Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

A data center is a physical location with networked computers, storage systems, and computational infrastructure that businesses utilize to store, gather, analyze, and disseminate massive quantities of data. A modular data center is a pre-assembled server farm that is comprised of normalized modules that can be handily collected and dismantled. This makes them an adaptable and versatile answer for endeavors that are expected to convey or grow their data center limit rapidly and without any problem. Likewise, a particular data center is a versatile assortment of the relative multitude of parts expected to supply data center limit. Modular data center is commonly comprised of the accompanying parts such as servers, stockpiling, organizing gear, power frameworks, and cooling frameworks. These parts are commonly housed in pre-assembled modules that can be handily shipped and introduced. The modules can be associated together to make a bigger data center, or they can be utilized as independent units. Measured data centers offer various benefits over conventional data centers, including quicker organization, more adaptability, versatility, effectiveness, and a lot more because of their normalized plan and the use of pre-assembled parts. These modular data centers are a flexible option that can be used in a variety of situations, including data center expansion, disaster recovery, new data center development, military applications, and edge computing. The modular data center is becoming the undisputed choice for businesses of all sizes as interest in data center boundaries continues to grow.

Rapid Adoption of Cloud and Digital Transformation by Indian Companies

. Customers are shifting to cloud-based solutions due to their scalability and cost-effective specifications. Several cloud service providers across the world have revealed their availability zones in India, particularly in locations such as Hyderabad, Delhi (NCR), Chennai, Mumbai, and Bengaluru since they have strong fiber connection in addition to being close to clients. Three availability zones (AZs) are being built by Amazon Web Services (AWS) in Hyderabad. Microsoft has purchased Hyderabad-area property tracts to establish a new data center zone. While 67% of the large enterprises already accelerated cloud adoption, 39% of medium-sized companies, and 38% of small companies embarked on their cloud journey. . Moreover, Mumbai and Delhi-NCR are Google's two cloud computing hubs in India. Businesses such as Yotta Infrastructure, NTT-Netmagic, STT GDC India, Sify Modular Data Centers, CtrlS Datacenters Ltd, and other building hyperscale data centers and data center parks in India. Moreover, as cloud-managed services are a vital part of digital transformation, their demand will further expand in the coming years. Furthermore, the Indian government support to transform India into a global data hub has resulted in several regulations and reforms that have given the essential framework for the expansion of cloud computing and cloud-enabled modular data centers. Therefore, the rapid adoption of cloud and digital transformation by Indian companies will drive the growth of the India modular data center market during the forecast period.Growing Focus on Security and Government Support

As businesses in India become increasingly reliant on data, the need for secure data centers has grown exponentially. The growing cybersecurity attacks, environmental and physical security concern has proliferated enterprises to adopt modular data centers. Modular data centers are typically designed with security in mind. These data centers offer several security advantages that can help organizations protect their data from unauthorized access and are equipped with a variety of cybersecurity features, such as firewalls, intrusion detection systems, and data encryption. Modular data centers are designed to withstand a variety of environmental conditions, such as extreme temperatures and humidity. This helps to protect the data center from damage that can be caused by environmental factors. In addition, the continuous initiatives taken by the Indian government such as the National Cyber Security Policy, the National Data Center Policy, the Digital India Initiative, and many more have enabled the enterprises to adopt modular data centers. As these trends continue, modular data centers are likely to become even more popular in the country. Hence, the growing focus on security and government support will propel the growth of the India modular data center market during the forecast period.Increasing Investments in Edge Data Centers

Edge computing is becoming more popular in the market just like 5G has been massively ramped up in the last couple of years, because of the rising use of connected devices among consumers and organizations. In many Tier II and Tier III cities as well as in rural areas, this has resulted in a significant demand for higher-bandwidth internet, necessitating the construction of modular data centers to process information in comparison with big cities. Edge data centres will develop a decentralized data center architecture in which numerous edge data centers are linked to a single hyperscale facility. Over 25.2 percent of Indian population with 189 Indian cities have 5G coverage as of January 2023, with significant market participants, including Reliance Jio, Bharti Airtel, and Vodafone Idea. In 256 cities, Reliance Jio is offering 5G connection. Bharti Airtel is second, covering more than 80 cities, while Vodaphone is third. Throughout India, companies such as Airtel are partnering up to design and build networks by using equipment from large enterprises such as Nokia, Ericsson, and Samsung. Moreover, the 5G implementation will further offer faster access to information, which will lead to more edge datacenter deployments due to the surge in data consumption. Furthermore, companies are extending their 5G coverage to new locations across the region, which necessitates the construction of the physical infrastructure to facilitate the significant degree of data sharing. Hence, increasing 5G investments are driving the growth of the India modular data center market.Market Segmentation

The India modular data center market is divided into component, organization size, and industry vertical. Based on component, the market is segmented into service and solutions. Based on service, the market is bifurcated into all-in-one module and individual module. The individual module segment is further bifurcated into IT, power, and cooling. Based on solutions, the market is segmented into design & consulting, integration & deployment, and maintenance & support. Based on organization size, the market is further divided into SMEs and large enterprises. Based on industry vertical, the market is further divided into IT & telecom, BFSI, media & entertainment, government & defense, healthcare, retail, and others.Market Players

Major market players in the India modular data center market are CtrlS Datacenters Ltd, Sify Technologies Limited, Tata Communications Service Limited, HCL Infosystems, Wipro Technologies Limited, Digital Reality Trust Inc., NTT Global Data Centers, Equinix Inc., Vantage Data Centers and many more.Report Scope:

In this report, the India modular data center market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Modular Data Center Market, By Component:

- Services

- All-in-one Module

- Individual Module

- IT

- Power

- Cooling

- Solutions

- Design and Consulting

- Integration and Deployment

- Maintenance & Support

India Modular Data Center Market, By Organization Size:

- SMEs

- Large Enterprises

India Modular Data Center Market, By Industry Vertical:

- IT & Telecom

- BFSI

- Media & Entertainment

- Government & Defense

- Healthcare

- Retail

- Others

India Modular Data Center Market, By Region:

- East India

- West India

- North India

- South India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India modular data center market.Available Customizations:

India modular data center market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- CtrlS Datacenters Ltd

- Sify Technologies Limited

- Tata Communications Service Limited

- HCL Infosystems

- Wipro Technologies Limited

- Digital Reality Trust Inc.

- NTT Global Data Centers

- Equinix Inc.

- Vantage Data Centers

Table Information

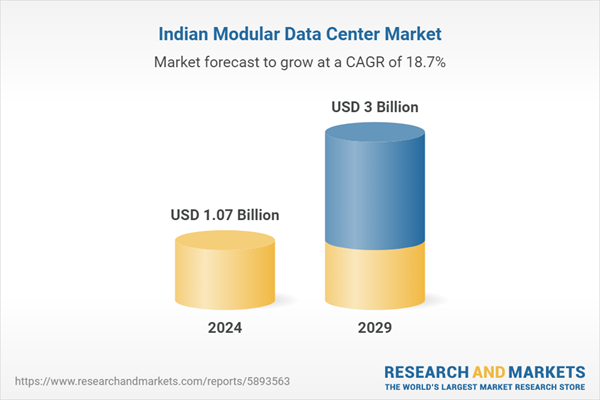

| Report Attribute | Details |

|---|---|

| No. of Pages | 74 |

| Published | October 2023 |

| Forecast Period | 2024 - 2029 |

| Estimated Market Value ( USD | $ 1.07 Billion |

| Forecasted Market Value ( USD | $ 3 Billion |

| Compound Annual Growth Rate | 18.7% |

| Regions Covered | India |

| No. of Companies Mentioned | 9 |