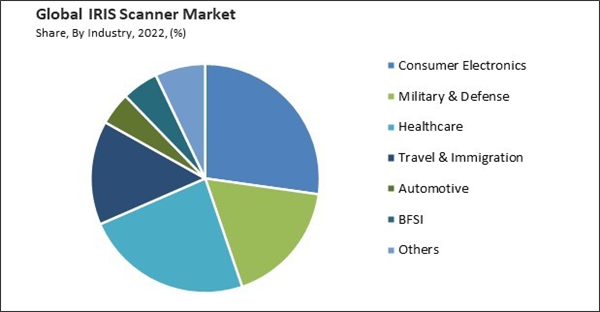

Military personnel and defense contractors often use iris scanning technology for identity verification. This is essential for ensuring that individuals are who they claim to be within military installations and in the field. Thus, the military and defense segment would register around 18% share in the market by 2030. Iris scanners are integrated into weapons and equipment to enhance security and restrict access. This helps prevent unauthorized use or tampering with military assets. Military & defense personnel uses iris scanners to securely access classified information and secure communication systems, assuring that only authorized individuals can access sensitive data. Some of the factors impacting the market are expansion of contactless biometrics, growing need for security and authentication and high cost of IRIS scanner.

In a post-COVID-19 world, the importance of hygienic and touchless technologies has grown. Iris recognition is contactless because it entails scanning the iris from a distance, eliminating the need for physical contact with a sensor or device. In healthcare settings, contactless biometrics are crucial for patient safety and hygiene. Iris scanners allow for patient identification and secure access to electronic health records without physical touch, reducing the risk of cross-contamination. Traditional biometric methods like fingerprint or handprint scanning can raise concerns about hygiene and disease transmission. The emphasis on contactless biometrics, considering hygiene and security concerns, has driven the adoption of iris scanning technology in various sectors, including healthcare, government, finance, and access control. Additionally, one of the primary drivers for the market is the increasing demand for highly secure and reliable authentication methods. Iris recognition is known for its accuracy and the uniqueness of everyone’s iris patterns, making it a robust solution for identity verification and access control. The need for secure financial transactions is critical in the financial services sector. These are used for secure logins, transaction authorization, and biometric payments, adding a layer of security to digital financial services. As the demand for touchless and secure authentication methods grows and the growing security and authentication needs are significant drivers for the growth of the market.

However, High-quality iris scanning technology is relatively expensive to implement. This cost is a barrier to adoption, especially for smaller organizations or applications with tight budgets. The cost of acquiring and installing iris scanning hardware and software is a significant barrier for organizations, especially smaller businesses or institutions with limited budgets. The upfront investment required to implement the technology can be a deterrent. Integrating iris scanning technology with existing access control systems or other security infrastructure can involve additional costs. Addressing these concerns and ensuring user acceptance is a challenge. The cost of implementing iris scanning technology is a factor that slows down its adoption in specific applications and markets.

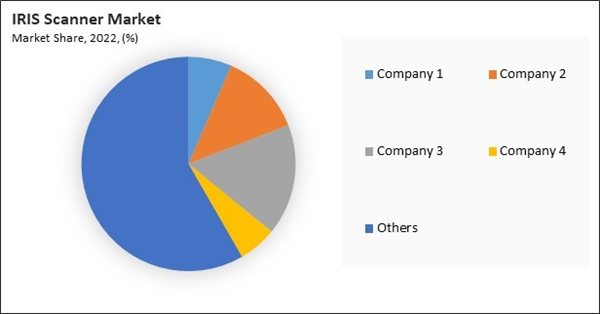

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

Industry Outlook

Based on industry, the market is classified into consumer electronics, healthcare, military & defense, BFSI, travel & immigration, automotive, and others. In 2022, the consumer electronics segment witnessed the largest revenue share in the market. Iris scanning technology has been integrated into high-end smartphones as an additional biometric security feature alongside fingerprint recognition. Users can unlock their devices, make secure payments, and access sensitive information using irises. This added layer of security is attractive to consumers, especially for privacy-conscious users. Some tablets and laptops have also incorporated iris scanners for secure logins and user authentication.Component Outlook

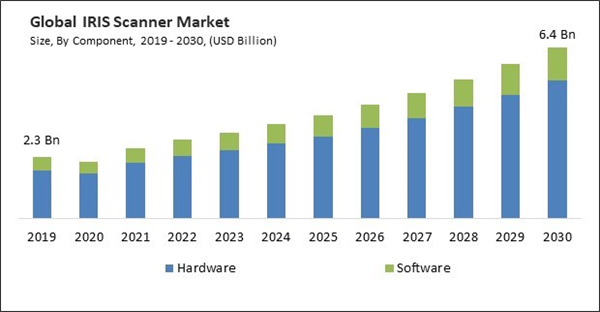

By component, the market is categorized into software and hardware. In 2022, the software segment covered a considerable revenue share in the market. Iris enrollment software is used to capture and store the unique iris patterns of individuals. During enrollment, individuals' irises are scanned and converted into a template stored securely for future authentication. The core of iris recognition software involves matching algorithms that compare the captured iris patterns with stored templates to determine whether a person's identity is verified. These algorithms are responsible for the accuracy and reliability of the recognition process.Regional Outlook

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region led the market by generating the highest revenue share. North America, particularly the United States and Canada, witnessed increasing adoption of iris scanning technology. This adoption was driven by the need for highly secure and accurate biometric authentication in various sectors, including government, healthcare, finance, and corporate enterprises. North America's government and defense sectors have significantly used iris recognition technology. Iris scanners were employed in secure facilities, border control, immigration, and military applications to enhance security and control access to sensitive areas.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Dermalog Identification Systems GmbH, M2SYS Technology, ams-OSRAM AG. eyeLock LLC (VOXX International Corporation), Princeton Identity, Inc., CMITech Co, Ltd., HID Global Corporation (Assa Abloy AB), Thales Group S.A., Iris ID, Inc. and IrisGuard Ltd.

Scope of the Study

Market Segments Covered in the Report:

By Component- Hardware

- Software

- Consumer Electronics

- Military & Defense

- Healthcare

- Travel & Immigration

- Automotive

- BFSI

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Dermalog Identification Systems Gmbh

- M2SYS Technology

- ams-OSRAM AG

- eyeLock LLC (VOXX International Corporation)

- Princeton Identity, Inc.

- CMITech Co, Ltd.

- HID Global Corporation (Assa Abloy AB)

- Thales Group S.A.

- Iris ID, Inc.

- IrisGuard Ltd.

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Dermalog Identification Systems Gmbh

- M2SYS Technology

- ams-OSRAM AG

- eyeLock LLC (VOXX International Corporation)

- Princeton Identity, Inc.

- CMITech Co, Ltd.

- HID Global Corporation (Assa Abloy AB)

- Thales Group S.A.

- Iris ID, Inc.

- IrisGuard Ltd.