, rising incidences of neonatal disorders, growing demand for specialized neonatal care, and expanding healthcare infrastructure.

The neonatal infants enteral feeding devices market size is expected to see steady growth in the next few years. It will grow to $2.58 billion in 2029 at a compound annual growth rate (CAGR) of 3.5%. The growth in the forecast period can be attributed to increasing adoption of enteral nutrition in neonatal intensive care units, rising investments in healthcare infrastructure in emerging markets, growing awareness about the benefits of enteral feeding in neonates, expanding applications of enteral feeding devices in homecare settings, and advancements in enteral feeding technology for improved patient outcomes. Major trends in the forecast period include technological advancements, miniaturization of enteral feeding devices, integration of smart technology for remote monitoring, development of specialized enteral formulas for neonates, emphasis on infection prevention and control measures, and personalized nutrition solutions for individualized care.

The increasing prevalence of preterm birth is expected to drive the growth of the neonatal infant enteral feeding devices market in the coming years. Preterm birth refers to babies born before completing 37 weeks of gestation, which can result in various health complications due to incomplete development. Factors contributing to preterm births include rising maternal age, lifestyle choices, medical interventions like assisted reproductive technologies, maternal health issues, and environmental influences. Neonatal infant enteral feeding devices are used in these cases to deliver vital nutrition directly into the stomach or intestines of premature infants who are unable to feed orally, supporting their growth and development. For example, in May 2024, the Office for National Statistics, a UK-based governmental body, reported a slight increase in the percentage of preterm live births from 7.5% in 2021 to 7.9% in 2022. As a result, the growing incidence of preterm birth is contributing to the expansion of the neonatal infant enteral feeding devices market.

The rising number of neonatal admissions is expected to fuel the expansion of the neonatal infant enteral feeding devices market. Neonatal admissions involve hospitalization or admission of newborn infants, typically within the first 28 days of life, for medical care and monitoring. Neonatal infant enteral feeding devices are instrumental in providing specialized medical interventions and monitoring for premature or critically ill infants, addressing their immediate health requirements and enhancing their chances of survival and healthy development. For instance, according to the American Academy of Pediatrics in October 2023, the percentage of infants classified as late preterm (LPT) and low birth weight (LBW) receiving exclusive care in the nursery increased from 83.9% to 88.8% due to special circumstances, highlighting the growing demand for neonatal infant enteral feeding devices.

Major companies in the neonatal infant enteral feeding devices market are focusing on developing products with advanced technologies such as real-time assessment technology to monitor feeding and ensure optimal nutrition, thereby mitigating the risk of complications. Real-time assessment technology enhances feeding precision, safety, early issue detection, data-driven decision-making, parental involvement, and overall efficiency in neonatal care. For example, in August 2023, Cardinal Health launched its next-generation NTrainer System 2.0, a medical device aimed at helping premature and newborn infants develop oral coordination skills necessary for transitioning to independent feeding faster. This FDA Class II biofeedback device utilizes real-time assessment technology to provide clinicians with objective data to track an infant's progress in developing pre-feeding skills.

Major companies operating in the neonatal infants enteral feeding devices market are Cardinal Health Inc., Abbott Inc., 3M, Medtronic Plc, Kimberly-Clark Corporation, Becton Dickinson and Company, Boston Scientific Corporation, Fresenius Kabi AG, Terumo Corporation, Coloplast Corp., B. Braun Melsungen AG, Moog Inc., Cook Medical Inc., Teleflex Incorporated, ConvaTec Inc., Halyard Health Inc., Hollister Incorporated, CONMED Corporation, Avanos Medical Inc., Amsino International Inc., Nutricia, Vygon SA, Wellspect Healthcare, Applied Medical Technology Inc., Qosina Corporation.

North America was the largest region in the neonatal infants enteral feeding devices market in 2024. The regions covered in the neonatal infants enteral feeding devices market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the neonatal infants enteral feeding devices market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Neonatal infants' enteral feeding devices are specialized medical tools engineered specifically for delivering enteral nutrition to premature or critically ill newborns who are unable to feed orally. These devices play a crucial role in administering vital nutrients, fluids, and medications directly into the gastrointestinal tract of neonates, thereby facilitating their growth, development, and recovery within the neonatal intensive care unit (NICU) or special care nursery.

The primary products in this category include gastrostomy tubes, jejunostomy tubes, duodenostomy tubes, nasal feeding tubes, and oropharyngeal feeding tubes. Gastrostomy tubes, for instance, are medical instruments inserted through the abdomen into the stomach, providing essential nutrition and medication to individuals who cannot consume food orally due to medical conditions. These tubes are manufactured from various materials such as silicone, polyurethane, and polyvinyl chloride, available in different sizes tailored for both preterm and full-term infants. They find utility across various settings including clinics, hospitals, ambulatory care facilities, home use, and others.

The neonatal infants enteral feeding devices market research report is one of a series of new reports that provides neonatal infants enteral feeding devices market statistics, including neonatal infants enteral feeding devices industry global market size, regional shares, competitors with a neonatal infants enteral feeding devices market share, detailed neonatal infants enteral feeding devices market segments, market trends and opportunities, and any further data you may need to thrive in the neonatal infants enteral feeding devices industry. This neonatal infants enteral feeding devices market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The neonatal infants enteral feeding devices market consists of sales of nasogastric tubes, orogastric tubes, specialized feeding pumps, and accessories for delivering nutrition to newborns who cannot feed orally. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Neonatal Infants Enteral Feeding Devices Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on neonatal infants enteral feeding devices market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for neonatal infants enteral feeding devices ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The neonatal infants enteral feeding devices market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product Type: Gastrostomy Tubes; Jejunostomy Tubes; Duodenostomy Tubes; Nasal Feeding Tubes; Oropharyngeal Feeding Tubes2) By Material: Silicone; Polyurethane; Polyvinyl Chloride

3) By Size: Preterm; Full Term

4) By Application: Clinic; Hospital; Ambulatory Care; Home Use; Other Applications

Subsegments:

1) By Gastrostomy Tubes: Percutaneous Endoscopic Gastrostomy (Peg) Tubes; Balloon Gastrostomy Tubes; Non-Balloon Gastrostomy Tubes2) By Jejunostomy Tubes: Percutaneous Endoscopic Jejunostomy (Pej) Tubes; Balloon Jejunostomy Tubes; Non-Balloon Jejunostomy Tubes

3) By Duodenostomy Tubes: Percutaneous Endoscopic Duodenostomy Tubes; Balloon Duodenostomy Tubes; Non-Balloon Duodenostomy Tubes

4) By Nasal Feeding Tubes: Nasogastric (Ng) Tubes; Nasoduodenal (Nd) Tubes; Nasojejunal (Nj) Tubes

5) By Oropharyngeal Feeding Tubes: Oro-Gastric (Og) Tubes; Oro-Pharyngeal Nasal Tubes

Key Companies Mentioned: Cardinal Health Inc.; Abbott Inc.; 3M; Medtronic Plc; Kimberly-Clark Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Neonatal Infants Enteral Feeding Devices market report include:- Cardinal Health Inc.

- Abbott Inc.

- 3M

- Medtronic Plc

- Kimberly-Clark Corporation

- Becton Dickinson and Company

- Boston Scientific Corporation

- Fresenius Kabi AG

- Terumo Corporation

- Coloplast Corp.

- B. Braun Melsungen AG

- Moog Inc.

- Cook Medical Inc.

- Teleflex Incorporated

- ConvaTec Inc.

- Halyard Health Inc.

- Hollister Incorporated

- CONMED Corporation

- Avanos Medical Inc.

- Amsino International Inc.

- Nutricia

- Vygon SA

- Wellspect Healthcare

- Applied Medical Technology Inc.

- Qosina Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 2.25 Billion |

| Forecasted Market Value ( USD | $ 2.58 Billion |

| Compound Annual Growth Rate | 3.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |