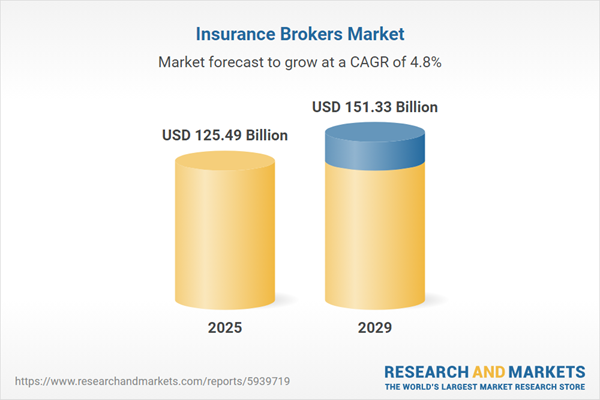

The insurance brokers market size is expected to see steady growth in the next few years. It will grow to $151.33 billion in 2029 at a compound annual growth rate (CAGR) of 4.8%. The growth in the forecast period can be attributed to an increase in chronic diseases and disabilities, growth of the middle-class in emerging markets, and increasing mergers and acquisitions. Major trends in the forecast period include technologies to aid automation of insurance, adaption of insurance portals and digital distribution channels for efficiency, entry of nontraditional firms in the insurance brokers market, and increasing mergers and acquisitions.

The forecast of 4.8% growth over the next five years reflects a modest reduction of 0.4% from the previous estimate for this market. This reduction is primarily due to the impact of tariffs between the US and other countries. This is likely to directly affect the US through higher operational costs, as broker management platforms and client portal solutions, primarily sourced from the United Kingdom and Canada, become more expensive to license due to increased software tariffs. The effect will also be felt more widely due to reciprocal tariffs and the negative effect on the global economy and trade due to increased trade tensions and restrictions.

Major companies in the insurance brokers market are concentrating on developing insurance platforms to streamline operations, enhance customer experience, improve policy management, and deliver more personalized and efficient insurance solutions through digital transformation and automation. These insurance platforms aim to enhance the management of healthcare and insurance services by integrating technology, data-driven insights, and personalized care to simplify the user experience in navigating health insurance. For example, in May 2024, Riskbirbal Insurance Brokers Pvt Ltd, an India-based company, launched the Wellconnect platform. This platform centralizes all relevant information regarding health insurance services, making it easier for users to access what they need without navigating multiple sources. Wellconnect seamlessly integrates with existing Human Resource Management Systems (HRMS), facilitating a streamlined onboarding process for new users and ensuring easy access to all health-related benefits.

Major companies operating in the insurance brokers market are focused on creating mobile applications to provide customers with greater accessibility, enhance real-time communication, and streamline policy management. These insurance apps are designed to improve the management of healthcare and insurance services. The app features a car claim tracking system that allows users to easily submit and monitor claims. It also facilitates the effortless submission and monitoring of medical claims, giving users a detailed overview of their claim history. For instance, in August 2024, Contact Insurance Brokerage, an Egypt-based company, launched a mobile application. Users can view both active and expired insurance policies by entering their Egyptian national ID number, simplifying access to important documents and information. The app provides personalized health notifications, including reminders for medication schedules and alerts tailored for women’s health. A dedicated section offers health articles and tips, promoting overall wellness among users.

In April 2024, Aon plc, a UK-based company providing insurance broker services, acquired Global Insurance Brokers Private Ltd. for an undisclosed amount. Through this acquisition, Aon aims to expand its portfolio by incorporating Global Insurance Brokers' expertise in Insurance & Reinsurance Broking, as well as Risk Management and Claim Consulting. Global Insurance Brokers Private Ltd. is an India-based company that offers insurance broker services.

Major companies operating in the insurance brokers market include Marsh & McLennan Cos Inc, Aon PLC, Arthur J Gallagher & Co, Willis Towers Watson PLC, Acrisure LLC, Brown & Brown Inc., Truist Insurance Holdings Inc., USI Insurance Services LLC, Lockton Companies Inc., HUB International Limited, Beacon Insurance Brokers Pvt. Ltd., Urjita Insurance Brokers Pvt. Ltd., Mahindra Insurance Brokers Limited, Efficient Insurance Brokers Pvt. Ltd., Vibhuti Insurance Brokers Pvt.Ltd., Unison Insurance Broking Services Pvt. Ltd., Uib Insurance Brokers (India) Private Limited, Mga Insurance Brokers, Mega Capital, Roderick Insurance Brokers, Unity Insurance Brokers, Insurance Advisernet Australia, Fanhua Inc., Chang'an Insurance Brokers Co., Ltd., Mintaian Insurance Surveyors & Loss Adjusters Group Co., Ltd, Shenzhen Huakang Insurance Agency Co., Ltd., Jiangtai Insurance Broker Co. Ltd., Air Union Insurance Brokers Co. Ltd., Huatai Insurance Agency & Consultant Service Ltd, Axa France Vie, Icare Insurance Brokers, Western Europe, Lloyd's Of London Limited, Aon Holding Deutschland Gmbh, Funk Gruppe Gmbh, Ecclesia Holding Gmbh, Allianz Global, Crédit Agricole Assurances, Cnp Assurance, Société Générale, Bnp Paribas Cardif, Mai Insurance Brokers Poland Sp. Z O.O., Howden Insurance Brokers Nederland B.V, Meijers Assurantiën B.V, Aon Nederland, International Insurance Brokers S.R.O., Cbiz, Inc., Canadian Insurance Brokers Inc., Aligned Insurance Inc., Novamar Insurance, Jah Insurance Brokers Corp, Thb Mexico, Intermediario De Reaseguro, S.A. De C.V., Alliant Insurance Services, Inc, Nfp Corp, Assured Partners Inc, Ttms Argentina S.A, 123seguro, Insur Insurance Company S.A., Src Brokers, Uai Brazil Insurance Broker, Alc Corretora De Seguros, Aon Brasil - São Paulo, Ez Towers, Middle East, Bupa Arabia For Cooperative Insurance, Abu Dhabi Insurance Brokers L.L.C, Nexus Insurance Brokers Llc, Wehbe Insurance Services Llc, New Shield Insurance Brokers Llc, Gulf Oasis Insurance Brokers Llc, Earnest Insurance Brokers Llc, Al Noor Insurance Broker, Arab Orient Insurance Brokers, Lusail Insurance Brokers, Insurance Brokers of Nigeria (Ibn), Northlink Insurance Brokers, Carrier Insurance Brokers, Glanvills Enthoven, Union Commercial Insurance Brokers.

North America was the largest region in the insurance brokers market in 2024. Western Europe was the second largest market in the global insurance brokers market share. The regions covered in the insurance brokers market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the insurance brokers market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Canada, Spain.

The insurance brokers market consists of sales of insurance products by entities that act as intermediaries (i.e., agents or brokers) in selling annuities and insurance policies. This market excludes the direct selling of insurance products by insurance companies. The value of the market is based on the fees or commissions paid to brokers by the insured, both commercial and personal. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The sharp rise in U.S. tariffs and the ensuing trade tensions in spring 2025 are having a considerable impact on the financial sector, particularly in the areas of investment strategies and risk management. The increased tariffs have intensified market volatility, leading institutional investors to adopt more cautious approaches and driving greater demand for hedging solutions. Banks and asset managers are encountering higher costs in cross-border transactions as disrupted global supply chains and declining corporate earnings weigh on equity market performance. At the same time, insurance providers are facing elevated claims risks linked to supply chain interruptions and trade-related business losses. Furthermore, reduced consumer spending and weaker export demand are limiting credit growth and dampening investment appetite. In response to these challenges, the sector must focus on diversification, accelerate digital transformation, and strengthen scenario planning to manage the heightened economic uncertainty and safeguard profitability.

An insurance broker is an authorized individual who sells insurance and often works with multiple insurance providers to offer customers a variety of insurance products.

The primary types of insurance brokers include life insurance, general insurance, health insurance, and others. Life insurance in the insurance brokers market involves a contract between the insurer and the policyholder, promising to pay a specified sum of money upon the death of the insured person. Services offered by insurance brokers can be accessed through various modes, including offline and online, and are utilized by both corporate entities and individuals.

The insurance brokers research report is one of a series of new reports that provides insurance brokers statistics, including insurance brokers industry global market size, regional shares, competitors with insurance brokers share, detailed insurance brokers segments, market trends and opportunities, and any further data you may need to thrive in the insurance brokers industry. This insurance brokers research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Insurance Brokers Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on insurance brokers market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for insurance brokers? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The insurance brokers market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Type: Life Insurance, General Insurance, Health Insurance, Other Types2) by Mode: Offline, Online

3) by End User: Corporate, Individuals

Subsegments:

1) by Life Insurance: Term Life Insurance; Whole Life Insurance; Universal Life Insurance2) by General Insurance: Property Insurance; Liability Insurance; Auto Insurance

3) by Health Insurance: Individual Health Plans; Group Health Plans; Critical Illness Insurance

4) by Other Types: Travel Insurance; Pet Insurance; Specialty Insurance

Companies Mentioned:Marsh & McLennan Cos Inc; Aon PLC; Arthur J Gallagher & Co; Willis Towers Watson PLC; Acrisure LLC; Brown & Brown Inc.; Truist Insurance Holdings Inc.; USI Insurance Services LLC; Lockton Companies Inc.; HUB International Limited; Beacon Insurance Brokers Pvt. Ltd.; Urjita Insurance Brokers Pvt. Ltd.; Mahindra Insurance Brokers Limited; Efficient Insurance Brokers Pvt. Ltd.; Vibhuti Insurance Brokers Pvt.Ltd.; Unison Insurance Broking Services Pvt. Ltd.; Uib Insurance Brokers (India) Private Limited; Mga Insurance Brokers; Mega Capital; Roderick Insurance Brokers; Unity Insurance Brokers; Insurance Advisernet Australia; Fanhua Inc.; Chang'an Insurance Brokers Co., Ltd.; Mintaian Insurance Surveyors & Loss Adjusters Group Co., Ltd; Shenzhen Huakang Insurance Agency Co., Ltd.; Jiangtai Insurance Broker Co. Ltd.; Air Union Insurance Brokers Co. Ltd.; Huatai Insurance Agency & Consultant Service Ltd; Axa France Vie; Icare Insurance Brokers; Western Europe; Lloyd's of London Limited; Aon Holding Deutschland Gmbh; Funk Gruppe Gmbh; Ecclesia Holding Gmbh; Allianz Global; Crédit Agricole Assurances; Cnp Assurance; Société Générale; Bnp Paribas Cardif; Mai Insurance Brokers Poland Sp. Z O.O.; Howden Insurance Brokers Nederland B.V; Meijers Assurantiën B.V; Aon Nederland; International Insurance Brokers S.R.O.; Cbiz, Inc.; Canadian Insurance Brokers Inc.; Aligned Insurance Inc.; Novamar Insurance; Jah Insurance Brokers Corp; Thb Mexico, Intermediario De Reaseguro, S.bA. De C.V.; Alliant Insurance Services, Inc; Nfp Corp; Assured Partners Inc; Ttms Argentina S.a; 123seguro; Insur Insurance Company S.bA.; Src Brokers; Uai Brazil Insurance Broker; Alc Corretora De Seguros; Aon Brasil - São Paulo; Ez Towers; Middle East; Bupa Arabia for Cooperative Insurance; Abu Dhabi Insurance Brokers L.L.C; Nexus Insurance Brokers Llc; Wehbe Insurance Services Llc; New Shield Insurance Brokers Llc; Gulf Oasis Insurance Brokers Llc; Earnest Insurance Brokers Llc; Al Noor Insurance Broker; Arab Orient Insurance Brokers; Lusail Insurance Brokers; Insurance Brokers of Nigeria (Ibn); Northlink Insurance Brokers; Carrier Insurance Brokers; Glanvills Enthoven; Union Commercial Insurance Brokers

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Insurance Brokers market report include:- Marsh & McLennan Cos Inc

- Aon PLC

- Arthur J Gallagher & Co

- Willis Towers Watson PLC

- Acrisure LLC

- Brown & Brown Inc.

- Truist Insurance Holdings Inc.

- USI Insurance Services LLC

- Lockton Companies Inc.

- HUB International Limited

- Beacon Insurance Brokers Pvt. Ltd.

- Urjita Insurance Brokers Pvt. Ltd.

- Mahindra Insurance Brokers Limited

- Efficient Insurance Brokers Pvt. Ltd.

- Vibhuti Insurance Brokers Pvt.Ltd.

- Unison Insurance Broking Services Pvt. Ltd.

- Uib Insurance Brokers (India) Private Limited

- Mga Insurance Brokers

- Mega Capital

- Roderick Insurance Brokers

- Unity Insurance Brokers

- Insurance Advisernet Australia

- Fanhua Inc.

- Chang'an Insurance Brokers Co., Ltd.

- Mintaian Insurance Surveyors & Loss Adjusters Group Co., Ltd

- Shenzhen Huakang Insurance Agency Co., Ltd.

- Jiangtai Insurance Broker Co. Ltd.

- Air Union Insurance Brokers Co. Ltd.

- Huatai Insurance Agency & Consultant Service Ltd

- Axa France Vie

- Icare Insurance Brokers

- Western Europe

- Lloyd's of London Limited

- Aon Holding Deutschland Gmbh

- Funk Gruppe Gmbh

- Ecclesia Holding Gmbh

- Allianz Global

- Crédit Agricole Assurances

- Cnp Assurance

- Société Générale

- Bnp Paribas Cardif

- Mai Insurance Brokers Poland Sp. Z O.O.

- Howden Insurance Brokers Nederland B.V

- Meijers Assurantiën B.V

- Aon Nederland

- International Insurance Brokers S.R.O.

- Cbiz, Inc.

- Canadian Insurance Brokers Inc.

- Aligned Insurance Inc.

- Novamar Insurance

- Jah Insurance Brokers Corp

- Thb Mexico, Intermediario De Reaseguro, S.bA. De C.V.

- Alliant Insurance Services, Inc

- Nfp Corp

- Assured Partners Inc

- Ttms Argentina S.a

- 123seguro

- Insur Insurance Company S.bA.

- Src Brokers

- Uai Brazil Insurance Broker

- Alc Corretora De Seguros

- Aon Brasil - São Paulo

- Ez Towers

- Middle East

- Bupa Arabia for Cooperative Insurance

- Abu Dhabi Insurance Brokers L.L.C

- Nexus Insurance Brokers Llc

- Wehbe Insurance Services Llc

- New Shield Insurance Brokers Llc

- Gulf Oasis Insurance Brokers Llc

- Earnest Insurance Brokers Llc

- Al Noor Insurance Broker

- Arab Orient Insurance Brokers

- Lusail Insurance Brokers

- Insurance Brokers of Nigeria (Ibn)

- Northlink Insurance Brokers

- Carrier Insurance Brokers

- Glanvills Enthoven

- Union Commercial Insurance Brokers

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | September 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 125.49 Billion |

| Forecasted Market Value ( USD | $ 151.33 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 80 |