Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

In 2024, the Ministry of Commerce and Industry (Department of Industry and Internal Trade) has issued three Quality Control Orders (QCOs) for Cookware and Utensils, Insulated Flask Bottles and Containers, and Potable Water Bottles. These orders mandate that products covered under them must bear a Standard Mark (ISI Mark) once the QCOs are implemented. Manufacturers are required to obtain BIS Certification to ensure their products comply with ISI Mark standards. Non-compliance with BIS Certification will prohibit manufacturers from selling these products in the Indian market.

Key Market Drivers

Rising Disposable Income, Urbanization and Changing Lifestyles

India's economic growth over the past few decades has significantly increased the disposable income levels of its population, particularly the middle class. As incomes rise, consumers are more willing to invest in higher-quality kitchenware, including non-stick cookware. Non-stick cookware is perceived as durable, easy to use, and time-saving, which appeals to households looking for convenient cooking solutions amidst busy lifestyles.Rapid urbanization has reshaped consumer preferences and lifestyles in India. Urban dwellers, who often have hectic schedules and limited time for cooking, prefer kitchenware that offers convenience and efficiency. Non-stick cookware fits this requirement perfectly due to its non-stick surface, which reduces the need for excessive oil and simplifies cleaning. The shift towards nuclear families and dual-income households in urban areas further drives the demand for convenient cooking solutions, thereby boosting the market for non-stick cookware.

Young Population and Changing Preferences

India has a large population of young adults who are more inclined towards adopting modern kitchen technologies and products. This demographic segment values convenience, health-consciousness, and efficiency in cooking, all of which are catered to by non-stick cookware. The preference for healthier cooking methods, such as using less oil, aligns with the health-conscious mindset prevalent among the younger generation. There is a growing awareness among Indian consumers about health and nutrition. Non-stick cookware allows for cooking with minimal oil, which is perceived as a healthier option compared to traditional cooking methods. As more consumers become health-conscious and seek ways to reduce fat intake in their diets, non-stick cookware becomes increasingly popular as a practical solution.Traditional and Modern Cooking Practices

While traditional cooking methods continue to be valued in Indian households, there is a growing acceptance of modern kitchen technologies that offer convenience without compromising on taste or health benefits. Non-stick cookware manufacturers have adapted by combining traditional designs with modern materials and technologies, thereby appealing to a broader spectrum of consumers who seek both authenticity and innovation in their cooking experiences. India is known for its diverse culinary traditions and regional cuisines. Non-stick cookware's versatility in cooking a wide range of dishes - from dosas and rotis to stir-fries and pasta - caters to the multicultural palate of Indian consumers. This versatility is a significant driver of its adoption across various demographic segments and geographic regions within India.Key Market Challenges

Health and Safety Concerns

Health and safety issues related to non-stick cookware have been a persistent challenge in the market. Non-stick coatings traditionally used in cookware contain chemicals such as perfluorooctanoic acid (PFOA) and polytetrafluoroethylene (PTFE), which can release toxic fumes at high temperatures. These fumes pose potential health risks to consumers, including respiratory issues and other health complications.There is a growing awareness among Indian consumers about the health risks associated with non-stick cookware. This awareness has prompted concerns about the safety of using non-stick pans, especially when exposed to high heat or when the coating begins to degrade over time. Manufacturers need to adhere to stringent regulatory standards to ensure that non-stick cookware products are safe for consumer use. Compliance with international safety norms and certifications is essential but can be challenging for smaller manufacturers or those operating in less regulated markets.

Durability and Performance Issues

Another significant challenge in the India non-stick cookware market is related to durability and performance concerns. Non-stick coatings can degrade over time due to wear and tear, exposure to high temperatures, and improper use or cleaning methods. Non-stick coatings may wear off or peel over prolonged use, affecting the cookware's performance and safety.This can lead to food sticking to the surface, uneven cooking, and decreased longevity of the product. Non-stick cookware is susceptible to scratching, especially when metal utensils are used. Scratches on the coating can compromise its non-stick properties and expose underlying materials, potentially affecting food safety. Some non-stick coatings may not withstand high temperatures, leading to thermal degradation and release of harmful chemicals. Manufacturers need to ensure that their products are designed to withstand recommended cooking temperatures without compromising safety or performance.

Market Saturation and Competition

The non-stick cookware market in India is highly competitive with numerous brands vying for market share. Intense competition often leads to price wars among manufacturers, driving down profit margins and limiting opportunities for premium pricing. Consumers may prioritize affordability over brand loyalty or product features, making it challenging for brands to maintain profitability.With a multitude of brands offering similar products, differentiation becomes crucial. However, achieving meaningful differentiation beyond price can be difficult, especially in a market where consumers may perceive little variation in product quality or performance. Building and maintaining brand loyalty in a competitive market requires consistent quality, innovation, and effective marketing strategies. Established brands with strong reputations often have an advantage over newer entrants or smaller players trying to establish themselves.

Key Market Trends

Shift towards Healthier and Eco-Friendly Products

There is a notable trend towards healthier and eco-friendly non-stick cookware products in India. Consumers are increasingly conscious of their health and environmental impact, leading to a demand for non-stick cookware. There is a growing preference for non-stick cookware with PFOA-free coatings. Perfluorooctanoic acid (PFOA) is a chemical used in traditional non-stick coatings that has been associated with health risks. Manufacturers are responding by developing alternative coatings that are free from PFOA and other harmful chemicals, ensuring safer cooking practices.Ceramic and silicone-based coatings have gained popularity as they are perceived to be safer and more environmentally friendly alternatives to traditional non-stick coatings. These coatings are known for their non-toxic properties, scratch resistance, and ability to withstand higher temperatures compared to traditional coatings. Manufacturers are increasingly focusing on sustainable practices throughout the product lifecycle, from sourcing raw materials to manufacturing processes and packaging. This includes using recycled materials, reducing carbon footprints, and promoting recyclability of products at the end of their lifecycle.

Innovation in Design and Functionality

Innovation in design and functionality is another key trend driving the India non-stick cookware market. Manufacturers are continuously introducing new features and designs to cater to consumer preferences for convenience, versatility, and aesthetics. There is a rising demand for multi-functional cookware that can perform various cooking tasks with ease. This includes modular cookware sets, interchangeable lids, and versatile cooking surfaces that allow for different cooking techniques such as frying, steaming, and baking.Consumers are increasingly seeking cookware with ergonomic designs that offer comfort and ease of use. Features such as heat-resistant handles, lightweight materials, and balanced designs that ensure safe handling and maneuverability are becoming more prevalent. With the advent of smart technology, there is a trend towards integrating smart features into cookware. This includes temperature sensors, Bluetooth connectivity, and app-controlled cooking functionalities that enable precise control over cooking processes and enhance user experience.

Segmental Insights

Distribution Channel Insights

In the non-stick cookware market in India, the offline distribution channel dominates primarily due to several key factors that cater to consumer preferences and market dynamics. Indian consumers often prefer to physically inspect and handle products before making a purchase, especially for kitchenware like non-stick cookware. Offline stores provide consumers with the opportunity to evaluate the quality, durability, and design of cookware firsthand, which builds trust and confidence in their purchase decision.Offline retail channels, including specialty kitchenware stores, department stores, hypermarkets, and local shops, offer a wide range of non-stick cookware brands and products under one roof. This convenience of accessibility allows consumers to compare different brands, features, and prices, making it easier to find products that meet their specific needs and preferences. Traditional shopping habits and cultural norms in India favor the physical shopping experience, where consumers can negotiate prices, seek recommendations from store staff, and engage in face-to-face interactions. This personalized shopping experience adds value and reassurance, particularly for considered purchases like kitchenware.

Regional Insights

The North region dominated the non-stick cookware market in India due to its higher population density, urbanization, and culinary diversity. Urban centers like Delhi-NCR and Punjab have strong purchasing power and a preference for quality kitchenware. Cultural influences and the popularity of North Indian cuisine, which heavily relies on non-stick cookware for versatile cooking needs, further bolster its dominance.Additionally, the well-developed retail infrastructure ensures widespread availability and accessibility of non-stick cookware products across the region, catering effectively to consumer preferences and demand. The North region benefits from a well-established retail and distribution network, including organized retail chains, specialty kitchenware stores, and local markets. This infrastructure ensures widespread availability of non-stick cookware products across urban and rural areas, catering to diverse consumer segments.

Key Market Players

- Butterfly Gandhimathi Appliances Limited

- Hawkins Cookers Limited

- Stovekraft Limited

- Nirlep Appliances Private Ltd.

- Usha Shriram Private Limited

- Havells India Limited

- Bhalaria Metal Craft Pvt. Ltd.

- Vinod Cookware India Private Limited

- Seeba Industries Private Limited (thinKitchen)

- Poorvika Mobiles Private Limited

Report Scope:

In this report, the India Non-stick Cookware Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Non-stick Cookware Market, By Product Type:

- Pan

- Bakeware

- Pressure Cooker

- Sandwich Toaster

- Egg Poacher

- Others

India Non-stick Cookware Market, By Material:

- PTFE Coated

- Aluminium Coated

- Ceramic Coated

- Others

India Non-stick Cookware Market, By Distribution Channel:

- Online

- Offline

India Non-stick Cookware Market, By Region:

- North

- South

- East

- West

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Non-stick Cookware Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Butterfly Gandhimathi Appliances Limited

- Hawkins Cookers Limited

- Stovekraft Limited

- Nirlep Appliances Private Ltd.

- Usha Shriram Private Limited

- Havells India Limited

- Bhalaria Metal Craft Pvt. Ltd.

- Vinod Cookware India Private Limited

- Seeba Industries Private Limited (thinKitchen)

- Poorvika Mobiles Private Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 82 |

| Published | November 2024 |

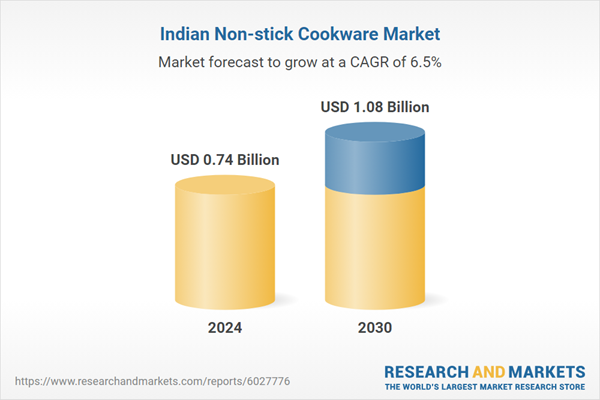

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 0.74 Billion |

| Forecasted Market Value ( USD | $ 1.08 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |