Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Water softeners equipment refers to devices designed to remove minerals such as calcium and magnesium, which cause water hardness. These minerals can lead to scale buildup in pipes, appliances, and fixtures, reducing their efficiency and lifespan. Water softeners primarily use ion-exchange technology, where calcium and magnesium ions are replaced with sodium or potassium ions, effectively "softening" the water. Other technologies, such as reverse osmosis or salt-free systems, also exist to address water hardness.

Water softeners are commonly used in residential, commercial, and industrial settings. In homes, they prevent damage to plumbing systems, reduce detergent usage, and improve the quality of water for washing and bathing. In industries like textiles, power generation, and food processing, soft water is essential to ensure smooth operation of machinery and improve product quality.

With rising urbanization, water quality concerns, and increasing awareness about the effects of hard water, the demand for water softeners has grown significantly. The market has expanded to offer various types of softening systems, including compact models for smaller homes and advanced salt-free or smart solutions for enhanced efficiency and sustainability. Water softeners are crucial in regions with high water hardness, contributing to improved infrastructure, reduced maintenance costs, and better overall water quality.

Key Market Drivers

Government Regulations and Environmental Awareness

The Indian government has recognized the importance of water conservation and quality control in addressing the country’s water crisis. As part of its commitment to sustainable development, the government has been introducing and enforcing various regulations to improve water quality, including those related to the treatment of hard water. The initiatives such as the National Mission for Clean Ganga, the Swachh Bharat Abhiyan (Clean India Mission), and efforts to manage wastewater are fostering greater awareness about the necessity of water treatment.As water scarcity becomes an increasingly urgent issue in many parts of India, environmental awareness about the importance of water conservation is also rising. Consumers and businesses are becoming more conscious of the environmental impacts of untreated hard water and its negative effects on infrastructure, the environment, and public health. This growing awareness has led to a surge in demand for sustainable and efficient water treatment solutions. Moreover, stricter regulations are encouraging industrial sectors to adopt water-softening solutions to comply with quality standards. Industries such as textiles, chemicals, food and beverages, and power plants rely on high-quality water for operations. The use of water softeners helps them meet water quality standards set by regulatory bodies, thus promoting market growth.

The government is also encouraging the use of eco-friendly and water-efficient technologies. As part of this drive, water softening systems that use minimal chemicals or salt-free alternatives are gaining traction. These systems align with environmental sustainability goals and offer businesses and consumers a way to reduce their environmental footprint. With such regulatory and environmental trends in play, the water softeners equipment market in India is set for significant expansion. India has committed to reducing its carbon emissions by 33-35% of its 2005 levels by 2030, as part of the Paris Agreement on Climate Change.

Rapid Urbanization and Increasing Demand for Clean Water

Urbanization is a key factor driving the demand for water softening equipment in India. Over the past few decades, India has witnessed rapid urban growth, with cities expanding rapidly and rural populations migrating to urban areas in search of better living standards and economic opportunities. This urbanization process has placed enormous pressure on water supply systems, which are often unable to provide sufficient clean water to meet the needs of the growing population.In many urban centers, water sourced from rivers, lakes, or reservoirs is increasingly mixed with groundwater to meet demand. As a result, water quality often deteriorates, leading to the presence of high levels of minerals such as calcium and magnesium. This is especially the case in cities like Delhi, Bangalore, and Chennai, where hard water is common. The challenge of providing safe and clean water to households, industries, and businesses has led to an increased reliance on water treatment and purification technologies, including water softeners.

With the population in urban areas expected to continue growing, the demand for water softening solutions is likely to increase. Households require soft water for daily activities like cooking, washing, and bathing, while businesses, especially in sectors like hospitality, manufacturing, and healthcare, need to ensure high-quality water for operational purposes.

As a result, the market for water softening equipment is experiencing substantial growth in both residential and commercial segments. In addition, the increasing use of water softeners for irrigation purposes in agriculture to maintain soil health and improve crop yields is further expanding the market. India’s total annual water demand is estimated at 1.18 trillion cubic meters (BCM), but the available water resources are only about 1,100 BCM. About 60% of India’s drinking water comes from groundwater sources, but nearly 60% of India’s aquifers are considered over-exploited, especially in urban and industrial areas.

Technological Advancements in Water Softening Systems

Technological innovations are playing a critical role in the growth of the water softeners equipment market in India. The water softening industry has witnessed significant advancements in recent years, with new technologies and improved features making these systems more efficient, cost-effective, and user-friendly. The shift toward automated, salt-free, and smart water softening systems is particularly notable.Traditional water softeners rely on the ion-exchange process, which uses salt to remove calcium and magnesium from the water. However, newer technologies are offering more sustainable alternatives, such as salt-free water softeners, which use potassium chloride or other environmentally friendly compounds. These systems are gaining popularity as they not only reduce the environmental impact of salt discharge but also reduce the need for regular maintenance. Additionally, the rise of smart water softening systems, which can be monitored and controlled remotely through mobile apps, is gaining traction in India.

These advanced systems allow users to track their water usage and optimize their softening processes, leading to enhanced convenience and efficiency. Such systems are particularly attractive to tech-savvy consumers and businesses that prioritize automation and energy efficiency. Furthermore, reverse osmosis (RO) technology has also been integrated into water softening solutions, enabling better water filtration and the removal of a broader range of contaminants. The combination of advanced filtration and softening in one system offers a comprehensive solution for consumers looking for high-quality water for drinking, cooking, and other uses.

As these technological innovations continue to evolve, water softening systems are becoming more accessible and appealing to a wider audience in India, contributing significantly to market growth. With improved performance, ease of use, and reduced environmental impact, these advancements are expected to drive the water softeners equipment market in the years to come.

Key Market Challenges

High Initial Cost and Maintenance Expenses

One of the key challenges in the water softeners equipment market in India is the high initial cost and ongoing maintenance expenses associated with the systems. While water softeners are an essential solution for many households and industries in regions affected by hard water, the price point can be a significant barrier for a large section of the population. The initial installation cost of a water softener system, especially for advanced models using technologies like reverse osmosis or salt-free softening, can be relatively high. This upfront investment often deters price-sensitive consumers, particularly in rural areas or low-income segments where the affordability of such systems is limited.Maintenance costs associated with water softeners can add to the financial burden. Regular servicing, the need for replacement parts (like resin beds, membranes, or filters), and the ongoing need for salt or chemicals in traditional systems further increase the total cost of ownership. For instance, in ion-exchange systems, salt is regularly required to regenerate the resin beads, adding to both the operational cost and the environmental impact. Even salt-free systems, though more eco-friendly, come with their own set of maintenance requirements, such as periodic cleaning and replacing of components. The long-term maintenance costs can deter many potential buyers from investing in water softeners, especially when alternatives like bottled water or filtration units are perceived as more affordable.

The awareness of water softeners and their benefits remains limited in certain segments of the market. Many consumers are either unaware of how these systems can improve water quality or are skeptical of the associated costs. In addition, some may resort to traditional and cheaper alternatives like water filtration units that may not fully address the issues related to water hardness, such as scaling or appliance damage, thus hindering the growth of the water softener market.

Given the considerable costs involved, many potential customers in India may not see water softeners as a feasible investment. To overcome this challenge, companies need to adopt strategies such as offering more affordable, entry-level models, financing options, and increasing awareness regarding the long-term benefits of investing in water softeners, including savings on appliance repairs, detergents, and water bills.

Lack of Consumer Awareness and Education

Another significant challenge faced by the water softeners equipment market in India is the lack of consumer awareness and education regarding the importance of water softening and its associated benefits. Despite the growing issues of water hardness in many regions of India, a significant proportion of the population remains unaware of the impact hard water has on health, infrastructure, and overall quality of life. As a result, many consumers do not fully recognize the value of investing in water softening solutions.In rural areas and smaller towns, people often rely on local water sources such as borewells or municipal water, which can be heavily mineralized. However, due to a lack of knowledge, they may not understand the long-term effects of using hard water, such as scale buildup in pipes, appliances, and industrial equipment, leading to inefficiency and frequent repairs. In such regions, there is also a perception that water is clean and safe to use as long as it is free from visible contaminants, which overlooks the issues caused by dissolved minerals. Consequently, the adoption rate of water softeners remains low in these areas.

Urban consumers, while more aware of water purification systems, often focus more on filtration technologies that address bacteria, viruses, and other harmful pathogens in drinking water, rather than on addressing water hardness. This lack of education about the specific problems caused by hard water can result in underutilization of water softening technologies, even in cities where water hardness levels are a significant concern.

Moreover, there is also confusion in the market regarding the various types of water treatment systems available, with many consumers unable to distinguish between water softeners, purifiers, and filters. The lack of clear guidance on the specific needs for soft water versus purified water contributes to the hesitation in purchasing water softening equipment. The abundance of product options and variations in technology can overwhelm consumers, leading to poor decision-making.

To overcome these challenges, manufacturers and distributors need to invest in consumer education campaigns that clearly explain the benefits of water softening, the problems caused by hard water, and how these systems work. Marketing strategies that include informational content, demonstrations, and easy-to-understand comparisons of water softening versus other water treatment systems could help bridge the knowledge gap and increase consumer demand for these products.

Key Market Trends

Growing Demand for Eco-Friendly and Salt-Free Water Softeners

A significant market trend in India’s water softeners equipment market is the increasing demand for eco-friendly and salt-free water softening solutions. Traditional ion-exchange water softeners often require salt to regenerate the resin beads, which can have a negative environmental impact. The disposal of the salt discharge can lead to soil and water contamination, which is a growing concern in many parts of India where water conservation is becoming critical. As consumers and businesses become more conscious of their environmental footprint, there is a rising preference for water softeners that use environmentally friendly technologies.Salt-free water softeners, such as those using the Template Assisted Crystallization (TAC) or electromagnetic technology, are gaining popularity. These systems do not require salt or chemicals to treat water, making them a more sustainable and cost-effective alternative for households and businesses. They work by altering the structure of the minerals in the water so that they do not form scale when the water cools. This is particularly beneficial in regions where water hardness levels are extremely high, as it reduces the long-term damage caused by scale buildup without relying on traditional salt-based systems.

To being eco-friendly, salt-free softeners often require less maintenance and have a longer lifespan than traditional ion-exchange systems, making them an attractive option for cost-conscious consumers. As awareness about the environmental impact of salt discharge grows and consumers seek more sustainable living solutions, the market for salt-free and low-maintenance water softeners is expected to expand rapidly.

Manufacturers are responding to this trend by innovating and offering more advanced, energy-efficient, and sustainable water softening products. The rise in demand for green technologies aligns with global environmental movements and governmental initiatives focused on water conservation and sustainable development, creating a conducive environment for eco-friendly water softeners in India.

Adoption of Smart Water Softening Systems

The shift towards digitalization and smart technologies is another prominent trend in the Indian water softeners equipment market. Smart water softening systems, which offer enhanced convenience, efficiency, and real-time monitoring, are gaining traction among both residential and commercial users. These systems are equipped with Internet of Things (IoT) capabilities, allowing users to remotely control and monitor their water softener systems via mobile applications or cloud-based platforms.One of the key benefits of smart water softeners is the ability to track water usage, monitor salt levels, and set regeneration cycles based on actual usage patterns. This leads to better water and energy efficiency, reducing operating costs and the environmental impact of water softening processes. These systems can also send alerts for maintenance needs, such as when salt needs to be replaced or when the system requires servicing. This remote monitoring and automated functionality enhance user experience by minimizing manual intervention and ensuring optimal performance.

In India, the demand for smart home products and automation is on the rise, driven by an increasingly tech-savvy population and the growing middle class. Urban consumers, in particular, are more inclined to invest in modern, connected appliances that offer convenience, control, and energy efficiency. The integration of smart technologies into water softeners aligns with this growing interest in smart home ecosystems and appliances.

As more manufacturers develop and offer smart water softeners equipped with advanced features such as Wi-Fi connectivity, mobile app integration, and predictive maintenance, this trend is likely to gain momentum in the Indian market. The ability to combine water softening with other smart home technologies, such as smart water purifiers, creates an attractive value proposition for modern consumers looking for an integrated water treatment solution.

Segmental Insights

Type Insights

The Electric held the largest market share in 2024. Electric water softeners dominate the India water softeners equipment market due to several key factors, including their efficiency, capacity, and advanced features that align with the demands of urban and industrial consumers.One of the main reasons for the dominance of electric water softeners is their ability to handle larger volumes of water. In densely populated urban areas and industrial sectors, high water demand necessitates more efficient and powerful water softening solutions. Electric systems, typically using ion-exchange technology, are designed to process significant quantities of water effectively, making them ideal for both residential homes with high water usage and commercial or industrial applications. These systems can regenerate automatically, ensuring a continuous supply of softened water without manual intervention, which adds to their convenience and suitability for high-demand environments.

Electric water softeners offer consistent performance in removing hardness-causing minerals like calcium and magnesium, ensuring that water quality remains optimal. This is particularly critical in regions with high water hardness, where untreated hard water can lead to scale buildup in pipes, appliances, and boilers, resulting in costly repairs and inefficiencies. Electric models effectively mitigate these issues by providing reliable soft water for everyday use, reducing long-term maintenance costs.

Another driving factor is the availability of advanced features in electric water softeners, such as smart technology and automated systems. These systems can be connected to mobile apps, allowing users to monitor and control the softening process remotely. This added convenience and technological integration are highly attractive to urban and tech-savvy consumers.

Although non-electric models are gaining popularity due to their lower initial cost and energy savings, electric water softeners remain the preferred choice in India due to their superior performance, reliability, and capacity to meet the needs of larger households, businesses, and industries.

Regional Insights

South India held the largest market share in 2024. South India dominates the India water softeners equipment market due to several key factors, including high water hardness, industrial growth, and an increasing demand for water treatment solutions.South India, particularly regions like Chennai, Bangalore, Hyderabad, and parts of Tamil Nadu and Karnataka, faces significant water hardness due to its reliance on groundwater sources. Over-extraction from borewells and wells in these areas leads to high mineral content in water, especially calcium and magnesium. This has resulted in widespread issues like scale buildup in plumbing systems, reduced efficiency of household appliances, and poor water quality, creating a growing demand for water softeners. As a result, consumers and businesses in South India are more likely to invest in water softeners to improve water quality and prevent infrastructural damage.

South India is a major hub for various industries, including textiles, power generation, food processing, and manufacturing, all of which require high-quality water for operations. In industries such as textile manufacturing, hard water can affect the dyeing process, leading to quality issues and increased costs. Similarly, in power plants and other heavy industries, hard water causes scaling in boilers and machinery, leading to reduced efficiency and higher maintenance costs. The demand for water softeners in these industrial sectors has further propelled the market in South India, where large-scale operations are heavily dependent on consistent and soft water.

South Indian cities are seeing rapid urbanization and an increase in disposable income. This shift has raised awareness about water quality and the need for water treatment solutions. As more residents and businesses seek better water quality, the demand for water softeners continues to grow, making South India a dominant region in the market.

Key Market Players

- Culligan International Company

- General Electric Company

- Pentair Plc

- Honeywell International Inc.

- 3M Company

- Whirlpool Corporation

- Kinetico Incorporated

- Ecolab Inc.

Report Scope:

In this report, the India Water Softeners Equipment Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Water Softeners Equipment Market, By Type:

- Electric

- Non-Electric

India Water Softeners Equipment Market, By Product:

- Salt-Based

- Salt-Free

India Water Softeners Equipment Market, By End Use:

- Residential

- Commercial

- Industrial

India Water Softeners Equipment Market, By Region:

- South India

- North India

- West India

- East India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Water Softeners Equipment Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Culligan International Company

- General Electric Company

- Pentair Plc

- Honeywell International Inc.

- 3M Company

- Whirlpool Corporation

- Kinetico Incorporated

- Ecolab Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 70 |

| Published | January 2025 |

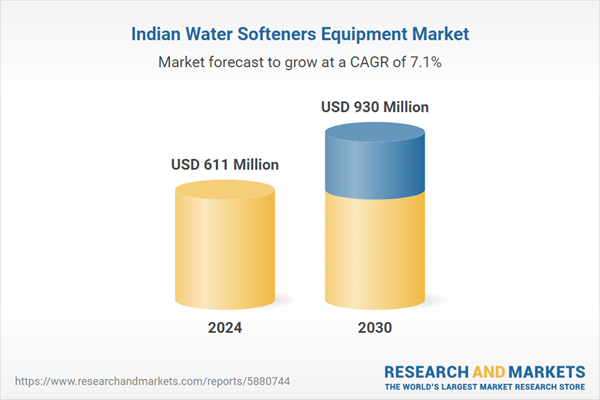

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 611 Million |

| Forecasted Market Value ( USD | $ 930 Million |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | India |

| No. of Companies Mentioned | 8 |