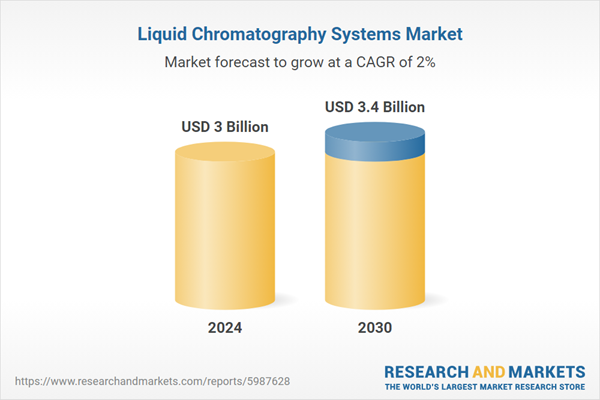

The global market for Liquid Chromatography Systems was valued at US$3 Billion in the year 2024, is expected to reach US$3.4 Billion by 2030, growing at a CAGR of 2% over the analysis period 2024-2030. Instruments, one of the segments analyzed in the report, is expected to record a 2.9% CAGR and reach US$1.6 Billion by the end of the analysis period. Growth in the Consumables segment is estimated at 1.6% CAGR over the analysis period.

The U.S. Market is valued at US$807.2 Million While China is Forecast to Grow at 4.3% CAGR

The Liquid Chromatography Systems market in the U.S. is valued at US$807.2 Million in the year 2024. China, the world's second largest economy, is forecast to reach a projected market size of US$661.6 Million by the year 2030 trailing a CAGR of 4.3% over the analysis period 2024-2030. Among the other noteworthy geographic markets are Japan and Canada, each forecast to grow at a CAGR of 0.3% and 1.4% respectively over the analysis period. Within Europe, Germany is forecast to grow at approximately 0.8% CAGR.Liquid chromatography systems are a cornerstone in the field of analytical chemistry, used extensively for separating, identifying, and quantifying components in a mixture. These systems are critical in various industries, including pharmaceuticals, biotechnology, environmental monitoring, and food and beverage testing. The technology operates by passing a liquid sample through a column filled with a stationary phase. Different components in the sample interact differently with the stationary phase and elute at different times, allowing for their separation and analysis. High-performance liquid chromatography (HPLC) is a commonly used method that offers high resolution, speed, and sensitivity. Innovations such as ultra-high-performance liquid chromatography (UHPLC) further enhance these capabilities, providing even faster and more precise analysis, which is essential for complex sample matrices.

The technological advancements in liquid chromatography systems have led to significant improvements in automation, accuracy, and efficiency. Modern systems are equipped with sophisticated detectors like mass spectrometers, which provide detailed molecular information and enhance the identification and quantification process. Software integration allows for better data management and analysis, facilitating high-throughput screening and real-time monitoring. Additionally, there is a growing trend towards miniaturization and the development of portable liquid chromatography systems, enabling on-site testing and analysis. These advancements are particularly beneficial in fields such as environmental monitoring, where rapid and accurate detection of pollutants is crucial. The adoption of green chromatography techniques, which aim to reduce the use of harmful solvents and minimize waste, is also gaining momentum, reflecting the industry’ s commitment to sustainability.

The growth in the liquid chromatography systems market is driven by several factors. One of the primary drivers is the increasing demand for advanced analytical techniques in the pharmaceutical and biotechnology industries, where stringent regulatory standards necessitate precise and reliable testing methods. The rise in biopharmaceuticals and personalized medicine further fuels the need for sophisticated chromatography systems capable of handling complex biological samples. Additionally, the expanding applications of liquid chromatography in food safety testing, environmental analysis, and forensic science contribute to market growth. Consumer behavior, particularly the growing emphasis on product safety and quality, also propels demand. Technological innovations, such as the development of UHPLC and advancements in mass spectrometry integration, enhance system capabilities and drive market expansion. Furthermore, the trend towards automation and digitalization in laboratories improves operational efficiency and throughput, making these systems more attractive to various end-users. The cumulative effect of these factors ensures a robust and sustained growth trajectory for the liquid chromatography systems market.

Report Scope

The report analyzes the Liquid Chromatography Systems market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Instruments, Consumables, Other Types); Technology (High Performance Liquid Chromatography (HPLC), Ultra High Pressure Liquid Chromatography (UHPLC), Low Pressure Liquid Chromatography (LPLC), Other Technologies); End-Use (Pharmaceutical Companies End Use, Academic & Research Institutes End Use, Hospitals End Use, Agriculture End Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Instruments segment, which is expected to reach US$1.6 Billion by 2030 with a CAGR of a 2.9%. The Consumables segment is also set to grow at 1.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $807.2 Million in 2024, and China, forecasted to grow at an impressive 4.3% CAGR to reach $661.6 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Liquid Chromatography Systems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Liquid Chromatography Systems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Liquid Chromatography Systems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AB Sciex LLC, Agilent Technologies, Inc, Bio-Rad Laboratories, Inc., BÜCHI Labortechnik AG, Gilson, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 86 companies featured in this Liquid Chromatography Systems market report include:

- AB Sciex LLC

- Agilent Technologies, Inc

- Bio-Rad Laboratories, Inc.

- BÜCHI Labortechnik AG

- Gilson, Inc.

- JASCO, Inc.

- KNAUER Wissenschaftliche Geräte GmbH

- Malvern Panalytical Ltd

- Orochem Technologies Inc

- Restek Corporation

- Shimadzu Corp.

- Trajan Scientific and Medical

- Waters Corporation

- YMC Co., Ltd.

- YOUNGIN Chromass

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AB Sciex LLC

- Agilent Technologies, Inc

- Bio-Rad Laboratories, Inc.

- BÜCHI Labortechnik AG

- Gilson, Inc.

- JASCO, Inc.

- KNAUER Wissenschaftliche Geräte GmbH

- Malvern Panalytical Ltd

- Orochem Technologies Inc

- Restek Corporation

- Shimadzu Corp.

- Trajan Scientific and Medical

- Waters Corporation

- YMC Co., Ltd.

- YOUNGIN Chromass

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 428 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3 Billion |

| Forecasted Market Value ( USD | $ 3.4 Billion |

| Compound Annual Growth Rate | 2.0% |

| Regions Covered | Global |