The substantial investments in lithium-ion battery manufacturing in India indicate a strong commitment to expanding production capabilities. These investments will meet domestic needs and position India as a competitive player in the global market. Furthermore, efficient energy storage solutions are crucial as India expands its renewable energy capacity and integrates solar and wind energy into the grid. Lithium-ion batteries offer a viable solution due to their high energy density, long lifespan, and efficiency in storing and releasing energy. This capability stabilizes the grid and ensures a continuous power supply, further driving the market's growth.

The demand for lithium in India is primarily fueled by the government’s push towards clean energy and electrification of transportation. According to the India Brand Equity Foundation (IBEF), the country aims to achieve a 30% electric vehicle (EV) adoption target by 2030, focusing on two-wheelers, three-wheelers, and commercial vehicles. The government-initiated programs, such as the National Mission on Transformative Mobility, aim to decrease reliance on imports and boost local manufacturing of lithium-ion batteries in response to the increasing demand and a shift towards electrification.

India Lithium Market Report Highlights

- The market growth is attributed to factors, such as the abundance of consumer electronics, advancements in battery technology, and rising demand for portable electronic devices

- Based on products, the carbonates segment accounted for the largest revenue share of 52.7% in 2023. The demand for lithium carbonate is driven by the increasing need for energy storage solutions and the shift towards EVs to reduce carbon emissions

- The consumer electronics application segment is expected to register the fastest CAGR over the forecast period

- In January 2024, Khanij Bidesh India Ltd. (KABIL) signed an agreement for a lithium exploration and mining project in Argentina. This significant milestone marks the first lithium exploration and mining project by a Government Company in India

Table of Contents

Companies Mentioned

- TDK Corporation

- Evolute

- Exide Industries Ltd.

- Future Hi-tech Batteries Limited

- HBL Power Systems Limited

- Li Energy

- Luminous Power Technologies Private Limited

- Okaya

- TDS

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 80 |

| Published | May 2024 |

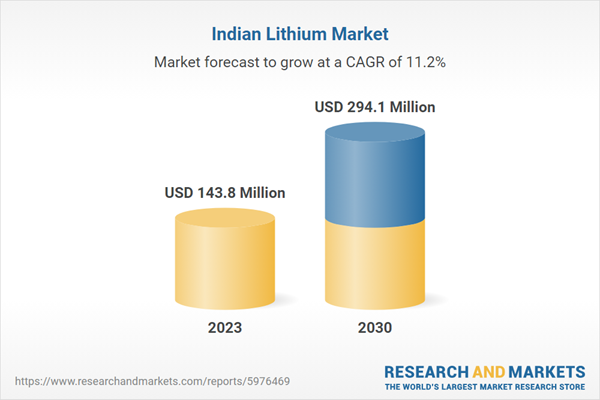

| Forecast Period | 2023 - 2030 |

| Estimated Market Value ( USD | $ 143.8 Million |

| Forecasted Market Value ( USD | $ 294.1 Million |

| Compound Annual Growth Rate | 11.2% |

| Regions Covered | India |

| No. of Companies Mentioned | 9 |