Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Water testing is a procedure to evaluate the quality of the water to assess the quality of the water which is essential to be monitored regularly. Water testing and analysis allow for the measurement of a variety of water characteristics, including turbidity, dissolved gas concentration, radioactivity, and water conductivity. The quality of water is essential to many different industries and activities such as fisheries, agriculture, forestry, pharmaceutical aquaculture, electronics, and food. Physiochemical tests and bacteriological tests are the two different types of water tests. Numerous techniques, including titration and spectrophotometric approaches, are used to conduct physiochemical testing. These tests include the dissolved oxygen test, odour test, turbidity test, BOD and TOC test, radioactivity test, and pH test. The total coliforms and faecal coliforms are measured using multi-tube dilution techniques and membrane filters in bacteriological tests.

Market Drivers

Increasing Applications of Water Testing and Analysis Across Several Industries

Water testing and analysis is widely used in numerous sectors, including mining, refineries, semiconductor, metals, pharmaceuticals, and food and beverage, among others. For instance, water is essential to the pharmaceutical sector and must be free of any toxins. The pharmaceutical industry depends heavily on water and requires different degrees of water purity. As a result, there is going to be an increase in demand for water testing and analysis due to foreign direct investment in the pharmaceutical industry in the upcoming years. For instance, the Department of Pharmaceuticals has approved 17 Foreign Direct Investment (FDI) proposals worth USD 182.44 million under the brownfield pharmaceutical projects in the year 2020-21. Furthermore, water testing also plays a major role in electronics industries as it requires ultrapure water for manufacturing and cleaning. In the electronics industry, salinity testing helps to test the amount of salt in the water which will help in generating electricity. Salt-diffused water is more efficient for generating electricity hence salinity testers are used to test the salinity of water. Similarly, mining and refineries utilize large volumes of water. The wastewater generated from these industries is tested and treated to avoid pollution. Water quality is a priority for many industries. Hence, due to the growing importance of water testing and analysis across various industries, the India water testing and analysis market is expected to grow during the forecast period.Rising Infrastructure Project and Urbanization

The Union Government has made significant investments in infrastructure growth to support their nation’s economy and create employment. To meet the projected increase in the urban population over the upcoming years, residential infrastructure as well as smart cities, particularly urban centres, are being planned and built in the upcoming years which led to an increase in the demand for treating wastewater coming out from infrastructural and construction activities. Moreover, the Indian government introduced various housing schemes to fulfil the demand of the rising population. For instance, to address the urban housing shortage among EWS/LIG and MIG categories, including slum dwellers, the union government launched the Pradhan Mantri Awasa Yojana in 2015. The goal of the programme is to provide every eligible urban household a pakka home and basic amenities including access to electricity, sewage systems, and clean drinking water. The Pradhan Mantri Awas Yojana (PMAY) budget, the government's major housing project, has increased by 280% from 2016-17; it now stands at from USD 2515.32 million in the most recent 2023-24 budget to USD 9550.8 million. Additionally, there are other programmes including "Housing for All" and the "Smart Cities Mission" for the construction of sustainable infrastructure across the nation which positively enhance the demand for pure quality water to urban & rural populations. Hence, due to all such infrastructure initiatives, the demand for water testing and analysis is growing across the nation in the upcoming years.Significant Water Treatment Regulations

Wastewater contains various toxic chemicals and harmful elements that are harmful to the environment as well as human beings' health and has a major negative impact on the country’s population avoid these complications. That’s why, the Indian government implemented new regulations to ensure the proper treatment of water before use or disposal. The government investment in the water treatment facility is focusing on improving the quality of water. For instance, there is currently, a network of 1,933 active labs linked to Water Quality Information Management Systems (WQMIS). The centre government has earmarked 2% of its entire National Jal Jeevan Mission (JJM) budget (USD 1200 million out of nearly USD 6000 million in 2021-22) for water testing across the country. As a result, the ongoing JJM, a central government priority plan to connect tap water to every rural family by 2024, ensures both the requisite amount and quality of drinking water supply. As a result, through 2028, the market for water testing and analysis will rise at a significant rate during the forecast period.Market Challenge

High Cost of Equipment and Less Developed Water Infrastructure

The market for water testing and analysis in India is anticipated to increase steadily through 2028 but the high cost of equipment will have a major restraining effect on the market of water testing and analysis across the country. Additionally, the expansion of the water testing and analysis market would be negatively impacted by the absence of an established infrastructure for water testing through 2028. For instance, under the Jal Jeevan Mission, a total of 2021 drinking water quality testing laboratories have been set up across the country to enhance the quality of water. Whereas in the northeast region, there are approximately 302 water testing laboratories including Arunachal Pradesh, having 112 water quality testing laboratories, followed by Assam with 80, Meghalaya with 31, Mizoram with 31, Tripura with 21, Manipur with 13, Nagaland with 12, and Sikkim with 2. Thus, the lack of water testing infrastructure across the country has negative impact on the water testing and analysis market.Market Segmentation

India water testing and analysis market is divided into type, product type, application, and region. Based on type, the market is divided into handheld, portable, and benchtop. Based on product type, the market is divided into PH meter, total organic carbon, turbidity meter, dissolved oxygen, and conductivity. Based on application, the market is divided into municipal, industry, laboratory, government, environment, and others. The market analysis also studies the regional segmentation to devise regional market segmentation, divided among North India, South India, West India, and East India.Market Players

Major market players in the India water testing and analysis market are ABB India Ltd, GE Power India Limited, DHR Holding India Pvt. Ltd, Thermo Fisher Scientific India Pvt. Ltd, Honeywell International India Pvt Ltd, HORIBA India Pvt Ltd, Shimadzu Analytical India Pvt Ltd, and Mettler Toledo India Private Limited.Report Scope:

In this report, the India water testing and analysis market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Water Testing and Analysis Market, By Type:

- Handheld

- Portable

- Benchtop

India Water Testing and Analysis Market, By Product Type:

- PH Meter

- Total Organic Carbon

- Turbidity Meter

- Dissolved Oxygen

- Conductivity

India Water Testing and Analysis Market, By Application:

- Municipal

- Industry

- Laboratory

- Government

- Environment

- Others

India Water Testing and Analysis Market, By Region:

- North India

- South India

- West India

- East India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India water testing and analysis market.Available Customizations:

The publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- ABB India Ltd

- GE Power India Limited

- DHR Holding India Pvt. Ltd

- Thermo Fisher Scientific India Pvt. Ltd

- Honeywell International India Pvt Ltd

- HORIBA India Pvt Ltd

- Shimadzu Analytical India Pvt Ltd

- Mettler Toledo India Private Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 77 |

| Published | October 2023 |

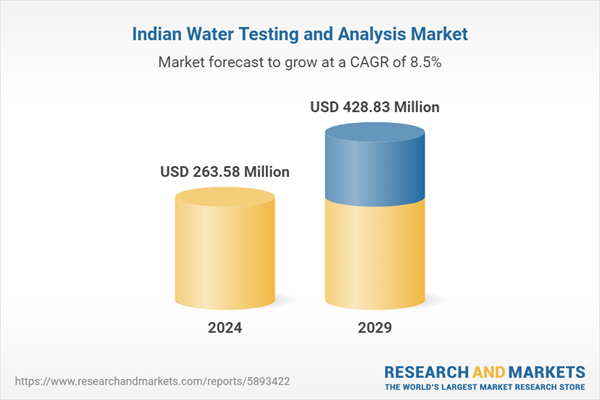

| Forecast Period | 2024 - 2029 |

| Estimated Market Value ( USD | $ 263.58 Million |

| Forecasted Market Value ( USD | $ 428.83 Million |

| Compound Annual Growth Rate | 8.5% |

| Regions Covered | India |

| No. of Companies Mentioned | 8 |