Global Hydraulic Valves Market - Key Trends and Drivers Summarized

What Are Hydraulic Valves and Why Are They Critical in Modern Industries?

Hydraulic valves are essential components in hydraulic systems, which are widely used in various industries to control the flow, pressure, and direction of hydraulic fluid. These systems convert the energy stored in pressurized fluids into mechanical power, which can then be used to operate machinery and equipment in sectors like construction, manufacturing, agriculture, and transportation. Hydraulic valves serve as the key regulators of this process, determining the amount of fluid flowing through the system, directing its path, and managing the pressure at which it operates. Without these valves, hydraulic systems would lack the precision and safety needed to function properly. Hydraulic valves are available in different types, including directional control valves, pressure relief valves, and flow control valves, each designed to perform specific tasks in regulating the fluid dynamics of a system. Directional valves, for example, manage the path of the fluid, controlling which components are activated in the system. Pressure valves maintain the system's pressure within safe operating limits, while flow control valves regulate the speed of fluid movement, influencing how fast actuators like hydraulic cylinders or motors operate. Given their pivotal role in ensuring the smooth, safe, and efficient operation of hydraulic systems, hydraulic valves are a cornerstone of modern industrial processes.How Does Design and Material Innovation Influence the Performance of Hydraulic Valves?

The design and materials used in hydraulic valves are critical to their performance, durability, and efficiency in various applications. Historically, hydraulic valves were simple mechanical devices, but with advances in material science and engineering, they have become far more sophisticated and capable of withstanding harsh operating environments. Modern hydraulic valves are now made from robust materials such as stainless steel, carbon steel, and alloys that are resistant to corrosion, wear, and extreme temperatures. These materials ensure that valves can operate reliably even in high-pressure systems or in environments where exposure to chemicals and contaminants is common, such as in marine or mining operations. Another key aspect of hydraulic valve design is precision. Hydraulic systems demand high levels of accuracy, and modern valves are engineered to allow precise control of fluid flow, direction, and pressure, ensuring the machinery they control operates efficiently and safely. For example, proportional valves enable variable flow rates and pressures to be adjusted smoothly, improving the responsiveness of systems like those found in mobile equipment or advanced robotics. Additionally, advanced sealing technologies have been incorporated into hydraulic valve design to prevent fluid leakage, ensuring both operational efficiency and environmental protection. The incorporation of electronic control in some hydraulic valves, such as electrohydraulic valves, has further revolutionized their application, allowing for remote control, automation, and integration with smart systems, further enhancing their functionality in complex operations.What Are the Primary Applications of Hydraulic Valves and Who Benefits the Most from Their Use?

Hydraulic valves are utilized in a wide range of industries, each benefiting from the precision and power that hydraulic systems offer. In the construction industry, for instance, hydraulic valves are integral to the operation of heavy machinery such as excavators, loaders, and cranes. These machines rely on hydraulic systems to control their lifting, pushing, and digging operations, and the valves ensure that the right amount of fluid is directed to the appropriate actuators, allowing for smooth and safe movements. In manufacturing, hydraulic systems play a key role in operating machines that perform tasks like stamping, molding, and pressing, where precise control of pressure and force is critical. The agricultural sector also benefits significantly from hydraulic valves, which are used in equipment such as tractors, harvesters, and irrigation systems, enabling farmers to operate machinery that is both powerful and efficient, even under difficult field conditions. In the transportation industry, hydraulic systems are essential in everything from aircraft and ships to trucks and trains, where they control braking systems, steering mechanisms, and landing gear operations. Even renewable energy industries, such as wind power, utilize hydraulic valves in the maintenance and operation of wind turbines, where hydraulics help control blade pitch and braking systems. Across all these industries, the benefits of hydraulic valves include improved machine performance, enhanced safety, and greater operational efficiency, all of which contribute to better productivity and lower downtime.What Factors Are Fueling the Growth of the Hydraulic Valve Market?

The growth in the hydraulic valve market is driven by several factors, reflecting both technological advancements and broader industrial trends. One of the primary drivers is the increasing demand for automation and efficiency in industrial operations. As industries like manufacturing, construction, and agriculture seek to optimize their processes, hydraulic systems are being integrated with smart technologies, and the valves used in these systems are becoming more advanced. Electrohydraulic valves, which allow for remote control and precision in fluid management, are gaining popularity as part of this shift toward automation and the Industrial Internet of Things (IIoT). Additionally, the ongoing expansion of the construction industry, particularly in developing economies, is fueling demand for heavy machinery, which in turn drives the need for hydraulic valves. As urbanization accelerates, the demand for infrastructure projects - such as roads, bridges, and buildings - is increasing, and hydraulic systems play a key role in the machinery used to carry out these projects. Moreover, there is a growing focus on energy efficiency and environmental sustainability, which is also shaping the hydraulic valve market. Hydraulic systems, when properly regulated by high-performance valves, can operate with greater energy efficiency, reducing waste and lowering operational costs. Industries are increasingly looking for ways to minimize their carbon footprint, and advanced hydraulic valves contribute by optimizing fluid flow and reducing the energy required to power machinery. The increased use of renewable energy sources like wind and hydroelectric power is another growth factor, as hydraulic systems are essential in managing the power generation and maintenance of equipment in these industries. Additionally, government regulations aimed at improving safety standards in industrial machinery and processes have led to higher demand for reliable hydraulic valves that can ensure compliance with stringent operational standards. Finally, the expansion of sectors like mining, marine, and aerospace, all of which require robust and reliable hydraulic systems, is expected to further drive market growth, as these industries continue to innovate and expand their operations globally.Report Scope

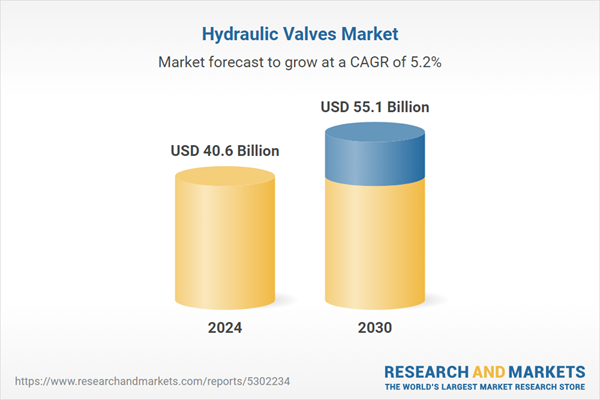

The report analyzes the Hydraulic Valves market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Application (Oil & Gas, Water & Wastewater, Construction & Earthmoving, Power).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Oil & Gas Application segment, which is expected to reach US$22.7 Billion by 2030 with a CAGR of a 5.9%. The Water & Wastewater Application segment is also set to grow at 5.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $10.6 Billion in 2024, and China, forecasted to grow at an impressive 7.9% CAGR to reach $12.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Hydraulic Valves Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Hydraulic Valves Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Hydraulic Valves Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Bermad Water Technologies, Bosch Rexroth, CBF Hydraulic, Curtiss-Wright, Daikin Industries and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Hydraulic Valves market report include:

- Bermad Water Technologies

- Bosch Rexroth

- CBF Hydraulic

- Curtiss-Wright

- Daikin Industries

- Eaton

- Emerson Electric

- Enerpac

- Hawe

- HAWE Hydraulik

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Bermad Water Technologies

- Bosch Rexroth

- CBF Hydraulic

- Curtiss-Wright

- Daikin Industries

- Eaton

- Emerson Electric

- Enerpac

- Hawe

- HAWE Hydraulik

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 40.6 Billion |

| Forecasted Market Value ( USD | $ 55.1 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |