Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The market is primarily driven by several factors, including the increasing prevalence of diabetes on a global scale. With the rising number of individuals diagnosed with diabetes, the demand for reliable and accurate glucose monitoring devices has witnessed a significant surge. Moreover, technological innovations have revolutionized the landscape of glucose monitoring, introducing advanced features and functionalities that enhance user experience and convenience. Additionally, there has been a growing awareness and emphasis on early diabetes management, as it is widely acknowledged that proactive monitoring and control of blood glucose levels can significantly improve the quality of life for individuals living with diabetes. This shift in mindset has further fueled the demand for glucose monitoring devices, as more people recognize the importance of timely interventions and proactive measures in managing their condition effectively. The Glucose Monitoring Devices market is a dynamic and rapidly evolving industry, constantly striving to meet the ever-changing needs and expectations of individuals with diabetes. The continuous advancements in technology, coupled with the growing awareness and understanding of diabetes management, are expected to drive further growth and innovation in this crucial sector.

Key Market Drivers

Rising Prevalence of Diabetes

The rising prevalence of diabetes in India is undeniably increasing the demand for glucose monitoring devices in the country. Diabetes has reached epidemic proportions in India, with millions of individuals living with the condition, and this growing health concern has led to a significant uptick in the demand for tools to manage and monitor blood glucose levels. India is often referred to as the diabetes capital of the world due to the sheer number of individuals affected by the disease. In India, it is estimated that 77 million individuals over the age of 18 are affected by type 2 diabetes, with nearly 25 million at risk of developing the condition (pre-diabetics). Over 50% of these individuals are unaware of their diabetic status, which can result in severe health complications if not diagnosed and treated promptly. As lifestyles change, including dietary habits and physical activity levels, the prevalence of both type 1 and type 2 diabetes has surged. People with diabetes require regular monitoring of their blood glucose levels to manage their condition effectively.With the increasing awareness about diabetes and the importance of early detection and effective management, there is a growing emphasis on self-monitoring of blood glucose levels. Patients and healthcare providers recognize the value of real-time data to make informed decisions about medication, diet, and lifestyle changes. The proactive approach to health and wellness is on the rise in India. Regular blood glucose monitoring is seen not only as a way to manage diabetes but also as a preventive measure to detect pre-diabetes and make lifestyle adjustments to avoid progression to diabetes.

Growth in The Aging Population

The growth of the aging population in India is significantly increasing the demand for glucose monitoring devices. India, like many other countries, is experiencing a demographic shift characterized by a larger proportion of elderly individuals. The current senior population, aged 60 and above, is 153 million and is projected to increase to 347 million by 2050. This aging population is more susceptible to chronic health conditions, including diabetes, which has led to a surge in demand for tools that can help manage and monitor blood glucose levels effectively. Aging is a significant risk factor for developing type 2 diabetes. As individuals grow older, their bodies may become less insulin-sensitive, increasing their susceptibility to diabetes. This heightened risk necessitates regular monitoring of blood glucose levels to manage the condition. Elderly individuals often have multiple health issues, including diabetes. Managing diabetes alongside other chronic conditions requires precise and consistent blood glucose monitoring to prevent complications and ensure optimal health.Improved healthcare and living conditions have led to increased life expectancy in India. Longer life spans mean that individuals are more likely to develop chronic health conditions like diabetes, making the need for glucose monitoring devices more pronounced. Many elderly individuals wish to maintain their independence and live at home for as long as possible. Glucose monitoring devices empower them to self-manage their diabetes, reducing the need for frequent hospital visits and enabling them to lead more active and autonomous lives. There is a growing awareness among both healthcare providers and the elderly population about the importance of regular blood glucose monitoring for diabetes management. This awareness has contributed to increased demand for glucose monitoring devices. The aging population in India is driving up the demand for glucose monitoring devices due to the increased risk of diabetes and the desire for better management of chronic conditions among elderly individuals. These devices play a vital role in helping older adults maintain their health, independence, and overall quality of life as they age.

Technological Advancements

Technological advancements are playing a pivotal role in increasing the demand for glucose monitoring devices in India. These innovations are reshaping the landscape of diabetes management by making blood glucose monitoring more convenient, accurate, and accessible. Continuous Glucose Monitoring (CGM) systems have revolutionized diabetes management by providing real-time data on blood glucose levels 24/7. These systems offer a comprehensive view of glucose fluctuations, allowing individuals to make immediate adjustments to their insulin doses, diet, and physical activity. For example, in September 2023, India-based startup Bonatra has introduced the Smart Ring X1, a wearable device that monitors various health parameters such as heart rate, blood oxygen levels (SpO₂), and sleep quality. The Smart Ring X1 integrates with the Bonatra app to report these metrics and syncs with continuous glucose monitors (CGMs) to generate a metabolic score. The availability and adoption of CGM technology in India have significantly increased, driven by the desire for better glycemic control.Many modern glucose monitoring devices can sync with smartphones and wearable devices, allowing users to conveniently track and share their glucose data with healthcare providers and caregivers. The integration of mobile apps and cloud-based platforms has made it easier to manage diabetes and receive timely support and guidance. Technological advancements have led to the development of smaller, more portable glucose monitoring devices. These devices are discrete and can be carried easily, encouraging regular monitoring, even in public settings. Improved sensor technology and algorithms have enhanced the accuracy and precision of glucose monitoring devices, reducing the risk of false readings. This reliability is crucial for informed decision-making and better diabetes management.

Improvements in Healthcare Infrastructure

Improvements in healthcare infrastructure in India are significantly increasing the demand for glucose monitoring devices. Better healthcare infrastructure means that more individuals in India have improved access to healthcare services, including diabetes diagnosis and management. With an increasing number of people seeking medical care, the demand for glucose monitoring devices has risen.Improved healthcare infrastructure often goes hand in hand with increased awareness and education about chronic diseases like diabetes. Healthcare providers and public health campaigns are educating the population about the importance of regular blood glucose monitoring for early detection and effective management of diabetes. This awareness has led to greater demand for glucose monitoring devices. The development of specialized diabetes centers and clinics has expanded across India. These centers offer comprehensive diabetes care, including the provision of advanced glucose monitoring devices. Patients are more likely to receive regular monitoring and personalized treatment plans, leading to increased demand for these devices.

The Indian government has launched several initiatives to address the rising burden of diabetes. For example, the Ministry of Health and Family Welfare has initiated an ambitious program to screen and provide standard care to 75 million individuals with hypertension or diabetes by 2025. These initiatives often include the provision of glucose monitoring devices to underserved populations, further boosting demand. Healthcare infrastructure improvements have facilitated the integration of technology into healthcare delivery. This includes the use of electronic health records (EHRs) and telemedicine platforms, making it easier for healthcare providers to remotely monitor patients' glucose levels and adjust treatment plans as needed. The adoption of more urbanized and sedentary lifestyles has contributed to an increase in lifestyle-related diseases, including diabetes. As a result, more people are seeking medical attention and monitoring their glucose levels, leading to higher demand for monitoring devices.

Key Market Challenges

High Cost of Glucose Monitoring Devices

Many individuals in India, particularly those from low-income backgrounds, find it challenging to afford the upfront costs associated with purchasing glucose monitoring devices. The recurring expenses for test strips and sensors can also strain their finances over time. Health insurance coverage for glucose monitoring devices and related supplies remains limited in India. This means that individuals often have to bear the full cost of these devices out of pocket, making them less accessible to a significant portion of the population.Healthcare providers, including hospitals and clinics, often face budget constraints. The high cost of glucose monitoring devices can deter these facilities from investing in the necessary equipment, limiting access to comprehensive diabetes care for their patients. Rural and underserved areas in India may have limited access to healthcare services and resources. High-cost glucose monitoring devices are less likely to be available or affordable in these regions, leaving individuals with fewer options for diabetes management. High device costs can discourage individuals from monitoring their blood glucose regularly, leading to poor adherence to diabetes management plans. This, in turn, can result in suboptimal disease control and increased healthcare costs due to complications.

Limited Availability of These Devices in Remote and Rural Areas

Remote and rural areas often have limited access to healthcare facilities and medical supplies. Glucose monitoring devices, including glucometers and test strips, may not be readily available in these regions. This geographical disparity leads to reduced demand for these devices due to their scarcity. Even when glucose monitoring devices are available in urban centers, transportation barriers can hinder their distribution to remote and rural areas. The cost and logistical challenges associated with transporting these devices to distant locations further limit their availability.Individuals in remote and rural areas may have limited awareness about the importance of blood glucose monitoring in diabetes management. Without proper education and awareness campaigns, there may be a lack of demand for these devices, as people may not fully understand their significance. In many rural areas, where income levels are lower, the affordability of glucose monitoring devices can be a major hurdle. Even if these devices were more widely available, the cost could still be prohibitive for many individuals, decreasing the demand. Remote and rural areas often have underdeveloped healthcare infrastructure, including a shortage of trained healthcare professionals. Without the necessary support and guidance from healthcare providers, individuals may be less inclined to seek out glucose monitoring devices.

Key Market Trends

Growth in the Use of Non-Invasive Glucose Monitoring Devices

The growth in the use of non-invasive glucose monitoring devices is playing a significant role in increasing the demand for glucose monitoring devices in India. These non-invasive devices, which measure blood glucose levels without the need for pricking the skin, have garnered attention for their convenience and reduced discomfort. Non-invasive glucose monitoring devices offer a less invasive and painless alternative to traditional finger-stick methods. This improved comfort encourages individuals with diabetes to monitor their blood glucose levels more regularly and consistently, leading to better disease management. Non-invasive devices are often user-friendly and require minimal training. This simplicity makes them accessible to a broader population, including those who may have difficulty with traditional fingerstick methods.The increasing emphasis on preventive healthcare in India has spurred interest in non-invasive monitoring. Individuals are using these devices not only for diabetes management but also for early detection and lifestyle adjustments to prevent the onset of diabetes. Non-invasive monitoring devices empower individuals to take control of their health. They provide valuable insights into glucose patterns and trends, enabling users to make proactive decisions about their diabetes care. As the use of non-invasive glucose monitoring devices continues to grow, it is likely to further boost the overall demand for glucose monitoring devices in India. These devices offer an attractive alternative for individuals with diabetes, contributing to improved disease management and better health outcomes.

Increased Use of Smart Glucometers

Smart glucometers allow users to easily and wirelessly transfer their blood glucose data to smartphones or other devices. This connectivity provides a seamless way to track and manage glucose levels over time, facilitating more proactive diabetes management. Users can access real-time glucose readings and trend data through dedicated mobile apps, offering a comprehensive view of their condition. This instant access to critical information empowers individuals with diabetes to make timely adjustments to their treatment plans.Smart glucometers enable data sharing with healthcare providers, caregivers, and family members, facilitating remote monitoring and timely interventions when necessary. This feature is especially valuable in a country as vast as India, where access to healthcare facilities may be limited in remote areas. Many smart glucometer apps include features for tracking medication schedules, diet, and exercise routines. Users can set reminders for medications and monitor the impact of lifestyle changes on their blood glucose levels.

The user-friendly interfaces of smart glucometers and accompanying apps make them accessible to a wide range of users, including those who may not be tech-savvy. This ease of use encourages more individuals to adopt these devices for regular monitoring. Continuous technological advancements in smart glucometers, including enhanced accuracy, smaller form factors, and longer battery life, make them increasingly attractive to individuals seeking effective and convenient diabetes management solutions.

Segmental Insights

Product Insights

Based on the product, continuous glucose monitoring (CGM) devices are anticipated to dominate over Self-Monitoring Glucose Devices (SMBG). The CGM devices provide real-time glucose level readings, enabling users to take immediate action based on accurate data. This eliminates the need for frequent finger pricking, a downside of SMBG devices, making CGM a more convenient and user-friendly option for individuals managing diabetes.Moreover, the continuous tracking feature of CGM devices allows for better glucose management by providing valuable insights into glucose patterns and trends. This comprehensive data empowers users to make informed decisions about their dietary choices, exercise routines, and medication adjustments, ultimately leading to more effective diabetes management and the prevention of potential complications associated with the condition. By leveraging the valuable information provided by CGM devices, individuals can take proactive steps towards achieving optimal glucose control and maintaining overall health and well-being.

Application Insights

Based on application, the prevalence of Type 2 Diabetes is anticipated to have a substantial impact on the demand for glucose monitoring devices in India. This particular variation of the disease, which is frequently linked to lifestyle factors such as diet and physical activity, is witnessing a rapid surge in cases due to the changing lifestyles and eating habits of the population. This shift in health patterns has created a pressing need for effective management and monitoring of Type 2 Diabetes, thereby fueling the growth of the glucose monitoring device market in India. As healthcare providers and individuals strive to tackle this health challenge, the demand for advanced and reliable glucose monitoring devices is expected to grow correspondingly, contributing to the overall improvement of diabetes care in the country.Regional Insights

The Western region of India, particularly spearheaded by states like Maharashtra and Gujarat, is expected to exert a significant influence over the Glucose Monitoring Devices Market. This can be attributed to several factors including a higher prevalence of diabetes, a more developed healthcare infrastructure, and an increasing awareness of the importance of self-monitoring glucose devices among the population in these states. As a result, these states are likely to witness a greater adoption of glucose monitoring devices, leading to a substantial growth in the market within the region.Also, the Western region of India has been at the forefront of technological advancements in healthcare, with major cities like Mumbai and Ahmedabad serving as hubs for medical research and innovation. This has paved the way for the introduction of cutting-edge glucose monitoring devices that offer improved accuracy, convenience, and ease of use. Moreover, initiatives taken by the state governments to promote diabetes management and control have further contributed to the growth of the glucose monitoring devices market in this region. These initiatives include awareness campaigns, subsidized healthcare services, and the establishment of specialized diabetes care centers. With the rising prevalence of diabetes and the increasing focus on proactive healthcare management, the demand for glucose monitoring devices is expected to soar in the Western region of India. This presents a lucrative opportunity for manufacturers and suppliers to cater to the needs of a large and growing consumer base.

Key Market Players

- Roche Diagnostics India Pvt. Ltd.

- Abbott India Ltd.

- Becton Dickinson Pvt. Ltd.

- ARKRAY Healthcare Pvt. Ltd.

- B. Braun Medical (India) Pvt. Ltd.

- Johnson & Johnson Ltd.

- India Medtronic Private Ltd.

- Pulsatom Health Care Pvt. Ltd.

- Bio-Rad laboratories India Pvt.Ltd.

Report Scope:

In this report, the India Glucose Monitoring Devices Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Glucose Monitoring Devices Market, By Product:

- Self-Monitoring Glucose Devices

- Continuous Glucose Monitoring Devices

India Glucose Monitoring Devices Market, By Application:

- Type 1 Diabetes

- Type 2 Diabetes

- Gestational Diabetes

India Glucose Monitoring Devices Market, By End User:

- Home Care Settings

- Hospital

- Others

India Glucose Monitoring Devices Market, By Region:

- North

- South

- West

- East

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Glucose Monitoring Devices Market.Available Customizations:

India Glucose Monitoring Devices Market report with the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Roche Diagnostics India Pvt. Ltd.

- Abbott India Ltd.

- Becton Dickinson Pvt. Ltd.

- ARKRAY Healthcare Pvt. Ltd.

- B. Braun Medical (India) Pvt. Ltd.

- Johnson & Johnson Ltd.

- India Medtronic Private Ltd.

- Pulsatom Health Care Pvt. Ltd.

- Bio-Rad laboratories India Pvt.Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | June 2024 |

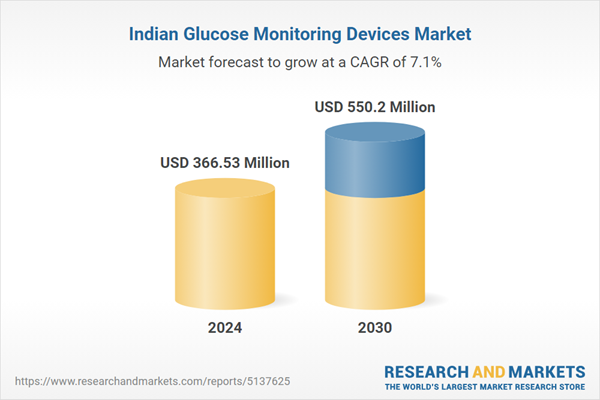

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 366.53 Million |

| Forecasted Market Value ( USD | $ 550.2 Million |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | India |

| No. of Companies Mentioned | 9 |