Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Advancements in IP Address Management Solutions

The global Internet Protocol Address Management (IPAM) market is experiencing significant growth driven by continuous advancements in IP address management solutions. Innovations in IPAM tools, such as automation, integration with cloud services, and enhanced security features, have led to more efficient and reliable IP address management. These solutions are becoming increasingly sophisticated, enabling organizations to efficiently allocate, track, and monitor IP addresses in complex and dynamic network environments. As the demand for seamless and secure network connectivity continues to rise, IPAM solutions are evolving to meet these challenges, offering innovative features and capabilities that cater to the diverse needs of businesses across various industries. The ongoing development of IPAM technologies positions the market for sustained expansion, providing organizations with the tools they need to effectively manage their IP resources and support their digital initiatives.Rising Complexity of Network Infrastructures

The increasing complexity of network infrastructures is a key driver behind the growth of the global IPAM market. As organizations expand their digital footprints and adopt cloud, IoT, and mobile technologies, the number of IP-enabled devices and endpoints has grown exponentially. Managing IP addresses in such intricate and diverse network environments has become a daunting task. IPAM solutions offer the automation and centralized control needed to navigate this complexity efficiently. Furthermore, the transition to IPv6, with its expanded address space, is adding to the demand for advanced IPAM solutions. These solutions are essential in optimizing IP address allocation, reducing conflicts, and ensuring network security. As businesses grapple with the challenges of managing increasingly intricate network infrastructures, the IPAM market is poised to flourish by providing essential tools that streamline IP address management, enhance network performance, and strengthen cybersecurity.Growing Emphasis on Network Security

The growing emphasis on network security is a significant driver fueling the expansion of the global IPAM market. With the escalating threat landscape and the increasing sophistication of cyberattacks, organizations are prioritizing network security and visibility. Effective IP address management plays a pivotal role in bolstering network security by providing accurate information about IP address assignments and detecting unauthorized or suspicious activities. IPAM solutions offer features such as IP address tracking, DNS monitoring, and DHCP lease management, which are crucial for identifying and mitigating security threats. As businesses invest in cybersecurity measures to protect their digital assets and data, IPAM solutions become an integral part of their security infrastructure. The demand for robust IPAM tools that enhance network security is driving the market's growth, positioning it as a vital component of organizations' cybersecurity strategies. In an era where cybersecurity is paramount, the IPAM market is set to expand by providing essential capabilities that safeguard network integrity and data confidentiality.Migration to Cloud-Based Infrastructure

The migration to cloud-based infrastructure is a key driver behind the growth of the global IPAM market. Organizations are increasingly adopting cloud services and hybrid cloud environments to achieve scalability, flexibility, and cost-efficiency. Cloud-based IPAM solutions offer the agility and accessibility required to manage IP addresses in cloud and virtualized environments. These solutions provide centralized IP address management across distributed cloud resources, simplifying the allocation and tracking of IP addresses in dynamic cloud ecosystems. As the cloud computing paradigm continues to reshape IT infrastructures, the demand for cloud-compatible IPAM solutions is on the rise. The market is witnessing a shift toward cloud-based IPAM offerings, which are becoming integral to organizations' cloud strategies. With cloud adoption showing no signs of slowing down, the IPAM market is well-positioned for sustained growth, offering solutions that support the evolving needs of businesses in their cloud journeys. The integration of IPAM with cloud services is set to drive market expansion as organizations seek to optimize their cloud-based networks and ensure seamless connectivity.Key Market Challenges

Materials Integration Complexity

The integration of diverse organic materials into electronic devices presents a significant challenge within the Global Internet Protocol Address Management (IPAM) Market. In contrast to conventional inorganic semiconductors, organic materials exhibit a wide range of properties, introducing complexities that can lead to compatibility issues and performance disparities among IPAM components. Achieving a harmonious and consistent level of performance across various organic materials while efficiently integrating them into IPAM solutions becomes a multifaceted endeavor. This intricate task necessitates substantial investments in research and development by manufacturers aiming to surmount these challenges and produce IPAM products that consistently deliver high performance and reliability. Consequently, the market's ability to provide seamless IP address management solutions hinges on the successful resolution of these integration complexities. by doing so, the IPAM market can continue to thrive and offer innovative solutions that cater to a wide array of network environments while maintaining consistent and dependable performance standards across diverse organic materials.Environmental Impact and Sustainability

Balancing the environmental impact of IPAM solutions represents a significant challenge for the Global Internet Protocol Address Management Market. While organic materials used in IPAM devices often possess a more eco-friendly profile compared to their inorganic counterparts, several environmental aspects demand meticulous attention. These include responsible sourcing of materials, effective recycling of electronic waste, and the judicious management of potentially hazardous chemicals employed in manufacturing processes. The core challenge lies in harmonizing the sustainability objectives of IPAM solutions with the imperative to mitigate environmental concerns. Achieving this delicate balance demands conscientious efforts. Moreover, meeting stringent environmental regulations while preserving cost-effectiveness amplifies the complexity of the task. Successfully navigating this challenge hinges on a continuous commitment to innovation and the adoption of ethical manufacturing practices. As the IPAM market strives to align with environmentally conscious trends, finding the right equilibrium will be paramount. by doing so, the market can continue to thrive, offering eco-friendly IP address management solutions that not only satisfy stringent environmental standards but also adhere to responsible, sustainable practices throughout the product lifecycle.Performance and Durability

Ensuring the performance and durability of IPAM components pose substantial challenges due to their susceptibility to degradation over time, stemming from factors like hardware limitations, data volume growth, and evolving networking technologies. This challenge is particularly pronounced in the IPAM market, where achieving a delicate equilibrium between long-term stability and optimal performance is imperative. Developers are compelled to direct substantial resources into research endeavors aimed at devising protective measures. These include the development of advanced algorithms, innovative data storage techniques, and enhancements to IPAM software itself, all of which collectively serve to safeguard the reliability and longevity of IPAM solutions. This challenge assumes heightened significance in applications that demand unwavering performance, making it imperative for developers to invest significantly in research and development. Consequently, the market's ability to deliver robust and long-lasting IPAM solutions hinges on the successful resolution of these durability concerns. by addressing these issues effectively, the IPAM market can bolster its appeal across various industries, offering reliable and resilient IP address management components capable of enduring the challenges of evolving networking landscapes while maintaining peak performance levels over extended periods.Standardization and Interoperability

The absence of universally accepted industry standards in the realm of IP address management presents a formidable obstacle, affecting both developers and users of IPAM solutions. This dearth of standardization gives rise to complications concerning compatibility among distinct IPAM devices and software, impeding their widespread acceptance and utilization. Consequently, it is imperative to institute uniform standards across the IPAM sector, spanning criteria for IP address allocation, network protocols, and data exchange formats. These standards hold pivotal importance in stimulating the expansion of the market. To achieve this, concerted efforts are required from all stakeholders within the industry. Collaboration is essential to devise and enact these universally recognized standards, ultimately fostering seamless interoperability and facilitating the smooth integration of IPAM components across a diverse array of network environments. This cooperative approach serves as the linchpin for the market's growth, ensuring that IPAM solutions can be seamlessly adopted and leveraged across industries and by users alike, thereby harnessing the full potential of this transformative technology.Key Market Trends

Flexible and Wearable Electronics

The Global Internet Protocol Address Management (IPAM) Market is witnessing a transformative trend centered around the rapid proliferation of flexible and wearable electronics. This trend gains prominence as consumer preferences shift towards electronic devices that offer enhanced comfort and adaptability. In this context, organic electronics are at the forefront of innovation. These lightweight and pliable components empower the creation of electronic devices that can bend and conform, leading to the development of flexible displays, smart wearables, and health monitoring devices. The driving force behind this trend is the growing aspiration for technology to seamlessly integrate into daily life. Internet Protocol Address Management materials play a pivotal role, enabling the engineering of flexible and user-centric devices that align with this consumer appetite for seamless integration. The trajectory of this trend is poised to continue on a robust growth path as the demand for cutting-edge wearable technology surges. Its impact resonates across diverse industries, from healthcare, where wearable health monitors are revolutionizing patient care, to fashion, where smart clothing is redefining style and functionality. This trend signifies a profound shift in consumer expectations and underscores the pivotal role played by organic electronics in enabling innovative, wearable, and adaptable electronic solutions.IoT Integration and Smart Environments

The integration of Internet of Things (IoT) technology and the evolution of smart environments represent significant trends exerting a substantial impact on the Global Internet Protocol Address Management (IPAM) Market. As IoT applications continue to expand across sectors like smart homes, agriculture, and healthcare, there is a discernible uptick in the demand for Internet Protocol Address Management sensors and displays. Organic electronics are gaining traction due to their inherent advantages, such as flexibility and efficiency, making them well-suited for crafting economical and low-power IoT devices. This trend gains momentum from the imperative for real-time data acquisition, process automation, and the establishment of intelligent control systems. Internet Protocol Address Management components facilitate the seamless integration of these devices into the intricate tapestry of IoT ecosystems. With the proliferation of smart environments in both residential and industrial settings, the convergence of organic electronics and IoT technologies is transformative. This amalgamation heralds a new era where the synergy between organic electronics and IoT redefines interactions with the world, fostering enhanced efficiency, convenience, and connectivity across various applications.Sustainability and Eco-Friendly Materials

Sustainability is a pivotal and overarching trend within the Global Internet Protocol Address Management (IPAM) Market. Heightened environmental consciousness permeates consumer preferences and industrial strategies, driving an escalating demand for eco-friendly electronic solutions. Organic materials used in electronic devices emerge as a natural choice, possessing inherent sustainability advantages over conventional inorganic counterparts. This trend is galvanized by a mounting commitment to curbing electronic waste, embracing renewable resources, and adopting ecologically sound manufacturing practices. Manufacturers invest substantially in research and development endeavors aimed at enhancing the sustainability of Internet Protocol Address Management materials and resultant devices, addressing the needs of the eco-conscious market segment. As sustainability retains its position as a paramount influencer, organic electronics play a fundamental role in aligning with and fulfilling environmental objectives, fostering a harmonious synergy between technological innovation and environmental stewardship.Healthcare and Medical Applications

The Healthcare and Medical Applications trend represent a significant transformation within the Global Internet Protocol Address Management (IPAM) Market, responding to the dynamic needs of the healthcare sector. Internet Protocol Address Management components are progressively finding their place in an array of medical devices, including biosensors, implantable electronics, and drug delivery systems. This surge in adoption is propelled by the increasing demand for medical solutions that are non-invasive, biocompatible, and flexible, aligning perfectly with organic materials' intrinsic properties. These materials offer the potential to create patient-centric and wearable medical devices, ushering in a new era of healthcare technology. As the healthcare industry continues its pursuit of innovative electronic solutions to enhance patient care and monitoring, the integration of organic electronics is poised to make significant contributions to medical technology and patient outcomes. This trend underscores the pivotal role organic electronics will play in the ongoing evolution of healthcare, promising advancements that prioritize patient well-being and comfort while revolutionizing the diagnosis, treatment, and management of medical conditions.Segmental Insights

Component Insights

In 2022, the Services segment asserted its dominance in the Global Internet Protocol Address Management (IPAM) Market and is poised to maintain its leading position throughout the forecast period. Services in the IPAM market encompass a wide range of offerings, including consulting, implementation, training, support, and managed services, all of which are crucial for organizations seeking effective IP address management solutions. The dominance of the Services segment can be attributed to several key factors. Firstly, as businesses worldwide continue to grapple with the challenges of complex and rapidly expanding networks, they increasingly rely on specialized service providers and consultants to streamline their IP address management processes. These services provide expertise in configuring, optimizing, and maintaining IPAM solutions, ensuring they align with an organization's specific needs and network infrastructure. Additionally, the growing complexity of IPv6 adoption and the need for efficient IP address allocation have driven organizations to seek professional services to navigate these intricacies. Furthermore, the ongoing shift towards cloud-based IPAM solutions necessitates service providers who can assist in seamless migration and integration. As the IPAM market continues to evolve, service providers will play a pivotal role in helping businesses harness the full potential of IP address management, ensuring the security, scalability, and optimization of their network infrastructure.Deployment Insights

In 2022, the Cloud-based deployment segment asserted its dominance in the Global Internet Protocol Address Management (IPAM) Market and is anticipated to maintain this leadership position in the forecast period. Several factors contribute to the cloud-based IPAM's prominence. Firstly, the increasing adoption of cloud computing across industries has driven organizations to seek IPAM solutions that seamlessly integrate with their cloud infrastructure. Cloud-based IPAM offers the flexibility and scalability necessary to support dynamic, distributed, and virtualized network environments, making it an ideal choice for modern businesses. Furthermore, the cloud-based deployment model aligns well with the trend towards remote work and the decentralization of IT infrastructure. With more organizations embracing hybrid and multi-cloud architectures, cloud-based IPAM solutions provide a centralized and accessible platform for efficient IP address management across diverse environments. Cost-effectiveness is another driving factor, as cloud-based solutions eliminate the need for extensive on-premises hardware and maintenance costs. They offer a pay-as-you-go pricing model, allowing organizations to scale resources based on their specific requirements. Additionally, cloud-based IPAM solutions often include built-in automation and real-time monitoring capabilities, which are crucial for maintaining network health and security in dynamic environments. As the demand for flexible, scalable, and cost-efficient IP address management solutions continues to grow, the cloud-based IPAM segment is well-positioned to maintain its dominance in the market, catering to the evolving needs of organizations in an increasingly digital and cloud-centric landscape.Regional Insights

The North American region emerged as the dominant force in the Global Internet Protocol Address Management (IPAM) Market and is poised to maintain its leadership throughout the forecast period. North America's dominance can be attributed to several key factors. Firstly, it houses a substantial number of large enterprises and data centers, both of which have a critical need for efficient IP address management to support their extensive network infrastructure. Additionally, the region boasts a thriving technology ecosystem, with many IPAM solution providers headquartered in the United States and Canada, further driving innovation and adoption in the market. North America's commitment to network security and compliance has spurred the adoption of IPAM solutions, as they play a pivotal role in ensuring the integrity and security of network resources. Moreover, the region has been at the forefront of IPv6 adoption, driven by the exhaustion of IPv4 addresses, and this transition has created a significant demand for advanced IPAM solutions capable of managing both IPv4 and IPv6 addresses seamlessly. The robust regulatory landscape in North America, particularly regarding data privacy and security, has compelled organizations to invest in comprehensive IPAM solutions to meet compliance requirements. With the increasing complexity of network environments and the rise of cloud-based services, North American businesses are expected to continue prioritizing IP address management as an essential component of their IT infrastructure, sustaining the region's dominance in the Global IPAM Market.Key Market Players

- BT Diamond IP

- Bluecat Network

- Crypton Computers Ltd.

- BT INS

- Cisco Systems

- Men & Mice

- Infoblox

- Microsoft

- Tcpwave

- FusionLayer

- No-IP

- DNS Made Easy

- NS1

- Iris Network Systems

- Entuity

- SolarWinds

- Zscaler

Report Scope

In this report, the Global Internet Protocol Address Management Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Global Internet Protocol Address Management Market, by Component:

- Software

- Services

Global Internet Protocol Address Management Market, by Deployment:

- On-Premises

- Cloud

Global Internet Protocol Address Management Market, by Organization size:

- SME

- Large Enterprises

Global Internet Protocol Address Management Market, by Region:

- North America

- Europe

- South America

- Middle East & Africa

- Asia Pacific

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Internet Protocol Address Management Market.Available Customizations

The following customization option is available based on your specific needs: Detailed analysis and profiling of additional market players (up to five).This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- BT Diamond IP

- Bluecat Network

- Crypton Computers Ltd.

- BT INS

- Cisco Systems

- Men & Mice

- Infoblox

- Microsoft

- Tcpwave

- FusionLayer

- No-IP

- DNS Made Easy

- NS1

- Iris Network Systems

- Entuity

- SolarWinds

- Zscaler

Table Information

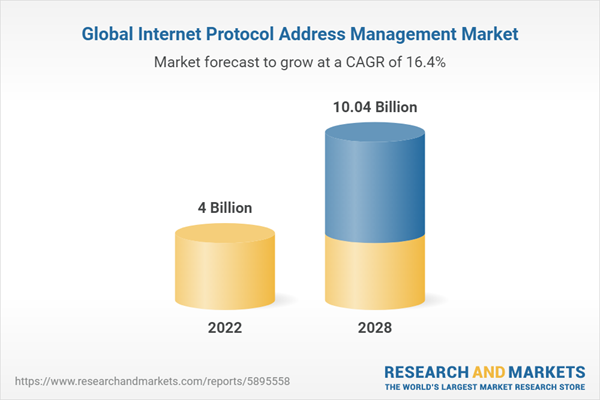

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | October 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 4 Billion |

| Forecasted Market Value ( USD | $ 10.04 Billion |

| Compound Annual Growth Rate | 16.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 17 |