Global Industrial Wireless Sensors Market - Key Trends & Drivers Summarized

Why Is the Industrial Wireless Sensors Market Gaining Momentum Now?

The global market for industrial wireless sensors is experiencing significant growth, driven by a confluence of technological advancements, increasing automation, and the proliferation of smart devices. As industries across the globe shift towards Industry 4.0 and embrace digital transformation, wireless sensors are becoming a cornerstone in modern industrial infrastructure. These sensors offer the flexibility, scalability, and efficiency required to meet the complex demands of connected industrial environments. Advancements in wireless communication technologies, such as 5G and Low-Power Wide-Area Networks (LPWAN), are expanding the possibilities for wireless sensor applications, enabling real-time data collection and analysis across large-scale industrial operations. The trend towards smart factories, where operations are heavily reliant on data-driven decision-making, has further accelerated the adoption of wireless sensors. These sensors are critical in facilitating remote monitoring, predictive maintenance, and real-time process control, all of which are key elements in enhancing operational efficiency and reducing downtime.How Are Technological Innovations Shaping the Future of Industrial Wireless Sensors?

Technological innovations are playing a pivotal role in shaping the future of industrial wireless sensors, with a strong focus on improving performance, reducing costs, and expanding application areas. The integration of Artificial Intelligence (AI) and Machine Learning (ML) within Industrial Internet of Things (IIoT) platforms has significantly enhanced the capabilities of wireless sensors. These technologies allow for advanced data processing and predictive analytics, enabling more accurate and timely insights, which are essential for optimizing industrial processes. Additionally, developments in edge computing are transforming how data from wireless sensors is handled, with more processing power being pushed closer to the source of data. This reduces latency and enhances the ability to make real-time decisions on the factory floor. Battery life improvements and the miniaturization of sensor components are also critical innovations that are making wireless sensors more practical and cost-effective for widespread industrial deployment. The emergence of robust cybersecurity protocols is another crucial development, addressing the increasing concerns around data security in wireless sensor networks.What Regulatory and Environmental Factors Are Influencing Market Growth?

Regulatory and environmental factors are having a profound impact on the growth trajectory of the industrial wireless sensors market. Increasingly stringent regulations concerning workplace safety and environmental monitoring are driving the adoption of wireless sensors, as these devices are essential for compliance and for minimizing environmental impact. For instance, industries such as oil and gas, chemicals, and manufacturing are under growing pressure to monitor and mitigate emissions, leakage, and other environmental hazards. Wireless sensors provide the necessary real-time data to ensure compliance with these regulations and to address any issues promptly. Furthermore, the growing emphasis on energy efficiency and sustainable practices is prompting industries to adopt wireless sensors for monitoring and optimizing energy consumption. The rise of smart grid initiatives and smart energy management solutions is also creating new opportunities for the deployment of wireless sensors. These sensors play a crucial role in monitoring energy distribution, managing loads, and ensuring the stability of energy networks, all of which are critical in the transition towards more sustainable industrial practices.What Are the Key Drivers Fueling the Growth of the Industrial Wireless Sensors Market?

The growth in the industrial wireless sensors market is driven by several factors that are deeply intertwined with the evolving needs and behaviors of industries and end-users. One of the most significant drivers is the rapid expansion of IoT and smart device ecosystems, which necessitates the widespread deployment of wireless sensors to support the seamless integration and communication of devices within industrial environments. The shift towards automation and the adoption of Industry 4.0 principles have also been instrumental in driving demand, as wireless sensors are essential for enabling the connected, data-driven operations that these paradigms require. Another critical driver is the increased focus on predictive maintenance, where wireless sensors are used to monitor equipment health and predict failures before they occur, thereby reducing downtime and maintenance costs. The rise of smart infrastructure, including smart factories and buildings, is further fueling market growth, as these environments rely heavily on wireless sensors for everything from environmental monitoring to energy management. Additionally, the ongoing investments in upgrading industrial wireless networks, such as the roll-out of 5G, are creating a conducive environment for the adoption of high-speed, reliable wireless sensor networks. As industries continue to prioritize efficiency, sustainability, and digitalization, the demand for advanced wireless sensor technologies is set to remain on an upward trajectory.Report Scope

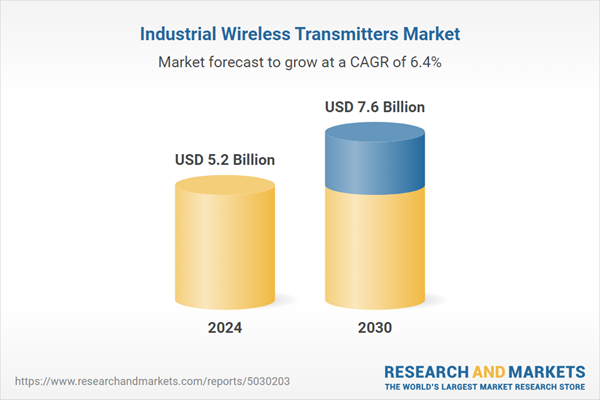

The report analyzes the Industrial Wireless Transmitters market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Pressure Transmitters, General Purpose, Level Transmitters, Temperature Transmitters, Flow Transmitters, Tank Gauging Transmitters, Other Types); Vertical (Industrial Automation, Aerospace & Defense, Food & Agriculture, Chemical / Petrochemicals, Energy & Power, Water & Wastewater Treatment, Other Verticals).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Pressure Transmitters segment, which is expected to reach US$1.9 Billion by 2030 with a CAGR of 7%. The General Purpose Transmitters segment is also set to grow at 6.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.4 Billion in 2024, and China, forecasted to grow at an impressive 10.6% CAGR to reach $1.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Industrial Wireless Transmitters Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Industrial Wireless Transmitters Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Industrial Wireless Transmitters Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ascom Holding AG, Eaton Corporation PLC, Emerson Electric Company, Honeywell International, Inc., Inovonics Wireless Corporation. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 11 companies featured in this Industrial Wireless Transmitters market report include:

- Ascom Holding AG

- Eaton Corporation PLC

- Emerson Electric Company

- Honeywell International, Inc.

- Inovonics Wireless Corporation.

- Keri Systems, Inc.

- OleumTech

- Omega Engineering, Inc.

- PHOENIX CONTACT GmbH & Co. KG

- Rohde & Schwarz GmbH & Co. KG

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ascom Holding AG

- Eaton Corporation PLC

- Emerson Electric Company

- Honeywell International, Inc.

- Inovonics Wireless Corporation.

- Keri Systems, Inc.

- OleumTech

- Omega Engineering, Inc.

- PHOENIX CONTACT GmbH & Co. KG

- Rohde & Schwarz GmbH & Co. KG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 208 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5.2 Billion |

| Forecasted Market Value ( USD | $ 7.6 Billion |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |