Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

This sector offers a vibrant and promising landscape. Key factors driving its expansion include a deep-rooted cultural connection to natural remedies, an intensified focus on health and wellness, and the proliferation of digital channels for product access and education. Nevertheless, stakeholders in this market must effectively address challenges related to quality assurance and regulatory compliance. By doing so, they can capitalize on opportunities for innovation and enhance consumer engagement, ultimately positioning themselves for success in this competitive environment.

Key Market Drivers

Increasing Health Awareness

Increasing health awareness is a pivotal driver of growth in the Indian herbal supplement market. This trend is reshaping consumer behaviors and preferences, leading to a greater demand for natural health solutions. As consumers become more informed about health and wellness, there is a noticeable shift from reactive to preventive healthcare. Individuals are increasingly prioritizing preventive measures to maintain their health and reduce the risk of chronic diseases. This shift has propelled the demand for herbal supplements, which are perceived as natural, safe, and effective options for enhancing immunity, improving metabolic health, and supporting overall wellness.For example, supplements rich in antioxidants, vitamins, and minerals are gaining popularity among health-conscious consumers aiming to boost their immune systems and enhance their overall vitality. The proliferation of information available through digital platforms, social media, and health-related content has empowered consumers to make informed choices regarding their health.

With greater access to knowledge about the benefits of various herbs and natural ingredients, consumers are increasingly seeking products that align with their health goals. This trend has led to a surge in interest in herbal supplements known for specific benefits, such as ashwagandha for stress relief, turmeric for inflammation, and tulsi for respiratory health. Brands that effectively communicate the scientific backing and traditional uses of their herbal ingredients are better positioned to attract health-conscious consumers.

The increasing prevalence of lifestyle-related diseases, such as obesity, diabetes, and cardiovascular issues, has heightened health awareness among the Indian population. As individuals recognize the link between their lifestyle choices and health outcomes, there is a growing demand for natural supplements that can help manage or prevent these conditions. Herbal supplements that promote weight management, improve digestion, and regulate blood sugar levels are particularly appealing to consumers looking for natural ways to address these health concerns. The modern consumer's approach to health is increasingly holistic, encompassing physical, mental, and emotional well-being.

As a result, there is a rising interest in herbal supplements that offer multifaceted benefits. For instance, adaptogenic herbs like ashwagandha and rhodiola are sought after for their ability to combat stress and enhance mental clarity, addressing both physical and psychological health. This holistic perspective aligns with the principles of Ayurveda, further driving the demand for herbal products that promise comprehensive wellness solutions.

Health trends, often amplified by social media influencers, play a significant role in shaping consumer perceptions and behaviors. The rise of wellness culture has led to increased interest in herbal supplements, as influencers and health advocates promote their benefits. This social media-driven awareness not only informs consumers about specific products but also cultivates a community around health-focused lifestyles. Brands that engage effectively with consumers on these platforms can significantly boost their visibility and credibility, leading to increased sales and brand loyalty.

The COVID-19 pandemic has acted as a catalyst for health awareness, with many individuals reevaluating their lifestyles and prioritizing immune health. This heightened focus on preventive measures has resulted in an increased interest in herbal supplements that are believed to enhance immunity and overall health. Products containing ingredients like echinacea, elderberry, and various herbal blends have seen a surge in demand as consumers seek to bolster their defenses against illness. The pandemic has also fostered a greater appreciation for natural remedies, further driving interest in herbal supplements.

Health-conscious consumers are increasingly demanding transparency in product labeling and ingredient sourcing. They seek assurance that the herbal supplements they choose are safe, effective, and free from harmful additives. Brands that prioritize education - through informative packaging, educational content, and clear communication regarding ingredient sourcing and benefits - are better positioned to build trust and loyalty among consumers. This focus on transparency aligns with the rising health awareness, as informed consumers are more likely to invest in products that align with their health values.

Increasing Aging Population

The increasing aging population in India is a significant factor driving the growth of the herbal supplement market. This demographic shift is reshaping consumer preferences and health needs, leading to heightened demand for products tailored to the specific requirements of older adults. As the population ages, there is a corresponding rise in age-related health concerns, including joint pain, cognitive decline, cardiovascular issues, and chronic diseases such as diabetes and hypertension. Older adults are more likely to seek natural and effective remedies to manage these conditions.Herbal supplements, known for their potential to provide supportive care without the side effects often associated with pharmaceutical drugs, are increasingly being viewed as viable options. For instance, supplements containing turmeric for inflammation and boswellia for joint health are gaining traction among older consumers looking to improve mobility and alleviate pain.

Older generations, particularly those familiar with traditional practices, often have a strong preference for natural remedies. In India, the cultural heritage of Ayurveda and traditional herbal medicine influences the perception of herbal supplements as safe and effective. As the aging population seeks alternatives to synthetic medications, they are turning to herbal products that align with their values and past experiences. This cultural inclination toward natural solutions is further amplified by a growing skepticism about the long-term effects of pharmaceutical interventions, driving demand for herbal supplements.

Aging individuals are increasingly aware of the importance of preventive health measures. This demographic is more inclined to adopt proactive health strategies to maintain their quality of life and independence. Herbal supplements that promote overall wellness - such as those that enhance immunity, support digestion, and improve mental clarity - are particularly appealing to older adults. By integrating herbal supplements into their daily routines, seniors aim to mitigate health issues before they escalate, thereby driving market demand for preventive herbal solutions. Cognitive decline is a common concern among the aging population, leading to a growing interest in supplements that support brain health and cognitive function.

Products containing herbal ingredients like ginkgo biloba, ashwagandha, and bacopa monnieri are increasingly popular as consumers seek to enhance memory, focus, and overall mental acuity. This focus on cognitive wellness aligns with the broader trend of adopting holistic health practices, positioning herbal supplements as a valuable tool for maintaining mental health in older age.

As individuals age, they face an increased risk of osteoporosis and arthritis, making bone and joint health a priority. Herbal supplements that promote joint mobility and support bone density are in high demand. Ingredients such as glucosamine, chondroitin, and herbal extracts like devil’s claw and ginger are being marketed to seniors seeking to alleviate discomfort and maintain an active lifestyle. The appeal of these supplements lies in their perceived natural efficacy, further driving growth in this segment of the market.

With rising life expectancy and improved financial independence, many older adults in India are willing to invest in their health and well-being. As a result, there is a growing segment of seniors who are not only more health-conscious but also more affluent. This demographic shift is contributing to the willingness to spend on premium herbal supplements that promise quality and efficacy. Brands that position themselves as providers of high-quality, scientifically backed herbal products are likely to benefit from this increasing purchasing power among older consumers.

The aging population is increasingly engaged in social activities and community wellness initiatives. As seniors prioritize their health, they often participate in group wellness programs that emphasize natural living and preventive care. This trend fosters a community-oriented approach to health, where discussions about herbal supplements and natural remedies become commonplace. Brands that tap into this community spirit, offering products that facilitate social engagement around health and wellness, can capture this growing market segment.

Rising Demand for Natural and Organic Products

The rising demand for natural and organic products is a significant catalyst for the growth of the Indian herbal supplement market. This trend reflects a broader shift in consumer preferences towards products perceived as safe, environmentally friendly, and health-promoting. There is a growing awareness among consumers regarding the health impacts of synthetic chemicals and additives found in conventional supplements and pharmaceuticals. The Indian population is becoming increasingly health-conscious, seeking products that are not only effective but also safe. Herbal supplements, often derived from natural sources and free from artificial additives, align with these health-centric values.Consumers are increasingly inclined to choose herbal products that promise holistic health benefits without the potential side effects associated with synthetic alternatives. The clean label movement emphasizes transparency in ingredient sourcing and product formulation. Consumers are now more informed and concerned about what they put into their bodies, leading to a preference for products with simple, recognizable ingredients. Herbal supplements, often derived from traditional practices and natural sources, fit perfectly into this clean label philosophy. Brands that transparently communicate their sourcing, production processes, and ingredient benefits are likely to attract discerning consumers seeking assurance of product integrity.

In India, there is a long-standing cultural affinity for traditional medicine systems, particularly Ayurveda. This cultural backdrop supports the demand for herbal supplements that are viewed as authentic and rooted in historical practices. As consumers increasingly value products that honor traditional wisdom, herbal supplements are gaining traction. The perception of herbal products as integral to the Indian way of life enhances their appeal, leading to sustained demand in the market.

Growing concerns about environmental sustainability are influencing consumer choices across various sectors, including health and wellness. Many consumers prefer herbal supplements derived from sustainably sourced ingredients, reflecting their desire to support eco-friendly practices. Brands that prioritize sustainable farming, ethical sourcing, and eco-friendly packaging are likely to resonate with environmentally conscious consumers. This emphasis on sustainability not only enhances brand reputation but also drives demand for herbal supplements as consumers align their purchasing decisions with their values.

The rising demand for natural and organic products has led to significant innovation within the herbal supplement market. Manufacturers are responding to consumer preferences by developing a diverse range of products that cater to specific health needs, such as stress relief, digestion support, and immunity enhancement. The introduction of new formulations, such as functional foods and beverages infused with herbal extracts, is further expanding the market. This innovation attracts a broader audience, including health-conscious millennials and Gen Z consumers, who are more inclined to explore diverse health products.

The power of social media and wellness trends cannot be underestimated in shaping consumer behavior. Influencers and health advocates often promote natural and organic products, leading to increased visibility and interest in herbal supplements. Social media platforms facilitate the sharing of information about the benefits of herbal remedies, driving a narrative that favors natural solutions. Brands that effectively engage with consumers through educational content, testimonials, and community building are likely to capitalize on this trend, boosting demand for their products.

The Indian government has been increasingly supportive of natural and organic products, recognizing their potential for both health promotion and economic growth. Initiatives aimed at promoting Ayurvedic and herbal medicines contribute to a favorable regulatory environment. This support enhances consumer confidence in herbal supplements, as government endorsements and quality standards encourage trust in these products. As regulatory bodies emphasize the importance of quality and efficacy, the market for natural and organic herbal supplements is expected to grow.

Key Market Challenges

Quality Assurance and Standardization

One of the foremost challenges confronting the herbal supplement market in India is the lack of stringent quality assurance and standardization. Despite the growing demand for herbal products, the industry is often marked by variability in product quality. Many supplements may not adhere to consistent manufacturing practices, leading to concerns about efficacy, safety, and contamination with harmful substances.The absence of rigorous quality control measures can result in products that do not meet consumer expectations, eroding trust in the market. Additionally, with multiple players entering the space, ensuring that all products comply with established standards becomes increasingly difficult. Regulatory bodies have started implementing guidelines; however, enforcement remains inconsistent. Manufacturers must invest in robust quality control processes, sourcing standards, and certifications to enhance consumer confidence and meet regulatory requirements.

Regulatory Challenges and Compliance

The regulatory landscape for herbal supplements in India is complex and continually evolving, posing significant challenges for market players. While the government has made strides in promoting traditional medicine, including herbal supplements, the regulatory framework often lacks clarity. Manufacturers face difficulties in navigating the requirements for product approval, labeling, and marketing claims.The lack of uniformity in regulations can lead to confusion among manufacturers and consumers alike. Some products may fall under the purview of food safety regulations, while others may be classified as drugs or traditional medicine, leading to differing compliance requirements. This inconsistency can hinder innovation and market entry for new players, as they may struggle to understand and adhere to the regulatory landscape. To mitigate this challenge, companies must remain vigilant in staying updated on regulatory changes and invest in compliance measures to ensure their products meet all necessary guidelines.

Key Market Trends

Integration of Technology in Product Development and Marketing

The increasing integration of technology into product development and marketing strategies is a major trend influencing the growth of the herbal supplement market. Companies are leveraging advanced technologies such as artificial intelligence (AI), big data analytics, and digital marketing to enhance their product offerings and engage with consumers more effectively.Manufacturers are utilizing data analytics to identify consumer preferences and emerging health trends, enabling them to develop targeted herbal formulations that meet specific health needs. By analyzing customer feedback, market trends, and scientific research, companies can innovate and improve product efficacy. The rise of e-commerce platforms has transformed how consumers discover and purchase herbal supplements. Brands are increasingly adopting digital marketing strategies to reach a broader audience through social media, influencer partnerships, and content marketing. This approach not only enhances visibility but also facilitates direct communication with consumers, allowing brands to build trust and brand loyalty.

Technology enables companies to offer personalized supplement solutions tailored to individual health goals and preferences. This trend towards customization is gaining traction, as consumers seek products that cater specifically to their unique needs, such as dietary restrictions, lifestyle choices, and health conditions.

Emphasis on Preventive Health and Wellness

There is a growing emphasis on preventive health and wellness among consumers, significantly influencing the herbal supplement market. As individuals become increasingly aware of the importance of maintaining their health and preventing chronic diseases, they are turning to herbal supplements as part of their proactive health strategies.The trend towards holistic wellness encompasses not just physical health but also mental and emotional well-being. Consumers are seeking supplements that support overall health, including immune function, stress management, and digestive health. Herbal supplements with adaptogenic properties, such as ashwagandha and holy basil, are particularly popular among health-conscious individuals looking to manage stress and enhance resilience. The convergence of the food and supplement markets is driving the popularity of functional foods - food products enhanced with herbal ingredients that provide additional health benefits. Products like herbal teas, energy bars, and fortified beverages that incorporate herbal extracts are gaining traction, appealing to consumers looking for convenient and health-promoting options.

The increasing awareness of preventive health measures is particularly pronounced among the aging population, who seek natural solutions to maintain their health and improve quality of life. Herbal supplements that address age-related health concerns, such as joint support, cognitive health, and cardiovascular wellness, are in high demand, positioning brands to cater to this growing demographic.

Segmental Insights

Product Insights

Based on the category of Product, the Turmeric segment emerged as the dominant in the market for India Herbal Supplement in 2024. Turmeric (Curcuma longa) is one of the most dominant segments in the Indian herbal supplement market. Renowned for its active compound, curcumin, turmeric has gained significant traction due to its anti-inflammatory, antioxidant, and antimicrobial properties.Turmeric is widely recognized for its potential health benefits, particularly in managing chronic inflammation, boosting immunity, and supporting joint health. Its use in traditional medicine systems, such as Ayurveda, further solidifies its position as a staple in herbal supplements. Turmeric’s integration into everyday cooking as a spice enhances its popularity.

As consumers increasingly seek natural remedies for common ailments, they often turn to turmeric-based supplements for added health benefits. The rising trend of incorporating functional ingredients into food and beverages has led to the introduction of turmeric-infused products, such as golden milk and herbal teas. This diversification has broadened its consumer base and appeal. These factors are expected to drive the growth of this segment.

Form Insights

The Tablets segment is projected to experience rapid growth during the forecast period. Tablets represent one of the most popular forms of herbal supplements in India. Their solid dosage form is favored for its convenience, ease of consumption, and precise dosage.Tablets are easy to carry and can be consumed without the need for additional preparation, making them a preferred choice for busy individuals. Tablets tend to be more affordable than some other forms, appealing to a broader demographic. Their mass production is cost-efficient, enabling manufacturers to offer competitive pricing. The stability of tablets contributes to their popularity, as they generally have a longer shelf life compared to liquid forms, reducing the risk of spoilage. These factors collectively contribute to the growth of this segment.

Regional Insights

South India emerged as the dominant in the India Herbal Supplement market in 2024, holding the largest market share in terms of value. Southern India, comprising states such as Kerala, Tamil Nadu, Karnataka, Andhra Pradesh, and Telangana, stands out as a significant hub for herbal supplements. This region is deeply rooted in traditional practices, particularly Ayurveda, which has fostered a strong consumer base for herbal products.Southern India has a rich tradition of herbal medicine, with Ayurveda and Siddha systems being prominent. Kerala is known for its Ayurvedic practices and therapies, attracting both domestic and international consumers seeking authentic herbal products. The region boasts a diverse range of medicinal plants and herbs, making it an ideal location for herbal supplement manufacturing. States like Tamil Nadu and Karnataka are known for cultivating various herbal crops, contributing to a robust supply chain. The popularity of wellness tourism in states like Kerala, where Ayurvedic resorts and health retreats are prevalent, has further stimulated demand for herbal supplements. Visitors seeking natural remedies often purchase local herbal products, bolstering the market.

Key Market Players

- Himalaya Wellness Company

- Dabur India Limited

- Patanjali Ayurved Limited

- Zandu Realty Ltd

- Baidyanath

- Organic India Pvt. Ltd

- Amway India Enterprises Pvt. Ltd.

- Charak Pharma Pvt. Ltd

- Ayurleaf Herbals

- Herbalife International of America, Inc

Report Scope:

In this report, the India Herbal Supplement Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Herbal Supplement Market, By Product:

- Moringa

- Ashwagandha

- Echinacea

- Flaxseeds

- Turmeric

- Ginger

- Ginseng

- Others

India Herbal Supplement Market, By Form:

- Tablets

- Capsules

- Soft Gels

- Liquid

- Powder & Granules

India Herbal Supplement Market, By Application:

- Immunity

- General Health

- Energy & Weight Management

- Bone & Joint Health

- Others

India Herbal Supplement Market, By Distribution Channel:

- Pharmacies and Drug Stores

- Online

- Supermarkets and Hypermarkets

- Others

India Herbal Supplement Market, By End User:

- Adult

- Geriatric

- Pregnant Females

- Children

- Infants

India Herbal Supplement Market, By Region:

- North India

- South India

- East India

- West India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Herbal Supplement Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Himalaya Wellness Company

- Dabur India Limited

- Patanjali Ayurved Limited

- Zandu Realty Ltd

- Baidyanath

- Organic India Pvt. Ltd

- Amway India Enterprises Pvt. Ltd.

- Charak Pharma Pvt. Ltd

- Ayurleaf Herbals

- Herbalife International of America, Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 88 |

| Published | November 2024 |

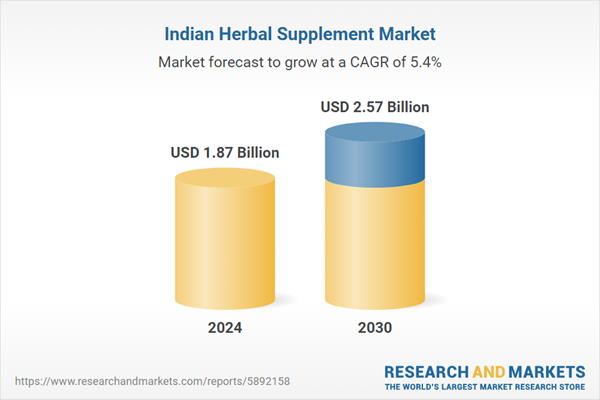

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.87 Billion |

| Forecasted Market Value ( USD | $ 2.57 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |