An automotive hydrostatic fan drive system is a specialized mechanism used in heavy-duty vehicles, such as buses, construction machinery, and agricultural vehicles, to regulate the cooling process. The system employs hydrostatic technology to control the fan speed based on real-time cooling needs. It uses hydraulic fluid to transmit power from the engine to the fan, allowing for variable and precise speed adjustments.

The advantage of this system is that it offers increased fuel efficiency and operational flexibility. Additionally, it contributes to enhanced vehicle performance by ensuring optimal cooling, thereby extending the lifespan of critical engine components. Adopting an automotive hydrostatic fan drive system can also lead to reduced maintenance costs, as it experiences less wear and tear compared to its mechanical counterparts.

The rising needs of the automotive industry for compact, quiet, and self-sufficient engine cooling solutions to enhance engine performance are driving the global market. Along with this, a heightened awareness of environmental sustainability has accelerated the adoption of electric heavy-duty vehicles globally, further creating a positive market outlook. Moreover, the use of hydrostatic fan drive systems in hybrid vehicles contributes to decreased energy wastage and lower carbon emissions, offering an additional avenue for market growth. Besides, significant investments are being made in research and development to make hydrostatic systems more robust and versatile.

This continuous innovation not only enhances the capabilities of these systems but also expands their potential applications. Furthermore, the advent of temperature-responsive, digitally regulated hydrostatic fan drive systems that optimize fan speed during periods of low cooling necessity also add to the market's momentum. Other factors, including increasing auto sales and strategic partnerships among industry leaders to refine engine production processes and product effectiveness, are further enhancing market prospects.

Automotive Hydrostatic Fan Drive System Market Trends/Drivers:

Increasing Emphasis on Fuel Efficiency

Regulatory bodies around the world are tightening emissions standards and setting stringent fuel efficiency targets for heavy-duty vehicles, such as buses, construction machinery, and agricultural equipment. Traditional mechanical fan drives often run at a constant speed or have limited variability, thereby consumed more energy than necessary and lowered the overall fuel efficiency of the vehicle. Hydrostatic fan drive systems address this inefficiency by providing variable fan speed, which is adjusted in real-time according to the cooling needs of the engine.This adaptability not only lowers fuel consumption but also reduces CO2 emissions, making the technology highly appealing to both manufacturers and end-users who are focused on sustainability and cost reduction. As fossil fuel prices continue to fluctuate and environmental considerations become increasingly important, the push for more fuel-efficient systems is expected to remain a significant driver for the adoption of hydrostatic solutions in the automotive sector.

Augmenting Demand for Operational Flexibility and Performance

Various industries, including construction, agriculture, and public transportation require equipment that can perform optimally under various conditions, such as fluctuating temperatures, inconsistent load requirements, and irregular usage patterns. Traditional cooling systems with mechanical fan drives often fail to meet these dynamic needs, resulting in performance issues and increased wear and tear on the engine.Automotive hydrostatic fan drive systems offer the ability to precisely control fan speed according to real-time requirements, ensuring optimal engine cooling and, subsequently, improved vehicle performance. By reducing the likelihood of engine overheating and minimizing mechanical stress, these systems extend the lifespan of the engine and other critical components, thereby reducing the total cost of ownership and increasing the appeal for businesses in these sectors.

An Enhanced Focus on Longevity and Reduced Maintenance

Frequent maintenance and early replacement of engine parts can be a significant operational burden for businesses. Hydrostatic fan drive systems exhibit reduced wear and tear compared to mechanical systems, primarily because they operate only when needed and at the speed required for effective cooling. This targeted operation leads to less mechanical stress, thereby extending the life of not just the cooling system but also of the engine it serves.By minimizing the need for frequent servicing and potential part replacements, hydrostatic systems offer a more cost-effective and reliable cooling solution. As companies continue to seek ways to optimize operational expenses and improve the lifecycle value of their equipment, the demand for automotive hydrostatic fan drive systems is likely to rise.

Automotive Hydrostatic Fan Drive System Industry Segmentation:

The research provides an analysis of the key trends in each segment of the market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on component, pump type, and vehicle type.Breakup by Component:

- Variable Axial Piston Pump

- Fixed Gear Motor

- Engine Control Unit

- Oil Cooler

- Hydraulic Values and Sensor.

Variable axial piston pump holds the largest share in the industry

The report has provided a detailed breakup and analysis of the market based on the component. This includes variable axial piston pump, fixed gear motor, engine control unit, oil cooler, and hydraulic values and sensors. According to the report, variable axial piston pump accounted for the largest market share.Variable axial piston pumps offer a range of operational benefits, including high efficiency, durability, and adaptability to varying load conditions. They have the ability to adjust the flow rate and pressure of the hydraulic fluid in real-time, based on the cooling needs of the engine. This variable output ensures that the fan operates only at the speed necessary for effective cooling, thus optimizing energy usage and enhancing overall fuel efficiency. Additionally, these pumps are designed to be rugged and withstand harsh operational conditions often encountered in heavy-duty vehicles, construction machinery, and agricultural equipment.

Their robust construction minimizes wear and tear, thus contributing to lower maintenance costs and longer service life. Due to their functional importance and the advantages, they offer in terms of efficiency, adaptability, and durability, variable axial piston pumps represent the largest component segment in the automotive hydrostatic fan drive system market.

Breakup by Pump Type:

- Fixed Displacement Pump

- Variable Displacement Pump

Fixed displacement pumps are designed to move a specific volume of hydraulic fluid during each revolution, regardless of the resistance or pressure changes in the system. Due to their simpler construction and fewer moving parts, these pumps are often considered more durable and are generally easier to maintain. This straightforward design makes them well-suited for applications where a constant flow rate is desirable and where the operational parameters are relatively stable. For heavy-duty vehicles that operate in environments with predictable cooling needs, such as agricultural equipment used seasonally or construction machinery utilized in stable conditions, fixed displacement pumps offer a reliable and cost-effective solution.

On the other hand, variable displacement pumps represent another large segment in the automotive hydrostatic fan drive system market. These pumps are engineered to adjust the flow rate and pressure of the hydraulic fluid dynamically, depending on the real-time cooling requirements of the engine. They offer greater operational flexibility, allowing for precise control of the fan speed.

This adaptability makes them particularly useful in scenarios where the cooling needs are variable, such as in buses operating in fluctuating traffic conditions or construction equipment used for diverse tasks. They also exhibit the ability to adjust pump output contributes to higher fuel efficiency and reduced emissions, aligning with current regulatory and environmental demands.

Breakup by Vehicle Type:

- On-Road Vehicles

- Bus

- Truck

- Off-Road Vehicles

- Construction and Mining

- Agricultural

- Train, Metro and Tram.

Off-road vehicles represent the leading market segment

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes on-road vehicles (bus and truck), off-road vehicles (construction and mining, and agricultural), and train, metro and trams. According to the report, off-road vehicles represented the largest segment.Off-road vehicles are often subjected to extreme temperatures, inconsistent load demands, and rugged terrain, all of which can result in fluctuating cooling requirements. Traditional mechanical fan drives are less equipped to cope with these dynamic needs, often leading to inadequate cooling, higher fuel consumption, and increased wear and tear on the engine. Moreover, many off-road vehicles are designed for specialized tasks that have specific cooling demands.

A construction excavator may require rapid cooling during heavy digging operations but considerably less cooling during idle periods. Hydrostatic fan drive systems can adapt to these changes in workload, ensuring efficient cooling at all times. This adaptability not only improves the performance of the vehicle but also contributes to a longer lifespan of the engine and other critical components, thereby providing a lower total cost of ownership.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Afric.

Asia-Pacific leads the market, accounting for the largest automotive hydrostatic fan drive system market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia-Pacific accounted for the largest market share.Asia-Pacific’s rapid industrial growth, increasing investment in infrastructure development, and a burgeoning agricultural sector is supporting the market. These sectors are key consumers of heavy-duty vehicles, such as construction equipment, agricultural tractors, and buses, which in turn drive the demand for advanced cooling systems, including hydrostatic fan drives.

Additionally, Asia-Pacific is home to several key manufacturers and suppliers in the automotive industry. The presence of these industry giants provides an impetus for technological advancements, further promoting the adoption of hydrostatic fan drive systems. Local manufacturing also often results in cost advantages, making these systems more accessible and thus more widely adopted.

Moreover, the increasing urbanization in the region demands more efficient public transportation solutions, including buses that are equipped with hydrostatic fan drive systems for better fuel economy and performance.

Competitive Landscape:

Companies are heavily investing in research and development to create new formulations and types of malic acid, such as the development of less acidic variants or those suitable for specialized applications in food, pharmaceuticals, and other industries. Moreover, with the rise in demand for malic acid, particularly in emerging economies, companies are focusing on expanding their production capacities. This could involve setting up new manufacturing plants or modernizing existing ones to increase output.Several companies are also looking to expand their geographical footprint, targeting emerging markets where there is growing demand for processed foods, beverages, and personal care products that use malic acid as an ingredient. Furthermore, companies are also embracing digital technologies for better data management, predictive maintenance, and other operational efficiencies. This is crucial for optimizing production, distribution, and thereby reducing costs.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Axiomatic Technologies Corporation

- Bondioli & Pavesi S.p.A.

- Bosch Rexroth Aktiengesellschaft (Robert Bosch GmbH)

- Bucher Hydraulics (Bucher Industries AG)

- Casappa S.p.A.

- Concentric AB

- Danfoss

- JTEKT Corporation (Toyota Group)

- Parker Hannifin Corporation

- Quality Hydraulics & Pneumatics Inc.

- Walvoil S.p.A (Interpump Group S.p.A.

Key Questions Answered in This Report

- How big is the automotive hydrostatic fan drive system market?

- What is the expected growth rate of the global automotive hydrostatic fan drive system market during 2025-2033?

- What are the key factors driving the global automotive hydrostatic fan drive system market?

- What has been the impact of COVID-19 on the global automotive hydrostatic fan drive system market?

- What is the breakup of the global automotive hydrostatic fan drive system market based on the component?

- What is the breakup of the global automotive hydrostatic fan drive system market based on the vehicle type?

- What are the key regions in the global automotive hydrostatic fan drive system market?

- Who are the key players/companies in the global automotive hydrostatic fan drive system market?

Table of Contents

Companies Mentioned

- Axiomatic Technologies Corporation

- Bondioli & Pavesi S.p.A.

- Bosch Rexroth Aktiengesellschaft (Robert Bosch GmbH)

- Bucher Hydraulics (Bucher Industries AG)

- Casappa S.p.A.

- Concentric AB

- Danfoss

- JTEKT Corporation (Toyota Group)

- Parker Hannifin Corporation

- Quality Hydraulics & Pneumatics Inc.

- Walvoil S.p.A (Interpump Group S.p.A)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 148 |

| Published | June 2025 |

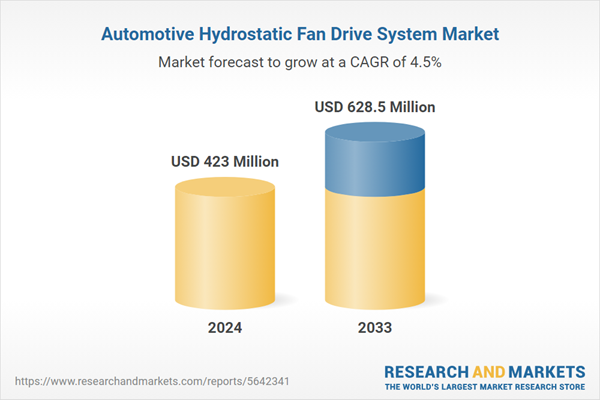

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 423 Million |

| Forecasted Market Value ( USD | $ 628.5 Million |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |