Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

With widespread adoption of smartphones, rising internet availability in rural and urban regions, and the shift towards digital finance, P2P lending is emerging as a key pillar in India's evolving fintech ecosystem. Moreover, the use of AI and machine learning in credit risk assessment is enhancing operational efficiency and expanding the borrower base. The increasing involvement of NBFCs and a surge in retail credit disbursement further emphasize the role of P2P platforms in bridging India's credit gap, especially for underserved individuals and small businesses.

Key Market Drivers

Increasing Digital Adoption and Internet Penetration

The rapid proliferation of smartphones and affordable internet access across India has significantly propelled the adoption of P2P lending platforms. By March 2024, India had 954.4 million internet subscribers, with rural connectivity accounting for a substantial share. The expansion of digital infrastructure has enabled easier access to online financial services for underserved populations, including those in semi-urban and rural areas.P2P platforms, operating through mobile applications and web portals, offer convenience, faster loan approvals, and minimal paperwork. They empower borrowers lacking traditional credit history or collateral to access funds and allow investors to diversify with small-ticket, high-return lending opportunities. Additionally, digital payment solutions like UPI facilitate secure, real-time transactions, supporting smooth disbursement and repayment processes. As financial inclusion deepens through digital channels, P2P lending continues to bridge credit accessibility gaps in the Indian market.

Key Market Challenges

Credit Risk and Default Management

Managing credit risk remains one of the most significant challenges for P2P lending platforms in India. Many borrowers are either new to credit or lack formal income documentation, making it difficult to accurately assess their repayment capacity. As loans on P2P platforms are typically unsecured, the absence of collateral increases the exposure to default. While platforms use proprietary AI models and alternative data to assess risk, these systems may not always capture accurate borrower behavior in a diverse and fragmented market.Recovery of defaulted loans can be complex, involving legal hurdles and time-consuming enforcement processes. Regulatory caps on individual lender exposure - such as the INR 5 million aggregate lending limit across platforms - aim to reduce systemic risk, but also restrict scalability. Additional compliance, such as mandatory net worth certification for higher exposures, adds another operational layer. These constraints, if not addressed with improved credit profiling and recovery mechanisms, may limit platform trust and future growth.

Key Market Trends

Integration of Advanced Technologies and AI

A notable trend reshaping the India P2P lending landscape is the widespread integration of artificial intelligence, machine learning, and big data analytics into lending operations. Platforms are deploying advanced AI algorithms to enhance credit scoring models, enabling real-time loan approval and better targeting of underserved borrowers with limited or no credit bureau history.By analyzing alternative data - such as mobile activity, e-commerce behavior, and transaction records - platforms can build more inclusive and accurate risk profiles. Automation is also streamlining onboarding, verification, and repayment workflows, reducing operating costs and human error. Moreover, machine learning tools continuously optimize loan decisions based on borrower performance trends, while predictive analytics assist in proactive fraud detection and collection planning. This digital innovation not only improves lender confidence and platform scalability but also contributes to broader financial inclusion by democratizing access to credit.

Key Market Players

- Transactree Technologies Private Limited (Lendbox)

- Fairassets Technologies Private Limited (Faircent)

- RNVP Technology Private Limited (i2ifunding)

- Bridge Fintech Solutions Private Limited (Finzy)

- Innofin Solutions Private Limited

- Lendingkart Technologies Private Limited

- Fintelligence Data Science Private Limited (RupeeCircle)

- Fair Vinimay Services Private Limited

- Etyacol Technologies Pvt. Ltd (Cashkumar)

- NDX P2P Private Limited (LiquiLoans)

Report Scope:

In this report, the India Peer-to-Peer (P2P) Lending Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Peer-to-Peer (P2P) Lending Market, By Type:

- Consumer Lending

- Business Lending

India Peer-to-Peer (P2P) Lending Market, By Borrower Type:

- Individual

- Small Business

- Real Estate

- Others

India Peer-to-Peer (P2P) Lending Market, By Region:

- North

- South

- East

- West

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Peer-to-Peer (P2P) Lending Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Transactree Technologies Private Limited (Lendbox)

- Fairassets Technologies Private Limited (Faircent)

- RNVP Technology Private Limited (i2ifunding)

- Bridge Fintech Solutions Private Limited (Finzy)

- Innofin Solutions Private Limited

- Lendingkart Technologies Private Limited

- Fintelligence Data Science Private Limited (RupeeCircle)

- Fair Vinimay Services Private Limited

- Etyacol Technologies Pvt. Ltd (Cashkumar)

- NDX P2P Private Limited (LiquiLoans)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 70 |

| Published | July 2025 |

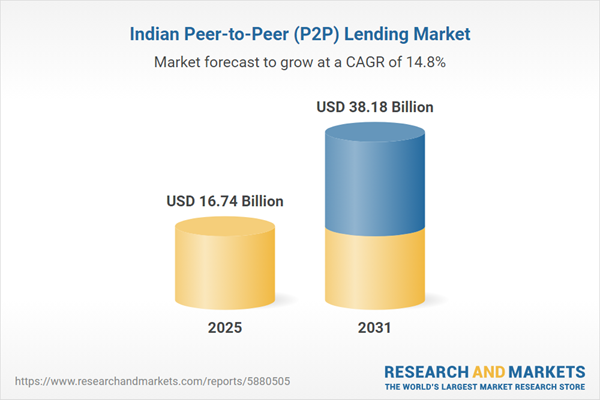

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 16.74 Billion |

| Forecasted Market Value ( USD | $ 38.18 Billion |

| Compound Annual Growth Rate | 14.7% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |