Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Growing Adoption of Precision Agriculture

The adoption of precision agriculture is a key driver in the India Soil Moisture Sensor Market. As farmers seek to enhance crop yields and optimize resource use, precision agriculture technologies have become increasingly vital. Soil moisture sensors play a crucial role in this domain by providing real-time data on soil moisture levels, which helps farmers make informed irrigation decisions. By utilizing these sensors, farmers can avoid over-irrigation and under-irrigation, leading to improved water efficiency and reduced costs. The rise in demand for precision agriculture is fueled by the need to increase agricultural productivity amidst shrinking arable land and water scarcity. This trend is supported by government initiatives and subsidies aimed at promoting modern farming techniques. As more farmers and agricultural businesses recognize the benefits of precision agriculture, the demand for soil moisture sensors continues to grow, driving the market forward.Increasing Water Scarcity and Demand for Efficient Irrigation

Water scarcity is a significant concern in India, driving the demand for technologies that improve water management. Soil moisture sensors are pivotal in this regard, as they provide precise information about soil water content, enabling efficient irrigation practices. By using these sensors, farmers can ensure that water is applied only when needed, thus conserving valuable water resources. The Indian government's focus on sustainable water management and agricultural efficiency has further accelerated the adoption of soil moisture sensors. Additionally, the integration of these sensors with automated irrigation systems enhances their effectiveness, making them an attractive option for farmers facing water constraints. As the urgency for water conservation grows, the soil moisture sensor market is expected to expand to meet the increasing need for efficient irrigation solutions.Technological Advancements and Innovation

Technological advancements in soil moisture sensors are driving market growth in India. Recent innovations have led to the development of more accurate, reliable, and cost-effective sensors. Advances such as wireless communication, integration with IoT platforms, and improved sensor materials have enhanced the functionality and appeal of these devices. Modern soil moisture sensors offer real-time data access through mobile applications and web interfaces, providing users with valuable insights and greater control over their irrigation practices. These technological improvements have made soil moisture sensors more accessible and appealing to a broader range of users, including small-scale farmers. As technology continues to evolve, the capabilities and applications of soil moisture sensors are expected to expand, further boosting market growth.Supportive Government Policies and Subsidies

Government policies and subsidies play a crucial role in driving the growth of the soil moisture sensor market in India. Recognizing the importance of modernizing agriculture and improving resource management, the Indian government has introduced various schemes and incentives to promote the adoption of advanced agricultural technologies. These include subsidies for purchasing soil moisture sensors and financial support for implementing precision agriculture practices. Additionally, government initiatives such as the Pradhan Mantri Krishi Sinchai Yojana (PMKSY) aim to enhance irrigation efficiency and water conservation, aligning with the objectives of soil moisture sensor technology. The supportive policy environment reduces the financial burden on farmers and encourages widespread adoption of soil moisture sensors, contributing to the market's expansion.Key Market Challenges

High Initial Costs

One significant challenge facing the India Soil Moisture Sensor Market is the high initial cost of advanced sensor technologies. While soil moisture sensors can offer substantial long-term benefits in terms of water conservation and crop yield improvement, the upfront investment required for purchasing and installing these devices can be prohibitive for many small and medium-sized farmers. The cost includes not only the sensors themselves but also associated infrastructure such as data loggers and communication systems. This financial barrier can limit the adoption of soil moisture sensors, particularly among smaller agricultural enterprises with constrained budgets. Additionally, the cost of maintenance and calibration adds to the overall expenditure. To address this issue, it is essential for stakeholders, including government bodies and technology providers, to explore options for reducing costs, such as offering subsidies, developing more affordable sensor models, or implementing financing solutions that can ease the financial burden on farmers and agricultural businesses.Limited Technical Knowledge

Another challenge hindering the growth of the soil moisture sensor market in India is the limited technical knowledge among end-users. Many farmers and agricultural professionals may lack the expertise required to effectively use and interpret data from these advanced sensors. The complexity of sensor installation, data analysis, and integration with existing irrigation systems can be overwhelming, leading to suboptimal use or even abandonment of the technology. This knowledge gap can result in underutilization of the sensors’ capabilities and diminished returns on investment. To overcome this challenge, there is a need for comprehensive training programs and support services that can educate users on the benefits, operation, and maintenance of soil moisture sensors. Collaboration between technology providers, agricultural extension services, and educational institutions can play a crucial role in bridging this knowledge gap and ensuring that the technology is used to its full potential.Infrastructural and Connectivity Issues

In India, especially in rural areas, infrastructural and connectivity issues pose significant challenges to the effective implementation of soil moisture sensors. Many regions suffer from inadequate infrastructure, such as unreliable electricity supply and limited internet connectivity, which are crucial for the functioning of wireless soil moisture sensors. These issues can lead to data transmission failures, reduced sensor accuracy, and difficulties in real-time monitoring. The lack of reliable infrastructure can also complicate the integration of soil moisture sensors with broader farm management systems. Addressing these challenges requires investment in improving rural infrastructure and exploring alternative solutions such as low-power or offline data logging sensors. Partnerships between technology providers and local governments could help enhance the overall infrastructure and connectivity, making it easier for farmers to adopt and benefit from soil moisture sensor technologies.Data Management and Interpretation

Effective data management and interpretation represent a substantial challenge in the soil moisture sensor market. While sensors provide valuable data on soil moisture levels, the sheer volume of data generated can be overwhelming for users without proper systems in place to manage and analyze it. Farmers may struggle with interpreting complex data sets and integrating this information into actionable insights for optimizing irrigation and improving crop management. Without appropriate data analytics tools and support, users may find it challenging to make informed decisions based on sensor data. To mitigate this issue, there is a need for user-friendly data management platforms and decision-support tools that can simplify data interpretation and provide actionable recommendations. Additionally, ongoing support from technology providers and training programs can help users better understand and utilize the data collected by soil moisture sensors, ultimately enhancing the effectiveness of the technology in agricultural practices.Key Market Trends

Increased Adoption of IoT-Enabled Sensors

A prominent trend in the India Soil Moisture Sensor Market is the growing adoption of Internet of Things (IoT)-enabled sensors. These advanced sensors integrate connectivity features, allowing real-time data collection and monitoring through wireless networks. IoT-enabled soil moisture sensors offer farmers and agricultural businesses enhanced capabilities to remotely monitor soil conditions, leading to improved water management and more efficient irrigation practices. The rise in mobile and cloud technologies has further facilitated this trend by providing users with easy access to data through mobile apps and web platforms. This shift towards IoT solutions is driven by the need for precision agriculture and data-driven decision-making, which help optimize water usage and increase crop yields. As technology costs decrease and connectivity improves in rural areas, the adoption of IoT-enabled sensors is expected to accelerate, expanding their presence in the Indian agricultural sector and contributing to sustainable farming practices.Integration with Precision Agriculture Technologies

Another significant trend in the India Soil Moisture Sensor Market is the integration of soil moisture sensors with broader precision agriculture technologies. Precision agriculture relies on data-driven techniques to enhance farm productivity and sustainability. Soil moisture sensors are increasingly being incorporated into comprehensive precision farming systems that include GPS, remote sensing, and data analytics tools. This integration allows for more precise monitoring of soil conditions and better management of resources such as water and fertilizers. By combining soil moisture data with other agricultural metrics, farmers can make more informed decisions about irrigation schedules, nutrient application, and crop management. The synergy between soil moisture sensors and precision agriculture technologies is enhancing the effectiveness of farming operations, promoting resource efficiency, and contributing to higher crop yields. This trend reflects a growing emphasis on leveraging technology to optimize agricultural practices and improve overall farm performance.Focus on Sustainable and Water-Efficient Farming

The increasing focus on sustainable and water-efficient farming practices is driving the growth of the soil moisture sensor market in India. With the rising awareness of water scarcity and environmental concerns, there is a strong push towards adopting technologies that promote efficient water use in agriculture. Soil moisture sensors play a crucial role in this context by providing accurate data on soil moisture levels, which helps farmers optimize irrigation practices and reduce water wastage. This trend is supported by government initiatives and agricultural policies aimed at promoting sustainable farming techniques and conserving water resources. Additionally, advancements in sensor technology and data analytics are enabling more precise and actionable insights, further enhancing the effectiveness of water management strategies. As environmental sustainability becomes a priority, the demand for soil moisture sensors is expected to grow, reflecting the agricultural sector's commitment to adopting eco-friendly and resource-efficient practices.Emergence of Advanced Data Analytics and AI Integration

The emergence of advanced data analytics and artificial intelligence (AI) is a key trend shaping the India Soil Moisture Sensor Market. Modern soil moisture sensors are generating vast amounts of data that require sophisticated analysis to derive actionable insights. The integration of AI and machine learning algorithms into soil moisture monitoring systems is enabling more accurate predictions and recommendations based on historical and real-time data. These technologies help identify patterns, optimize irrigation schedules, and predict soil moisture fluctuations, leading to more efficient water management and improved crop yields. The use of AI-driven analytics also enhances the ability to make proactive decisions and respond to changing conditions. As data analytics and AI technologies become more advanced and accessible, their integration with soil moisture sensors is expected to drive innovation and efficiency in agricultural practices, making it a significant trend in the market.Government Incentives and Support for Smart Agriculture

Government incentives and support for smart agriculture are influencing the growth of the soil moisture sensor market in India. Various government initiatives aim to promote the adoption of modern agricultural technologies and improve farm productivity. Subsidies, grants, and financial assistance programs are being introduced to encourage farmers to invest in advanced soil moisture sensors and other precision farming tools. Additionally, government-sponsored research and development programs are focused on enhancing sensor technologies and making them more affordable and accessible. These efforts are intended to support the transition towards smart agriculture, where technology plays a central role in optimizing resource use and enhancing crop management. The increasing availability of financial support and incentives is expected to drive the widespread adoption of soil moisture sensors, contributing to the growth of the market and fostering the development of sustainable and efficient farming practices in India.Segmental Insights

Sensor Type Insights

The capacitance sensors emerged as the dominant segment in the India Soil Moisture Sensor Market, and this trend is expected to continue during the forecast period. Capacitance sensors, known for their accuracy and reliability, measure soil moisture by detecting changes in the dielectric constant of the soil. This method is less invasive and provides more precise readings compared to traditional probe-based sensors. The technology’s ability to deliver real-time data with minimal calibration needs makes it highly favored in modern agricultural practices. Capacitance sensors offer several advantages, including better durability in harsh soil conditions and a lower tendency for calibration drift over time. These factors are crucial in a country like India, where diverse soil types and varying climatic conditions pose significant challenges. Moreover, the growing adoption of precision agriculture practices, driven by the need for efficient water management and improved crop yields, further supports the dominance of capacitance sensors. As Indian farmers increasingly seek technologies that offer detailed insights and enhance irrigation practices, the demand for capacitance-based soil moisture sensors continues to rise. Additionally, advancements in sensor technology and the increasing availability of cost-effective solutions are expected to sustain this trend. The integration of capacitance sensors with IoT and data analytics platforms also contributes to their prominence, as they enable farmers to make data-driven decisions and optimize water use efficiently. As the Indian agriculture sector continues to embrace technological innovations to address water scarcity and enhance productivity, capacitance sensors are anticipated to remain the leading choice, reinforcing their dominance in the market throughout the forecast period.Connectivity Insights

The wireless connectivity segment dominated the India Soil Moisture Sensor Market and is expected to maintain its dominance throughout the forecast period. Wireless soil moisture sensors have gained prominence due to their superior flexibility and ease of installation compared to wired sensors. These sensors use technologies such as Bluetooth, Wi-Fi, and cellular networks to transmit data, eliminating the need for extensive cabling and reducing installation complexity. The growing adoption of wireless sensors is driven by their ability to provide real-time data without physical constraints, which is crucial for effective irrigation management and precision agriculture. In India, where many agricultural fields are large and spread out, wireless connectivity offers a significant advantage by allowing farmers to remotely monitor soil moisture levels from a centralized location or mobile device. This capability aligns with the increasing demand for data-driven agricultural practices and smart farming solutions. Additionally, the reduction in the cost of wireless technology and improvements in battery life have further contributed to the appeal of wireless sensors. The ability to integrate wireless sensors with IoT platforms and cloud-based analytics also enhances their functionality, enabling farmers to make more informed decisions based on comprehensive data analysis. As the Indian agriculture sector increasingly adopts technology to address challenges such as water scarcity and optimize resource use, the demand for wireless soil moisture sensors is expected to grow. The convenience, scalability, and advanced features offered by wireless sensors ensure their continued dominance in the market, supporting their widespread adoption in the Indian agricultural landscape throughout the forecast period.Regional Insights

The Southern region of India emerged as the dominant in the Soil Moisture Sensor Market and is projected to sustain its leading position throughout the forecast period. This dominance can be attributed to several key factors unique to this region. Southern India, encompassing states like Tamil Nadu, Karnataka, Andhra Pradesh, and Telangana, has a significant agricultural base and is renowned for its diverse crop cultivation, including rice, sugarcane, and various fruits and vegetables. The region's agricultural practices are increasingly adopting advanced technologies to enhance productivity and manage water resources efficiently. Soil moisture sensors are particularly valuable in this context, as they provide critical data to optimize irrigation practices and conserve water, which is essential given the region's periodic water scarcity and varying climatic conditions.Southern India has seen substantial investments in agricultural technology and infrastructure development, which support the adoption of soil moisture sensors. Government initiatives and schemes promoting smart agriculture and precision farming are prevalent in this region, further driving the demand for these sensors. The presence of research institutions and agricultural universities in Southern India also contributes to the region's emphasis on integrating advanced technology into farming practices. Additionally, the robust network of agricultural cooperatives and extension services in the Southern states facilitates the widespread adoption of soil moisture sensors among local farmers.

As agricultural practices in Southern India continue to evolve with technological advancements and as the region faces increasing pressure to manage water resources efficiently, the demand for soil moisture sensors is expected to remain strong. This trend is likely to solidify the Southern region's dominant position in the India Soil Moisture Sensor Market throughout the forecast period, driven by both the necessity of efficient resource management and the ongoing push towards modernizing agriculture in this key agricultural hub.

Key Market Players

- Acclima, Inc

- Campbell Scientific, Inc.

- Dynamax, Inc.

- Lindsay Corporation

- Sentek Pty Ltd

- IMKO Micromodultechnik GmbH

- KROHNE Messtechnik GmbH

- Netafim Limited

- Delta-T Devices Ltd.

- Spectrum Technologies, Inc.

Report Scope:

In this report, the India Soil Moisture Sensor Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Soil Moisture Sensor Market, By Sensor Type:

- Capacitance sensors

- Probes

India Soil Moisture Sensor Market, By Connectivity:

- Wired

- Wireless

India Soil Moisture Sensor Market, By Application:

- Agriculture

- Construction & Mining

India Soil Moisture Sensor Market, By Region:

- North India

- South India

- West India

- East India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Soil Moisture Sensor Market.Available Customizations:

India Soil Moisture Sensor Market report with the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Acclima, Inc

- Campbell Scientific, Inc.

- Dynamax, Inc.

- Lindsay Corporation

- Sentek Pty Ltd

- IMKO Micromodultechnik GmbH

- KROHNE Messtechnik GmbH

- Netafim Limited

- Delta-T Devices Ltd.

- Spectrum Technologies, Inc.

Table Information

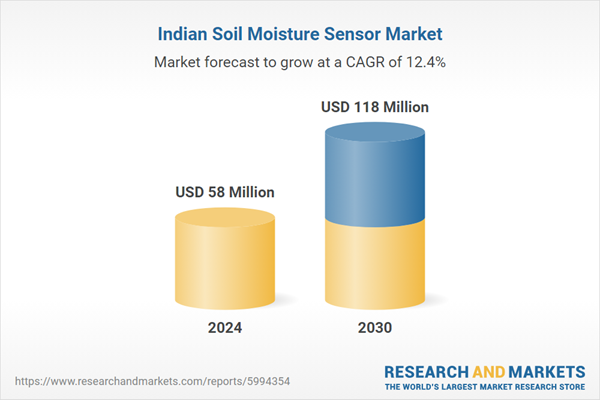

| Report Attribute | Details |

|---|---|

| No. of Pages | 86 |

| Published | August 2024 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 58 Million |

| Forecasted Market Value ( USD | $ 118 Million |

| Compound Annual Growth Rate | 12.4% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |