Iliac Stents: Why Are They Pivotal in Managing Peripheral Artery Disease and Complex Vascular Conditions?

Global Iliac Stents Market - Key Trends & Drivers Summarized

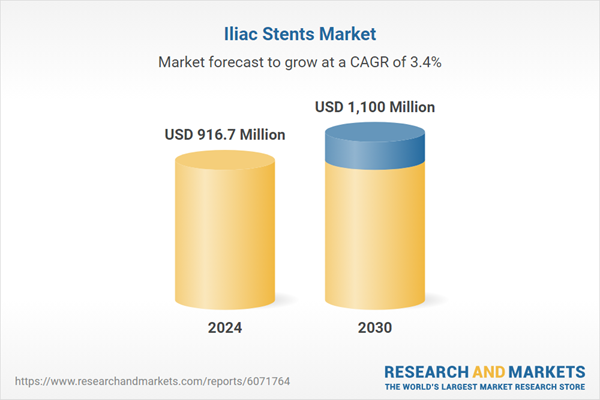

The global iliac stents market is experiencing significant growth, fueled by the rising prevalence of peripheral artery disease (PAD), increased demand for minimally invasive vascular interventions, and ongoing advancements in stent technology. Iliac stents are deployed to treat occlusions or narrowing (stenosis) in the iliac arteries, which supply blood to the pelvis and lower limbs. This condition often stems from atherosclerosis and can lead to critical limb ischemia if left untreated. The demand for iliac stents is particularly strong in elderly populations and patients with comorbidities such as diabetes, hypertension, and hyperlipidemia - conditions that predispose individuals to vascular complications.Recent years have seen a shift from open surgical repair to endovascular treatment (EVT), with iliac stenting becoming the gold standard due to its lower morbidity, shorter hospital stays, and quicker recovery. Market growth is also being supported by increasing access to vascular diagnostics, expanded health insurance coverage, and a rising number of PAD screening programs globally. In parallel, there is growing awareness among clinicians regarding early detection and aggressive treatment of iliac artery disease, especially in high-risk populations. These dynamics are contributing to a strong demand pipeline for stenting procedures and related devices in both developed and emerging healthcare markets.

What Technological Innovations Are Enhancing Iliac Stent Design and Outcomes?

Technological advancement in stent design and delivery systems is a key driver of market expansion. Manufacturers are continuously innovating to improve stent flexibility, radial strength, and long-term patency - especially in complex anatomical regions like the iliac bifurcation. Self-expanding stents, typically made of nitinol (a nickel-titanium alloy), are favored in tortuous or mobile arteries due to their conformability and resistance to external compression. Balloon-expandable stents, on the other hand, offer precision placement and higher radial force, making them suitable for heavily calcified or focal lesions. Hybrid stents that combine the benefits of both designs are also gaining traction.Drug-eluting stents (DES) have emerged as a game-changer, releasing antiproliferative agents such as paclitaxel or sirolimus to reduce restenosis rates. While DES are more commonly used in coronary arteries, their application in peripheral settings - including the iliac arteries - is expanding due to favorable clinical outcomes. In addition, bioresorbable scaffolds and polymer-free coatings are under development to minimize long-term complications such as late stent thrombosis. Improved delivery systems, including low-profile catheters and hydrophilic coatings, are making it easier to navigate complex lesions and reduce procedure time. These innovations are making iliac stenting safer, more efficient, and more durable, while expanding eligibility to broader patient populations.

Where Is Market Demand for Iliac Stents Growing - And What’ s Driving It?

North America and Western Europe continue to dominate the iliac stents market, owing to advanced healthcare infrastructure, high prevalence of PAD, and early adoption of novel vascular technologies. The U.S., in particular, is a key market due to robust clinical guidelines supporting endovascular interventions and extensive reimbursement coverage for PAD treatment. European countries such as Germany, France, and the UK also exhibit strong demand, driven by aging populations and proactive vascular screening initiatives.The Asia-Pacific region is emerging as a high-growth market, with China, India, and Japan leading the charge. Factors such as growing public health awareness, expanding access to interventional cardiology and radiology services, and a rising burden of cardiovascular risk factors are driving increased procedural volumes. Furthermore, governments in these regions are investing in the development of tertiary healthcare facilities and rural outreach programs, enhancing access to PAD diagnosis and intervention. Latin America, the Middle East, and parts of Africa are also witnessing gradual uptake as medical tourism, insurance penetration, and healthcare infrastructure improve. Across all regions, increasing physician training and strategic partnerships between medical device manufacturers and hospitals are accelerating the diffusion of iliac stenting technologies.

The Growth in the Iliac Stents Market Is Driven by Several Factors…

The growth in the iliac stents market is driven by several factors related to disease prevalence, technological advancement, and end-use expansion. A primary driver is the rising global incidence of peripheral artery disease, fueled by aging demographics and lifestyle-related risk factors such as smoking, obesity, and sedentary behavior. As PAD becomes more common, the need for effective revascularization options like iliac stents continues to increase. In addition, improvements in diagnostic imaging - such as duplex ultrasonography, CT angiography, and MR angiography - are facilitating early and accurate identification of iliac artery stenosis.Technological innovation remains a cornerstone of market expansion. The development of new stent platforms - offering enhanced deliverability, reduced restenosis, and longer durability - is attracting physician preference and improving clinical outcomes. End-use applications are also expanding beyond traditional vascular centers to include outpatient clinics and ambulatory surgical centers, enabled by the rise of low-profile, minimally invasive stent systems. Furthermore, favorable regulatory approvals, increasing clinical trial evidence, and growing payer support for endovascular procedures are driving broader adoption.

Lastly, global healthcare trends - such as the shift toward value-based care, increased patient awareness, and integration of artificial intelligence in vascular diagnostics - are reshaping how iliac artery disease is treated. These trends are reinforcing the strategic importance of iliac stents as a frontline therapy for PAD and ensuring sustained demand across regions, healthcare settings, and patient populations.

Report Scope

The report analyzes the Iliac Stents market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Self-Expandable Stents Type, Balloon-Expandable Stents Type, Covered Stents Type); Artery Lesions (Common Iliac Artery Lesions, Severe Calcified Artery Lesions, Complete Obstructive Artery Lesions); End-Use (Hospitals End-Use, Ambulatory Surgery Centers End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Self-Expandable Stents segment, which is expected to reach US$580.6 Million by 2030 with a CAGR of a 2.6%. The Balloon-Expandable Stents segment is also set to grow at 4.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $249.7 Million in 2024, and China, forecasted to grow at an impressive 6.2% CAGR to reach $220.8 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Iliac Stents Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Iliac Stents Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Iliac Stents Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of notable industry players.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Select Competitors (Total 44 Featured):

- Abbott Laboratories

- Alvimedica

- B. Braun Melsungen AG

- Becton, Dickinson and Company (BD)

- Biotronik SE & Co. KG

- Boston Scientific Corporation

- C. R. Bard, Inc.

- Cardinal Health, Inc.

- Cook Medical LLC

- Cordis Corporation

- Endologix LLC

- Getinge AB

- iVascular

- Jotec GmbH

- LeMaitre Vascular, Inc.

- Medtronic plc

- MicroPort Scientific Corporation

- OptiMed Medizinische Instrumente GmbH

- Terumo Corporation

- W. L. Gore & Associates, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott Laboratories

- Alvimedica

- B. Braun Melsungen AG

- Becton, Dickinson and Company (BD)

- Biotronik SE & Co. KG

- Boston Scientific Corporation

- C. R. Bard, Inc.

- Cardinal Health, Inc.

- Cook Medical LLC

- Cordis Corporation

- Endologix LLC

- Getinge AB

- iVascular

- Jotec GmbH

- LeMaitre Vascular, Inc.

- Medtronic plc

- MicroPort Scientific Corporation

- OptiMed Medizinische Instrumente GmbH

- Terumo Corporation

- W. L. Gore & Associates, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 377 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 916.7 Million |

| Forecasted Market Value ( USD | $ 1100 Million |

| Compound Annual Growth Rate | 3.4% |

| Regions Covered | Global |