The Indian market for sanitary napkins is seeing steady growth supported by growing awareness of menstrual hygiene and changing consumer behavior. Initiative by the government and campaigns of education have really boosted the perception of menstrual health in urban as well as rural areas, thereby creating a support environment for adopting sanitary products. Advances in women's literacy and a new focus on health and wellbeing have enabled greater numbers of women to make hygiene during menstruation a priority. Wider access to sanitary napkins through subsidization and healthcare outreach programs has similarly driven their take-up, particularly among the deprived. Urbanization and greater information access through digital media have also been central in altering attitudes and stigma about menstruation. Additionally, the emergence of younger, informed consumers who seek high-quality hygiene solutions contributes to the growing market size. For example, in January 2024, Paree Sanitary Pads introduced Paree Super Nights with heavy flow targeted through XXL size and double feather design for additional coverage. The product seeks to offer comfort and leakage protection for restful period nights. Furthermore, these shifts reflect a broader transformation in public attitudes and policy focus that favor long-term Indian sanitary napkin market growth.

India’s growing female workforce and rising disposable incomes are key factors accelerating demand in the sanitary napkin market. As increasing numbers of women enter the workforce and seek higher education, personal decision-making and purchasing power have enhanced, resulting in higher spending on personal care items. Development of contemporary retail facilities such as supermarkets, hypermarkets, and websites guarantee amplified access to a broader range of sanitary napkins suited to various consumers' needs. Product design innovation like ultra-thin pads, aromatic versions, and wings for extra comfort has also improved user experience and satisfaction, leading to repeat buys. In addition, the growing demand for chemical-free and natural products among health-focused consumers has expanded product lines and broadened the market base. For instance, in June 2023, Niine Sanitary Napkins (Uttar Pradesh) introduced India's first PLA-based biodegradable sanitary pads. CIPET-certified, the pads take 175 days to decompose, providing a sustainable, chemical-free option. Moreover, social media campaigns led by influencers and mass media campaigns continue to make menstruation a subject of everyday conversation, engendering an educated consumer base. Collectively, these socio-economic and technological developments reinforce the sanitary napkin market's strong and long-term growth trend throughout India.

Indian Sanitary Napkin Market Trends:

Public Health Programs Increase Rural Access

Government schemes have amplified exposure to sanitary napkins among rural India. Efforts such as the Reproductive and Child Health Program, Eco Femme, and My Pad seek to popularize menstrual hygiene and its availability. The flagship Scheme for Promotion of Menstrual Hygiene among Adolescent Girls in Rural India, initiated in 2011, targets girls between the ages of 10-19 with napkins priced at a subsidized rate of ₹6 per pack. As of 2024, more than 3.1 lakh Anganwadis and 3.6 lakh schools have implemented the scheme in states and union territories. These schemes break social taboos, increase hygiene awareness, and stimulate first-time usage among disadvantaged groups. By encouraging public-private partnerships and regular supply chains, the government is generating long-term demand and trust. This institutional drive ensures fair distribution, enables young girls, and enhances the overall menstrual infrastructure, bringing sanitary napkins within reach of millions who had no option but to use unsafe alternatives.Economic Empowerment Drives Informed Decisions

The sudden boost in women's workforce participation has redefined the demand for sanitary napkins. As per the Press Information Bureau, India's female labor force participation rose from 22% during 2017-18 to 40.3% during 2023-24. This economic independence is being converted into more control over health-related expenditures, including menstrual hygiene products. Women are now demanding better-quality products that provide improved comfort, protection, and hygiene. Due to heightened awareness and disposable income, urban and semi-urban consumers prefer branded, quality products over generic or low-priced ones. Such a trend allows for niche marketing campaigns that feature wellness, confidence, and lifestyle harmony. Brands are paying special attention to packaging, convenience, and subscription models to cater to contemporary consumer demands. The changing role of women as primary decision-makers in personal care purchasing is driving enduring growth in the category and causing more targeted offerings and innovation within mass and premium segments.Innovation and Sustainability Transform Preferences

Consumer attitudes in the sanitary napkin industry are changing fast with the growth of innovation and ecologism. Technologies like superabsorbent fiber technology are fueling the demand for better-absorbing, comfortable, and rash-free products. At the same time, there is a shift toward organic, biodegradable, and chemical-free products that cater to health and environmental concerns. Urban consumers especially are opting for sanitary pads without synthetic dyes, perfumes, and plastic coatings, preferring skin security and sustainability. This has created a high-end segment that focuses on clean-label and openness. Packaging innovations like compostable wrappers and modest travel packs are also adding to attractiveness. Online channels have further raised awareness among consumers, allowing side-by-side comparisons and driving purchasing decisions. The intersection of convenience, environmental ethics, and health is propelling a new normal in menstrual hygiene, broadening the market to encompass wellness and sustainability.Indian Sanitary Napkin Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the Indian sanitary napkin market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type and distribution channel.Analysis by Product Type:

- Supermarkets and Hypermarkets

- Pharmacies

- Convenience Stores

- Online

- Specialty Stores

- Others

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Pharmacies

- Convenience Stores

- Online

- Specialty Stores

- Others

Regional Analysis:

- Maharashtra

- Delhi-NCR

- Tamil Nadu

- Karnataka

- Gujarat

- Others

Competitive Landscape:

The Indian sanitary napkin market's competitive scenario is influenced by an active combination of indigenous and foreign competitors with a diverse array of products to cater to different consumer needs. Industry players emphasize design innovation, material, and performance to meet mounting demands for comfort, hygiene, and ecological sustainability. Organic and biodegradable sanitary napkins have boosted popularity among consumers concerned with health and the environment. Strategic product bundling and pricing, particularly in rural and semiurban areas, increase accessibility and customer retention. Effective distribution channels in urban, semiurban, and rural areas through modern trade, pharmacies, ecommerce websites, and local retailers boost availability of the products. Moreover, large-scale awareness drives and online promotions are being utilized to establish brand credibility and inform consumers about menstrual hygiene. The market also witnesses rising investment in domestic production and packaging, which sustains affordability and local demand.The report provides a comprehensive analysis of the competitive landscape in the Indian sanitary napkin market with detailed profiles of all major companies, including:

- P&G

- Johnson & Johnson

- Unicharm

- Emami, Ltd.

- Mankind

- Kimberly-Clark

- Edgewell

Key Questions Answered in This Report

1. How big is the sanitary napkin market in India?2. What is the future outlook of the sanitary napkin market in India?

3. What are the key factors driving the Indian sanitary napkin market?

4. Which region accounts for the largest Indian sanitary napkin segment market share?

5. Which are the leading companies in the Indian sanitary napkin market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Sanitary Napkins Market

5.1 Market Overview

5.2 Market Performance

5.2.1 Volume Trends

5.2.2 Value Trends

5.3 Market Breakup by Region

5.4 Market Breakup by Product Type

5.5 Market Forecast

6 Indian Sanitary Napkin Market

6.1 Market Overview

6.2 Market Performance

6.2.1 Volume Trends

6.2.2 Value Trends

6.3 Impact of COVID-19

6.4 Price Analysis

6.4.1 Key Price Indicators

6.4.2 Price Structure

6.4.3 Price Trends

6.5 Imports and Exports

6.5.1 Imports by Major Countries

6.5.2 Exports by Major Countries

6.6 Market Breakup by Product Type

6.7 Market Breakup by Distribution Channel

6.8 Market Breakup by Region

6.9 Market Forecast

7 Market Breakup by Product Type

7.1 Disposable Menstrual Pads

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Cloth Menstrual Pads

7.2.1 Market Trends

7.2.2 Market Forecast

7.3 Biodegradable Menstrual Pads

7.3.1 Market Trends

7.3.2 Market Forecast

8 Market Breakup by Distribution Channel

8.1 Supermarkets and Hypermarkets

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Pharmacies

8.2.1 Market Trends

8.2.2 Market Forecast

8.3 Convenience Stores

8.3.1 Market Trends

8.3.2 Market Forecast

8.4 Online

8.4.1 Market Trends

8.4.2 Market Forecast

8.5 Speciality Stores

8.5.1 Market Trends

8.5.2 Market Forecast

8.6 Others

8.6.1 Market Trends

8.6.2 Market Forecast

9 Market Breakup by Region

9.1 Maharashtra

9.1.1 Market Trends

9.1.2 Market Forecast

9.2 Delhi-NCR

9.2.1 Market Trends

9.2.2 Market Forecast

9.3 Tamil Nadu

9.3.1 Market Trends

9.3.2 Market Forecast

9.4 Karnataka

9.4.1 Market Trends

9.4.2 Market Forecast

9.5 Gujarat

9.5.1 Market Trends

9.5.2 Market Forecast

9.6 Others

9.6.1 Market Trends

9.6.2 Market Forecast

10 Competitive Landscape

10.1 Market Breakup by Key Players

10.2 Competitive Structure

10.3 Market Entry

10.3.1 Setting Up New Plant

10.3.2 Joint Ventures with Multinationals

10.3.3 Buying Equity in Existing Firms

11 Value Chain Analysis

11.1 Overview

11.2 Raw Material Suppliers

11.3 Sanitary Napkin Manufacturers

11.4 Distributors

11.5 Hospitals

11.6 Exporters

11.7 Retailers

12 SWOT Analysis

12.1 Overview

12.2 Strengths

12.3 Weaknesses

12.4 Opportunities

12.5 Threats

13 Porters Five Forces Analysis

13.1 Overview

13.2 Bargaining Power of Buyers

13.3 Bargaining Power of Suppliers

13.4 Degree of Rivalry

13.5 Threat of New Entrants

13.6 Threat of Substitutes

14 Sanitary Napkin Manufacturing Process

14.1 Product Overview

14.2 Detailed Process Flow

14.3 Various Unit Operations Involved

14.4 Mass Balance and Raw Material Requirements

15 Project Details, Requirements and Costs Involved

15.1 Land, Location and Site Development

15.2 Construction Requirements and Expenditures

15.3 Plant Machinery

15.4 Machinery Pictures

15.5 Raw Materials Requirements and Expenditures

15.6 Raw Material and Final Product Pictures

15.7 Packaging Requirements and Expenditures

15.8 Transportation Requirements and Expenditures

15.9 Utilities Requirements and Expenditures

15.10 Manpower Requirements and Expenditures

15.11 Other Capital Investments

16 Loans and Financial Assistance

17 Project Economics

17.1 Capital Cost of the Project

17.2 Techno-Economic Parameters

17.3 Product Pricing and Margins across Various Levels of the Supply Chain

17.4 Taxation and Depreciation

17.5 Income Projections

17.6 Expenditure Projections

17.7 Financial Analysis

17.8 Profit Analysis

18 Profiles of Key Players

List of Figures

Figure 1: India: Sanitary Napkin Market: Major Drivers and Challenges

Figure 2: Global: Sanitary Napkins Market: Sales Volume (in Billion Pieces), 2019-2024

Figure 3: Global: Sanitary Napkins Market: Sales Value (in Billion USD), 2019-2024

Figure 4: Global: Sanitary Napkins Market: Breakup by Region (in %), 2024

Figure 5: Global: Sanitary Napkins Market: Breakup by Product Type (in %), 2024

Figure 6: Global: Sanitary Napkins Market Forecast: Sales Volume (in Billion Pieces), 2025-2033

Figure 7: Global: Sanitary Napkins Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 8: India: Sanitary Napkin Market: Sales Volume (in Million Pieces), 2019-2024

Figure 9: India: Sanitary Napkin Market: Sales Value (in Million USD), 2019-2024

Figure 10: India: Sanitary Napkin Market: Average Prices (in USD/Piece), 2019-2024

Figure 11: Sanitary Napkin Market: Price Structure

Figure 12: India: Diapers and Sanitary Napkins: Import Volume Breakup by Country (in %), 2024

Figure 13: India: Diapers and Sanitary Napkins: Export Volume Breakup by Country (in %), 2024

Figure 14: India: Sanitary Napkin Market: Breakup by Product Type (in %), 2024

Figure 15: India: Sanitary Napkin Market: Breakup by Distribution Channel (in %), 2024

Figure 16: India: Sanitary Napkin Market: Breakup by Region (in %), 2024

Figure 17: India: Sanitary Napkin Market Forecast: Sales Volume (in Million Pieces), 2025-2033

Figure 18: India: Sanitary Napkin Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 19: India: Sanitary Napkin (Disposable Menstrual Pads) Market: Sales Value (in Million USD), 2019 & 2024

Figure 20: India: Sanitary Napkin (Disposable Menstrual Pads) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 21: India: Sanitary Napkin (Cloth Menstrual Pads) Market: Sales Value (in Million USD), 2019 & 2024

Figure 22: India: Sanitary Napkin (Cloth Menstrual Pads) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 23: India: Sanitary Napkin (Biodegradable Menstrual Pads) Market: Sales Value (in Million USD), 2019 & 2024

Figure 24: India: Sanitary Napkin (Biodegradable Menstrual Pads) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 25: India: Sanitary Napkin Market: Sales through Supermarkets and Hypermarkets (in Million USD), 2019 & 2024

Figure 26: India: Sanitary Napkin Market Forecast: Sales through Supermarkets and Hypermarkets (in Million USD), 2025-2033

Figure 27: India: Sanitary Napkin Market: Sales through Pharmacies (in Million USD), 2019 & 2024

Figure 28: India: Sanitary Napkin Market Forecast: Sales through Pharmacies (in Million USD), 2025-2033

Figure 29: India: Sanitary Napkin Market: Sales through Convenience Stores (in Million USD), 2019 & 2024

Figure 30: India: Sanitary Napkin Market Forecast: Sales through Convenience Stores (in Million USD), 2025-2033

Figure 31: India: Sanitary Napkin Market: Online Sales (in Million USD), 2019 & 2024

Figure 32: India: Sanitary Napkin Market Forecast: Online Sales (in Million USD), 2025-2033

Figure 33: India: Sanitary Napkin Market: Sales through Speciality Stores (in Million USD), 2019 & 2024

Figure 34: India: Sanitary Napkin Market Forecast: Sales through Speciality Stores (in Million USD), 2025-2033

Figure 35: India: Sanitary Napkin Market: Sales through Other Distribution Channels (in Million USD), 2019 & 2024

Figure 36: India: Sanitary Napkin Market Forecast: Sales through Other Distribution Channels (in Million USD), 2025-2033

Figure 37: Maharashtra: Sanitary Napkin Market: Sales Value (in Million USD), 2019 & 2024

Figure 38: Maharashtra: Sanitary Napkin Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 39: Delhi-NCR: Sanitary Napkin Market: Sales Value (in Million USD), 2019 & 2024

Figure 40: Delhi-NCR: Sanitary Napkin Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 41: Tamil Nadu: Sanitary Napkin Market: Sales Value (in Million USD), 2019 & 2024

Figure 42: Tamil Nadu: Sanitary Napkin Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 43: Karnataka: Sanitary Napkin Market: Sales Value (in Million USD), 2019 & 2024

Figure 44: Karnataka: Sanitary Napkin Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 45: Gujarat: Sanitary Napkin Market: Sales Value (in Million USD), 2019 & 2024

Figure 46: Gujarat: Sanitary Napkin Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 47: Others: Sanitary Napkin Market: Sales Value (in Million USD), 2019 & 2024

Figure 48: Others: Sanitary Napkin Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 49: India: Sanitary Napkin Market: Breakup by Key Player (in %), 2024

Figure 50: India: Sanitary Napkin Industry: Value Chain Analysis

Figure 51: India: Sanitary Napkin Industry: SWOT Analysis

Figure 52: India: Sanitary Napkin Industry: Porter’s Five Forces Analysis

Figure 53: Sanitary Napkin Manufacturing Process: Detailed Process Flow

Figure 54: Sanitary Napkin Manufacturing Process: Conversion Rate of Products and By Products

Figure 55: Sanitary Napkin Manufacturing Plant: Breakup of Capital Costs (in %)

Figure 56: Sanitary Napkin Industry: Profit Margins at Various Stages of Supply Chain

Figure 57: Sanitary Napkin Manufacturing Plant: Breakup of Operational Costs

Figure 58: The Procter & Gamble Company: SWOT Analysis

Figure 59: Johnson & Johnson Company: SWOT Analysis

Figure 60: Unicharm Corporation: SWOT Analysis

Figure 61: Kimberly-Clark Corporation: SWOT Analysis

List of Tables

Table 1: Global: Sanitary Napkins Market: Key Industry Highlights, 2024 and 2033

Table 2: India: Sanitary Napkin Market: Key Industry Highlights, 2024 and 2033

Table 3: India: Sanitary Napkin Market Forecast: Breakup by Product Type (in Million USD), 2025-2033

Table 4: India: Sanitary Napkin Market Forecast: Breakup by Distribution Channel (in Million USD), 2025-2033

Table 5: India: Sanitary Napkin Market Forecast: Breakup by Region (in Million USD), 2025-2033

Table 6: India: Diapers and Sanitary Napkins: Import Data by Country, 2024

Table 7: India: Diapers and Sanitary Napkins: Export Data by Country, 2024

Table 8: India: Sanitary Napkin Market: Competitive Structure

Table 9: India: Sanitary Napkin Market: Key Players

Table 10: Sanitary Napkins Manufacturing Plant: Raw Material Requirements in (Tons/ Day)

Table 11: Sanitary Napkin Manufacturing Plant: Costs Related to Land and Site Development (in USD)

Table 12: Sanitary Napkin Manufacturing Plant: Costs Related to Civil Works

Table 13: Sanitary Napkin Manufacturing Plant: Costs Related to Plant Machinery (in USD)

Table 14: Sanitary Napkin Manufacturing Plant: Raw Material Requirements (in Kg/Day) and Expenditures (USD/Kg)

Table 15: Sanitary Napkin Manufacturing Plant: Utility Requirements and Expenditures

Table 16: Sanitary Napkin Manufacturing Plant: Costs Related to Salaries and Wages (in USD)

Table 17: Sanitary Napkin Manufacturing Plant: Costs Related to Other Capital Investments (in USD)

Table 18: Details of Financial Assistance Offered by Financial Institutions

Table 19: Sanitary Napkin Manufacturing Plant: Capital Costs (in USD)

Table 20: Sanitary Napkin Manufacturing Plant: Techno-Economic Parameters

Table 21: Sanitary Napkin Manufacturing Plant: Taxation (in USD/Year)

Table 22: Sanitary Napkin Manufacturing Plant: Depreciation (in USD/Year)

Table 23: Sanitary Napkin Manufacturing Plant: Income Projections (in USD)

Table 24: Sanitary Napkin Manufacturing Plant: Expenditure Projections (in USD)

Table 25: Sanitary Napkin Manufacturing Plant: Cash Flow Analysis Without Considering the Income Tax Liability (in USD)

Table 26: Sanitary Napkin Manufacturing Plant: Cash Flow Analysis on Considering the Income Tax Liability (in USD)

Table 27: Sanitary Napkin Manufacturing Plant: Profit and Loss Account (in USD)

Companies Mentioned

- P&G

- Johnson & Johnson

- Unicharm

- Emami Ltd.

- Mankind

- Kimberly-Clark

- Edgewell

Table Information

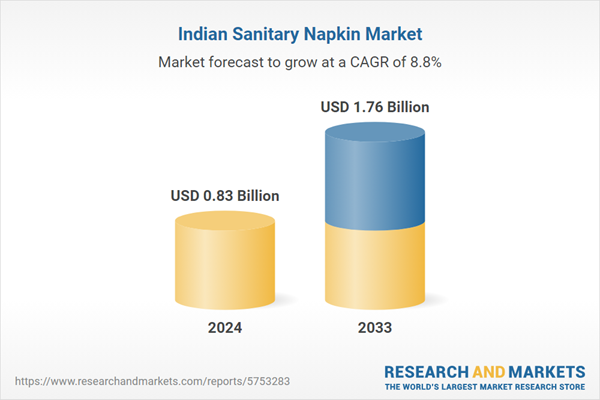

| Report Attribute | Details |

|---|---|

| No. of Pages | 119 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 0.83 Billion |

| Forecasted Market Value ( USD | $ 1.76 Billion |

| Compound Annual Growth Rate | 8.8% |

| Regions Covered | India |

| No. of Companies Mentioned | 7 |