Global Laboratory Automated Incubators Market - Trends & Technological Developments

Why Are Automated Incubators Becoming Vital in Modern Laboratory Settings?

Automated incubators are becoming vital in modern laboratory settings, providing precise control over environmental conditions such as temperature, humidity, and CO2 levels, which are crucial for a wide range of biological and chemical experiments. These incubators are particularly important in applications such as cell culture, microbiology, and pharmaceutical testing, where maintaining consistent and optimal conditions is essential for reproducibility and accuracy. The automation of incubators eliminates the need for manual monitoring and adjustments, reducing the potential for human error and ensuring that samples are kept under ideal conditions at all times. As research and production processes become more complex and demand increases for high-throughput and reliable results, the adoption of automated incubators is accelerating across various scientific and industrial fields.How Are Technological Innovations Enhancing Automated Incubators?

Technological innovations are significantly enhancing the performance and capabilities of automated incubators, making them more precise, reliable, and user-friendly. Advances in sensor technology are enabling more accurate monitoring and control of environmental parameters, ensuring that even slight fluctuations in temperature, humidity, or gas concentration are quickly corrected. The integration of data logging and remote monitoring systems allows researchers to track and manage incubator conditions in real-time, even from off-site locations, providing greater flexibility and control over experiments. The development of modular and customizable incubators is also allowing laboratories to tailor incubation conditions to specific applications, such as tissue engineering or drug screening. Additionally, the use of energy-efficient components and materials is improving the sustainability of automated incubators, reducing their environmental impact while maintaining high performance. These innovations are driving the adoption of automated incubators in laboratories that require precision, reliability, and efficiency.What Challenges Are Present in the Laboratory Automated Incubators Market?

The laboratory automated incubators market faces several challenges, including the high cost of advanced systems, the need for regular maintenance and calibration, and the complexity of integrating incubators with other laboratory automation equipment. The cost of purchasing and maintaining high-performance automated incubators can be significant, particularly for smaller laboratories or those with limited budgets. Regular maintenance and calibration are also essential to ensure that incubators continue to operate at peak performance, which can add to the operational costs and require specialized technical support. Integrating automated incubators with other laboratory automation systems, such as robotic arms or automated liquid handlers, can also be complex, requiring careful coordination and compatibility between different devices. To address these challenges, manufacturers are developing more cost-effective incubator models, offering comprehensive maintenance and support services, and focusing on creating interoperable systems that can be easily integrated into existing laboratory workflows.What Factors Are Driving Growth in the Laboratory Automated Incubators Market?

The growth in the laboratory automated incubators market is driven by several factors, including the increasing demand for high-throughput and precision research, the expansion of biopharmaceutical and clinical research activities, and the continuous advancements in laboratory automation technology. As the scope of scientific research expands, particularly in fields such as cell therapy, regenerative medicine, and microbiome studies, the need for reliable and consistent incubation conditions is becoming more critical, driving the adoption of automated incubators. The growth of the biopharmaceutical industry, with its emphasis on precision medicine and biologics, is also contributing to market growth, as these areas require stringent control over culture and testing environments. Additionally, the ongoing advancements in automation technology, including AI-driven optimization and enhanced sensor integration, are making automated incubators more accessible and effective, further supporting their adoption. As these trends continue, the laboratory automated incubators market is expected to grow, driven by the need for efficiency, reliability, and precision in modern laboratory environments.Report Scope

The report analyzes the Laboratory Automated Incubators market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: End-Use (Pharma & Biotech Companies, Research & Academic Institutes, Contract Research Organizations).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Pharma & Biotech Companies End-Use segment, which is expected to reach US$399.4 Million by 2030 with a CAGR of 4%. The Research & Academic Institutes End-Use segment is also set to grow at 3.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $193.8 Million in 2024, and China, forecasted to grow at an impressive 3.8% CAGR to reach $142.7 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Laboratory Automated Incubators Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Laboratory Automated Incubators Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Laboratory Automated Incubators Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as BD, bioMrieux, BioTek Instruments, DRG International Inc., INHECO GmbH and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 38 companies featured in this Laboratory Automated Incubators market report include:

- BD

- bioMrieux

- BioTek Instruments

- DRG International Inc.

- INHECO GmbH

- Shimadzu

- TAP Biosystems

- Tecan

- Thermo Fisher Scientific

- Xiril AG

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BD

- bioMrieux

- BioTek Instruments

- DRG International Inc.

- INHECO GmbH

- Shimadzu

- TAP Biosystems

- Tecan

- Thermo Fisher Scientific

- Xiril AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 221 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

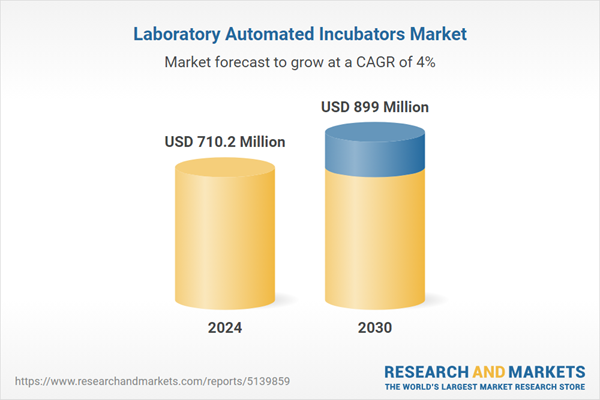

| Estimated Market Value ( USD | $ 710.2 Million |

| Forecasted Market Value ( USD | $ 899 Million |

| Compound Annual Growth Rate | 4.0% |

| Regions Covered | Global |