Global Industrial Installation Testers Market - Key Trends & Drivers Summarized

What Are Industrial Installation Testers and Why Are They Crucial?

Industrial installation testers play a pivotal role in ensuring the safety, efficiency, and compliance of electrical installations in various industrial settings. These sophisticated devices are designed to perform a comprehensive range of tests, including continuity testing, insulation resistance testing, loop impedance testing, and residual current device (RCD) testing. By accurately diagnosing potential faults and inefficiencies within electrical systems, industrial installation testers help prevent electrical failures, enhance operational safety, and ensure compliance with stringent regulatory standards. As industries increasingly prioritize safety and reliability, the demand for advanced testing equipment continues to rise, highlighting the critical importance of industrial installation testers in modern industrial operations.How Is Technology Transforming the Landscape of Industrial Installation Testing?

The industrial installation testers market is witnessing significant technological advancements that are transforming the landscape of electrical testing. Innovations such as the integration of smart technologies, wireless connectivity, and advanced data analytics are enhancing the functionality and user experience of these devices. Modern testers are now equipped with features like touchscreen interfaces, cloud-based data storage, and real-time data monitoring, which streamline the testing process and improve accuracy. The adoption of IoT-enabled testers allows for remote monitoring and diagnostics, providing maintenance teams with actionable insights and reducing downtime. As technology continues to evolve, industrial installation testers are becoming more sophisticated, user-friendly, and capable of meeting the complex demands of contemporary industrial environments.What Are the Emerging Trends Shaping the Market?

Several emerging trends are shaping the industrial installation testers market, reflecting the evolving needs and priorities of industrial sectors. One notable trend is the growing emphasis on sustainability and energy efficiency, driving the development of testers that can assess the efficiency of electrical installations and identify areas for improvement. Additionally, the rise of Industry 4.0 and the increasing adoption of automation and smart manufacturing technologies are fueling demand for advanced testers that can seamlessly integrate with automated systems. The market is also seeing a surge in demand for multifunctional testers that offer a broad range of testing capabilities in a single device, catering to the need for versatile and cost-effective solutions. Furthermore, the increasing focus on safety and regulatory compliance, especially in high-risk industries such as oil and gas, construction, and manufacturing, is driving the adoption of robust and reliable testing equipment.What Is Driving the Growth in the Industrial Installation Testers Market?

The growth in the industrial installation testers market is driven by several factors that are reshaping the industrial landscape. One of the primary drivers is the stringent regulatory environment, which mandates regular testing and maintenance of electrical installations to ensure safety and compliance. Technological advancements, such as the development of IoT-enabled testers and the integration of advanced analytics, are also propelling market growth by offering enhanced functionality and improved efficiency. The increasing complexity of industrial electrical systems, coupled with the rising demand for energy efficiency and sustainability, is further driving the need for sophisticated testing solutions. Additionally, the expansion of industrial sectors in emerging markets, driven by rapid urbanization and industrialization, is creating new opportunities for market growth. As industries continue to prioritize safety, reliability, and efficiency, the demand for advanced industrial installation testers is expected to witness sustained growth in the coming years.Report Scope

The report analyzes the Industrial Installation Testers market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Product (Low-Voltage, Medium-Voltage).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Low-Voltage Testers segment, which is expected to reach US$335.7 Million by 2030 with a CAGR of 4.2%. The Medium-Voltage Testers segment is also set to grow at 3.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $108.2 Million in 2024, and China, forecasted to grow at an impressive 3.7% CAGR to reach $79.4 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Industrial Installation Testers Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Industrial Installation Testers Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Industrial Installation Testers Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

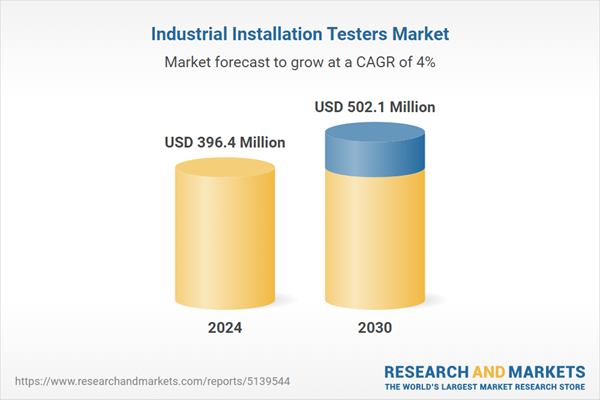

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Chauvin Arnoux Metrix, Fortive Corporation, Martindale Electric Co Ltd., Megger Ltd., Metrel d.d. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 62 companies featured in this Industrial Installation Testers market report include:

- Chauvin Arnoux Metrix

- Fortive Corporation

- Martindale Electric Co Ltd.

- Megger Ltd.

- Metrel d.d.

- Seaward Electronic Ltd

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Chauvin Arnoux Metrix

- Fortive Corporation

- Martindale Electric Co Ltd.

- Megger Ltd.

- Metrel d.d.

- Seaward Electronic Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 233 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 396.4 Million |

| Forecasted Market Value ( USD | $ 502.1 Million |

| Compound Annual Growth Rate | 4.0% |

| Regions Covered | Global |