Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

For consumers, smart meters offer transparency in energy consumption through mobile apps or in-home displays, allowing better energy usage decisions and cost control. For utility providers, these meters improve billing accuracy, enhance grid management, and enable swift outage detection.

Smart meters are instrumental in the development of smart grids by enabling dynamic pricing, supporting renewable integration, and participating in demand-response programs. Their contribution to energy efficiency and emissions reduction makes them a key technology in India’s sustainable energy strategy.

Key Market Drivers

Government Initiatives and Policy Support

Government backing and strategic policy frameworks are central to the expansion of India’s smart meter market. Initiatives like the Revamped Distribution Sector Scheme (RDSS) are designed to reduce AT&C losses and improve the financial performance of power distribution companies (DISCOMs) through large-scale deployment of prepaid smart meters.Additionally, the Smart Meter National Programme (SMNP) aims to replace over 250 million traditional meters with smart meters, supported by models such as CAPEX and OPEX to attract private sector investment. The Ministry of Power’s efforts, along with regulatory mandates from the Central Electricity Authority (CEA) and state regulators, have accelerated deployment timelines and introduced performance-linked incentives to utilities.

With an estimated investment of INR 50,000 crore (approx. USD 6.7 billion), SMNP is facilitating a country-wide transition to advanced metering infrastructure, positioning smart meters as a critical element in India's digitized energy ecosystem.

Key Market Challenges

High Upfront Costs and Financial Constraints

The high initial cost of smart meter deployment continues to be a major barrier. These costs include not just the meters, but also the communication infrastructure, data systems, and integration with existing utility networks. Many financially strained DISCOMs face difficulty in mobilizing these funds, even with central government support through schemes like RDSS.Funding disbursement under such schemes is often tied to performance metrics, delaying access to capital and hampering project momentum. The added burden of maintenance, cybersecurity, and software updates further stretches DISCOM budgets.

While the OPEX model offers an alternative by shifting initial investment to third-party vendors, its success depends on clear contract terms, timely payments, and effective risk-sharing. Additionally, potential tariff adjustments to recover smart meter costs may encounter resistance from consumers, especially in economically sensitive areas. Without robust financing mechanisms, awareness programs, and demonstrable savings, adoption could remain limited among key user segments.

Key Market Trends

Shift Toward Prepaid Smart Metering

The transition from postpaid to prepaid smart meters is gaining momentum across India. Prepaid metering enables consumers to manage electricity usage through advance payments, offering improved control over energy expenditure and minimizing billing disputes.For utilities, prepaid systems enhance revenue assurance by eliminating defaults and reducing the costs of meter reading and bill collection. These meters also allow for remote disconnection and reconnection, streamlining operations and improving service delivery.

This trend is being actively promoted under government schemes like RDSS and is increasingly adopted in urban and semi-urban areas, where consumers are digitally literate and value flexibility. Integration with mobile apps and user dashboards enables easy monitoring, recharging, and alert systems. Over time, prepaid meters are expected to become standard for residential and small commercial applications, supporting more sustainable and accountable electricity use.

Key Players Profiled in this India Smart Meter Market Report

- Itron, Inc.

- Landis+Gyr Group AG

- Siemens AG

- Schneider Electric SE

- Honeywell International, Inc.

- General Electric Company

- Kamstrup A/S

- Echelon Corporation

Report Scope:

In this report, the India Smart Meter Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Smart Meter Market, by Product Type:

- Smart Energy Meters

- Smart Water Meters

- Smart Gas Meters

India Smart Meter Market, by Application:

- Industrial

- Commercial

- Residential

India Smart Meter Market, by Technology Channel:

- Automatic Meter Reading

- Advanced Metering Infrastructure

India Smart Meter Market, by Region:

- South India

- North India

- West India

- East India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Smart Meter Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The leading companies profiled in this India Smart Meter market report include:- 1. Itron, Inc.

- 2. Landis+Gyr Group AG

- 3. Siemens AG

- 4. Schneider Electric SE

- 5. Honeywell International, Inc.

- 6. General Electric Company

- 7. Kamstrup A/S

- 8. Echelon Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 70 |

| Published | May 2025 |

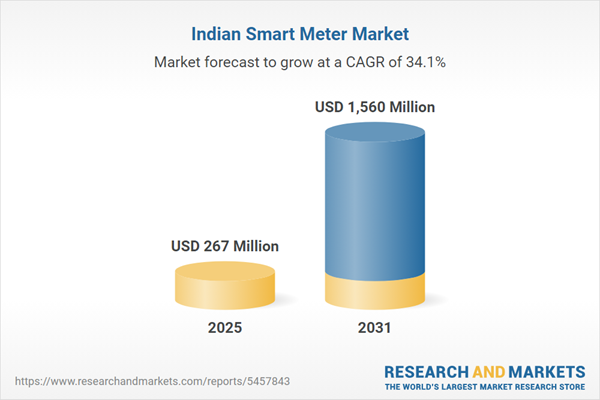

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 267 Million |

| Forecasted Market Value ( USD | $ 1560 Million |

| Compound Annual Growth Rate | 34.1% |

| Regions Covered | India |

| No. of Companies Mentioned | 9 |