Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Changing Consumer Preferences

Indian consumers, especially millennials and the urban population, are increasingly seeking unique and innovative alcoholic beverages. This shift is reflected in the growing demand for craft alcohol, including mead, which is perceived as a more natural, healthier, and artisanal option compared to traditional alcoholic drinks like beer and spirits. Mead’s versatility, with flavors ranging from sweet to dry and the potential to experiment with fruit, spice, and floral infusions, has further increased its appeal. This demand for novelty and variety is compelling both international and domestic producers to introduce mead variants that cater to the evolving tastes of the younger generation, further contributing to market expansion.Health and Wellness Trends

As consumers become more health-conscious, they are gravitating towards beverages with perceived health benefits. India's wellness market is expected to grow steadily at an annual rate of 5% between 2024 and 2032. Mead, made primarily from honey, offers a more natural alternative to other alcoholic drinks, often containing fewer additives and preservatives. Honey, the key ingredient in mead, is known for its antioxidant and antimicrobial properties, which enhances its appeal among those looking for drinks with added health benefits. Moreover, mead can be crafted with lower sugar content and fewer artificial ingredients, making it an attractive choice for health-conscious individuals. This trend is driving the popularity of mead, especially among those who prioritize clean-label and organic products.Growing Craft Alcohol Sector

The craft alcohol industry in India is expanding rapidly, driven by the rise of microbreweries, homebrewers, and local distilleries that focus on artisanal and small-batch production. This movement has paved the way for mead to gain a stronger foothold in the market. The increasing number of craft beverage festivals, specialty stores, and online platforms dedicated to niche alcoholic drinks are providing greater visibility and accessibility for mead. The craft alcohol sector, which promotes innovation and uniqueness, aligns perfectly with the characteristics of mead, further propelling its growth in India. Additionally, several craft mead producers are now focusing on creating mead with local ingredients, giving it a regional identity and increasing its appeal to diverse consumer bases.Key Market Challenges

Limited Awareness and Education

One of the major challenges facing the India mead beverage market is the limited awareness among consumers. Mead is still a relatively niche product in India, and many consumers are unfamiliar with its taste, production process, and varieties. Unlike more established alcoholic beverages such as beer and whiskey, mead lacks widespread recognition, which hinders its adoption. To overcome this, producers need to invest in educating the market through promotional activities, tastings, and collaborations with bars and restaurants to introduce mead to a broader audience. The lack of awareness can be especially challenging in a country where traditional alcoholic drinks dominate consumer choices.High Production Costs

The production of mead involves the use of premium ingredients such as honey, which can be expensive and difficult to source in large quantities. Additionally, mead requires a more time-consuming fermentation process compared to mass-produced alcoholic drinks, increasing the overall cost of production. These higher production costs can result in higher retail prices, which may limit mead's accessibility to price-sensitive consumers. To make mead more competitive in the Indian market, producers need to balance quality with affordability, potentially sourcing local honey or optimizing production processes to reduce costs without compromising on product integrity.Key Market Trends

Rise of Flavored and Fruit-Infused Mead

One of the recent trends in the India mead beverage market is the growing demand for flavored and fruit-infused meads. While traditional mead is made from honey, water, and yeast, producers are increasingly introducing variations with added fruits like apples, berries, mangoes, and citrus. These fruity meads cater to the evolving preferences of younger consumers who seek refreshing and innovative flavors. The trend is also aligned with the growing demand for fusion drinks that combine the best of different alcohol categories. Fruit-infused meads provide a unique twist, making them more accessible to those unfamiliar with the traditional mead taste. This trend is helping mead gain popularity in the Indian market by offering an exciting and varied drinking experience.Craft and Artisan Production

The trend of craft and artisanal alcoholic beverages is gaining momentum in India, and mead is benefiting from this movement. As consumers continue to shift toward high-quality, small-batch, and locally sourced products, mead production has followed suit. Many new mead brands are focusing on handcrafting their products with high-quality honey and other natural ingredients, resulting in unique and premium offerings. Additionally, local mead producers are beginning to experiment with indigenous flavors and spices, giving their meads a regional identity. This artisanal approach helps cater to the growing interest in "craft culture" and the desire for distinctive, small-batch alcohol options among Indian consumers.Increased Online Availability and E-commerce Platforms

The rise of e-commerce platforms and online retail has significantly boosted the accessibility of niche alcoholic beverages like mead in India. India's e-commerce market is projected to expand by 23.8% in 2024, fueled by the ongoing growth of online shopping and higher internet penetration. As the e-commerce industry grows, more consumers are exploring a wider range of alcoholic options from the comfort of their homes. Online platforms and direct-to-consumer models allow mead producers to reach a broader audience, even in regions where mead is not traditionally popular. The ability to order mead online has expanded its reach, especially in tier 2 and tier 3 cities, where access to specialty liquor stores may be limited. This trend is playing a crucial role in introducing mead to a larger consumer base, contributing to market growth.Segmental Insights

Product Type Insights

Traditional Mead is currently the dominating segment in the India mead beverage market, largely due to its deep-rooted history and association with natural ingredients like honey. Consumers in India, especially those exploring craft and artisanal beverages, appreciate traditional mead for its authentic taste and purity. The segment appeals to those seeking a more refined and classic alcoholic experience, with minimal flavor additives. While fruit-infused meads are gaining traction, traditional mead remains the primary choice due to its established identity and appeal, and it is expected to continue leading the market as consumer awareness grows.Regional Insights

The North region of India is currently the dominating market for mead beverages, driven by the region's urbanization and growing consumer base in cities like Delhi, Chandigarh, and Jaipur. This area has seen a surge in demand for craft and artisanal alcoholic drinks, with an increasing number of consumers seeking unique beverages like mead. The availability of specialty liquor stores, growing interest in international beverages, and higher disposable incomes in these urban centers have contributed to the dominance of North India. As consumer awareness expands, this trend is expected to continue, reinforcing the region's leadership in the mead market.Key Market Players

- Moonshine Meadery

- Cerana Meads

- Hill Zill Wines Pvt. Ltd. (Arka)

- Salud Beverages Pvt Ltd.

- Stump Meads

- No Label Mead

- Etowah Meadery, Corp.

- Schramm's Mead

- The Honey Wine Company, LLC

- Modern Methods Brewing Company

Report Scope:

In this report, the India Mead Beverage Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Mead Beverage Market, By Product Type:

- Traditional Mead

- Fruit Mead

India Mead Beverage Market, By Sales Channel:

- Liquor Stores

- On-Premises

- Others

India Mead Beverage Market, By Region:

- North

- South

- East

- West

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Mead Beverage Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Moonshine Meadery

- Cerana Meads

- Hill Zill Wines Pvt. Ltd. (Arka)

- Salud Beverages Pvt Ltd.

- Stump Meads

- No Label Mead

- Etowah Meadery, Corp.

- Schramm's Mead

- The Honey Wine Company, LLC

- Modern Methods Brewing Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 82 |

| Published | January 2025 |

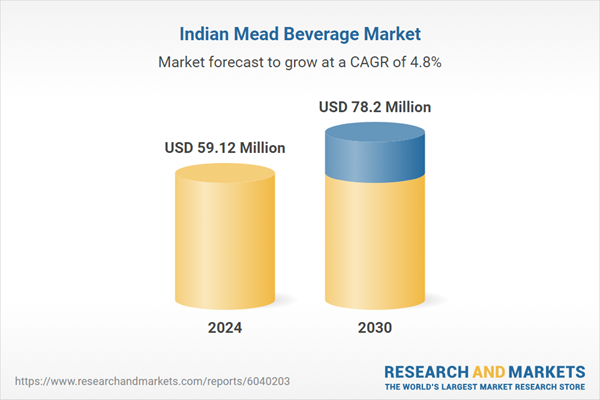

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 59.12 Million |

| Forecasted Market Value ( USD | $ 78.2 Million |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |