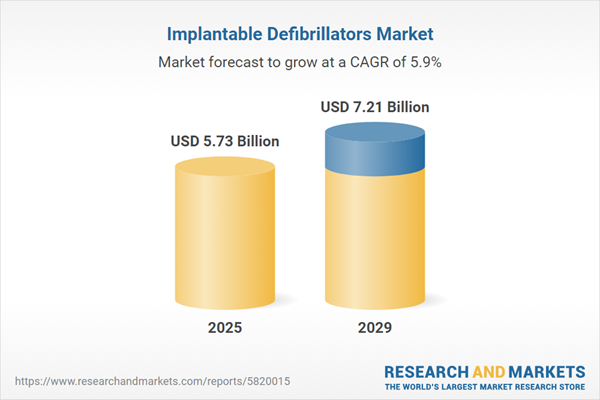

The implantable defibrillators market size is expected to see strong growth in the next few years. It will grow to $7.21 billion in 2029 at a compound annual growth rate (CAGR) of 5.9%. The growth in the forecast period can be attributed to remote monitoring and telemedicine integration, expansion of indications, focus on heart failure management, personalized medicine approaches, and global expansion of healthcare infrastructure. Major trends in the forecast period include miniaturization and design innovations, remote monitoring and connectivity, personalized therapy approaches, leadless implantable defibrillators, and battery technology advancements.

The expected rise in the prevalence of sudden cardiac arrest is poised to drive the growth of the implantable defibrillators market. Sudden cardiac arrest (SCA) is a condition where the heart unexpectedly stops beating, and implantable defibrillators play a vital role in providing lifesaving therapy by detecting and correcting abnormal heart rhythms that may lead to SCA. According to a report by the Journal of the American College of Cardiology, SCD causes 185,000 to 450,000 deaths annually in the US population, accounting for 7% to 18% of all fatalities. Therefore, the increasing prevalence of sudden cardiac arrest is a significant factor propelling the growth of the implantable defibrillators market.

The rising incidence of diabetes is anticipated to drive the expansion of the implantable defibrillators market in the future. Diabetes is a chronic metabolic condition characterized by high blood glucose or sugar levels, which can lead to significant damage to the heart, blood vessels, eyes, kidneys, and nerves over time. Implantable cardioverter defibrillators (ICDs) are vital for managing patients with diabetes, especially those who are at risk of sudden cardiac death. Research has demonstrated that ICDs can effectively lower the rates of arrhythmic death and overall mortality in patients with severe myocardial dysfunction, including those with diabetes. For example, in June 2024, NHS England, a governing body in the UK, reported that in 2023, 3,615,330 individuals registered with a GP were diagnosed with non-diabetic hyperglycemia, also known as pre-diabetes, which represents an increase from 3,065,825 in 2022 - an approximate rise of 18%. Consequently, the growing prevalence of diabetes is fueling the growth of the implantable defibrillators market.

A noteworthy trend in the implantable defibrillators market is the emphasis on product innovations by major companies. These companies are focusing on developing new products to maintain their competitive edge. For example, in December 2023, Medtronic, an Ireland-based medical device company, introduced a novel type of implantable cardioverter-defibrillator called the Aurora extravascular ICD. Unsuch as traditional transvenous ICDs, this device is inserted under the skin beneath the left armpit, providing defibrillation during cardiac arrest and ongoing pacemaker therapies. It features Epsila leads that are minimally invasively connected to the heart beneath the breastbone. Additionally, the implant incorporates Medtronic's Smart Sense technology, aimed at reducing the risk of unwarranted shocks, and SureScan technology, allowing patients to undergo MRI tests with the device in place.

Major companies operating in the implantable defibrillators market are also focused on introducing advanced Cardiac Rhythm Management (CRM) devices with cutting-edge features to drive market revenues. These devices, equipped with innovative technology, monitor and manage cardiac issues effectively. For instance, in October 2023, MicroPort CRM, a France-based developer and manufacturer of cardiac pacemakers and implantable cardiac defibrillators, launched the ULYS Implantable Cardioverter Defibrillator (ICDs) and the INVICTA defibrillation lead in Japan. The ULYS ICD, with its cutting-edge technology and low current consumption, is expected to have a significantly longer lifespan than conventional ICD devices. The INVICTA defibrillation lead, designed to continuously detect electrical signals from the heart's right ventricle, provides defibrillation shocks or pacing therapy in the case of a potentially fatal ventricular tachyarrhythmia.

In December 2022, Johnson & Johnson Services Inc., a US-based healthcare product manufacturer, completed the acquisition of Abiomed for $16.6 billion. This strategic move allowed Johnson & Johnson to enhance its global market-leading Biosense Webster electrophysiology business by adding heart recovery technologies from Abiomed, expanding its portfolio in rapidly growing cardiovascular areas, including implantable defibrillators. Abiomed is a US-based provider of cardiovascular medical technology specializing in treating heart failure and coronary artery disease.

Major companies operating in the implantable defibrillators market include Boston Scientific Corporation, LivaNova PLC, Biotronik SE & Co KG, MicroPort Scientific Corporation, Medtronic plc, St. Jude Medical Inc., Abbott Laboratories, Sorin Group Italia S.r.l., Nihon Kohden Corporation, Koninklijke Philips N.V., Fukuda Denshi Co Ltd., Progetti S.r.l., Imricor Medical Systems Inc., ZOLL Medical Corporation, Physio-Control International Inc., Cardiac Science Corporation, Defibtech LLC, HeartSine Technologies LLC, Schiller AG, CU Medical Systems Inc., Mindray Medical International Limited, Shenzhen Mindray Bio-Medical Electronics Co Ltd., Beijing M&B Electronic Instruments Co Ltd., Bexen Cardio SL, Pacemaker Technologies, EBR Systems Inc.

North America was the largest region in the implantable defibrillators market in 2024. Asia-Pacific is expected to be the fastest-growing region in the global implanted defibrillator market forecast period. The regions covered in the implantable defibrillators market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the implantable defibrillators market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

An implantable defibrillator is a small, battery-operated device inserted into the chest to regulate abnormal heart rhythms. It continuously monitors the heart's rhythm, and if it detects a dangerous or irregular pattern, it delivers an electrical shock to restore a normal rhythm.

The primary types of implantable defibrillators include single-chambered implantable defibrillators, dual-chambered implantable defibrillators, and biventricular implantable defibrillators. Single-chamber implantable defibrillators have only one right ventricular ICD shocking coil lead placed inside the heart's right ventricle. These devices continuously monitor the patient's heart rate and rhythm and can deliver electrical shocks to the heart. The main procedures for implantation are trans-venous implantable defibrillators and subcutaneous implantable defibrillators, utilized by hospitals and clinics, ambulatory surgery centers, and other end-users.

The implantable defibrillators market research report is one of a series of new reports that provides implantable defibrillators market statistics, including implantable defibrillators industry global market size, regional shares, competitors with an implantable defibrillators market share, detailed implantable defibrillators market segments, market trends and opportunities, and any further data you may need to thrive in the implantable defibrillators industry. The implantable defibrillators market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The implantable defibrillator market consists of sales of epicardial implantable cardioverter-defibrillator, substernal implantable cardioverter-defibrillator, and single-chamber ICD with atrial sensing. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Implantable Defibrillators Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on implantable defibrillators market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for implantable defibrillators? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The implantable defibrillators market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product Type: Single Chambered Implantable Defibrillators; Dual Chambered Implantable Defibrillators; Biventricular Implantable Defibrillators2) By Procedure Type: Trans-Venous Implantable Defibrillators; Subcutaneous Implantable Defibrillators

3) By End User: Hospitals and Clinics; Ambulatory Surgery Centers; Other End Users

Subsegments:

1) By Single Chambered Implantable Defibrillators: Standard Single Chamber ICDs; Leadless Single Chamber ICDs2) By Dual Chambered Implantable Defibrillators: Standard Dual Chamber ICDs; Advanced Dual Chamber ICDs

3) By Biventricular Implantable Defibrillators: Standard Biventricular ICDs; Advanced Biventricular ICDs With CRT

Key Companies Mentioned: Boston Scientific Corporation; LivaNova PLC; Biotronik SE & Co KG; MicroPort Scientific Corporation; Medtronic plc

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Boston Scientific Corporation

- LivaNova PLC

- Biotronik SE & Co KG

- MicroPort Scientific Corporation

- Medtronic plc

- St. Jude Medical Inc.

- Abbott Laboratories

- Sorin Group Italia S.r.l.

- Nihon Kohden Corporation

- Koninklijke Philips N.V.

- Fukuda Denshi Co Ltd.

- Progetti S.r.l.

- Imricor Medical Systems Inc.

- ZOLL Medical Corporation

- Physio-Control International Inc.

- Cardiac Science Corporation

- Defibtech LLC

- HeartSine Technologies LLC

- Schiller AG

- CU Medical Systems Inc.

- Mindray Medical International Limited

- Shenzhen Mindray Bio-Medical Electronics Co Ltd.

- Beijing M&B Electronic Instruments Co Ltd.

- Bexen Cardio SL

- Pacemaker Technologies

- EBR Systems Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 5.73 Billion |

| Forecasted Market Value ( USD | $ 7.21 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |