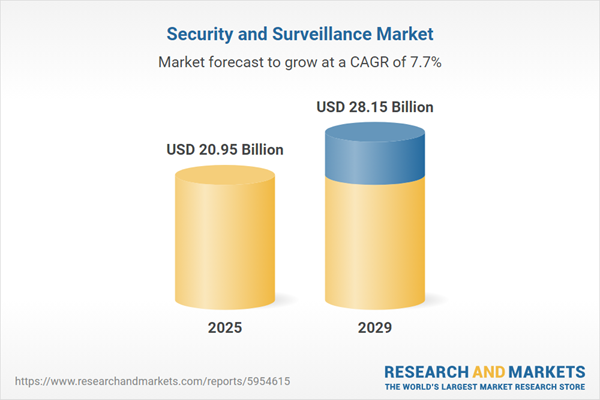

The security and surveillance market size has grown strongly in recent years. It will grow from $19.17 billion in 2024 to $20.95 billion in 2025 at a compound annual growth rate (CAGR) of 9.3%. The growth in the historic period can be attributed to warfare and conflict, urbanization and population growth, criminal activities, social and political movements, intelligence and counterintelligence operations.

The security and surveillance market size is expected to see strong growth in the next few years. It will grow to $28.15 billion in 2029 at a compound annual growth rate (CAGR) of 7.7%. The growth in the forecast period can be attributed to globalization and transnational threats, public perception and trust, economic factors, emerging threats, quantum computing, and cryptography. Major trends in the forecast period include development of surveillance technologies, advancements in artificial intelligence (AI) and machine learning, IoT (Internet of Things) integration, biometric technologies, cloud-based surveillance solutions.

The security and surveillance market is anticipated to experience growth due to the increasing incidents of terrorism and illegal activities. Terrorism involves the use of violence to instill fear for political, religious, or ideological purposes, while illegal activities encompass actions that violate established laws and regulations, often resulting in legal consequences. The rise in terrorism and illegal activities can be attributed to complex factors such as socio-economic disparities, political instability, religious extremism, and global interconnectedness. To counter these threats, security and surveillance measures are employed to detect and prevent terrorism and illegal activities by monitoring and analyzing suspicious behavior, potential threats, and illicit networks. According to the Institute for Economics and Peace (IEP) global terrorism index report in March 2023, terrorist attacks in 2022 became more lethal, with an average of 1.7 people killed per attack, compared to 1.3 deaths per attack in 2021. The report highlighted a total of 6,701 deaths attributed to terrorist activities in 2022, emphasizing the need for heightened security measures.

Key players in the security and surveillance market are actively investing in advanced solutions, such as AI (artificial intelligence) surveillance technologies, to bolster security measures and enhance threat detection capabilities. AI surveillance solutions utilize advanced algorithms and machine learning to analyze vast datasets, detect anomalies, and improve monitoring and response efficiency across different environments. For example, in August 2022, Vivotek Inc., a Taiwan-based company specializing in IP (Internet Protocol) cameras and video management software, launched VORTEX, a cloud-based video surveillance as a service (VSaaS) in the United States. This solution integrates camera, app, web, cloud, and deep learning technologies, providing an advanced AI surveillance system with real-time detection, post-hoc search capabilities, and cutting-edge deep search algorithms that transform metadata into searchable and measurable information.

In August 2023, South Korea-based global security technology company IDIS Co. Ltd. acquired Costar Technologies Inc. for approximately $23.2 million. This strategic acquisition positions IDIS to enhance its global presence and diversify its product range in the North American video market. The acquisition of Costar allows IDIS to expand its reach globally and offer a comprehensive range of security solutions. As the demand for integrated solutions grows, Costar's sales channel is expected to benefit from IDIS' 'one-stop-shop' model, facilitating the creation and deployment of complete video surveillance solutions, including deep learning analytics. Costar Technologies Inc., based in the US, specializes in providing various security solutions, including surveillance cameras, lenses, digital video recorders, and high-speed domes.

Major companies operating in the security and surveillance market are Samsung Electronics Co. Ltd., Dell Technologies Inc., Panasonic Corporation, Cisco Systems Inc., Hanwha Corporation, Schneider Electric SE, Honeywell International Inc., Zhejiang Dahua Technology Co. Ltd., ABB Ltd., Avnet Inc., Johnson Controls International plc, Tyco International plc, Hikvision Digital Technology Co. Ltd., Seagate Technology plc, Motorola Solutions Inc., NetApp Inc., Bosch Security Systems, FLIR Systems Inc., Axis Communications AB, Uniview Technologies Co. Ltd., IDIS Co. Ltd., Quantum Corporation, VIVOTEK Inc., Nedap N.V., MOBOTIX AG, Genetec Inc., Infortrend Technology Inc., Rasilient Systems Inc., Tiandy Technologies Co. Ltd.

Asia-Pacific was the largest region in the security and surveillance market in 2024. It is expected to be the fastest-growing region in the forecast period. The regions covered in the security and surveillance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the security and surveillance market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The security and surveillance market consists of revenues earned by entities by providing services such as physical observation, electronic monitoring, video recording, data collection and analysis, CCTV (Closed-Circuit Television) installation and monitoring, background checks, and screening services. The market value includes the value of related goods sold by the service provider or included within the service offering. The security and surveillance market also includes sales of intrusion detection systems, GPS (Global Positioning Systems) trackers, binoculars, video and audio recording devices, computers, CCTV systems, and alarm systems. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

Security and surveillance involve the implementation of protocols to protect individuals, assets, and information from potential threats or unauthorized access. This entails the deployment of monitoring systems, technologies, and procedures aimed at detecting, deterring, and responding to security incidents in diverse settings, including homes, businesses, and public spaces.

The primary categories of security and surveillance comprise security cameras, digital video recorders, and network video recorders (DVR and NVR). Security cameras are electronic devices designed to capture and record visual information, enhancing the safety of a specific area. They play a crucial role in surveillance and crime prevention by offering real-time monitoring and recorded footage for analysis. Video surveillance, smart home security, information technology (IT) security, and workplace surveillance are various technologies categorized under security and surveillance. These technologies cater to multiple end users, including industrial, commercial, residential, and others.

The security and surveillance research report is one of a series of new reports that provides security and surveillance market statistics, including the security and surveillance industry's global market size, regional shares, competitors with an security and surveillance market share, detailed security and surveillance market segments, market trends and opportunities, and any further data you may need to thrive in the security and surveillance industry. This security and surveillance market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Security And Surveillance Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on security and surveillance market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for security and surveillance? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The security and surveillance market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Security Cameras; Digital Video Recorder And Network Video Recorder (DVR And NVR)2) By Technology Type: Video Surveillance; Smart Home Security; Information Technology (IT) Security; Workplace Surveillance

3) By End-user: Industrial; Commercial; Residential; Other End-Users

Subsegments:

1) By Security Cameras: Analog Security Cameras; IP (Internet Protocol) Security Cameras; Wireless Security Cameras; PTZ (Pan-Tilt-Zoom) Cameras; Thermal Cameras; 360-Degree Cameras2) By Digital Video Recorder and Network Video Recorder (DVR and NVR): Analog DVR Systems; IP-based NVR Systems; Hybrid DVR/NVR Systems; Cloud-based DVR/NVR Systems; Standalone DVR/NVR Systems

Key Companies Mentioned: Samsung Electronics Co. Ltd.; Dell Technologies Inc.; Panasonic Corporation; Cisco Systems Inc.; Hanwha Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Security and Surveillance market report include:- Samsung Electronics Co. Ltd.

- Dell Technologies Inc.

- Panasonic Corporation

- Cisco Systems Inc.

- Hanwha Corporation

- Schneider Electric SE

- Honeywell International Inc.

- Zhejiang Dahua Technology Co. Ltd.

- ABB Ltd.

- Avnet Inc.

- Johnson Controls International plc

- Tyco International plc

- Hikvision Digital Technology Co. Ltd.

- Seagate Technology plc

- Motorola Solutions Inc.

- NetApp Inc.

- Bosch Security Systems

- FLIR Systems Inc.

- Axis Communications AB

- Uniview Technologies Co. Ltd.

- IDIS Co. Ltd.

- Quantum Corporation

- VIVOTEK Inc.

- Nedap N.V.

- MOBOTIX AG

- Genetec Inc.

- Infortrend Technology Inc.

- Rasilient Systems Inc.

- Tiandy Technologies Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 20.95 Billion |

| Forecasted Market Value ( USD | $ 28.15 Billion |

| Compound Annual Growth Rate | 7.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |