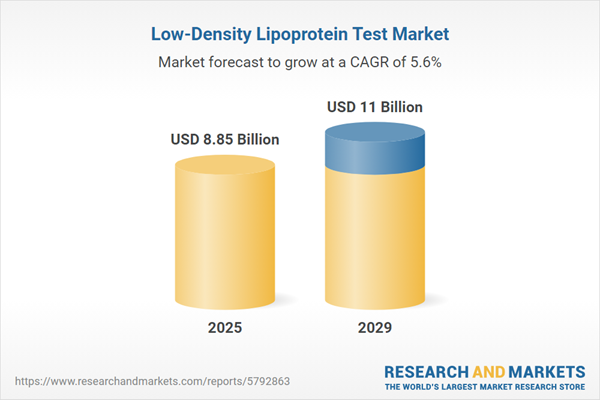

The low-density lipoprotein test market size is expected to see strong growth in the next few years. It will grow to $11 billion in 2029 at a compound annual growth rate (CAGR) of 5.6%. The growth in the forecast period can be attributed to increasing healthcare expenditure, aging population demographics, rise in cardiovascular disease burden, shift towards personalized medicine, healthcare policy and guidelines. Major trends in the forecast period include rising cardiovascular disease prevalence, emphasis on preventive healthcare, personalized medicine and treatment, focus on health awareness and education, regulatory guidelines and recommendations.

The increasing prevalence of cardiovascular diseases is expected to drive the growth of the low-density lipoprotein (LDL) test market in the coming years. Cardiovascular diseases are conditions that affect the heart or blood vessels. The LDL test is used to manage cardiovascular diseases by directly measuring the levels of low-density lipoprotein in the body. For example, in February 2024, the UK Parliament, the governing body of the UK, reported that heart and circulatory diseases are responsible for around 25% of all deaths in England, causing over 140,000 fatalities annually and approximately 480 deaths per day, or one death every three minutes. As a result, the growing prevalence of cardiovascular diseases is boosting the demand for LDL tests.

The increasing prevalence of obesity is expected to fuel the growth of the low-density lipoprotein test market. Obesity, characterized by excessive body fat accumulation and a body mass index (BMI) of 30 or higher, is associated with numerous health risks. The low-density lipoprotein (LDL) test is instrumental in measuring LDL cholesterol levels in individuals affected by obesity. For instance, according to the World Health Organization's March 2022 report, over 1 billion individuals globally grapple with obesity, comprising 650 million adults, 340 million adolescents, and 39 million children, with these numbers on the rise. Additionally, it is estimated that around 167 million people are poised to experience compromised health due to being overweight or obese. Therefore, the increasing prevalence of obesity is propelling the growth of the low-density lipoprotein test market.

Product innovations are becoming increasingly popular in the low-density lipoprotein (LDL) test market. Leading companies in this sector are launching innovative products to maintain their market positions. For example, in July 2023, Numares Health, a diagnostic company based in Germany, introduced the AXINON LDL-p Test System. This FDA-approved diagnostic tool offers a more comprehensive analysis of lipoproteins, providing insights into cardiac function that go beyond traditional LDL-C measurements. The system uses nuclear magnetic resonance (NMR) spectroscopy and advanced diagnostic algorithms to improve accuracy. It aids physicians in managing patients with a high risk of cardiovascular disease, especially those with cardiometabolic risk factors.

In February 2023, AstraZeneca PLC, a UK-based pharmaceutical and biotechnology company, completed the acquisition of CinCor Pharma Inc. for an undisclosed amount. This strategic move is expected to bolster AstraZeneca's cardiorenal pipeline, expanding it with Baxdrostat, a novel aldosterone synthase inhibitor (ASI). CinCor Pharma Inc., a US-based clinical-last biotechnology company, specializes in developing therapies for lowering LDL hypertension.

Major companies operating in the low-density lipoprotein test market include Abbott Laboratories, Qiagen N.V., Randox Laboratories Ltd., Eurofins Scientific SE, Danaher Corporation, Bio-Rad Laboratories Inc., OPKO Health Inc., DiaSorin S.p.A., Boster Biological Technology Ltd., Rockland Immunochemicals Inc., Sekisui Diagnostics LLC, DiaSys Diagnostic Systems GmbH, Eurolyser Diagnostica GmbH, Diazyme Laboratories Inc., Cell Biolabs Inc, Home Access Health Corporation, Thermo Fisher Scientific Inc., Becton, Dickinson and Company, Quest Diagnostics Incorporated, SpectraCell Laboratories Inc., Siemens Healthineers, Laboratory Corporation of America Holdings, Merck KGaA, F Hoffmann-La Roche Ltd., Agilent Technologies Inc., BioVision Incorporated, Abcam plc, BioAssay Systems, BioChain Institute Inc., BioLegend Inc., Enzo Life Sciences Inc., GenScript Biotech Corporation.

North America was the largest region in the Low-Density Lipoprotein Test market in 2024. The regions covered in the low-density lipoprotein test market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the low-density lipoprotein test market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The low-density lipoprotein test market includes revenues earned by entities by measuring very low-density lipoprotein (VLDL) testing and ultra low-density lipoprotein (ULDL) testing services. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The low-density lipoprotein (LDL) test is a blood test employed by doctors to measure a patient's levels of LDL cholesterol in the bloodstream. This testing can evaluate LDL levels independently or as part of a lipid panel test, offering insights into the accumulation of cholesterol in the arteries, which can contribute to heart attacks and strokes.

The primary product types of low-density lipoprotein tests include LDL-C, LDL-P, LDL-B, and other related products. Low-density lipoprotein cholesterol (LDL-C), commonly known as 'bad cholesterol,' tends to accumulate in the walls of blood vessels, increasing the risk of health issues such as heart attacks or strokes. The components used in these tests include kits, reagents, devices, and other related components. These tests find applications in various health conditions such as diabetes, stroke, atherosclerosis, obesity, dyslipidemia, carotid artery disease, peripheral arterial disease, angina, among others. Distribution channels encompass direct tenders and retail outlets, with usage prevalent in hospitals, clinics, ambulatory care centers, research laboratories, and other healthcare settings.

The low-density lipoprotein test market research report is one of a series of new reports that provides low-density lipoprotein test market statistics, including low-density lipoprotein test industry global market size, regional shares, competitors with a low-density lipoprotein test market share, detailed low-density lipoprotein test market segments, market trends and opportunities, and any further data you may need to thrive in the low-density lipoprotein test industry. This low-density lipoprotein test market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Low-Density Lipoprotein Test Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on low-density lipoprotein test market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for low-density lipoprotein test ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The low-density lipoprotein test market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- the market characteristics section of the report defines and explains the market.

- the market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- the forecasts are made after considering the major factors currently impacting the market. These include:

- the forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- the regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- the competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- the trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Product Type: LDL-C; LDL-P; LDL-B; Other Products2) by Component: Kits; Reagents; Devices; Other Components

3) by Disease Type: Diabetes; Stroke; Atherosclerosis; Obesity; Dyslipidaemia; Carotid Artery Disease; Peripheral Arterial Disease; Angina; Other Disease Types

4) by Distribution Channel: Direct Tenders; Retail

5) by End User: Hospitals; Clinics; Ambulatory Care; Research Laboratory; Other End Users

Subsegments:

1) by LDL-C (Low-Density Lipoprotein Cholesterol): Direct Measurement Tests; Calculated LDL-C Tests2) by LDL-P (Low-Density Lipoprotein Particle Number): NMR (Nuclear Magnetic Resonance) Tests; Other Particle Counting Methods

3) by LDL-B (Low-Density Lipoprotein Particle Size): Gradient Gel Electrophoresis; Other Size Measurement Techniques

4) by Other Products; Lipid Panel Tests: Genetic Testing For Dyslipidemia; Point-of-Care Testing Devices

Key Companies Mentioned: Abbott Laboratories; Qiagen N.V.; Randox Laboratories Ltd.; Eurofins Scientific SE; Danaher Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Low-Density Lipoprotein Test market report include:- Abbott Laboratories

- Qiagen N.V.

- Randox Laboratories Ltd.

- Eurofins Scientific SE

- Danaher Corporation

- Bio-Rad Laboratories Inc.

- OPKO Health Inc.

- DiaSorin S.p.A.

- Boster Biological Technology Ltd.

- Rockland Immunochemicals Inc.

- Sekisui Diagnostics LLC

- DiaSys Diagnostic Systems GmbH

- Eurolyser Diagnostica GmbH

- Diazyme Laboratories Inc.

- Cell Biolabs Inc

- Home Access Health Corporation

- Thermo Fisher Scientific Inc.

- Becton, Dickinson and Company

- Quest Diagnostics Incorporated

- SpectraCell Laboratories Inc.

- Siemens Healthineers

- Laboratory Corporation of America Holdings

- Merck KGaA

- F Hoffmann-La Roche Ltd.

- Agilent Technologies Inc.

- BioVision Incorporated

- Abcam plc

- BioAssay Systems

- BioChain Institute Inc.

- BioLegend Inc.

- Enzo Life Sciences Inc.

- GenScript Biotech Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 8.85 Billion |

| Forecasted Market Value ( USD | $ 11 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 33 |