Global Nephrology Drugs Market - Key Trends & Drivers Summarized

Why Are Nephrology Drugs Critical in Managing the Rising Global Burden of Kidney-Related Disorders?

Nephrology drugs, which target conditions affecting renal function - including chronic kidney disease (CKD), acute kidney injury (AKI), glomerulonephritis, nephrotic syndrome, and end-stage renal disease (ESRD) - are gaining prominence in response to the growing global prevalence of kidney-related health burdens. With over 850 million people worldwide affected by kidney diseases, according to the International Society of Nephrology, pharmacological intervention has become central to delaying disease progression, minimizing complications, and improving patient quality of life.Key drivers include the rapid rise in diabetes, hypertension, obesity, and aging populations - all of which significantly elevate renal risk. Moreover, kidney complications are often detected late, necessitating aggressive pharmacological management to stabilize function and prevent dialysis or transplantation. Therapies span a wide range, including antihypertensives (ACE inhibitors, ARBs), erythropoiesis-stimulating agents (ESAs), phosphate binders, potassium binders, sodium-glucose co-transporter 2 (SGLT2) inhibitors, and immunosuppressants. With nephrology intersecting both primary care and specialty medicine, drug innovation in this space is expanding into cardiometabolic and immunological domains.

How Are Therapeutic Innovations and Renal-Specific Drug Designs Transforming Disease Management?

The therapeutic landscape for nephrology is shifting from symptom management to disease-modifying approaches, driven by drug innovations that specifically target renal pathology. SGLT2 inhibitors, initially approved for type 2 diabetes, have demonstrated renal protective effects, slowing progression of CKD and reducing hospitalization rates for heart failure in patients with impaired renal function. Finerenone, a non-steroidal mineralocorticoid receptor antagonist (MRA), is another breakthrough therapy shown to reduce albuminuria and delay ESRD in diabetic kidney disease.Biologics and targeted immunosuppressants are also being developed for glomerular diseases such as lupus nephritis, focal segmental glomerulosclerosis (FSGS), and IgA nephropathy. Monoclonal antibodies like belimumab and voclosporin are expanding treatment options in autoimmune nephropathies. Precision dosing algorithms, renal pharmacogenomics, and drug delivery systems tailored for reduced renal clearance are enabling safer and more effective therapy across CKD stages. These developments are shifting nephrology from reactive treatment to proactive, organ-preserving care.

Which Patient Populations and Regional Healthcare Systems Are Shaping Demand for Nephrology Therapeutics?

The largest patient cohorts requiring nephrology drugs are those with diabetes, hypertension, and aging-related renal function decline. CKD disproportionately affects older adults and people of color, particularly in the U.S., South Asia, and parts of Africa where access to screening and early intervention remains limited. The global dialysis population - projected to surpass 5 million in the next decade - also drives ongoing demand for anemia management, phosphate regulation, and potassium stabilization drugs.North America is the leading market, driven by high disease prevalence, mature dialysis infrastructure, and widespread access to specialist care. Europe follows closely with integrated renal care pathways and widespread adoption of SGLT2 inhibitors. Asia-Pacific is experiencing the fastest growth due to high rates of diabetic nephropathy, large undiagnosed populations, and evolving reimbursement frameworks. India, China, and Japan are witnessing both rising disease incidence and local pharmaceutical investment in renal therapeutics. Latin America and the Middle East are emerging markets, where urbanization and non-communicable disease prevalence are accelerating nephrology drug uptake.

What Is Fueling Long-Term Growth and Innovation in the Nephrology Drugs Market?

The growth in the nephrology drugs market is fueled by an aging global population, increasing incidence of comorbidities such as diabetes and cardiovascular disease, and the clinical urgency of preventing dialysis and transplant dependence. Global health policy is emphasizing CKD screening, biomarker-driven stratification, and early pharmacological intervention, reinforcing the role of nephrology drugs across primary and tertiary care. Collaborative care models between nephrologists, endocrinologists, and cardiologists are further boosting integrated prescribing.Pipeline innovation is accelerating with novel agents targeting fibrosis, inflammation, and endothelial dysfunction. Partnerships between pharma firms and renal research networks are enabling rapid clinical trials, real-world data analysis, and biomarker validation. Digital health tools, including eGFR monitoring apps and AI-driven nephropathy risk calculators, are supporting personalized therapy and medication adherence. As CKD moves up the global health agenda, nephrology drugs will remain indispensable - delivering not only renal protection but systemic benefits across the heart-kidney-metabolic axis.

Report Scope

The report analyzes the Nephrology Drugs market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Administration Route (Oral, Parenteral, Other Administration Routes); Drug Class (ACE Inhibitors, Angiotensin Receptor Blockers, B-Blockers, Calcium Channel Blockers, Loop Diuretics Erythropoiesis-Stimulating Agents, Phosphate Binders, Other Drug Classes); Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Online Pharmacy).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Oral Administration segment, which is expected to reach US$12.7 Billion by 2030 with a CAGR of a 4%. The Parenteral Administration segment is also set to grow at 5.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $4.5 Billion in 2024, and China, forecasted to grow at an impressive 7.2% CAGR to reach $4.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Nephrology Drugs Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Nephrology Drugs Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Nephrology Drugs Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aman Resorts, AndBeyond, Banyan Group, Campfire Company, ChoZen Retreat and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Nephrology Drugs market report include:

- AbbVie Inc.

- Akebia Therapeutics, Inc.

- Alexion Pharmaceuticals

- Amgen Inc.

- AstraZeneca plc

- Baxter International Inc.

- Biocon Limited

- CSL Vifor

- Dr. Reddy's Laboratories Ltd.

- F. Hoffmann-La Roche AG

- FibroGen, Inc.

- Fresenius Medical Care AG & Co. KGaA

- GlaxoSmithKline plc (GSK)

- Johnson & Johnson

- Novartis AG

- Pfizer Inc.

- Sanofi S.A.

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- Zydus Lifesciences Limited

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AbbVie Inc.

- Akebia Therapeutics, Inc.

- Alexion Pharmaceuticals

- Amgen Inc.

- AstraZeneca plc

- Baxter International Inc.

- Biocon Limited

- CSL Vifor

- Dr. Reddy's Laboratories Ltd.

- F. Hoffmann-La Roche AG

- FibroGen, Inc.

- Fresenius Medical Care AG & Co. KGaA

- GlaxoSmithKline plc (GSK)

- Johnson & Johnson

- Novartis AG

- Pfizer Inc.

- Sanofi S.A.

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- Zydus Lifesciences Limited

Table Information

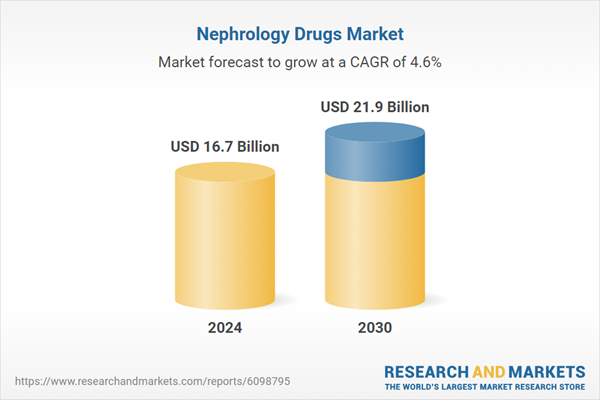

| Report Attribute | Details |

|---|---|

| No. of Pages | 386 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 16.7 Billion |

| Forecasted Market Value ( USD | $ 21.9 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Global |