The bottled water market has grown steadily over the past years, but with the launch of various functional bottled water, it is anticipated to grow faster than earlier. In Italy, more than 80 companies are operating in the bottled water industry, which makes the country one of the largest exporters of bottled water across the region. The concerns related to the contaminated water from tap water and the mobility and convenience that bottled water offers are benefiting the bottled water market across the country. The market is driven by the nation's rising disposable income, allowing more sales revenue for market participants. In some areas, the market is driven by increasing population demand and ineffective water supply management. The market study's sparkling water sector is predicted to grow faster as consumers switch to sparkling water enhanced with vitamins and minerals. The growing popularity of healthy lifestyles and the widespread use of bottled water for sports and outdoor activities like hiking and camping are the leading causes of the strong demand for Italy bottled water. Additionally, the market study is producing lucrative prospects for both current producers and new entrants due to the rising demand for bottled water packaged in an environmentally sustainable manner.

Moreover, according to Fine Waters, Italians consume the most bottled water per person in Europe. There are over 600 domestic Italian bottled water brands, which means about 600 different bottled water brands are sourced in Italy. Every Italian family pays roughly USD 318.43 a year on average. An Italian's average amount of water is nearly half a liter, and over half of the population prefers bottled water to tap water. In Italy, different mineral water brands are available in bottles, bearing their brand names and the locations where they were welled.

Italy Bottled Water Market Trends

Growth in Foodservice Expenditure and Tourism

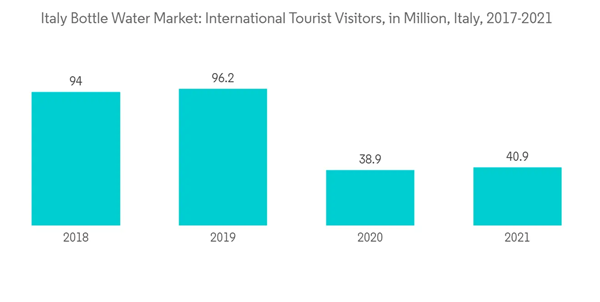

The Italian bottled market is expected to register steady growth from the food service and tourism industry. The still water segment is expected to register a high sales growth in volume, and the sparkling and functional features are expected to register a high sales growth in value. This can be attributed to the increasing consumer demand for high-quality premium sparkling and fortified drinking water, especially from the food service sector. Bottled water is usually charged much higher prices than off-trade retail distribution channels. In recent years, increasing tourism in Italy facilitated the growth in food service expenditure, propelling the development of the bottled water market. The market for bottled water currently offers a wide range of products with various features and costs. Thus, the extrinsic qualities, such as brand, packaging, origin, etc., and intrinsic qualities, such as the mineral composition of bottled water, affect its pricing.The growing food service channel is also one of the major driving factors for the sales value of bottled water, as food service occupies more than 60% of the market share due to high product prices in this channel. Additionally, bottled water in Italian restaurants is associated with premiumization, and it is known to be five times costlier in food service outlets than in supermarkets. This factor is impacting its consumption value to a large extent. Moreover, according to a Survey conducted by Banca d'Italia, Italy's overall number of foreign visitors as international tourists in 2021 accounted for nearly 41 million. Over USD 169.832 billion of the Italian GDP was added in 2021 due to travel and tourism. Thus with the boosting tourism sector in Italy, it is anticipated that it will impact the bottled market positively.

The Still Water Segment Holds the Largest Market Share

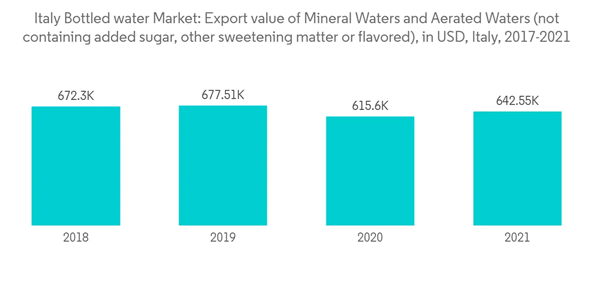

The still water segment holds a larger share of the market owing to its availability, and consumer preference. Still, spring water is another potential segment in the Italian water industry, although it is still very small. Spring water is increasingly used in the water cooler segment. Moreover, mineral water is a major part of the still water segment in the country. Italy is a country rich in mineral waters and, considering its orographic constitution, it can rely on natural mineral waters of different origins and compositions as a result of its granite rocks, dolomites calcareous, and volcanic rocks. Also, Italy is one of the major exporters of mineral water to the United States.Moreover, there are many players in the market offering spring water in bottled formats, for instance, the Italian still natural spring water brand called Acqua Panna comes from Tuscany's Gazzarro Mountain. The Panna factory has Europe's most cutting-edge bottling facilities, and currently, one of the top imported still waters at fine dining establishments in the United States is Acqua Panna Natural Spring Water.

Italy Bottled Water Market Competitor Analysis

Key players are focusing on product development and product innovation to meet the consumer's needs by offering a variety of tastes and product quality to maintain premiumization. The major companies in the Italian bottled water market are focusing on mergers and acquisitions, geographical expansions, product innovations, and partnerships to establish a broader consumer base for bottled water and strengthen their overall sales. Some of the major players use mergers and acquisitions as their key strategy. The strategy to follow mergers and acquisitions by these top players is to sustain and secure a leading position in the industry. This will enable the companies to maintain dominance over other players and remain in intense competition with other players in the market. Some major Italian bottled water market players are Acqua Minerale San Benedetto SpA, Ferrarelle SpA, Refresco Group BV (Spumador SpA), and Lauretana SpA.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Acqua Minerale San Benedetto SpA

- Nestle SA (Sanpellegrino SpA)

- Fonti di Vinadio SpA

- Ferrarelle SpA

- CoGeDi International SpA

- Acqua Lete

- Lauretana SpA

- Refresco Group BV (Spumador SpA)

- Maniva SpA