Speak directly to the analyst to clarify any post sales queries you may have.

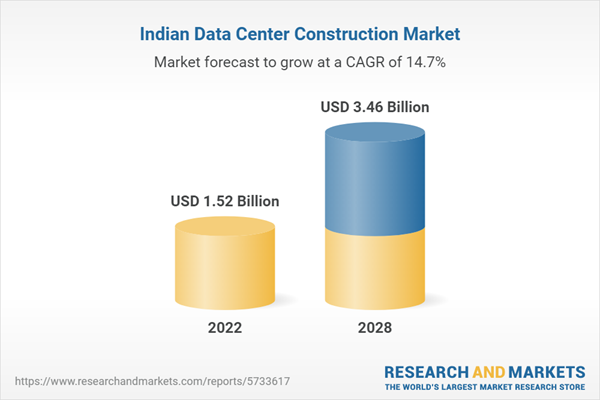

The India data center construction market is expected to grow at a CAGR of 14.76% from 2022 to 2028. Data center development has become a major criterion for offering internet services. Most data centers operate in major metros cities such as Mumbai, Chennai, Hyderabad, Bangalore, and Delhi. And in recent years, have been attracting significant investments for developing hyperscale data center campuses, and more data centers are planned to be established in 2022. As the 5G is already launched in India, it will result in more data generation within the servers, increasing the demand for edge centers across the country to process the data faster. The trend driving the edge computing model is the expanded use of consumer mobile devices, especially the growth of sensors as part of IoT.

Renewable Energy Adoption Among Data Center Providers

Renewable energy adoption is increasing rapidly in India, with support from government initiatives and data center service operators taking significant measures to purchase and produce renewable energy to power their data centers. In 2022, CtrlS built a new facility in Hyderabad with a power capacity of 18 MW. Additionally, the company has aimed to establish 500 edge data centers in Tier 2 and Tier 3 cities across the country with a 500-acre solar plant to power its operation with renewable energy. With sustainability taking center stage, renewable energy generation is expected to be a key consideration for operators in the India data center construction market.

Availability Of Liquid Cooling To Support AI & ML Workloads

Green Revolution Cooling has partnered with the Indian data center solutions provider Prasa to bring its cooling system to the country. Prasa has already commenced installing its liquid immersion systems in the region’s market. Schneider Electric and Vertiv are some of the liquid cooling solutions providers which offer their services in the region.

SEGMENTATION ANALYSIS

- In the India data center construction market, the electrical infrastructure adoption is expected to grow by around 14.85% year-over-year (YOY). In terms of power infrastructure, the generators segment was the largest contributor to the market revenue through the adoption of DRUPS systems.

- Indian data centers use both water-based and air-based cooling techniques. Facilities that depend on free-cooling techniques, such as free-cooling chillers and evaporative coolers, are expected to grow among facilities in the India data center construction market.

- In data centers, general construction consists of building development plans (site preparation and core and shell development), installation and commissioning, building designing services (architectural and engineering design), and security (fire and smoke detection.

- Regarding data center investment revenue, Maharashtra, Tamil Nadu, Telangana, and Uttar Pradesh dominate the India data center construction market.

- There are approx. 39 data center facilities in 14 states of India are certified by the Uptime Institute, of which 31 are Tier III facilities, and eight are Tier IV facilities.

The report includes the investment in the following areas:

- Facility Type

- Colocation

- Hyperscale

- Enterprise Data Centers

- Infrastructure

- Electrical Infrastructure

- Mechanical Infrastructure

- General Construction

- Electrical Infrastructure

- Uninterruptible Power Supply (UPS) Systems

- Generators

- Power Distribution Units

- Transfer Switches & Switchgear

- Other Electrical Infrastructure

- Mechanical Infrastructure

- Cooling Systems

- Racks

- Other Mechanical Infrastructure

- Cooling Systems

- CRAC & CRAH Units

- Chiller Units

- Cooling Towers, Condensers & Dry Coolers

- Other Cooling Units

- General Construction

- Core & Shell Development

- Installation & Commissioning Services

- Engineering & Building Design

- Fire Detection & Suppression

- Physical Security

- Data Center Infrastructure Management (DCIM)/Building Management Systems (BMS)

- Tier Standards

- Tier I & II

- Tier III

- Tier IV

GEOGRAPHICAL ANALYSIS

India has been and will be the preferred market for data center providers. The rising demand for on-demand video, mobile gaming, and online content will be a stronger force for data center procurement in the country. States such as Maharashtra, Tamil Nadu, Telangana, and Uttar Pradesh are witnessing growth in artificial intelligence, IoT, virtual reality, online payment systems, and smart solutions. Such factors are anticipated to attract investments into the country and boost the India data center construction market. Maharashtra led the data center in India, contributing 54.13% of investments, followed by Tamil Nadu, Telangana, and others.

- Geography

- India

- Maharashtra

- Tamil Nadu

- Telangana

- Uttar Pradesh

- Other States

VENDOR LANDSCAPE

- In 2022, AWS, AdaniConneX, Ascendas India Trust, Equinix, EverYondr, Princeton Digital Group (PDG), BAM Digital Realty, Microsoft, Google, NTT, and SpaceDC were some of the key players in the India data center construction market. Regarding investment in the India data center construction market, AdaniConneX led the industry and was among the major investors in 2022, with multiple new projects in the country.

- Many operators are investing in new facilities and expanding existing facilities as there is a surge in customer demand, making the region’s market highly competitive. New entrants are investing in constructing core and shell properties across the country. These new facilities are expected to be fully commissioned within two to three years of the initial build-out.

Prominent Construction Contractors

- AECOM

- AHLUWALIA CONTRACTS (INDIA) LTD.

- DEC Infra

- DSCO Group

- Emerge Engineering

- Larsen & Toubro (L&T)

- Prasa

- Listenlights

- Sterling and Wilson (Shapoorji Pallonji Group)

- Turner & Townsend

- Tata Projects

- Vastunidhi

Prominent Support Infrastructure

- ABB

- Blue Box (Swegon)

- Caterpillar

- Climaveneta Climate Technologies (Mitsubishi Electric)

- Cummins

- Delta Electronics

- Eaton

- Kirloskar Oil Engines (KOEL)

- Legrand

- NetRack Enclosures

- Panduit

- Riello Elettronica

- Rittal

- Rolls-Royce

- Schneider Electric

- Siemens

- STULZ

- Vertiv

Prominent Data Center Investors

- Nxtra by Airtel

- Amazon Web Services (AWS)

- CapitaLand

- Colt Data Centre Services

- CtrlS

- BAM Digital Realty

- Equinix

- NTT Global Data Centers

- Pi DATACENTERS

- Reliance Jio Infocomm

- ST Telemedia Global Data Centres

- Sify Technologies

- Web Werks

- Yotta Infrastructure Solutions

New Entrants

- AdaniConneX

- Chindata Group (Bridge Data Centres)

- Princeton Digital Group (PDG)

- SpaceDC

KEY QUESTIONS ANSWERED:

1. How big is the India data center construction market?

2. What is the growth rate of the India data center construction market?

3. What is the estimated market size in terms of area in the India data center construction market by 2028?

4. What factors drive the growth in the India data center construction market?

5. How many MW of power capacity is expected to reach the India data center construction market by 2028?

Table of Contents

1 Research Methodology

2 Research Objectives

3 Research Process

4 Scope & Coverage

4.1 Market Definition

4.2 Base Year

4.3 Scope of the Study

4.4 Market Segments

4.4.1 Market Segmentation by Facility Type

4.4.2 Market Segmentation by Infrastructure

4.4.3 Market Segmentation by Electrical Infrastructure

4.4.4 Market Segmentation by Mechanical Infrastructure

4.4.5 Market Segmentation by Cooling System

4.4.6 Market Segmentation by General Construction

4.4.7 Market Segmentation by Tier Standard

4.4.8 Market Segmentation by Geography

5 Report Assumptions & Caveats

5.1 Key Caveats

5.2 Currency Conversion

5.3 Market Derivation

6 Premium Insights

6.1 Key Highlights

6.2 Key Market Trends

6.3 Segmentation Analysis

6.4 Geographical Analysis

6.5 Vendor Analysis

7 Market at a Glance

8 Introduction

8.1 India Data Center Construction Market Overview

8.2 Internet Penetration

8.3 Data Center Selection Criteria

8.3.1 Key Factors

9 Market Opportunities & Trends

9.1 Edge Data Center Investments Fueled by 5G Deployment

9.2 Use of Renewable Energy in Data Centers

9.3 Growth of Rack Power Density

9.4 Availability of Liquid Cooling to Support Ai & Ml Workloads

10 Market Growth Enablers

10.1 Increased Investments by Colocation Providers

10.2 Government Investments in Digital Economy & Data Centers

10.3 Increased Data Center Investments Due to Cloud Adoption

10.4 Data Center Investments Driven by Big Data & IoT Implementation

11 Market Restraints

11.1 Power Reliability/Network Outage Challenges

11.2 Data Center Security Challenges

11.3 Location Constraints

12 Market Landscape

12.1 Market Overview

12.2 Investment: Market Size & Forecast

12.3 Area: Market Size & Forecast

12.4 Power Capacity: Market Size & Forecast

12.5 Five Forces Analysis

12.5.1 Threat of New Entrants

12.5.2 Bargaining Power of Suppliers

12.5.3 Bargaining Power of Buyers

12.5.4 Threat of Substitutes

12.5.5 Competitive Rivalry

13 Facility Type

13.1 Investment: Market Snapshot & Growth Engine

13.2 Area: Market Snapshot & Growth Engine

13.3 Power Capacity: Market Snapshot & Growth Engine

13.4 Colocation Data Centers

13.4.1 Market Overview

13.4.2 Investment: Market Size & Forecast

13.4.3 Area: Market Size & Forecast

13.4.4 Power Capacity: Market Size & Forecast

13.5 Hyperscale Data Centers

13.5.1 Market Overview

13.5.2 Investment: Market Size & Forecast

13.5.3 Area: Market Size & Forecast

13.5.4 Power Capacity: Market Size & Forecast

13.6 Enterprise Data Centers

13.6.1 Market Overview

13.6.2 Investment: Market Size & Forecast

13.6.3 Area: Market Size & Forecast

13.6.4 Power Capacity: Market Size & Forecast

14 Infrastructure

14.1 Market Snapshot & Growth Engine

14.2 Market Overview

14.3 Electrical Infrastructure

14.3.1 Market Overview

14.3.2 Market Size & Forecast

14.4 Mechanical Infrastructure

14.4.1 Market Overview

14.4.2 Market Size & Forecast

14.5 General Construction

14.5.1 Market Overview

14.5.2 Market Size & Forecast

15 Electrical Infrastructure

15.1 Market Snapshot & Growth Engine

15.2 Ups Systems

15.2.1 Market Overview

15.2.2 Market Size & Forecast

15.3 Generators

15.3.1 Market Overview

15.3.2 Market Size & Forecast

15.4 Transfer Switches & Switchgear

15.4.1 Market Overview

15.4.2 Market Size & Forecast

15.5 PdUS

15.5.1 Market Overview

15.5.2 Market Size & Forecast

15.6 Other Electrical Infrastructure

15.6.1 Market Overview

15.6.2 Market Size & Forecast

16 Mechanical Infrastructure

16.1 Market Snapshot & Growth Engine

16.2 Cooling Systems

16.2.1 Market Overview

16.2.2 Market Size & Forecast

16.3 Racks

16.3.1 Market Overview

16.3.2 Market Size & Forecast

16.4 Other Mechanical Infrastructure

16.4.1 Market Overview

16.4.2 Market Size & Forecast

17 Cooling System

17.1 Market Snapshot & Growth Engine

17.2 Crac & Crah Units

17.2.1 Market Overview

17.2.2 Market Size & Forecast

17.3 Chiller Units

17.3.1 Market Overview

17.3.2 Market Size & Forecast

17.4 Cooling Towers, Condensers & Dry Coolers

17.4.1 Market Overview

17.4.2 Market Size & Forecast

17.5 Other Cooling Units

17.5.1 Market Overview

17.5.2 Market Size & Forecast

18 General Construction

18.1 Market Snapshot & Growth Engine

18.2 Core & Shell Development

18.2.1 Market Overview

18.2.2 Market Size & Forecast

18.3 Installation & Commissioning Services

18.3.1 Market Overview

18.3.2 Market Size & Forecast

18.4 Engineering & Building Design

18.4.1 Market Overview

18.4.2 Market Size & Forecast

18.5 Fire Detection & Suppression

18.5.1 Market Overview

18.5.2 Market Size & Forecast

18.6 Physical Security

18.6.1 Market Overview

18.6.2 Market Size & Forecast

18.7 Dcim/Bms Solutions

18.7.1 Market Overview

18.7.2 Market Size & Forecast

19 Tier Standard

19.1 Market Snapshot & Growth Engine

19.2 Market Overview

19.3 Tier I & Ii

19.3.1 Market Overview

19.3.2 Market Size & Forecast

19.4 Tier Iii

19.4.1 Market Overview

19.4.2 Market Size & Forecast

19.5 Tier Iv

19.5.1 Market Overview

19.5.2 Market Size & Forecast

20 Geography

20.1 Investment: Snapshot & Growth Engine

20.2 Area: Snapshot & Growth Engine

20.3 Power Capacity: Snapshot & Growth Engine

21 Maharashtra

21.1 Market Snapshot

21.2 Market Overview

21.3 Investment: Market Size & Forecast

21.4 Area: Market Size & Forecast

21.5 Power Capacity: Market Size & Forecast

22 Tamil Nadu

22.1 Market Snapshot

22.2 Market Overview

22.3 Investment: Market Size & Forecast

22.4 Area: Market Size & Forecast

22.5 Power Capacity: Market Size & Forecast

23 Telangana

23.1 Market Snapshot

23.2 Market Overview

23.3 Investment: Market Size & Forecast

23.4 Area: Market Size & Forecast

23.5 Power Capacity: Market Size & Forecast

24 Uttar Pradesh

24.1 Market Snapshot

24.2 Market Overview

24.3 Investment: Market Size & Forecast

24.4 Area: Market Size & Forecast

24.5 Power Capacity: Market Size & Forecast

25 Other States

25.1 Market Snapshot

25.2 Market Overview

25.3 Investment: Market Size & Forecast

25.4 Area: Market Size & Forecast

25.5 Power Capacity: Market Size & Forecast

26 Competitive Landscape

26.1 Support Infrastructure

26.1.1 Electrical Infrastructure

26.1.2 Mechanical Infrastructure

26.1.3 General Construction

26.2 Data Center Investors

27 Prominent Construction Contractors

27.1 Aecom

27.1.1 Business Overview

27.1.2 Service Offerings

27.2 Ahluwalia Contracts (India) Ltd.

27.2.1 Business Overview

27.2.2 Service Offerings

27.3 Dec Infra

27.3.1 Business Overview

27.3.2 Service Offerings

27.4 Dsco Group

27.4.1 Business Overview

27.4.2 Service Offerings

27.5 Emerge Engineering

27.5.1 Business Overview

27.5.2 Service Offerings

27.6 Larsen & Toubro

27.6.1 Business Overview

27.6.2 Service Offerings

27.6.3 Key News

27.7 Prasa

27.7.1 Business Overview

27.7.2 Service Offerings

27.8 Listenlights

27.8.1 Business Overview

27.8.2 Service Offerings

27.9 Sterling and Wilson (Shapoorji Pallonji Group)

27.9.1 Business Overview

27.9.2 Service Offerings

27.10 Turner & Townsend

27.10.1 Business Overview

27.10.2 Service Offerings

27.11 Tata Projects

27.11.1 Business Overview

27.11.2 Service Offerings

27.12 Vastunidhi

27.12.1 Business Overview

27.12.2 Service Offerings

28 Prominent Support Infrastructure

28.1 Abb

28.1.1 Business Overview

28.1.2 Service Offerings

28.2 Blue Box (Swegon)

28.2.1 Business Overview

28.2.2 Product Offerings

28.3 Caterpillar

28.3.1 Business Overview

28.3.2 Product Offerings

28.4 Climaveneta Climate Technologies (Mitsubishi Electric)

28.4.1 Business Overview

28.4.2 Product Offerings

28.5 Cummins

28.5.1 Business Overview

28.5.2 Product Offerings

28.6 Delta Electronics

28.6.1 Business Overview

28.6.2 Product Offerings

28.7 Eaton

28.7.1 Business Overview

28.7.2 Product Offerings

28.8 Koel (Kirloskar Group)

28.8.1 Business Overview

28.8.2 Product Offerings

28.9 Legrand

28.9.1 Business Overview

28.9.2 Product Offerings

28.10 Netrack Enclosures

28.10.1 Business Overview

28.10.2 Product Offerings

28.11 Panduit

28.11.1 Business Overview

28.11.2 Service Offerings

28.12 Riello Elettronica (Riello Ups)

28.12.1 Business Overview

28.12.2 Product Offerings

28.13 Rittal

28.13.1 Business Overview

28.13.2 Product Offerings

28.14 Rolls-Royce

28.14.1 Business Overview

28.14.2 Product Offerings

28.15 Schneider Electric

28.15.1 Business Overview

28.15.2 Product Offerings

28.16 Siemens

28.16.1 Business Overview

28.16.2 Product Offerings

28.17 Stulz

28.17.1 Business Overview

28.17.2 Product Offerings

28.18 Vertiv

28.18.1 Business Overview

28.18.2 Product Offerings

29 Prominent Data Center Investors

29.1 Nxtra by Airtel

29.1.1 Business Overview

29.1.2 Service Offerings

29.1.3 Key News

29.2 Amazon Web Services

29.2.1 Business Overview

29.2.2 Service Offerings

29.3 Capitaland

29.3.1 Business Overview

29.3.2 Service Offerings

29.4 Colt Data Centre Services

29.4.1 Business Overview

29.4.2 Service Offerings

29.5 Ctrls

29.5.1 Business Overview

29.5.2 Service Offerings

29.6 Bam Digital Realty

29.6.1 Business Overview

29.6.2 Service Offerings

29.7 Equinix

29.7.1 Business Overview

29.7.2 Service Offerings

29.8 Ntt Global Data Centers

29.8.1 Business Overview

29.8.2 Service Offerings

29.9 Pi Datacenters

29.9.1 Business Overview

29.9.2 Service Offerings

29.10 Reliance Jio Infocomm

29.10.1 Business Overview

29.10.2 Service Offerings

29.11 St Telemedia Global Data Centres

29.11.1 Business Overview

29.11.2 Service Offerings

29.12 Sify Technologies

29.12.1 Business Overview

29.12.2 Service Offerings

29.13 Web Werks

29.13.1 Business Overview

29.13.2 Service Offerings

29.14 Yotta Infrastructure (Hiranandani Group)

29.14.1 Business Overview

29.14.2 Service Offerings

30 New Entrants

30.1 Adaniconnex

30.1.1 Business Overview

30.1.2 Service Offerings

30.2 Chindata Group (Bridge Data Centres)

30.2.1 Business Overview

30.2.2 Service Offerings

30.3 Princeton Digital Group

30.3.1 Business Overview

30.3.2 Service Offerings

30.4 Spacedc

30.4.1 Business Overview

30.4.2 Service Offerings

31 Report Summary

31.1 Key Takeaways

32 Quantitative Summary

32.1 India Data Center Construction Market

32.1.1 Investment: Market Size & Forecast

32.1.2 Infrastructure: Market Size & Forecast

32.2 Market Segmentation

32.2.1 Facility Type: Market Size & Forecast

32.2.2 Electrical Infrastructure: Market Size & Forecast

32.2.3 Mechanical Infrastructure: Market Size & Forecast

32.2.4 Cooling System: Market Size & Forecast

32.2.5 General Construction: Market Size & Forecast

32.2.6 Tier Standard: Market Size & Forecast

32.3 Geography: Market Size & Forecast

32.3.1 Market by Investment

32.3.2 Market by Area

32.3.3 Market by Power Capacity

32.4 Maharashtra

32.4.1 Market Size & Forecast

32.5 Tamil Nadu

32.5.1 Market Size & Forecast

32.6 Telangana

32.6.1 Market Size & Forecast

32.7 Uttar Pradesh

32.7.1 Market Size & Forecast

32.8 Other States

32.8.1 Market Size & Forecast

33 Appendix

33.1 Abbreviations

Companies Mentioned

- AECOM

- AHLUWALIA CONTRACTS (INDIA) LTD.

- DEC Infra

- DSCO Group

- Emerge Engineering

- Larsen & Toubro (L&T)

- Prasa

- Listenlights

- Sterling and Wilson (Shapoorji Pallonji Group)

- Turner & Townsend

- Tata Projects

- Vastunidhi

- ABB

- Blue Box (Swegon)

- Caterpillar

- Climaveneta Climate Technologies (Mitsubishi Electric)

- Cummins

- Delta Electronics

- Eaton

- Kirloskar Oil Engines (KOEL)

- Legrand

- NetRack Enclosures

- Panduit

- Riello Elettronica

- Rittal

- Rolls-Royce

- Schneider Electric

- Siemens

- STULZ

- Vertiv

- Nxtra by Airtel

- Amazon Web Services (AWS)

- CapitaLand

- Colt Data Centre Services

- CtrlS

- BAM Digital Realty

- Equinix

- NTT Global Data Centers

- Pi DATACENTERS

- Reliance Jio Infocomm

- ST Telemedia Global Data Centres

- Sify Technologies

- Web Werks

- Yotta Infrastructure Solutions

- AdaniConneX

- Chindata Group (Bridge Data Centres)

- Princeton Digital Group (PDG)

- SpaceDC

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 281 |

| Published | February 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 1.52 Billion |

| Forecasted Market Value ( USD | $ 3.46 Billion |

| Compound Annual Growth Rate | 14.6% |

| Regions Covered | India |

| No. of Companies Mentioned | 48 |