Global Jet Fuel Additives Market - Key Trends & Drivers Summarized

Why Are Jet Fuel Additives Essential for Aviation Performance and Safety?

Jet fuel additives are crucial in the aviation industry, where they are used to enhance fuel performance, ensure safety, and improve engine efficiency. These additives address a range of issues, from preventing fuel freezing at high altitudes to reducing deposits in fuel systems and improving combustion efficiency. Key types of jet fuel additives include anti-icing agents, antioxidants, corrosion inhibitors, and detergents. Anti-icing agents, for example, are vital for preventing the formation of ice crystals in fuel, which can clog fuel lines and filters, potentially leading to engine failure. The use of additives is particularly important in modern aviation, where engines are designed to operate under extreme conditions, and fuel performance directly impacts operational safety and efficiency. As airlines and aircraft manufacturers continue to seek ways to optimize fuel efficiency and reduce maintenance costs, the demand for high-performance jet fuel additives is expected to grow.How Are Technological Advancements Shaping the Development of Jet Fuel Additives?

Technological advancements are significantly shaping the development of jet fuel additives, making them more effective and environmentally friendly. Innovations in additive chemistry are leading to the creation of multi-functional additives that can simultaneously address multiple performance and safety issues. For instance, modern additives are being developed to enhance fuel stability, prevent corrosion, and improve lubricity, all in a single formulation. Additionally, the push towards sustainability in the aviation industry is driving research into bio-based and renewable jet fuel additives. These advancements not only help in reducing the environmental impact of aviation but also ensure compliance with increasingly stringent regulations on emissions and fuel composition. The integration of nanotechnology is another emerging trend, with nanoparticles being used to improve the dispersion and efficacy of additives, leading to better engine performance and reduced maintenance requirements.What Challenges and Opportunities Exist in the Jet Fuel Additives Market?

The jet fuel additives market faces several challenges, including regulatory compliance, the high cost of additive development, and the need for compatibility with diverse fuel types. Regulatory bodies such as the Federal Aviation Administration (FAA) and the International Civil Aviation Organization (ICAO) impose strict standards on fuel additives, ensuring they meet safety and environmental criteria. Compliance with these regulations can be costly and time-consuming, particularly as new environmental standards are introduced. Additionally, the high cost of developing advanced additives can be a barrier for smaller companies looking to enter the market. However, these challenges also present significant opportunities for innovation and market expansion. The growing demand for more efficient and sustainable aviation fuels is driving the need for new additive formulations that can enhance fuel performance while reducing environmental impact. Companies that can develop cost-effective, multi-functional, and environmentally friendly additives are well-positioned to capitalize on this growing demand.What Factors Are Driving Growth in the Jet Fuel Additives Market?

The growth in the jet fuel additives market is driven by several factors, including the increasing demand for fuel efficiency, the rising focus on environmental sustainability, and the expanding global aviation industry. As airlines and aircraft manufacturers strive to reduce operating costs and minimize their environmental footprint, the use of high-performance jet fuel additives is becoming increasingly important. The push towards more sustainable aviation fuels, including biofuels, is also contributing to the demand for additives that can enhance the performance of these alternative fuels. Additionally, the growth of the global aviation industry, particularly in emerging markets, is driving the need for more reliable and efficient fuel solutions. The ongoing advancements in additive technology, coupled with the increasing regulatory focus on emissions and fuel efficiency, are expected to further fuel the growth of the jet fuel additives market in the coming years.Report Scope

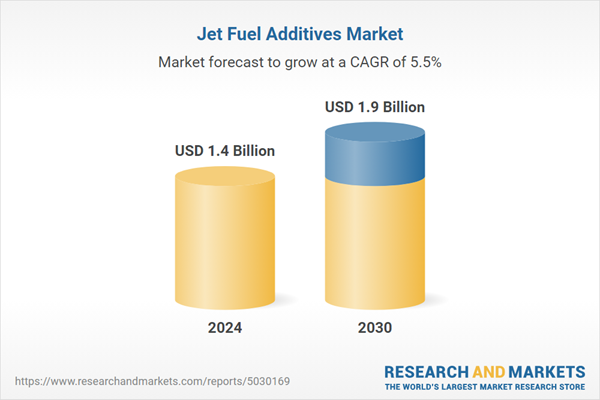

The report analyzes the Jet Fuel Additives market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Segment (Icing Inhibitors, Antioxidants, Antiknock Additives, Metal Deactivators, Corrosion Inhibitors, Other Segments); End-Use (Passenger, Cargo).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Icing Inhibitors segment, which is expected to reach US$636.8 Million by 2030 with a CAGR of 5.6%. The Antioxidants segment is also set to grow at 7.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $383.1 Million in 2024, and China, forecasted to grow at an impressive 5.2% CAGR to reach $300.9 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Jet Fuel Additives Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Jet Fuel Additives Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Jet Fuel Additives Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Afton Chemical Corporation, BASF SE, Cummins Filtration, Dorf-Ketal Chemicals India Pvt., Ltd., Dow, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 46 companies featured in this Jet Fuel Additives market report include:

- Afton Chemical Corporation

- BASF SE

- Cummins Filtration

- Dorf-Ketal Chemicals India Pvt., Ltd.

- Dow, Inc.

- DuPont de Nemours, Inc.

- General Electric Company

- Hammonds

- Innospec, Inc.

- Lanxess AG

- Meridian Fuels

- Nalco an Ecloab Company

- Shell Chemicals LP

- The Chemours Company

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Afton Chemical Corporation

- BASF SE

- Cummins Filtration

- Dorf-Ketal Chemicals India Pvt., Ltd.

- Dow, Inc.

- DuPont de Nemours, Inc.

- General Electric Company

- Hammonds

- Innospec, Inc.

- Lanxess AG

- Meridian Fuels

- Nalco an Ecloab Company

- Shell Chemicals LP

- The Chemours Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 246 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.4 Billion |

| Forecasted Market Value ( USD | $ 1.9 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |