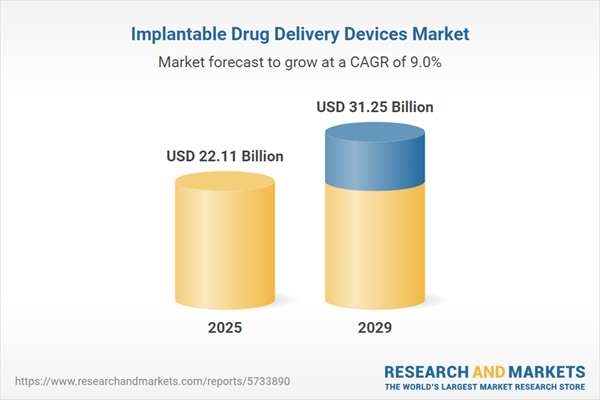

The implantable drug delivery devices market size has grown strongly in recent years. It will grow from $20.65 billion in 2024 to $22.11 billion in 2025 at a compound annual growth rate (CAGR) of 7.1%. The growth in the historic period can be attributed to aging population, chronic disease prevalence, consumer awareness, growing focus on preventive healthcare, increasing demand for personalized medicine.

The implantable drug delivery devices market size is expected to see strong growth in the next few years. It will grow to $31.25 billion in 2029 at a compound annual growth rate (CAGR) of 9%. The growth in the forecast period can be attributed to customized drug delivery, growing demand for minimally invasive surgeries, rising healthcare expenditure, global healthcare expansion, regenerative medicine, genomic medicine. Major trends in the forecast period include technological innovations, advancements in biotechnology, micro-implants, ai-powered dosage adjustment, telemedicine synergy, advanced biocompatible materials, advancements in drug delivery technology.

The increasing prevalence of target diseases such as diabetic retinopathy, cancer, cardiovascular conditions, and other chronic ailments is poised to be a driving force behind the growth of the implantable drug delivery devices market.for example, in March 2024, the Centers for Disease Control and Prevention (CDC), a US-based government agency, reported that the number of tuberculosis (TB) cases increased from 8,320 in 2022 to 9,615 in 2023, marking a rise of 1,295 cases or 16%. The site-specific drug administration capabilities of implantable drug devices have played a crucial role in treating these target diseases, fueling the demand for such devices in the market.

The increasing incidence of chronic diseases is also expected to be a significant driver of growth in the implantable drug delivery devices market. Chronic diseases are characterized by their long-lasting nature, lasting for three months or more. Implantable drug delivery devices are increasingly being employed to facilitate controlled and long-term medication administration for chronic diseases, thereby improving patient adherence and treatment efficacy. For instance, the World Health Organization (WHO) reported in September 2022 that chronic diseases are responsible for 74% of global deaths, with 41 million fatalities each year. This includes 17.9 million deaths from cardiovascular diseases, 9.3 million from cancer, 4.1 million from chronic respiratory diseases, and 2 million from diabetes. Consequently, the escalating prevalence of chronic diseases is a key driver behind the growth of the implantable drug delivery devices market.

Innovation efforts within the industry are focused on the development of 3D printing materials to support implantable drug delivery devices. These materials are used in additive manufacturing processes, such as 3D printing, to create customized and precise drug delivery systems. For instance, a study published in 2022 proposed the use of 3D-printed implants in combination with biodegradable rate-controlling membranes to produce devices capable of sustained delivery of hydrophobic drugs.

Major companies operating in the implantable drug delivery devices market are pursuing strategic partnerships to create an ultrasonic, non-invasive ocular drug delivery device. These partnerships involve companies collaborating and leveraging their respective strengths and resources for mutual benefits and success. For example, in May 2022, Opharmic Technology, a Hong Kong-based medtech company, partnered with CeramTec, a Germany-based chemical industry company, to develop innovative technology for non-invasively delivering drugs to the eyes. The aim is to replace intravitreal injections by using ultrasound-induced microstreaming to allow drug molecules to diffuse into the target eye tissue. This has the potential to revolutionize the treatment of various eye conditions.

In February 2022, Second Sight Medical Products, a California-based prosthetic device manufacturer, merged with Nano Precision Medical, a developer of NanoPortal drug implant technology. This merger paves the way for collaborative efforts in the development of drug delivery medical implants.

Implantable drug delivery devices are specialized drug delivery systems that are surgically implanted beneath the skin. These devices release drugs from a reservoir directly into the bloodstream, enabling targeted drug delivery and reducing the need for larger doses, which, in turn, minimizes potential side effects.

The primary product categories within the domain of implantable drug delivery devices include contraceptive implants, spinal implants, brachytherapy seeds, drug-eluting stents, bioabsorbable stents, intraocular stents, infusion pumps, and various other devices. Spinal implants, for instance, aid surgeons in treating deformities, providing spinal stability, and promoting fusion during surgical procedures. These devices employ a range of technologies, including diffusion, osmosis, magnetic mechanisms, and others. They find applications in a variety of medical fields, such as contraception, ophthalmology, cardiovascular treatments, diabetes management, oncology, the treatment of autoimmune diseases, and other medical areas.

The implantable drug delivery devices market research report is one of a series of new reports that provides implantable drug delivery devices market statistics, including implantable drug delivery devices industry global market size, regional shares, competitors with an implantable drug delivery devices market share, detailed implantable drug delivery devices market segments, market trends and opportunities, and any further data you may need to thrive in the implantable drug delivery devices industry. This implantable drug delivery devices market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Major companies operating in the implantable drug delivery devices market include AbbVie Inc., Bayer HealthCare, Medtronic Inc., Nucletron, Boston Scientific Corporation, Abbott Laboratories, Bausch and Lomb Inc., Merck & Co. Inc., Genentech Inc., EyePoint Pharmaceuticals Inc., DSM Biomedical, Delpor Inc., Teleflex Incorporated, 3M Company, Biotronik Inc., Alcon Inc., Terumo Corporation, Endologix Inc., TransEnterix Inc., China Grand Pharmaceutical and Healthcare Holdings, Innocoll Biotherapeutics, Atossa Therapeutics Inc., Intersect ENT, Microchips Biotech, Theradaptive Inc., CollPlant, Intarcia Therapeutics, Glaukos Corporation.

North America was the largest region in the implantable drug delivery devices market in 2024. Asia-Pacific was the second-largest region in the implantable drug delivery devices market report. The regions covered in the implantable drug delivery devices market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, and Africa. The countries covered in the implantable drug delivery devices market report are Australia, China, India, Indonesia, Japan, South Korea, Bangladesh, Thailand, Vietnam, Malaysia, Singapore, Philippines, Hong Kong, New Zealand, USA, Canada, Mexico, Brazil, Chile, Argentina, Colombia, Peru, France, Germany, UK, Austria, Belgium, Denmark, Finland, Ireland, Italy, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, Russia, Czech Republic, Poland, Romania, Ukraine, Saudi Arabia, Israel, Iran, Turkey, UAE, Egypt, Nigeria, South Africa.

The implantable drug delivery devices market consists of sales of contraceptive implants, spinal implants, brachytherapy seeds, drug-eluting stents, bio-absorbable stents, intraocular stents, infusion pumps, and others. Values in this market are factory gate values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Executive Summary

Implantable Drug Delivery Devices Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on implantable drug delivery devices market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 50 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for implantable drug delivery devices ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The implantable drug delivery devices market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Contraceptive Implants; Spinal Implants; Brachytherapy Seeds; Drug-Eluting Stents; Bio-absorbable Stents; Intraocular Stents; Infusion Pumps; Other Applications2) By Technology: Diffusion; Osmotic; Magnetic; Other Technologies

3) By Application: Contraception; Ophthalmology; Cardiovascular; Diabetes; Oncology; Autoimmune Diseases; Other Applications

Subsegments:

1) By Contraceptive Implants: Hormonal Contraceptive Implants; Non-hormonal Contraceptive Implants2) By Spinal Implants: Biodegradable Spinal Implants; Non-biodegradable Spinal Implants

3) By Brachytherapy Seeds: Iodine-125 Seeds; Palladium-103 Seeds; Cesium-131 Seeds; Other Brachytherapy Seeds

4) By Drug-Eluting Stents: Coronary Drug-Eluting Stents; Peripheral Drug-Eluting Stents

5) By Bio-absorbable Stents: Polymer-based Bio-absorbable Stents; Metal-based Bio-absorbable Stents

6) By Intraocular Stents: Glaucoma Intraocular Stents; Cataract Surgery Intraocular Stents

7) By Infusion Pumps: Insulin Pumps; Chemotherapy Infusion Pumps; Pain Management Infusion Pumps; Other Infusion Pumps

8) By Other Applications: Implantable Reservoirs; Implantable Micro-pumps; Implantable Drug Elution Devices

Key Companies Mentioned: AbbVie Inc.; Bayer HealthCare; Medtronic Inc.; Nucletron; Boston Scientific Corporation

Countries: Australia; China; India; Indonesia; Japan; South Korea; Bangladesh; Thailand; Vietnam; Malaysia; Singapore; Philippines; Hong Kong; New Zealand; USA; Canada; Mexico; Brazil; Chile; Argentina; Colombia; Peru; France; Germany; UK; Austria; Belgium; Denmark; Finland; Ireland; Italy; Netherlands; Norway; Portugal; Spain; Sweden; Switzerland; Russia; Czech Republic; Poland; Romania; Ukraine; Saudi Arabia; Israel; Iran; Turkey; UAE; Egypt; Nigeria; South Africa

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Implantable Drug Delivery Devices market report include:- AbbVie Inc.

- Bayer HealthCare

- Medtronic Inc.

- Nucletron

- Boston Scientific Corporation

- Abbott Laboratories

- Bausch and Lomb Inc.

- Merck & Co. Inc.

- Genentech Inc

- EyePoint Pharmaceuticals Inc.

- DSM Biomedical

- Delpor Inc.

- Teleflex Incorporated

- 3M Company

- Biotronik Inc.

- Alcon Inc.

- Terumo Corporation

- Endologix Inc.

- TransEnterix Inc.

- China Grand Pharmaceutical and Healthcare Holdings

- Innocoll Biotherapeutics

- Atossa Therapeutics Inc.

- Intersect ENT

- Microchips Biotech

- Theradaptive Inc.

- CollPlant

- Intarcia Therapeutics

- Glaukos Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 22.11 Billion |

| Forecasted Market Value ( USD | $ 31.25 Billion |

| Compound Annual Growth Rate | 9.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 29 |