The hardwood flooring market growth is primarily driven by the increasing demand for aesthetically appealing, durable, and eco-friendly flooring solutions. Rising urbanization and growth in the construction and real estate sectors further boost market demand. Consumers' preference for premium interiors, coupled with advancements in manufacturing technologies offering enhanced durability and design options, contribute significantly. Government initiatives promoting sustainable and green building materials also support market growth. Additionally, the rising disposable incomes of consumers, especially in emerging economies, enable investment in high-quality flooring. However, the market faces challenges such as high costs and competition from alternative materials like vinyl and laminate. Despite this, home remodeling and renovations represent some of the key hardwood flooring market trends.

The hardwood flooring market forecast in the United States indicated significant growth due to the rising demand for premium, durable, and sustainable flooring options. The booming construction industry, fueled by urbanization and residential housing development, particularly in the emerging economies, are playing a pivotal role in driving the market growth. Consumers’ growing preference for eco-friendly materials aligns with hardwood’s natural and renewable qualities. Renovation and remodeling activities, driven by trends in modern interiors, further boost the hardwood flooring market demand. Technological advancements in engineered wood products, offering improved durability and affordability, also contribute to market growth. For instance, in July 2024, the National Hardwood Lumber Association (NHLA) and the Real American Hardwood Coalition (RAHC), in collaboration unveiled a new website at RealAmericanHardwood.pro. with the United States Forest Service. The website was created to present new and cutting-edge hardwood product technologies for the built environment, as well as to inform architects, interior designers, and construction professionals about the qualities of Real American Hardwoods. Additionally, increasing disposable income and a shift toward high-quality, long-lasting flooring solutions drive adoption.

Hardwood Flooring Market Trends

Increasing Demand for Engineered Wood

The rising demand for engineered wood is bolstering the market growth. The demand for engineered wood is likely to remain high during the projection period since it is a suitable substitute for concrete and hardwood. According to the U.S. Department of Agriculture (USDA), engineered wood products, such as plywood and oriented strand board (OSB), account for approximately 50% of all softwood and hardwood consumption in the U.S. construction industry. Architects, builders, code officials, and designers frequently employ engineered wood products. They also understand energy-efficient farming practices that save energy, speed up building, lower labor expenses, and reduce waste. The product demand is predicted to grow faster in North America and Europe due to higher disposable income and broad awareness of the benefits of engineered wood among the population. The engineered wood products can be tailored to the end user's needs and specifications, thereby accelerating its popularity and creating a positive hardwood flooring market outlook.Rising Trend of Innovative Wood Flooring

The global market has been rapidly expanding due to changes in consumer preferences and the introduction of innovative products. Customers are increasingly seeking affordable, highly efficient, and environmentally friendly flooring materials, according to current market trends in the hardwood flooring industry. A survey conducted by the National Association of Home Builders (NAHB) in 2021 indicates that about 25% of new single-family homes in the U.S. were constructed using green building practices, which include the use of eco-friendly materials. As a result, this growing trend is not only significant in sustainable construction but also very popular because of the environmental benefits associated with the correct choice of products. The demand for hardwood or engineered wood is fast increasing in comparison to demand for luxury vinyl tiles. This is due to the additional advantages offered by the product, such as ease of cleaning, improved acoustics, a premium appearance, strength, durability, and a high level of indoor air quality. Hardwood floors are available in a variety of hues, styles, stains, and species. As a result, the market for hardwood flooring has significant opportunities for innovation, branding, and rebranding of new and enhanced flooring products.Growing Demand for Consumer-friendly Building Designs

The rapid growth of the world's population has led to a significant need for housing options to meet the increasing demand. According to the United Nations, the global population is expected to reach 9.7 billion by 2050, escalating the need for sustainable housing solutions. When building or purchasing a home, consumers pay close attention to the design and interior of the building to improve their living experience. A product that frequently comes into contact with the human body for extended periods is flooring. Therefore, it is essential to choose an appropriate flooring option when planning the interiors of structures. Hardware flooring market research report states that food-based flooring not only satisfies requirements like strong impact & scratch resistance and good moisture handling abilities, but also boasts high durability and resistance to chemicals and spills. They also satisfy the consumers' need for natural visual and texture aesthetics, making them a great flooring option. Furthermore, by creating a variety of grades and styles of engineered wood floors that mirror the appearance of different trees and environmental elements, companies aim to appeal to new customers and drive growth in the wood flooring sector.Hardwood Flooring Industry Segmentation

This report provides an analysis of the key trends in each segment of the market, along with forecasts at the global and regional levels for 2025-2033. The report has categorized the market based on end-use sector and raw material.Analysis by End-Use Sector

- Residential Sector

- Commercial Sector

Analysis by Raw Material

- Red Oak

- White Oak

- Maple

- Others

Regional Analysis

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Key Regional Takeaways

United States Hardwood Flooring Market Analysis

In 2024, the United States accounted for the largest market share of over 87.50% in North America. Robust growth in U.S. hardwood flooring is, to a significant extent, an offspring of the residential and commercial construction sectors, as these are considered the fastest growing in the industry. According to an industry report, the United States construction sector spent USD 2 trillion in 2023; this amounts to 4.4% contribution to the Gross Domestic Product. With 8 million people employed in the sector, 6.2 million of them in construction-specific occupations, demand for quality building materials, such as hardwood flooring, is continuously on the increase. In 2023, 1.5 million homes were built, further adding to the need for flooring solutions. Homebuyers and renovators are increasingly choosing hardwood flooring for its aesthetic appeal, durability, and sustainability. Environmental concerns also contribute to the growth of the market. Consumers increasingly demand FSC-certified wood and low-VOC finishes. Shaw Floors and Armstrong Flooring, industry leaders, have responded by launching innovative products designed to meet the evolving demands of the U.S. market.Europe Hardwood Flooring Market Analysis

The hardwood flooring market in Europe continues to sustain growth, which is driven by increased demand for residential renovations and new construction projects across key countries such as Germany, the UK, and France. According to an industry report, the European construction industry valued at EUR 1.6 trillion (USD 1.65 trillion) in 2022 gave significant portions towards residential and commercial buildings. European consumers have now valued more on using natural and sustainably produced material; that would have really heightened the use of hardwood floor. Additionally, most people opt for FSC products; there's increased interest in engineered hardwood floors that prove more robust than conventional solid hardwood, especially if done professionally. To this end, companies like Tarkett and Parquet Flooring are expanding their product lines and innovating in finishes, design, and performance. Furthermore, the increased emphasis on eco-consciousness and sustainable building practices is driving the development of flooring solutions that meet environmental standards, further strengthening Europe's position in the global hardwood flooring market.Asia Pacific Hardwood Flooring Market Analysis

The Asia Pacific hardwood flooring market is growing very fast, given the expansion in the construction industry and the disposable incomes of its people. According to an industrial report, construction in China represents about 6.8% of the nation's GDP in 2023, with over 50 million working in the construction industry. A large share in the economy generates a high demand for quality construction materials, and hardwood flooring is among them. Demand is rising, especially in countries such as Beijing and Shanghai due to growing urbanization. Even India, having a construction sector valued at USD 890 billion in the year 2023, has its headquarters in the construction arena. That's where up-scale residential properties look for hardwood flooring more than ever. Consumers are looking for engineered hardwood as well as sustainable products due to their durability and environmental benefits. Local manufacturers and international brands are targeting this growing market with innovative products tailored to regional preferences.Latin America Hardwood Flooring Market Analysis

In Latin America, hardwood flooring has had growth because of the increasing urbanization, rising incomes of the middle class, and an absolute boom in housing. Going by the region's biggest economy, Brazil, the construction and engineering industry saw one of its greatest stakeholders, Odebrecht Engenharia e Construção (OEC), raising over four billion Brazilian reals (USD 0.6 Billion) in revenue in 2023. This surge in construction has had a very positive impact on demand for quality flooring materials, such as hardwood. According to an industrial report, in Brazil, sales of housing units increased by 35% in 2023 from the previous year, mainly on account of the success of the government-backed Casa Verde e Amarela program, which promotes low-cost housing and has led to a spate of home constructions, thereby boosting demand for hardwood flooring. Other countries in the region, such as Mexico and Colombia, are also coming to use premium flooring products more as those developing, middle-class affluence and urban developments are ramping up.Middle East and Africa Hardwood Flooring Market Analysis

The hardwood flooring market in the Middle East and Africa is growing steadily due to urbanization and luxury construction projects. According to industrial reports, in the UAE, the construction industry is the third most important sector, after oil and trade, and is supported by around 6,000 companies, mainly located in Abu Dhabi. High-end residential and commercial properties, which focus on premium materials, have the highest demand for quality hardwood flooring. With ongoing investments in architectural development, especially large-scale projects in Dubai and Abu Dhabi, the demand for hard-wearing yet aesthetically pleasing flooring solutions is growing. Elsewhere in the region, for instance South Africa, demand is picking up as people move to towns, and rich customers seek good-quality flooring that gives them prestige. The market is gaining with both local producers and international brands making innovative, sustainable, and luxurious flooring choices in the face of the increasing need for quality building materials in the region.Competitive Landscape

Major manufacturers are investing in research and development (R&D) activities to introduce innovative products that cater to changing consumer preferences. This includes introducing new finishes, textures, and installation methods to enhance the visual appeal and durability of these flooring solutions. In line with this, many companies are adopting sustainable sourcing and manufacturing practices to address growing environmental concerns. They are obtaining certifications, such as Forest Stewardship Council (FSC), to assure consumers of their commitment to responsible sourcing and forest conservation. Apart from this, they are offering customization options that allow customers to choose from a wide range of wood species, stains, and finishes. It allows customers to create unique flooring solutions that align with their interior design preferences.The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- AHF

- LLC

- UNILIN

- Beaulieu International Group

- Classen

- FRITZ EGGER GmBH & Co. OG

- Formica Group

Key Questions Answered in This Report

1. How big is the hardwood flooring market?2. What is the future outlook of hardwood flooring market?

3. What are the key factors driving the hardwood flooring market?

4. Which region accounts for the largest hardwood flooring market share?

5. Which are the leading companies in the global hardwood flooring market?

Table of Contents

Companies Mentioned

- AHF LLC

- UNILIN

- Beaulieu International Group

- Classen

- FRITZ EGGER GmBH & Co. OG

- Formica Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 147 |

| Published | February 2025 |

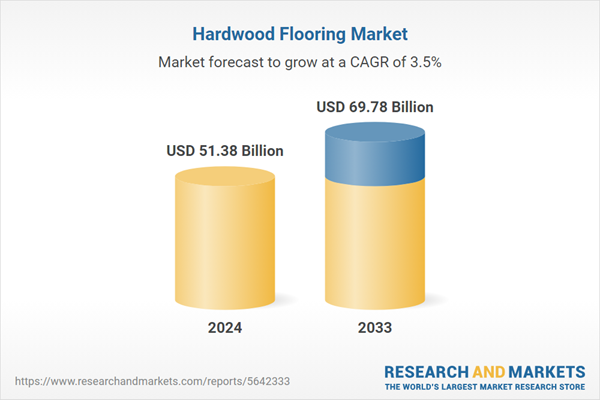

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 51.38 Billion |

| Forecasted Market Value ( USD | $ 69.78 Billion |

| Compound Annual Growth Rate | 3.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 6 |