India Snacks Market Analysis:

- Major Market Drivers: The major drivers of India snacks market include rapid urbanization and a gradual shift in consumer lifestyle towards various convenience foods. Rising disposable income allow people for greater spending on processed foods while the young demographic which contributes a significant portion of population shows a strong preference for quick, easy and on-the-go snack options. The influence of western culture has also introduced a variety of snacks food into the Indian market promoting a taste for diverse and innovative products. In line with this, the expansion of retail infrastructure and ecommerce across the country has made snack foods more accessible further stimulating India snacks market growth.

- Key Market Trends: The India snacks market is witnessing various key trends which includes an increase in health-conscious snacking option as consumers nowadays increasingly seek healthier alternatives like baked, non-fried snacks and those with natural ingredients. There is also a growing preference for regional and ethnic flavors which leads the manufacturer to innovate with local taste profiles. In line with this, the increase in premiumization with consumers willing to pay more for gourmet and niche snack products is evident. The integration of convenient packaging and rise in online sales channels or also driving India snacks market growth.

- Competitive Landscape: Some of the major market players in the India snacks market industry include Agro Tech Foods Ltd. (Conagra Brands, Inc.), Balaji Wafers Pvt. Ltd., Bikanervala Foods Private Limited, Haldiram Snacks Private Limited, ITC Limited, Parle Products Private Limited¸ PepsiCo, Prataap Snacks Limited, TTK Foods (TTK Healthcare), and Urban Platter, among many others.

- Challenges and Opportunities: The India snacks market faces various challenges like fluctuation in raw material prices and strict food safety regulations that can impact the production cost and market entry. Competition from unorganized sectors also poses a significant challenge. However, opportunities abound with the increase in demand for convenience foods among the growing middle class and the country’s working population. There is a potential for India snacks market growth in Tier 2 and tier 3 cities where market penetration is still low. Furthermore, increase in consumer inclination towards organic and healthy snack options presents a promising avenue for new and existing players to explore and expand.

India Snacks Market Trends:

Rise in Health and Wellness Trends

The health and wellness trend in India snacks market is becoming increasingly prominent as consumer nowadays look for healthier eating options. The shift is evident in growing popularity of snacks that are natural, organic, vegan, low- calorie and gluten-free. These products cater to health-conscious consumers who are mindful of their dietary choices and prefer snacks that contribute to their well-being. According to an article published in the Times of India in 2023, 38% of the Indian population is strictly vegetarian. Snack manufacturers nowadays are responding to this trend by creating products that align with the customers health preferences thereby expanding India snacks market.Increase in Retail Channels

The expansion of retail channels in India snacks market is notably influenced by the increase in online platforms mainly due to the COVID-19 pandemic. This trend is facilitated by the advancements of logistics and delivery networks across the country which allows for a broader reach and convenience. According to a report by Indian Brand Equity Foundation, India has gained 125 million online shoppers in the past three years with another 80 million expected by 2025. India's e-commerce market is expected to reach 111 billion USD by 2024 and 200 billion USD by 2026.Innovation in Packaging

Innovations in packaging within India snacks market are mainly influenced by the rising consumer demands for convenience and sustainability. Pouch packaging has become especially popular and favored for its ease in use during on-the-go consumption and efficient storage capabilities. According to an article published by Invest India, India's food processing sector is expected to reach $535 Bn by 2025-26, with the food and beverage packaging industry projected to reach $86 Bn in 2029. Sustainable packaging, using biodegradable, recyclable, or compostable materials, is becoming increasingly popular. Eco-friendly materials include corn plastic, bamboo, wood and plant fibres, and mushroom-based packaging.India Snacks Market Segmentation:

The research provides an analysis of the key trends in each segment of the market, along with forecasts at the country and state levels for 2025-2033. Our report has categorized the market based on product type, pack type, pack size and distribution channel.Breakup by Product Type:

- Chips

- Salted Peanuts

- Fryums

- Popcorn.

Chips accounts for the majority of the India snacks market share

The report has provided a detailed breakup and analysis of the market based on the product type. This includes Chips, Salted Peanuts, Fryums, Popcorns. According to the report, Chips represented the largest segment.The Indian snacks market is largely dominated by chips, owing to their immense popularity across all age groups. Chips come in a wide range of flavors and forms, catering to Indiaal tastes and preferences, which makes them a favorite among a vast consumer base. Manufacturers are continually innovating with new flavors and healthier options, such as baked and multigrain chips, to meet the growing demand. Furthermore, chips' dominance in the snacks sector is further reinforced by their easy availability, ranging from small retail shops to large supermarkets.

Breakup by Pack Type:

- Pouch

- Other.

Pouch holds the largest share of the industry

A detailed breakup and analysis of the market based on the Pack Type have also been provided in the report. This includes pouch and others. According to the report, pouch accounted for the largest India snacks market share.In the India snacks market, pouch packaging dominates due to its convenience, affordability, and effectiveness in preserving freshness. Pouches are favored for their lightweight nature and ease of storage, making them ideal for on-the-go consumption. They also offer excellent marketing surfaces for attractive designs and nutritional information, enhancing shelf appeal. The ability to seal in flavors and extend shelf life without the need for refrigeration further adds to their popularity. This packaging type's versatility allows it to cater to a wide range of snack products, securing its large market share.

Breakup by Pack Size:

- Less than 50 gm

- 50-100 gm

- More than 100 g.

Less than 50 gm represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the pack size. This includes less than 50 gm, 50-100 gm, and more than 100 gm. According to the report, less than 50 gm represented the largest segment.The India snacks market is currently being dominated by the less than 50 grams packaging segment. This is mainly due to the fact that consumers prefer smaller portions, as it allows them to try out new flavors without committing to larger quantities. This packaging size is highly appealing to individuals who are looking for light snacks or are managing their calorie intake. Additionally, it caters well to a transient customer base, such as commuters and schoolchildren who prefer quick and portable eating options. The affordability of these smaller packs encourages impulse purchases, which further boosts their popularity in the market.

Breakup by Distribution Channel:

- General Trade

- Modern Trade

- Online and E-Commerce

- Other.

General Trade exhibits a clear dominance in the market

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes general trade, modern trade, online and e-commerce, and others. According to the report, general trade accounted for the largest market share.General trade, comprising small retailers, local shops, and kiosks, exhibits clear dominance in the India snacks market. This sector's vast network and deep penetration into both urban and rural areas make it the most accessible shopping channel for the majority of consumers. These outlets are preferred for their convenience and the ability to offer localized, personal customer service. Moreover, general trade often provides flexible pricing and credit options, which are crucial in price-sensitive markets, ensuring its continued prevalence and dominance in the snacks industry.

Breakup by States:

- Maharashtra

- Uttar Pradesh

- Delhi

- Gujarat

- Karnataka

- Andhra Pradesh

- Telangana

- Goa

- Other.

Maharashtra leads the market, accounting for the largest India snacks market share

The report has also provided a comprehensive analysis of all the major markets in the region, which include Maharashtra, Uttar Pradesh, Delhi, Gujarat, Karnataka, Andhra Pradesh, Telangana, Goa, and others. According to the report, Maharashtra was the largest market for snacks in India.The India snacks market is led by Maharashtra, owing to its large urban population and significant economic status. The cosmopolitan cities of Mumbai and Pune in the state have a fast-paced lifestyle and a diverse population that loves to experiment with various flavors and products, resulting in a high demand for snack foods. Maharashtra's strong retail infrastructure and high consumer spending power make it an important India for snack manufacturers. Often, new products are launched here to assess market trends and consumer preferences.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have been provided. Some of the major market players in the India snacks industry include Agro Tech Foods Ltd. (Conagra Brands, Inc.), Balaji Wafers Pvt. Ltd., Bikanervala Foods Private Limited, Haldiram Snacks Private Limited, ITC Limited, Parle Products Private Limited¸ PepsiCo, Prataap Snacks Limited, TTK Foods (TTK Healthcare), and Urban Platter, among many others.

- The competitive landscape of the India snacks market is vibrant and dynamic, characterized by the presence of both multinational giants and local players. Leading companies like PepsiCo, Haldiram's, and ITC Limited dominate with extensive product portfolios, strong brand recognition, and widespread distribution networks. For instance, PepsiCo India plans to invest 1,266 INR crore in a new flavor manufacturing facility in Ujjain, Madhya Pradesh. The facility will be operational by the first quarter of the year 2026 and run entirely on renewable energy, reducing carbon footprint and ensuring responsible water management. Furthermore, the market also sees continual entries from new startups focusing on health-oriented and premium snack options, further intensifying the competition.

Key Questions Answered in This Report

- How big is the India snacks market?

- What is the expected growth rate of the India snacks market during 2025-2033?

- What are the key factors driving the India snacks market?

- What has been the impact of COVID-19 on the India snacks market?

- What is the breakup of the India snacks market based on the product type?

- What is the breakup of the India snacks market based on the pack type?

- What is the breakup of the India snacks market based on the pack size?

- What is the breakup of the India snacks market based on the distribution channel?

- What are the key regions in the India snacks market?

- Who are the key players/companies in the India snacks market?

Table of Contents

Companies Mentioned

- Agro Tech Foods Ltd. (Conagra Brands INC.)

- Balaji Wafers Pvt. Ltd.

- Bikanervala Foods Private Limited

- Haldiram Snacks Private Limited

- ITC Limited

- Parle Products Private Limited

- PepsiCo

- Prataap Snacks Limited

- TTK Foods (TTK Healthcare)

- Urban Platter

Table Information

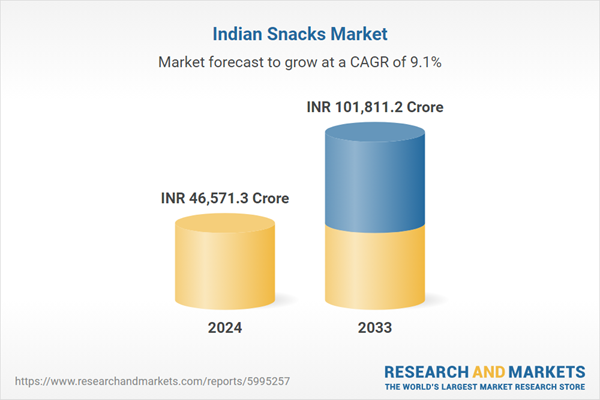

| Report Attribute | Details |

|---|---|

| No. of Pages | 118 |

| Published | June 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( INR | INR 46571.3 Crore |

| Forecasted Market Value ( INR | INR 101811.2 Crore |

| Compound Annual Growth Rate | 9.1% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |