Industrial transmitters refer to electronic devices used in industrial settings to measure process variables and convert them into electrical signals for transmission. It includes pressure, temperature, level, flow, vibration, pH, conductivity, oxygen, and general-purpose transmitters. They are comprised of several components, such as sensing elements, microcontrollers, digital signal processors (DSP), memory, communication interface, display unit, power supply, and enclosure. Industrial transmitters are widely used in pipelines, refineries, reactors, water treatment plants, automobiles, aircraft, defense equipment, assembly lines, manufacturing facilities, smelters, research laboratories, and heating, ventilation, and air conditioning (HVAC) systems. It provides precise and reliable measurements of various parameters, which aids in maintaining consistency, improving product quality, optimizing processes, reducing energy consumption, and enhancing overall efficiency. As a result, industrial transmitters find extensive applications across the oil and gas, automotive, chemical, food and beverage (F&B), manufacturing, power generation, and aerospace industries.

Industrial Transmitters Market Trends:

The rising demand for industrial automation across the globe is one of the primary factors propelling the market growth. Industrial transmitters are widely used to provide real-time monitoring and accurate measurements of various industrial processes, such as pressure, temperature, level, pH, and flow rate, which aids in improving operational efficiency, reducing human errors, and enhancing process control. In addition to this, the increasing emphasis on optimizing industrial operations to reduce costs and augment productivity is acting as another growth-inducing factor. Furthermore, the implementation of strict regulations by governments is facilitating product adoption across industries to monitor process variables and ensure compliance with safety standards, minimize environmental impact, and prevent accidents and hazardous situations. Additionally, the recent development of smart transmitters incorporated with advanced diagnostics features that are capable of instantly identifying faults and potential issues, which enable predictive maintenance, reduce downtime, and optimize overall performance, is positively influencing the market growth. Besides this, the integration of wireless communication and the Internet of Things (IoT) technology to eliminate the need for complex wiring, allow flexible installation, and enable remote monitoring and control is favoring the market growth. Moreover, the growing demand for customized transmitters to cater to specific applications and industrial requirements is supporting the market growth. Other factors, including rapid industrialization activities, increasing investments in developing advanced products, and the rising adoption of digital technologies across industries, are anticipated to drive the market growth.Key Market Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type and industry vertical.Type Insights:

- Pressure Transmitter

- Flow Transmitter

- Level Transmitter

- General Purpose Transmitter

- Temperature Transmitter

- Others

Industry Vertical Insights:

- Oil and Gas

- Energy and Power

- Chemical and Petrochemical

- Water and Wastewater Treatment

- Others

Regional Insights:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global industrial transmitters market. Detailed profiles of all major companies have been provided. Some of the companies covered include ABB Ltd, AMETEK, Inc., Danfoss A/S, Dwyer Instruments Inc., Emerson Electric Co, Fuji Electric Co. Ltd. (Furukawa Group), General Electric Company, Honeywell International Inc., Schneider Electric, Siemens AG, WIKA Alexander Wiegand SE & Co. KG, Yokogawa Electric Corporation, etc. Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.Key Questions Answered in This Report:

- How has the global industrial transmitters market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global market?

- What is the impact of each driver, restraint, and opportunity on the global market?

- What are the key regional markets?

- Which countries represent the most attractive market?

- What is the breakup of the market based on the type?

- Which is the most attractive type in the market?

- What is the breakup of the market based on the industry vertical?

- Which is the most attractive industry vertical in the market?

- What is the competitive structure of the market?

- Who are the key players/companies in the global industrial transmitters market?:

Table of Contents

Companies Mentioned

- ABB Ltd

- AMETEK Inc.

- Danfoss A/S

- Dwyer Instruments Inc.

- Emerson Electric Co

- Fuji Electric Co. Ltd. (Furukawa Group)

- General Electric Company

- Honeywell International Inc.

- Schneider Electric

- Siemens AG

- WIKA Alexander Wiegand SE & Co. KG

- Yokogawa Electric Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 148 |

| Published | March 2025 |

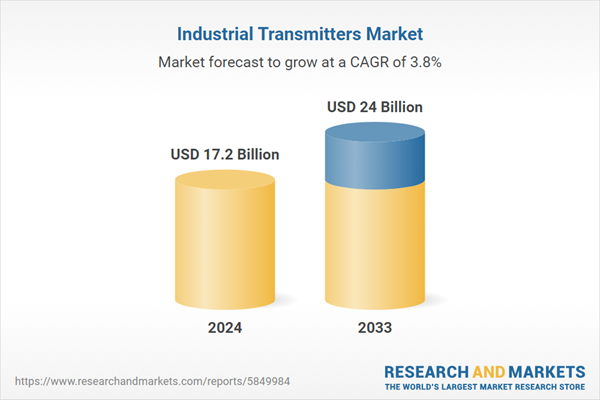

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 17.2 Billion |

| Forecasted Market Value ( USD | $ 24 Billion |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |