Silver Nanowires is the fastest growing segment, Asia-Pacific is the largest market globally

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The transparent conductive film display market is significantly driven by the expanding demand for touch-enabled devices, as these films are critical for enabling seamless interactivity across diverse applications. As consumers increasingly prioritize intuitive interfaces, the widespread integration of touch capabilities remains essential for product differentiation. Supporting this trend, according to Synaptics' investor relations, in August 2024, the company, a key supplier of interface solutions including touch controllers, reported a 14% year-over-year increase in revenue to $282.8 million for its fiscal fourth quarter of 2024. This growth reflects robust demand in the underlying component market for touch functionality.Key Market Challenges

The continuous development and increasing commercial viability of alternative transparent conductive materials, notably silver nanowires and metal mesh technologies, present a direct impediment to the growth of the Global Transparent Conductive Film Display Market. These alternative solutions offer competitive performance characteristics coupled with potentially lower production costs compared to conventional Indium Tin Oxide (ITO) films. This economic advantage directly influences material selection among display manufacturers, as they seek to optimize cost structures without compromising device functionality.Key Market Trends

A primary trend reshaping the market is the shift towards next-generation transparent conductive materials. This involves moving beyond traditional Indium Tin Oxide (ITO) solutions to alternative materials such as silver nanowires, carbon nanotubes, and metal mesh, which offer enhanced flexibility, improved conductivity, and lower manufacturing costs. This evolution is critical for advanced display technologies requiring greater resilience and performance. For example, in December 2024, DENSO collaborated with Canatu to develop transparent conductive films using carbon nanotube technology, specifically for automotive sensor applications. This highlights the industry's commitment to material innovation for demanding environments.Key Market Players Profiled:

- Teijin Ltd

- Toyobo Co. Ltd

- TDK Corporation

- Cambrios Technologies Corporation

- XTPL S.A.

- OIKE & Co. Ltd

- Dontech Inc.

- Sekisui Chemical Co., Ltd.

- Nitto Denko Corporation

- Canatu Oy

Report Scope:

In this report, the Global Transparent Conductive Film Display Market has been segmented into the following categories:By Material:

- ITO on Glass

- Silver Nanowires

- ITO on PET

- Metal Mesh

- Carbon Nanotubes

- Others

By Devices:

- Tablets

- Smartphones

- Notebooks

- LCDs

- Wearable Devices

- Others

By End-User:

- IT and Telecommunication

- Automotive and Aerospace

- Media and Entertainment

- Government and Defense

- Consumer Electronics

- Others

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Transparent Conductive Film Display Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Teijin Ltd

- Toyobo Co. Ltd

- TDK Corporation

- Cambrios Technologies Corporation

- XTPL S.A.

- OIKE & Co. Ltd

- Dontech Inc.

- Sekisui Chemical Co., Ltd.

- Nitto Denko Corporation

- Canatu Oy

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | November 2025 |

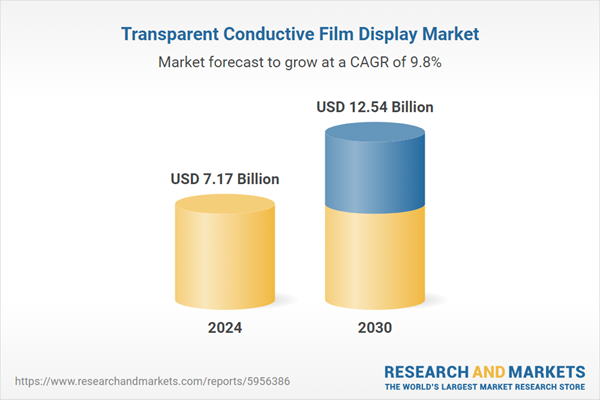

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 7.17 Billion |

| Forecasted Market Value ( USD | $ 12.54 Billion |

| Compound Annual Growth Rate | 9.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |