Speak directly to the analyst to clarify any post sales queries you may have.

Concise strategic framing of the current state of graphene composites technology and the commercial context shaping adoption across high-performance industries

Graphene-reinforced composites have transitioned from laboratory demonstrations toward integration in demanding commercial applications, driven by an expanding understanding of structure-property relationships and scalable production pathways. Over the past decade, advances in synthesis, post-processing, and composite engineering have collectively reduced barriers to adoption by improving consistency, enabling targeted property tuning, and demonstrating reliability across cyclic and impact-loading scenarios. As a result, decision-makers in product design and supply chain management are increasingly evaluating graphene composites not simply as a novelty but as a performance enabler with definable benefits in weight reduction, conductivity, and thermal management.This introduction frames the technology’s present state by synthesizing material science progress, manufacturing considerations, and adoption dynamics. It contextualizes the evolving regulatory and standards landscape that informs qualification timelines and procurement strategies. Importantly, it spotlights the converging commercial pressures-electrification of mobility, stricter thermal management requirements in electronics, and aerospace fuel-efficiency mandates-that are elevating the strategic relevance of graphene-enhanced solutions. The narrative that follows aims to equip executives, engineers, and investors with a clear appraisal of opportunities and operational challenges so that subsequent strategic choices are grounded in a balanced, practical perspective.

Comprehensive examination of the converging technological, supply-chain, and commercial forces driving rapid maturation and industrial integration of graphene composites

Several transformative shifts are reshaping the graphene composites landscape, with each dynamic reinforcing others to accelerate maturation and commercial relevance. Technological advances in deposition and exfoliation have improved quality control and throughput, narrowing the performance gap between lab-scale demonstrations and industrial-grade materials. Concurrently, manufacturers are refining integration techniques-such as functionalized interfaces and optimized dispersion approaches-that translate graphene’s intrinsic properties into measurable composite performance enhancements. These technical improvements are reinforced by a growing pool of validated use cases across sectors where weight, thermal management, or electrical conductivity deliver quantifiable value.Market and supply-chain shifts are also significant drivers. Strategic partnerships between material innovators and OEMs are reducing commercialization timelines by synchronizing product development cycles and qualification processes. Meanwhile, evolving regulatory expectations and component-level certification regimes are encouraging early standardization efforts, which tend to lower integration risk. Financially, investment is becoming more targeted: capital is channeled into scaling production processes that demonstrate reproducible quality and into applications with clear value propositions. Taken together, these trends point to a landscape in which graphene composites are increasingly moving from high-potential material to qualified option for performance-driven applications.

Analytical overview of how the United States tariff measures enacted in 2025 reshaped sourcing strategies, supplier resilience, and regional manufacturing priorities across the value chain

The United States’ tariff actions in 2025 introduced a new factor that affected sourcing strategies, cost structures, and supplier selection across the graphene composites ecosystem. Tariff changes altered the calculus for importing precursor materials and finished graphene products, prompting multinational buyers to reassess total landed cost and to accelerate supplier diversification. In response, some manufacturers intensified nearshoring strategies or sought to localize critical processing steps to mitigate exposure to tariff volatility. These adjustments favored vertically integrated producers and contract manufacturers capable of providing secure, traceable supply chains with predictable lead times.Operationally, the tariff environment highlighted the importance of supplier resilience and material traceability. Companies with multi-jurisdictional production footprints or flexible processing routes were better positioned to absorb cost shifts without disrupting customer commitments. Downstream adopters also recalibrated qualification plans to include secondary sourcing contingencies and longer inventory lead-ins for critical components. From a strategic standpoint, the tariff measures accelerated conversations around long-term supplier partnerships, investments in regional manufacturing capacity, and cooperative R&D arrangements aimed at reducing dependency on tariff-exposed inputs. Transitioning through that period reinforced the lesson that geopolitical and trade policy developments can materially affect technology adoption pathways and that proactive supply-chain design is essential to maintain competitive continuity.

Holistic segmentation-based insights clarifying how industry, application, production process, form, and grade determine commercialization routes and adoption priorities for graphene composites

Segmentation offers a practical framework for understanding where graphene composites deliver differentiated value and how technical choices map to market needs. When analyzed by end-use industry, the material’s attributes align with Aerospace & Defense demands for high strength-to-weight composites and damage tolerance, with Automotive requirements for lightweighting and thermal management in electrified powertrains, with Construction opportunities for durable, multifunctional facades and reinforcement, with Electronics & Semiconductor needs for conductive films and thermal interface materials, with Energy & Power priorities for durable storage and conductive coatings, and with Healthcare possibilities for biocompatible sensors and enhanced structural components.Viewed through the lens of application, distinctions become operationally meaningful. Barrier Materials leverage graphene’s impermeability for protective layers and corrosion resistance, while Conductive Inks & Coatings exploit its electrical conductivity for printed electronics. Energy Storage applications use graphene-enhanced electrodes and conductive additives to improve cycling performance and rate capability. Structural Composites are one of the most commercially active application groups and include subsegments such as Aerospace Components that demand stringent certification, Automotive Components that balance cost with manufacturability, and Sporting Goods that prioritize weight and impact resistance. Thermal Interface Materials address heat dissipation needs and split into Adhesive, Grease, and Pad forms, each governed by different processing and reliability considerations.

Production process segmentation clarifies technology readiness and scaling trajectories: Chemical Vapor Deposition and Epitaxial Growth deliver high-quality, low-defect films suitable for electronics and high-performance composites, whereas Liquid Phase Exfoliation and Mechanical Exfoliation offer routes to bulk powders and dispersions used in coatings and structural matrices. Form-based segmentation-Coating, Composite, Film, and Powder-captures the dominant material presentation and directly informs handling, integration, and lifecycle management. Finally, grade distinctions between Few Layer, Multi Layer, and Single Layer graphene define electrical, thermal, and mechanical properties and therefore determine suitability for specific end-use cases. Integrating these segmentation dimensions enables more precise product development roadmaps and procurement strategies that match material attributes to application-specific acceptance criteria.

In-depth regional perspective on how Americas, Europe-Middle East-Africa, and Asia-Pacific market dynamics drive differentiated adoption, investment, and supply-chain strategies for graphene composites

Regional dynamics materially influence how graphene composite technologies diffuse, how supply chains are structured, and where investment is concentrated. In the Americas, a strong emphasis on aerospace and automotive electrification has driven demand for high-strength, lightweight composites and advanced thermal management solutions. The region’s industrial base has also encouraged collaborations between material suppliers, OEMs, and defense primes, shaping qualification pathways and early-adopter programs. Policy incentives and infrastructure funding in North America further create conditions for domestic scale-up initiatives and pilot manufacturing lines focused on regional sourcing resilience.Europe, Middle East & Africa present a diverse set of drivers. European environmental and efficiency mandates, coupled with a dense automotive and aerospace manufacturing footprint, foster interest in graphene composites for lightweighting and performance gains. The region’s regulatory focus on supply-chain transparency and materials stewardship accelerates adoption of certified materials and recyclability considerations. In parallel, Middle Eastern investments are beginning to support advanced material manufacturing capacity, while selective African markets are showing interest in niche applications tied to infrastructure and energy. Across this region, cross-border collaboration and harmonized standards are influential in reducing barriers to commercialization.

Asia-Pacific exhibits pronounced momentum driven by high-volume electronics manufacturing, a strong battery supply chain, and rapidly growing industrial composites demand. The region benefits from well-established chemical and advanced materials production capabilities, enabling faster scaling of graphene production processes and a competitive supplier base. National industrial strategies in several countries prioritize advanced materials for strategic sectors, which, combined with dense manufacturing ecosystems, accelerates integration of graphene composites into mainstream products. Consequently, Asia-Pacific tends to lead on production scale and iterative application development, while other regions emphasize qualification and certified integration into regulated markets.

Strategic competitive assessment highlighting how specialized innovators, integrated manufacturers, and service-oriented suppliers are differentiating through quality, partnerships, and certification capabilities

Competitive dynamics in the graphene composites sector are defined by a mix of specialized material innovators, traditional chemical companies extending into advanced carbon allotropes, and vertically integrated manufacturers that couple synthesis capability with composite processing. Leading organizations are distinguishing themselves through investments in quality control, proprietary functionalization chemistries, and strategic partnerships with OEMs to co-develop qualification roadmaps. Companies that demonstrate reliable, repeatable production of application-specific grades and that provide technical validation through independent testing are securing early commercial wins.Across the value chain, successful players combine technical credibility with operational capabilities such as supply assurance, regulatory compliance support, and materials characterization services. Some firms are pursuing licensing models and focused collaborations to broaden market access without the capital intensity of large-scale manufacturing, while others prioritize backward integration into precursor sourcing to control input variability. Additionally, several entrants are differentiating on downstream services-offering composite design assistance, pilot-scale processing, and certification support-to reduce adopter friction. The competitive landscape favors entities that can marry material performance with pragmatic manufacturability and who can demonstrate traceable quality credentials aligned with target industry standards.

Practical strategic and operational recommendations for executives to accelerate adoption of graphene composites while managing supply risk and demonstrating validated performance benefits

Industry leaders seeking to capitalize on graphene composite opportunities should pursue a coordinated strategy that aligns technical development with commercial validation and supply-chain resilience. A practical first step is to prioritize applications where graphene’s contribution to product performance is measurable and can be validated through standardized testing and pilot deployments. This reduces adoption friction and accelerates ROI realization. Concurrently, forming early strategic partnerships with component manufacturers and end users will enable co-development that shortens qualification cycles and embeds material requirements into product roadmaps.Operationally, leaders should invest in diversified sourcing and consider regional manufacturing hubs to mitigate geopolitical and tariff-related risk. Building transparent quality systems, investing in traceable material certification, and documenting long-term performance through accelerated aging and field trials will increase buyer confidence. From a product perspective, focusing R&D on scalable processing techniques and on interface chemistry that improves dispersion and load transfer will yield the most commercially relevant improvements. Finally, organizations should implement a staged commercialization plan that sequences high-value, low-barrier applications ahead of more regulated sectors, thereby creating revenue streams and reference cases that support subsequent, larger-scale integrations.

Rigorous mixed-methods research approach combining primary expert interviews, technical literature synthesis, patent review, and scenario analysis to ensure traceable, actionable conclusions

The research underpinning this analysis integrates primary interviews with materials scientists, supply-chain managers, and commercial leads, supplemented by secondary technical literature, patent landscape reviews, and public regulatory documents. Primary engagement focused on capturing operational realities: manufacturing constraints, quality control challenges, and real-world performance outcomes across multiple end-use sectors. Secondary sources provided broader context on process technologies, functionalization approaches, and standards development activity. Cross-validation between primary insights and technical literature ensured that conclusions reflect both empirical experience and peer-reviewed evidence.Methodologically, the analysis emphasizes traceability of assertions; claims regarding material capabilities are anchored to documented test results and comparative studies rather than speculative extrapolation. Where appropriate, scenario analysis was applied to evaluate how supply-chain disruptions, policy shifts, and process-scale improvements might influence strategic choices. The approach balances technical depth-assessing synthesis routes, form factors, and grade implications-with commercial considerations such as qualification timelines, procurement practices, and partnership models. Together, these methods yield an evidence-based, actionable narrative designed to inform investment, product development, and supply-chain decisions.

Integrated synthesis of technical progress, adoption prerequisites, and strategic imperatives that define the near-term commercialization trajectory for graphene composites

The conclusion synthesizes the central insight that graphene composites have moved beyond conceptual promise toward targeted commercial relevance where application-specific advantages are clear and qualification pathways can be defined. Technical progress in synthesis and integration, combined with evolving industry demand drivers such as electrification and efficiency mandates, has created conditions for selective adoption across multiple industries. However, successful commercialization hinges on pragmatic steps: selecting high-value applications, validating performance through standardized testing, and designing resilient supply chains that can absorb policy and trade variability.Looking ahead, momentum will favor organizations that can demonstrate reproducible quality at scale and who invest in collaborative qualification with downstream partners. Regulatory clarity and emerging standards will further reduce adoption friction as they materialize. In the near term, the landscape will be characterized by iterative application wins rather than broad, simultaneous adoption, with each validated deployment building confidence and enabling the next wave of integration. For stakeholders, the strategic imperative is to act deliberately-prioritize measurable impact, de-risk through partnerships, and invest selectively in capabilities that shorten qualification timelines and enhance supply assurance.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Graphene Composites Market

Companies Mentioned

- ACS Material LLC

- Applied Graphene Materials Ltd

- Directa Plus SpA

- Graphenea S.A.

- Haydale Graphene Industries Plc

- Mersen SA

- NanoXplore Inc

- Thermo Fisher Scientific Inc.

- Thomas Swan & Co. Ltd

- Versarien Plc

- Vorbeck Materials Corp

- XG Sciences Inc

Table Information

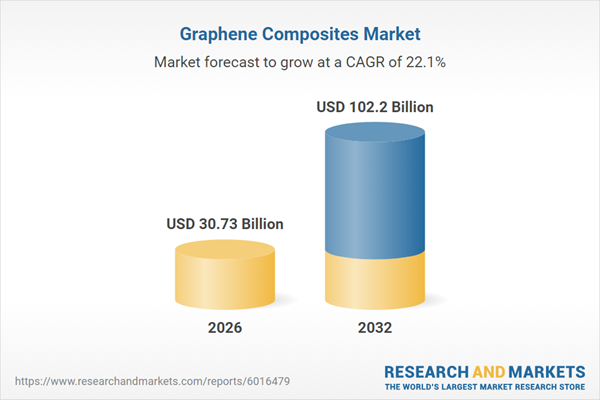

| Report Attribute | Details |

|---|---|

| No. of Pages | 184 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 30.73 Billion |

| Forecasted Market Value ( USD | $ 102.2 Billion |

| Compound Annual Growth Rate | 22.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |