Market Lifecycle Stage

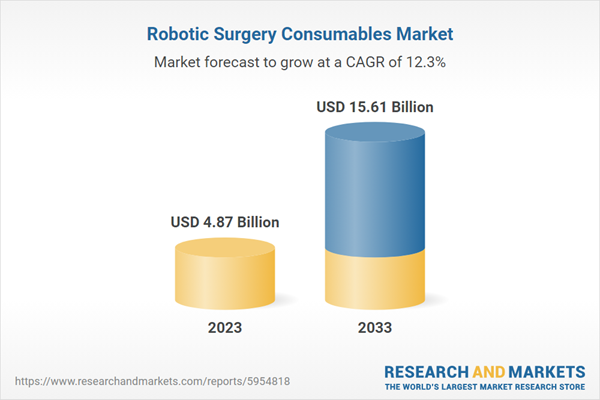

The robotic surgery consumables market has been experiencing rapid growth and is expected to reach $15.61 billion by 2033. This phase reflects a mature stage in its lifecycle, driven by technological advancements, increased adoption of robotic surgical systems, and growing demand for minimally invasive procedures. Intensified competition among manufacturers and supportive regulatory policies further contribute to sustained market expansion, offering significant opportunities for industry players.Industry Impact

The incorporation of robotic surgery consumables into the healthcare sector has brought about transformative changes, yielding numerous advantages. These consumables have notably heightened surgical precision and broadened the range of procedures achievable with greater accuracy and efficiency. Patients benefit from improved outcomes and quicker recovery times due to the less invasive nature of robotic-assisted surgeries, resulting in reduced hospital stays and post-operative discomfort. Furthermore, the adoption of robotic systems has boosted the overall productivity and effectiveness of operating rooms, enabling healthcare providers to serve more patients efficiently. Additionally, these systems have facilitated advancements in medical training, providing healthcare professionals with simulated environments to hone their skills in intricate surgical techniques. Despite the initial investment required, the long-term economic ramifications of robotic surgery consumables include cost reductions stemming from decreased complication rates and enhanced patient outcomes. Hence, the widespread integration of robotic surgery consumables has profoundly reshaped the landscape of contemporary healthcare, offering innovative solutions that elevate patient care and operational efficiency across diverse medical specialties.Market Segmentation:

Segmentation 1: by Product Type

- Access and Facilitation Equipment

- End Effectorss

- Closure

- Other Consumables

End Effectors to Dominate the Global Robotic Surgery Consumables Market (by Product Type)

The product type segment comprises end effectors, access and facilitation equipment, closures, and other consumables.End effectors significantly contribute to a company's intellectual property. Many market leaders manufacture their end effectors, ensuring compatibility with their developed robotic surgery systems. Imitated instruments from third-party vendors may lead to severe consequences such as patient fatalities and increased risks. To address this issue, manufacturers design their instruments with pre-programmed IDs that are recognized by the robotic system's interface when attached. Imitated products lack recognition and are consequently unusable.

Market growth is anticipated to be fueled by the rising demand for smaller sizes to accommodate more complex surgeries. Extensive research and development efforts are directed toward refining the end effectors, including their materials and biocompatibility. Moreover, the market for end effectors in robotic surgeries is fiercely competitive, with Intuitive Surgical, Inc. holding a prominent position as the leading player.

Segmentation 2: by Application

- General Surgery

- Gynecology Surgical Procedure

- Urology Surgical Procedure

- Orthopedic Surgical Procedure

- Cardiology Surgical Procedure

- Head and Neck Surgical Procedure

- Other Surgical Procedure

General Surgery to Dominate the Global Robotic Surgery Consumables Market (by Application)

In 2022, the general surgery segment held the largest share of the global robotic surgery consumables market. The global landscape of healthcare robotics has been experiencing notable technological advancements, significantly influencing the methods of disease diagnosis and treatment. The utilization of robotic assistance in general surgeries empowers surgeons to execute intricate procedures with enhanced precision and flexibility. Robotic systems provide superior control over consumables used in robotic surgery, owing to the remarkable dexterity of the instruments. Despite the shorter duration of conventional manual general surgeries compared to robotic procedures, experimental evidence suggests that robotic-assisted general surgery could result in reduced blood loss and superior short-term outcomes. Examples of robotic-assisted surgical systems employing robotic surgery consumables for general surgery include the da Vinci Xi, Senhance Robotic System, and Versius Robotic System.Segmentation 3: by End User

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Ambulatory Surgical Centers (ASCs)

Hospital End User Segment to Dominate the Global Robotic Surgery Consumables Market (by End User)

In 2022, the hospitals end user segment held the largest share of the global robotic surgery consumables market. Hospitals stand out as the primary purchasers of robotic surgery systems, making the most significant contribution to the consumption of related consumables. The growth in the adoption of robotic surgery systems has been propelled by key factors such as the increasing prevalence of chronic disorders and a growing geriatric population, leading to a rise in the annual number of procedures. A prevailing trend in the industry involves collaborations between major manufacturers of robotic surgery systems and consumables, as well as hospitals.Segmentation 4: by Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

North America to Dominate the Global Robotic Surgery Consumables Market (by Region)

North America held the largest share of the robotic surgery consumables market in 2022, which can be attributed to the presence of leading companies in the field, such as Intuitive Surgical, Inc., Medtronic plc, and Stryker Corporation. Emerging players such as CMR Surgical (U.K.), Versius Surgical (U.K.), Transenterix, and Titan Medical are also gaining traction in the region.Furthermore, the North America region has high market attractiveness for robotic surgery system and consumable manufacturers, which can be attributed to high patient acceptance of advanced surgical technologies as well as a substantially large and well-established healthcare industry. The U.S. is expected to be the major revenue-generating country in North America. The U.S. accounted for over 98% share of the total North America market for robotic surgery consumables in 2022.

Demand - Drivers, Restraints, and Opportunities

Market Drivers:

Rise in Adoption of Robotic Surgeries Driven by Growing Geriatric Population: In the last few years, robotic-assisted procedures have gained popularity over their conventional counterparts. Robotic-assisted procedures are becoming more common due to their various benefits, such as decreased blood loss, length of hospital stay, post-operative pain, and fewer post-operative complications. The geriatric population is most benefited from the robotic-assisted approach. According to a study published by the National Center for Biotechnology Information (NCBI) in 2018, titled “Is Robotic-Assisted Surgery Safe in the Elderly Population? An Analysis of Gynecologic Procedures in Patients ≥ 65 Years Old,” minimally invasive procedures are advantageous for the aging population with higher physical restriction, comorbidities, and are at higher surgical risk. In addition to this, another study published by NCBI in 2021, titled “Robotic versus Laparoscopic Colorectal Surgery in Elderly Patients in Terms of Recovery Time: A Monocentric Experience,” robotic colorectal surgery is associated with better recovery and shorter length of hospital stay when compared with the laparoscopic approach.Market Restraints:

High Cost of Surgical Robotic Systems and Associated Procedures: The adoption of robotic-assisted surgical platforms faces a major hurdle in their high costs, requiring a substantial initial investment, often exceeding $2 million. Additional expenses, including consumables and surgical instruments, contribute to the overall expense. For instance, the da Vinci Xi 12 mm reusable Hasson Cone has been priced at $995 per unit, significantly higher than conventional/manual surgical instruments. This substantial cost has hindered the widespread adoption of robotic-assisted surgical platforms, particularly in developing countries.Market Opportunities:

Development of Low-Cost Robotic Surgery Platforms: The emergence of low-cost robotic surgery platforms presents a lucrative opportunity for the consumables market. These platforms expand access to advanced surgical procedures, particularly in emerging markets, driving increased demand for associated consumables. Moreover, heightened competition fosters innovation in manufacturing processes, potentially leading to more affordable consumables. Overall, this trend not only broadens the adoption of robotic surgery but also stimulates growth and innovation within the consumables market.How can this report add value to an organization?

Workflow/Innovation Strategy: The robotic surgery consumables market (by product) has been segmented based on product type, including access and facilitation equipment, end effectors, closure, and other consumables. Moreover, the study provides the reader with a detailed understanding of the different applications.

Growth/Marketing Strategy: To foster growth in the global robotic surgery consumables market, businesses can concentrate on expanding into emerging regions and catering to specialized applications while innovating products. Utilizing digital marketing and forming partnerships with industry leaders can boost brand presence and market reach. Offering comprehensive training and superior customer service can foster client trust and loyalty. Continuous market analysis and adaptability to changing customer demands are crucial for long-term success.

Competitive Strategy: Key players in the global robotic surgery consumables market have been analyzed and profiled in the study, including manufacturers involved in new product launches, acquisitions, expansions, and strategic collaborations. Moreover, a detailed competitive benchmarking of the players operating in the global robotic surgery consumables market has been done to help the reader understand how players stack against each other, presenting a clear market landscape.

Methodology

Key Considerations and Assumptions in Market Engineering and Validation

- The base year considered for the calculation of the market size is 2022. The historical year analysis has been done from FY2020 to FY2021, and the market size has been calculated for FY2022 and projected for the period 2023-2033.

- The geographical distribution of the market revenue has been estimated to be the same as the company’s net revenue distribution. All the numbers have been adjusted to two digits after decimals for report presentation reasons. However, the real figures have been utilized for compound annual growth rate (CAGR) estimation. CAGR has been calculated from 2023 to 2033.

- The market has been mapped based on different types of products available in the market and several indications. All the key manufacturing companies that have a significant number of offerings to the market have been considered and profiled in the report.

- In the study, the primary respondents' verification was considered to finalize the estimated market for the robotic surgery consumables market.

- The latest annual reports of each market player have been taken into consideration for market revenue calculation.

- Market strategies and developments of key players have been considered for the calculation of sub-segment split.

- The base currency considered for the market analysis is US$. Currencies other than the US$ have been converted to the US$ for all statistical calculations, considering the average conversion rate for that particular year. The currency conversion rate has been taken from the historical exchange rate of the Oanda website or from the annual reports of the respective company, if stated.

Primary Research

The key data points taken from the primary sources include:

- Validation and triangulation of all the numbers and graphs

- Validation of the report’s segmentation and key qualitative findings

- Understanding of the numbers of the various markets for market type

- Percentage split of individual markets for regional analysis

Secondary Research

Open Sources

- World Health Organization (WHO), PubMed, Medical Device Regulations (MDR), and Food and Drug Administration (FDA)

- Annual reports, SEC filings, and investor presentations of the leading market players

- Companies’ websites and detailed study of their portfolios

- Gold standard magazines, journals, whitepapers, press releases, and news articles

- Databases

The key data points taken from the secondary sources include:

- Segmentations, split-ups, and percentage shares

- Data for market value

- Key industry trends of the top players in the market

- Qualitative insights into various aspects of the market, key trends, and emerging areas of innovation

- Quantitative data for mathematical and statistical calculations

Key Market Players and Competition Synopsis

The robotic surgery consumables market involves products, disposable and reusable tools, and accessories tailored for robotic surgical systems. These items aid in performing precise minimally invasive surgeries across various specialties such as urology, gynecology, general surgery, and orthopedic surgery, among others. Products include surgical instruments, trocars, endoscopes, drapes, gloves, and training kits. Market growth has been further fueled by the rising adoption of robotic surgery, technological advancements, increased demand for minimally invasive procedures, and ongoing innovations in surgical techniques and materials.The applications of robotic surgery consumables encompass a broad spectrum of medical procedures, spanning general surgery, gynecology, urology, orthopedics, cardiology, head and neck surgeries, and various other specialties.

The primary drivers fueling the growth of the robotic surgery consumables market include significant technological advancements within the field, particularly in robotic surgical systems, coupled with their increasing integration into various stages of surgical procedures, thus propelling market expansion. The heightened sensitivity and precision offered by robotic surgery consumables further contribute to driving market momentum. However, challenges such as the high initial investment costs associated with robotic surgical systems and the shortage of skilled personnel may pose constraints on market growth. Nevertheless, the robotic surgery consumables market is expected to witness sustained growth, driven by the growing demand for advanced surgical techniques and the imperative for precise and efficient surgical interventions in the healthcare sector.

Some of the prominent companies in this market are:

- Johnson & Johnson (Auris Health, Inc.)

- Intuitive Surgical, Inc.

- Medtronic plc. (Mazor Robotics)

- Zimmer Biomet Holdings (Medtech SA)

- Renishaw plc.

- Venus Concept (Restoration Robotics, Inc.)

- Smith & Nephew plc.

- Stryker Corporation (Mako Surgical Corporation)

- THINK Surgical, Inc.

- CMR Surgical Ltd.

- B. Braun SE (Aesculap)

- Meerecompany, Inc.

- Virtual Incision Corporation

- Asensus Surgical US, Inc. (Transenterix, Inc.)

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Johnson & Johnson (Auris Health, Inc.)

- Intuitive Surgical, Inc.

- Medtronic plc. (Mazor Robotics)

- Zimmer Biomet Holdings (Medtech SA)

- Renishaw plc.

- Venus Concept (Restoration Robotics, Inc.)

- Smith & Nephew plc.

- Stereotaxis, Inc.

- Stryker Corporation (Mako Surgical Corporation)

- THINK Surgical, Inc.

- CMR Surgical Ltd.

- Meerecompany, Inc.

- Virtual Incision Corporation

- Asensus Surgical US, Inc. (Transenterix, Inc.)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 128 |

| Published | April 2024 |

| Forecast Period | 2023 - 2033 |

| Estimated Market Value ( USD | $ 4.87 Billion |

| Forecasted Market Value ( USD | $ 15.61 Billion |

| Compound Annual Growth Rate | 12.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 14 |