The demand for heating, ventilation, & air conditioning (HVAC) compressors is expected to be fueled by the growing need for power-saving ratings, stricter laws & regulations governing energy-efficient practices in the U.S., and increased consumer awareness. Governments at various levels, namely Federation and state governments, have established standards to improve the operation of HVAC systems. Observing the market trend, companies are also taking the initiative to expand their product portfolio in energy-efficient products.

In February 2023, LG Electronics (LG) released its latest compressors in the Component Solutions booth at AHR Expo 2023. The new compressors use eco-responsible low-GWP refrigerants, R32, and R454B. Unlike the commonly used R410A, which has a GWP of approximately 2,088, the refrigerants deployed by the company's recent models have a GWP below 750. Moreover, LG unveiled a collection of Internet of Things (IoT) gadgets that can communicate with home system air conditioners. These devices include the AI-based Amazon Echo, Google Home, Next, and Honeywell. In addition, LG introduced numerous products like the Multi F and Multi V solutions, which extend cooling and heating depending on the characteristics, sizes, and uses of a building.

The North America HVAC compressor industry is highly consolidated, with the presence of major players such as Emerson Electric Co., Danfoss, LG, and Panasonic. New product launches, expansions, technological investments, and mergers & acquisitions strategies are adopted by the participants to strengthen their positions in the market. For instance, in February 2023, Danfoss announced the construction of a new sensor and compressor manufacturing unit in Apodaca, Mexico.

North America HVAC Compressor Market Report Highlights

- Variable-speed compressors are expected to grow at a CAGR of 6.9% over the forecast period. In this the compressor capacity is managed via variable-speed technology, which alters the speed of the compressor in short intervals and over a broad operating range.

- The U.S. HVAC compressor market dominated the North American market and accounted for the largest revenue share of 91.1% in 2024. This growth can be attributed to a strong demand for energy-efficient solutions driven by environmental regulations.

- Single-stage scroll compressors led the North America HVAC compressor industry and market accounted for the largest revenue share of 52.7% in 2024. The majority of household heating and cooling systems use single-stage scroll compressors.

- HVAC compressor manufacturers adopt several strategies, including acquisitions, partnerships, new product launches, and geographical expansions to cater to the changing technological demand for equipment from various end-use industries such as residential, commercial, and industrial, and enhance their market penetration

- In February 2025, Hitachi Scroll Compressor unveiled a groundbreaking low-displacement compressor at the AHR Expo, marking its North American debut. The new HVAC compressor, designed to enhance energy efficiency and reduce environmental impact, showcased advanced technology that promises improved performance in cooling and heating systems. This innovation is expected to meet the increasing demand for eco-friendly solutions in HVAC applications, highlighting Hitachi's commitment to sustainable and cutting-edge technology. The product attracted significant attention from industry professionals at the event.

This report addresses:

- Market intelligence to enable effective decision-making.

- Market estimates and forecasts from 2018 to 2030.

- Growth opportunities and trend analyses.

- Segment and regional revenue forecasts for market assessment.

- Competition strategy and market share analysis.

- Product innovation listings for you to stay ahead of the curve.

- COVID-19's impact and how to sustain in this fast-evolving market.

Why Should You Buy This Report?

- Comprehensive Market Analysis: Gain detailed insights into the market across major regions and segments.

- Competitive Landscape: Explore the market presence of key players.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The major companies profiled in this North America HVAC Compressor market report include:- Danfoss Group

- Emerson Electric Co.

- Daikin Industries Ltd.

- Mitsubishi Electric Corporation

- LG Electronics

- Hitachi Ltd.

- Tecumseh Products Company LLC.

- Panasonic Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 70 |

| Published | February 2025 |

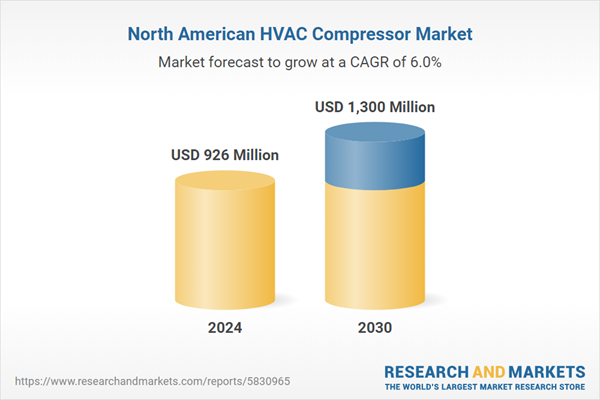

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 926 Million |

| Forecasted Market Value ( USD | $ 1300 Million |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | North America |

| No. of Companies Mentioned | 9 |