Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

As one of the world's leading leather exporters, India is in a favorable position to benefit from this growing demand for leather chemicals. The country's expertise in leather production, coupled with its strong export capabilities, positions it as a key player in the global market. In addition to this, the domestic market in India is also witnessing significant growth, driven by rising disposable incomes and evolving lifestyle preferences. This has further contributed to the increasing demand for leather chemicals within the country.

Moreover, the leather chemicals market in India is experiencing a shift towards sustainable practices. There is a rising demand for eco-friendly leather chemicals, driven by stricter environmental regulations and greater consumer awareness about sustainability. Manufacturers and suppliers are increasingly focusing on developing and promoting sustainable alternatives that have minimal impact on the environment.

In conclusion, the future of India's leather chemicals market looks promising. With its strong export capabilities, growing domestic demand, and a commitment to sustainability, the market is poised for robust growth in the coming years. The industry's focus on quality, durability, and eco-friendliness will continue to drive innovation and propel the market forward.

Key Market Drivers

Urbanization and Rising Disposable Income

Urbanization, a global phenomenon, holds particular importance for developing economies like India. As more and more people migrate to cities in search of better opportunities, there is an unprecedented demand for consumer goods, including leather products.In urban environments, the abundance of retail outlets and e-commerce platforms provides a wide range of leather goods, ranging from footwear and apparel to accessories and home décor. This increased accessibility and availability have led to a significant rise in the consumption of leather products, thereby driving the demand for leather chemicals used in their production.

Moreover, urban environments tend to foster fashion-conscious consumers who value quality and durability. Leather, being perceived as a premium material, holds immense appeal for these consumers. This trend has further spurred the growth of the leather industry, directly impacting the leather chemicals market.

India's economic growth has resulted in a substantial increase in per capita disposable income. This financial freedom about has brought about a shift in consumption patterns, with consumers willing to spend more on high-quality and durable goods. Leather products, renowned for their longevity and aesthetic appeal, have become increasingly popular among these discerning consumers. Consequently, the production of leather goods has experienced an upswing to meet this rising demand, inevitably leading to an increased need for leather chemicals at various stages of the leather processing.

Furthermore, the expanding middle-class population with disposable income is becoming more aware and concerned about sustainability. This heightened awareness has resulted in a surge in demand for eco-friendly leather chemicals, pushing manufacturers to innovate and develop sustainable solutions.

In conclusion, urbanization and rising disposable income are playing a pivotal role in driving India's leather chemicals market. As these trends continue, the market is expected to maintain its growth trajectory, offering lucrative opportunities for players in the leather chemicals industry.

With a focus on sustainable practices and the production of high-quality leather goods, the Indian leather industry is set to make significant strides, solidifying its place on the global stage. At the heart of this growth story will be the indispensable role of leather chemicals, supporting the industry's progress and ensuring its continued success.

Growth of Leather Industry

The Indian leather industry, deeply rooted in history, holds significant traditional value. Over the years, it has transformed into a dynamic and competitive market, playing a vital role in India's manufacturing sector and exports.Ranked as the world's eighth-largest exporter of leather and leather products, India's leather industry employs approximately 4.42 million individuals, making it a crucial sector from a socio-economic perspective. These statistics highlight the immense scale of the industry and its potential for future growth.

Within the leather production process, leather chemicals occupy a pivotal role, contributing to various stages such as tanning, dyeing, and finishing. These chemicals enhance the durability, aesthetic appeal, and overall quality of the final product, making them indispensable.

As the leather industry continues to prosper, the demand for leather chemicals also grows in tandem. The surge in production, driven by both domestic and international demand for leather goods, directly translates to an increased consumption of leather chemicals.

Furthermore, emerging trends such as the rising preference for high-quality and durable goods, along with the growing demand for eco-friendly leather products, are exerting influence on the leather chemicals market. Manufacturers are consistently innovating to produce chemicals that can deliver superior quality products while minimizing environmental impact, reflecting the industry's commitment to sustainability and customer satisfaction.

Key Market Challenges

Volatility in Prices of Raw Materials

Leather chemicals, which are utilized at various stages of leather production, are derived from a range of raw materials including chromium salts, vegetable tannins, and synthetic tanning agents. The costs of these inputs are susceptible to fluctuations influenced by a multitude of factors such as changes in supply and demand dynamics, geopolitical tensions, and evolving environmental regulations.For instance, chromium salts, a crucial raw material used in leather tanning, have experienced considerable price volatility due to inconsistent supply and the rising concerns surrounding environmental impact. Similarly, the prices of vegetable tannins are heavily influenced by agricultural yields, which can be unpredictable due to changing weather patterns and the occurrence of natural disasters.

The inherent price volatility of these raw materials directly impacts the cost of production for leather chemicals, thereby posing challenges for accurate business forecasting. Manufacturers may face squeezed profit margins if they are unable to pass on the increased costs to their customers.

Furthermore, this climate of uncertainty creates a challenging environment for companies to plan long-term investments and formulate growth strategies. The unpredictability in raw material prices can potentially slow down the growth of the market and discourage new entrants from entering the industry. Thus, it becomes imperative for stakeholders in the leather industry to navigate these challenges and find innovative solutions to mitigate the impact of price fluctuations on their operations.

Key Market Trends

Growing Demand for Biodegradable Chemicals

In recent years, sustainability has emerged as a key concern across industries, including the leather industry, which has long been associated with significant environmental impact. With increasing consumer awareness and stricter environmental regulations, there is a growing demand for eco-friendly and sustainable alternatives to traditional leather production.To address this demand, the industry is actively embracing biodegradable or eco-friendly leather chemicals derived from natural sources. These chemicals are specifically designed to reduce the environmental footprint of the leather production process. By adopting these sustainable practices, the leather industry is taking a proactive stance in mitigating its impact on the environment.

The shift towards biodegradable leather chemicals has had a significant impact on the Indian leather chemicals market. Manufacturers have recognized the potential in this growing preference for sustainable and eco-friendly products. As a result, they have introduced a range of eco-friendly and bio-based chemicals that offer similar performance to their synthetic counterparts but with a lower environmental footprint. This strategic move not only aligns with market demands but also positions these manufacturers as leaders in the evolving leather chemicals market.

While the adoption of biodegradable leather chemicals presents numerous opportunities, it also comes with its set of challenges. One of the key challenges is the cost of producing these eco-friendly chemicals, which can be higher than that of traditional chemicals. This factor may impact the profitability of manufacturers in the short term. Additionally, ensuring that these biodegradable chemicals deliver the same quality and performance as their synthetic counterparts requires substantial investment in research and development. Manufacturers must commit resources to ensure that the transition towards sustainable practices does not compromise the overall product quality.

Despite these challenges, the potential benefits, both in terms of environmental impact and market demand, make the adoption of biodegradable chemicals a worthwhile endeavor. Manufacturers who can successfully navigate these challenges stand to gain a competitive edge in the evolving leather chemicals market. By embracing sustainability and meeting the growing demand for eco-friendly alternatives, these forward-thinking manufacturers are well-positioned to thrive in an industry that is rapidly evolving towards more sustainable practices.

In conclusion, the growing demand for biodegradable chemicals is a trend that is reshaping the Indian leather chemicals market. As the industry continues to prioritize sustainability and environmental responsibility, the market for these eco-friendly chemicals is set to grow exponentially. This presents exciting opportunities for forward-thinking manufacturers who are committed to meeting the demands of a more environmentally conscious consumer base. By actively embracing sustainable practices and investing in research and development, these manufacturers can establish themselves as leaders in the evolving leather chemicals market and contribute to a greener and more sustainable future.

Segmental Insights

Product Insights

Based on the category of product, the polyurethane resins segment emerged as the dominant player in the Indian market for Leather Chemicals in 2023. The increase in consumption of polyurethane in leather processing can be attributed to its various benefits. Polyurethane is not only used to make organic solvent-free finish formulations, but it is also utilized as binders, basecoats, and topcoats. Hybrid acrylic polyurethane polymers, in particular, have made significant contributions to the development of solvent-free finish formulations. With their exceptional tensile strength, elasticity, and resistance to abrasion and solvents, PU resins are not only used in PU-based synthetic products but also find application in various other formulations and processing methods.Furthermore, the demand for PU resins in the manufacturing industry is expected to rise due to the environmental advantages of PU-based leather over vinyl-based leather. While PU-based leather is considered more environmentally friendly, it is worth noting that the manufacturing process involved is lengthier, making it a more expensive alternative. Nevertheless, the industry continues to recognize the importance of PU resins in meeting both environmental and performance requirements.

End User Insights

The footwear segment is projected to experience rapid growth during the forecast period. The demand for the product is primarily attributed to the increasing demand for leather, which is extensively used in the manufacturing of footwear. This rise in demand for leather in the footwear industry has consequently led to a surge in demand for these chemicals. Apart from leather, footwear also comprises other essential components such as rubber, plastic, textile, and metal. These chemicals find multiple applications in the footwear industry, including leather finishing, tanning, dyeing, as well as strengthening the crust and filling. Their usage plays a crucial role in enhancing the overall quality and durability of footwear products.Regional Insights

West India emerged as the dominant player in the India Leather Chemicals Market in 2023, holding the largest market share in terms of value. West India, encompassing major states like Maharashtra and Gujarat, is blessed with a plethora of strategic geographical advantages that contribute to its economic growth. This region boasts a sprawling coastline, offering seamless access to vital shipping routes. As a result, the export of chemical products, particularly in the leather industry, is expedited with ease and efficiency.Furthermore, West India takes pride in its well-developed infrastructure, which includes robust road networks and state-of-the-art ports. These exceptional transportation facilities facilitate seamless logistics and distribution of leather chemicals, ensuring timely delivery and customer satisfaction. The region's commitment to efficient transportation has undoubtedly played a pivotal role in establishing its dominance in the leather chemicals market.

Moreover, West India's industrial landscape, particularly in chemical manufacturing, is exceptionally strong. States like Gujarat have a rich historical background in chemical production, making significant contributions to India's overall chemical industry output. This well-established industrial ecosystem provides leather chemical manufacturers with an abundance of resources, skills, and expertise, further solidifying the region's stronghold in the market.

In summary, West India's strategic geographical advantages, coupled with its well-developed infrastructure and strong industrial base, make it an ideal hub for the production and export of leather chemicals. The region's commitment to excellence and efficient logistics has cemented its position as a leader in the market, bringing growth and prosperity to its inhabitants.

Report Scope:

In this report, the India Leather Chemicals Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Leather Chemicals Market, By Product:

- Biocides

- Surfactants

- Chromium Sulfate

- Polyurethane Resins

- Sodium Bicarbonate

- Others

India Leather Chemicals Market, By Process Type:

- Tanning & Dyeing

- Beamhouse

- Finishing Chemicals

India Leather Chemicals Market, By End User:

- Footwear

- Upholstery

- Leather Goods

- Garments

India Leather Chemicals Market, By Region:

- North India

- East India

- West India

- South India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Leather Chemicals Market.Available Customizations:

India Leather Chemicals Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Stahl India Pvt. Ltd.

- Lanxess India Pvt. Ltd.

- TFL Quinn India Pvt. Ltd.

- BASF India Ltd.

- Haryana Leather Chemicals Ltd.

- Dadia Chemical Industries Ltd.

Table Information

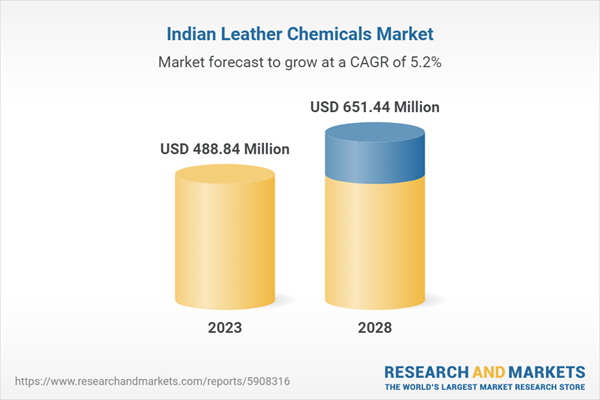

| Report Attribute | Details |

|---|---|

| No. of Pages | 90 |

| Published | October 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 488.84 Million |

| Forecasted Market Value ( USD | $ 651.44 Million |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | India |

| No. of Companies Mentioned | 6 |